-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Near Highs, Crude At Jan Lvls

HIGHLIGHTS

- Russia Requests Security Council Meeting On NATO Weapons Supplies To Ukraine

- HUNGARY BLOCKS EU18B EU AID PACKAGE FOR UKRAINE: MINISTER, Bbg

- CREDIT SUISSE WEALTH MANAGERS OFFER 7% NOTE TO WIN CLIENT CASH, Bbg

- APPLE SCALES BACK SELF-DRIVING CAR AND DELAYS LAUNCH UNTIL 2026, Bbg

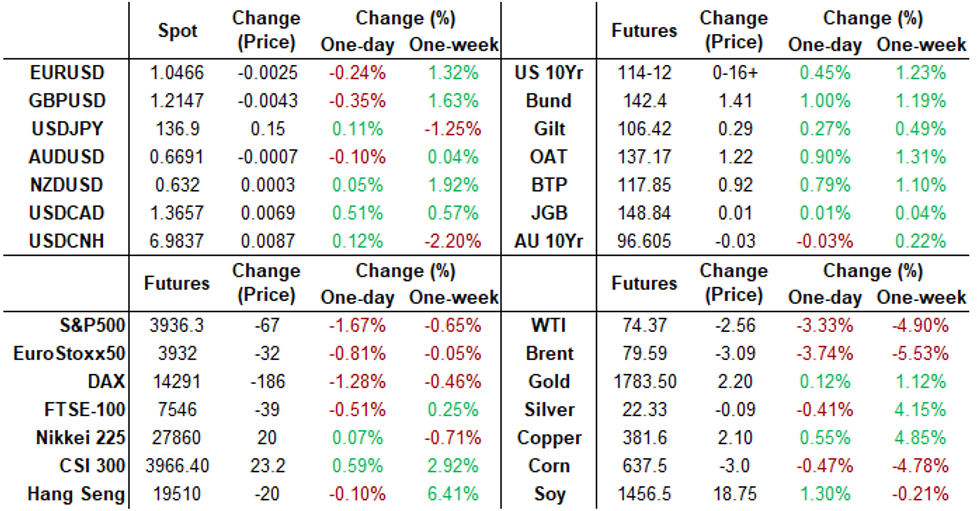

US TSYS: Tsy Yld Curves: New Inverted Lows

Tsy futures inching off late session highs after the bell, modest overall volumes (TYH3 just over 950k at the bell), while yield curves quietly bull flattened to deepest level of inversion since late 1981: 2s10s tapped -84.883 low -- signaling uncertainty over potential for economic recession in 2023.

Reviewing second half trades shows 10Y Block buy added vs. large 5Y sale:

- -19,288 FVH3 108-24.75, sell-through 108-25.5 post-time bid at 1151:17ET, 108-24 last trade, +2 vs. +12,679 TYH3 114-05.5, buy through 114-03.5 post-time offer

- Tsys were see-sawing in relatively narrow range after midday. Tsy support appeared to mirror moves in German Bunds in the first half.

- Limited data this morning as participants plied the sidelines to await Friday's Nov PPI (0.2% MoM est vs. 0.2% prior).

- US OCT TRADE GAP -$78.2B VS SEP -$74.1B

- US REDBOOK: NOV STORE SALES +5.7% V YR AGO MO; STORE SALES +5.7% WK ENDED DEC 03 V YR AGO WK

- Fed funds implied hike for Dec'22 +0.6bp from this morning at 51.8bp, Feb'23 cumulative 89.5bp to 4.730% (Mar'23 106.8bp to 4.903%), terminal slips to 4.97% in Jun'23 vs. 5.0% earlier.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00058 to 3.81729% (+0.00186/wk)

- 1M +0.00414 to 4.22143% (+0.03657/wk)

- 3M +0.01114 to 4.73457% (+0.00200/wk)*/**

- 6M +0.01514 to 5.20200% (+0.05286/wk)

- 12M +0.05171 to 5.56414% (+0.13471/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $107B

- Daily Overnight Bank Funding Rate: 3.82% volume: $287B

- Secured Overnight Financing Rate (SOFR): 3.81%, $1.096T

- Broad General Collateral Rate (BGCR): 3.78%, $415B

- Tri-Party General Collateral Rate (TGCR): 3.78%, $400B

- (rate, volume levels reflect prior session)

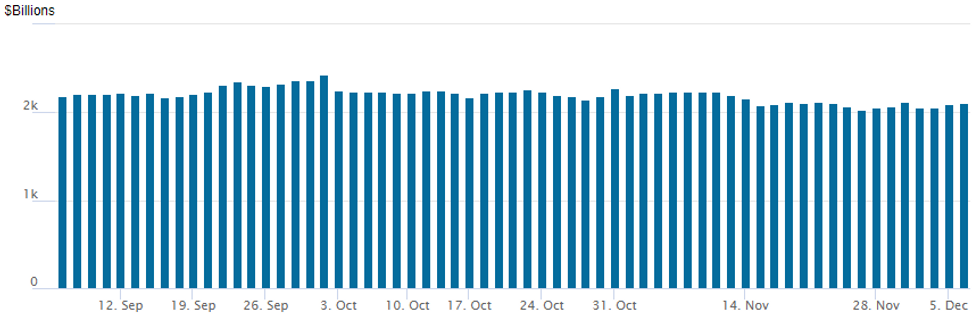

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to $2,111.465B w/ 97 counterparties vs. $2,093.647B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Continued better put structure trade in 10Y Tsy options, taking advantage of the rebound (or fading it) to buy downside puts at cheaper levels. Massive 10Y put condor buy sums things up nicely:- Just over +100,000 TYH3 110.5/111.5/112.5/113.5 put condors 11 vs. 113-31.5 to 114-01.5/0.05%, misc trades in individual strikes pushing volumes slightly higher. Current 10YY at 3.5552% w/ TYH3 futures trading 114-00, a rise in yields to put the structure in-the-money is within the realm of possibility given 10YY topped 4.2% in early November.

- To see TYH3 futures trade down/between 112.5 - 111.5, 10YY would need to climb to appr 3.786% to 3.940% for the condor to go in-the-money. March Tsy options expire on Feb 24, well after the first FOMC for 2023 on Feb 1.

- Treasury Options:

- 30,000 wk3 TY 115 calls, 24 ref 114-02

- 100,000 TYH3 110.5/111.5/112.5/113.5 put condors 11 vs. 113-31.5/0.05%

- -2,500 FVG 111/112 4x5 call spds, 21.5-22.5 ref 108-28.25

- Update, +20,000 TYF 110/111 put spds, 3

- 7,500 TYG 108.5/109.5/1111broken put flys, ref 114-05

- 1,500 TYF 112.5/113.5 put spds vs. 115.25 calls, ref 114-00.5

- 3,000 wk2 FV 108 puts, 3.5

- SOFR Options:

- +2,500 SFRH5/SFRM5/SFRU5 97.50/98.50 1x2 call spd strip, all three at 0.0

- Block, 2,500 short Jun 97.25/97.75 call spds, 8.0 vs. 96.355/0.10%

- 2,000 SFRH 95.25/95.50/95.62 broken call trees

- 3,000 SFRU 95.00/95.50 strangles ref 95.185

- 3,200 Blue Jan 96.50/96.75 put spds ref 97.095

EGBs-GILTS CASH CLOSE: Rally After Weak Open

Bunds and Gilts strengthened Tuesday, with German yields leading the way lower in a largely risk-off session (stocks off ~0.7%).

- Bunds recovered from early weakness following stronger-than-expected German factory orders data. Gilts followed suit, rallying most of the session.

- ECB's Lane said in an interview published pre-open that it's likely eurozone inflation is close to peaking and that while more hikes will be necessary, "a lot has been done already"; Herodotou said the ECB was "very near the neutral range".

- Periphery EGB spreads largely kept pace, with BTP/Bund spreads about 2bp tighter, and GGBs more than 5bp tighter.

- The December to March Eurex futures roll is nearly complete ahead of Thursday's deadline.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.6bps at 2.064%, 5-Yr is down 7.2bps at 1.817%, 10-Yr is down 8bps at 1.8%, and 30-Yr is down 4.9bps at 1.63%.

- UK: The 2-Yr yield is down 2.5bps at 3.304%, 5-Yr is down 1.6bps at 3.229%, 10-Yr is down 2.8bps at 3.076%, and 30-Yr is up 0.2bps at 3.449%.

- Italian BTP spread down 2bps at 185.3bps / Greek down 5.5bps at 194.9bps

EGB Options: Mostly Bund Put Plays And Vol Selling

Tuesday's Europe rates / bond options flow included:

- OEG3 116.00/114.75 put spread bought for 8.5 in 7.5k

- RXF3 142 straddle sold at 270 in 1k

- RXG3 139.00/137.00/136.00 broken put fly bought for 37 in 1.5k

- RXF3 140/138 1x1.5 put spread bought for 28 in 3k

- RXG3 139/137/136 put fly bought for 33 in 4k

FOREX: Lower Equities Boost Greenback Despite Fix-Induced Dip

- Pressure on equities throughout Tuesday’s session ultimately boosted the US dollar, however, flows potentially linked to the WMR fix at 1600GMT provided solid two-way price action.

- The USD index (+0.30%) had traded with a positive tone throughout early US trade, slowly erasing previous losses amid constant pressure on major equity indices. However, in the period roughly 30 minutes before and up to the WMR fixing window, the index dropped roughly 45 pips. Most noticeable in G10 was the spike in GBP, with cable rallying sharply from around 1.2155 to 1.2269 and EUR/GBP extending slippage to a new daily low of 0.8576. GBP futures saw activity ramp higher heading into the fix, with near 4000 futures contracts trading inside 60 seconds - cash equivalent of around $290mln.

- Following this short-term dynamic, order was restored and the greenback regained its upward bias as equities extended their intra-day declines with the S&P 500 slipping as much as 2% approaching the APAC crossover.

- Losses have been broad based across G10 with the Canadian dollar the biggest victim, falling 0.55% ahead of tomorrow’s BOC rate decision. Tomorrow's decision is seen as a tight call between another downshift to 25bp or sticking with a 50bps hike.

- The latest climb for USDCAD sees it breach noted resistance at 1.3646 (Nov 29 high). Next up is 1.3690 (61.8% retracement of Oct 13 – Nov 15 bear leg) before 1.3808, the Nov 3 high and a key resistance.

- Australian GDP overnight as well as Chinese trade balance figures highlight the data docket before the Bank of Canada decision, due later on Wednesday.

FX: Expiries for Dec07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0370(E725mln), $1.0600(E1.8bln)

- USD/JPY: Y134.00($920mln)

- GBP/USD: $1.1900-15(Gbp665mln)

- EUR/GBP: Gbp0.8520(E700mln)

- EUR/JPY: Y147.00(E684mln)

- NZD/USD: $0.6450(N$811mln)

- USD/CAD: C$1.3540($2.4bln), C$1.3600($1.5bln)

- USD/CNY: Cny6.8900($930mln), Cny6.9690-20($1.8bln), Cny7.1000($1.0bln)

Late Equity Roundup: Back To Mid-Nov Levels, Energy Weighing

Carry-over weakness for US stock indexes, Energy sector leading the way lower as SPX eminis slips back to mid-November levels: currently -69.5 (-1.74%) at 3933.75; DJIA -433.47 (-1.28%) at 33513.77; Nasdaq -253.3 (-2.3%) at 10986.75.

- SPX leading/lagging sectors: Energy sector (-3.05%) lead the sell-off in the second half as crude prices fell to the lowest since January (WTI -2.65 at 74.28). Marathon (MRO) -4.14%, Hess (HES) -3.98%, Devon (DVN) -4.0%, Occidental (OXY) -3.6%.

- Communication Services (-3.00%) weighed by interactive media shares such as Meta, formally Facebook (META) -6.62%, Google (-2.82%); followed by Information Technology (-2.69%) weighed by semiconductor stocks (ENPH -8.10%, AMD -5.10%.

- Leaders: Utilities for a second day (+0.26%), Consumer Staples (-0.91%) and Health Care (-1.13%) sectors outperformed.

- Dow Industrials Leaders/Laggers: Carry-over selling in Goldman Sachs (GS) -10.58 at 360.96 w/ banks, financial shares generally weaker, Visa (V) -6.0 at 207.68, Boeing paring Mon gains (BA) -6.46 at 178.54 - profit taking after reports United Airlines looking to buy dozens of new 787 Dreamliners.

- Leaders: United Health (UNH) +3.30 at 538.34, Travelers Ins (TRV) +1.19 at 188.40..

COMMODITIES: WTI Hits Year-To-Date Lows, Brent Breaches Bear Trigger

- A second consecutive day of heavy declines has seen WTI fall to its lowest of the year, hurt by concern for central bank tightening and future oil demand growth.

- Turkish authorities earlier cleared an oil tanker with Russian insurance papers, starting to ease significant congestion of 20 tankers in Turkish straits one day after the G7/EU oil price cap was imposed.

- Russia is considering setting a price floor for its international oil sales as a response to the G7/EU oil price cap according to officials familiar with the plan.

- WTI is -3.4% at $74.35, clearing support at $76.29 (Nov 29 low) and with a low of $73.41 coming close to $73.38 (1.00 proj of the Aug 30 – Sep 28 – Nov 7 price swing).

- Brent is -3.9% at $79.49, confirming a bearish outlook with clearance of the bear trigger at $79.68 (Sep 26 low). Further downward momentum could test $77.04 (Jan 1 low, cont.).

- Gold is +0.1% at $1770.38. Key resistance is seen at $1807.9 (Aug 10 high) whilst support is at $1747.4 (20-day EMA).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/12/2022 | 0030/1130 | *** |  | AU | Quarterly GDP |

| 07/12/2022 | 0430/1000 |  | IN | India RBI Rate Decision | |

| 07/12/2022 | 0645/0745 | ** |  | CH | Unemployment |

| 07/12/2022 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/12/2022 | 0700/0800 | *** |  | SE | GDP |

| 07/12/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 07/12/2022 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/12/2022 | 0710/0810 |  | EU | ECB Lane Speech at China FX Global Perspective | |

| 07/12/2022 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/12/2022 | 0745/0845 | * |  | FR | Current Account |

| 07/12/2022 | 0900/1000 | * |  | IT | Retail Sales |

| 07/12/2022 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 07/12/2022 | 1000/1100 | * |  | EU | Employment |

| 07/12/2022 | 1000/1100 | *** |  | EU | GDP (final) |

| 07/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/12/2022 | - | *** |  | CN | Trade |

| 07/12/2022 | 1300/1400 |  | EU | ECB Panetta Speech at at LBS-AQR Insight Summit | |

| 07/12/2022 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 07/12/2022 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 07/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 07/12/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 08/12/2022 | 2350/0850 | ** |  | JP | GDP (r) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.