-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS: Tsys Reject Early Bid Post-CPI

- MNI DALY SAYS FED STILL HAS MORE WORK TO DO ON INFLATION

- MNI US: Manchin "Thinking Seriously" About Becoming Independent

- MNI US: NYT: US/Iran Reach Deal To Release Prisoners, Unlock Sanctioned Oil Revenue

- FED DALY (NONVOTER): CPI DATA DOESN'T SAY `VICTORY IS OURS' ON INFLATION, Bbg

US TSYS Yields Higher Despite Dip in Core CPI, PPI Up Next

- Treasury futures finishing near late session lows after initially gapping to session highs (TYU3 tapped 111-29) following this morning's July CPI: core MoM 0.16% vs. 0.2% est. Core goods deflation accelerated to -0.33% M/M from -0.05% M/M.

- The drag from used vehicles was at the low end of expectations seen beforehand, at -1.34% M/M vs analysts averaging circa -2% (ranging from -1.3% to -3.2%) after -0.45% M/M. There should be further declines in the pipeline. However, more notable from the goods side was core goods ex used vehicles printing -0.18% M/M after two 0.00% M/M readings.

- Initial jobless claims disappointed as they surprisingly increased to 248k (cons 230k) after an unrevised 227k, for its largest weekly increase since early June.

- Fed pricing comes off post-CPI session lows but only just with SF Fed’s Daly (’24 voter) noting the Fed still has more work to do and that the CPI data was largely as expected and that it doesn’t say ‘victory is ours’ on inflation.

- Daly added the Fed is yet to determine whether to raise and how long to hold rates, with Daly being data dependent and it premature to decide on another hike. There is a lot more info coming in before the September meeting and before year-end.

- Delayed reaction, Treasury futures traded weaker after $23B 30Y auction (912810TT5) tailed with 4.189% high yield vs. 4.175% WI; 2.42x bid-to-cover vs. 2.43x in the prior month.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00001 to 5.31247 (-.00777/wk)

- 3M +0.00237 to 5.36915 (-0.00143/wk)

- 6M +0.00043 to 5.42140 (-0.01279/wk)

- 12M +0.00342 to 5.31174 (-0.05061/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $111B

- Daily Overnight Bank Funding Rate: 5.31% volume: $282B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.322T

- Broad General Collateral Rate (BGCR): 5.27%, $561B

- Tri-Party General Collateral Rate (TGCR): 5.27%, $551B

- (rate, volume levels reflect prior session)

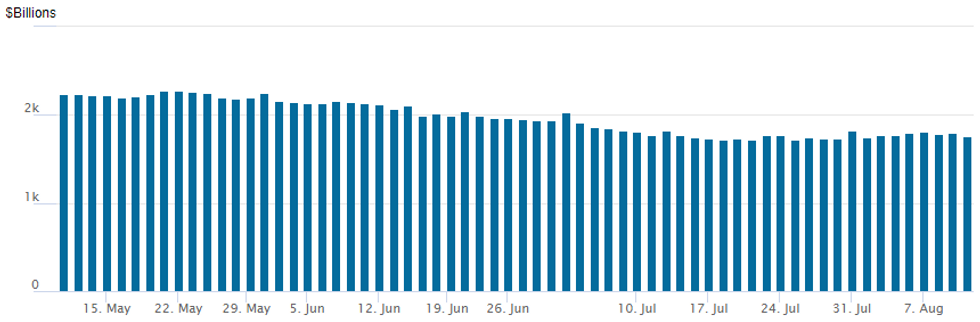

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The latest operation recedes to $1,759.897B, w/103 counterparties, compared to $1,796.519B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Mixed trade on rather decent volumes were reported Thursday, better puts on net as underlying futures reversed the post-CPI data bid to broadly weaker in through the second half. A notable shift in derivatives occurred as rate hike projections into year end cooled, spurring some chunky upside call buying in the short end. Of note, paper bought over 80,000 wk2 TY 112.5 calls that expire tomorrow, at 1-2 with underlying futures trading at 110-28. Note, TYU3 traded as high as 111-29 after this morning's CPI data while Friday sees the next inflation metric with July PPI released.

- Treasury Options:

- 2,000 USU3 118/119 put spds, 11 ref 121-19

- +20,000 TYU3 110/111/111.5 put trees, 3

- 8,500 TYU3 110 puts, 12 last ref 111-11.5

- Update, over 80,000 wk2 TY 112.5 calls, 2.0-1.0 ref 111-18

- 6,200 TYU3 110.25/110.5/111.25 broken put trees ref 111-08.5

- 4,600 FVU3 104.5 puts, 1.5 ref 106-30 to -30.25

- 2,800 FVU3 103.5 puts, 1 ref 106-31 to -29.5

- SOFR Options:

- 2,000 SFRZ3 94.18/94.37/94.62 put flys

- Block, 20,000 SFRU3 94.62/94.68 call spds .25 over SFRU3 94.50 puts ref 94.615

- Block, 5,000 SFRZ4 95.25/95.75/96.25 put flys, 7.0 ref 96.04

- +10,000 SFRH4 95.00/96.00/96.25 1x1x2 broken call trees, 0.5

- over 10,600 SFRM4 96.00/97.00 call spds 13.0 ref 95.30

- 3,000 SFRZ3 94.25/94.50/94.75/95.00 call condors ref 94.66

- 6,600 SFRZ3 94.00 puts, 0.75 ref 94.66

- Block, 8,880 SFRF4 94.00/94.25 put spds, 2.0 vs. 94.905/0.05%

- 4,500 SFRQ3 94.56 puts, .75 ref 94.595

- over 10,100 0QQ3 95.56 puts, 2.0 ref 95.72

- Block/screen, 11,750 0QZ3 95.62/96.00 put spds 15.5 vs. 2QZ3 96.12/96.50 put spds, 14.0

- Block, 5,000 0QV3 95.87/2QV3 96.37 put spds, 0.5 net/short Oct over

- 2,200 SFRF4 95.37/95.75 call spds ref 94.91

- Block, 3,000 0QZ3 95.50/95.62/95.87 put flys, 6.0 ref 96.025

- 8,250 0QU3 95.25/95.50/95.75 put trees ref 95.68

- Block, 8,000 SFRQ3 94.62/94.68 call spds, 0.5 ref 94.595

- 2,500 SFRM4 94.25/95.00 put spds ref 95.27

- 5,000 SFRV3 94.93 calls ref 94.645

- 2,000 SFRQ3 94.43/94.56 put spds ref 94.595

- 3,000 2QQ3 96.62/96.75 call spds ref 96.48

- 2,000 SFRV3 94.62/94.93 1x2 call spds ref 94.64 to -.635

- 3,000 0QQ3 95.6875 calls, 5.5 ref 95.655 to -.67

EGBs-GILTS CASH CLOSE: Bunds Underperform Again

Bunds underperformed Gilts for a 2nd consecutive session Thursday, with European yields moving higher after the much-anticipated US CPI reading for July came in on the soft side of expectations.

- A typically quiet pre-US inflation report morning included a yield jump at the open on a broader risk-on move. But yields began sagging in the afternoon, amid a US-led bid.

- Shortly after the CPI release was digested, yields began resolving in an upward direction, with the move exacerbated by erstwhile Federal Reserve dove Daly noting after the data that the central bank had more work to do.

- The German curve bear steepened modestly on the day. The UK curve twist steepened as BoE hike expectations continued to fade, with the long-end trading more in tune with global core FI counterparts.

- Periphery spreads tightened, mirroring a risk-on rise in European equities.

- Final CPIs for the Netherlands, Portugal and Italy brought no major surprises.

- Friday's schedule brings UK GDP, and French and Spanish final July inflation.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.2bps at 2.984%, 5-Yr is up 3.4bps at 2.545%, 10-Yr is up 3.1bps at 2.528%, and 30-Yr is up 3.5bps at 2.625%.

- UK: The 2-Yr yield is down 2.1bps at 4.905%, 5-Yr is down 2.2bps at 4.39%, 10-Yr is down 0.1bps at 4.364%, and 30-Yr is up 1.3bps at 4.575%.

- Italian BTP spread down 3.2bps at 161.8bps / Greek down 2.2bps at 130.6bps

EGB Options: Sonia Call Fly Buying Continues Amid Limited Trade Thursday

Thursday's Europe rates / bond options flow included:

- SFIZ3 94.60/94.80/95.00 call fly bought for 2.5 in 3k. Recall this was bought Wednesday for 2.25 in 5k and Tuesday for 1.75 in 17.5k total

FOREX: USD Stages Impressive Recovery Following Inflation Release

- A moderately lower headline print for US CPI in July had the initial effect of a weaker greenback, however, as some stronger detail emerged from the data, the USD index staged an impressive recovery, bouncing to session highs in late US trade.

- The USD index stands in very minor positive territory after being down as much 0.70% in the immediate aftermath of the release.

- The most notable laggard in the second half of the session has been the Japanese Yen, registering as one of the weakest currencies across G10 on Thursday. Despite the sharp move down in USDJPY to 143.30 after the US inflation data, the recovery has been consistent and substantial throughout US trade, showing little regard for the turn lower for major equity benchmarks.

- An uptrend in USDJPY remains intact and the pair continues to narrow the gap with key medium term pivot resistance at 145.07, the June 30 high, which also represents the key bull trigger. A break of 145.07 would confirm a resumption of the trend and first target 145.69 before 146.38, both Fibonacci projection levels.

- More moderate declines have been seen for the likes of GBP, NZD and CAD, however both the Euro and AUD remain just about in positive territory after their initial boost throughout European trade amid a more benign risk backdrop.

- Emerging market currencies have proved more resilient amid the turnaround for equities and the likes of ZAR, HUF, CLP, COP remain firmly higher on the session, posting between 0.85-1.85% advances.

- UK growth data will highlight Friday’s European docket before US producer prices data for July and Preliminary U Mich sentiment and inflation expectations round off the week’s economic data calendar.

FX Expiries for Aug11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950(E1.6bln), $1.0973-90(E1.1bln), $1.1000(E737mln), $1.1025-30(E895mln)

- USD/JPY: Y141.30-35($1.1bln), Y142.25($997mln), Y144.00($500mln), Y145.00($755mln)

- AUD/USD: $0.6530(A$590mln), $0.6600(A$532mln), $0.6675(A$1.5bln), $0.6800(A$1.1bln)

- USD/CAD: C$1.3325($3.3bln)

- USD/CNY: Cny7.1000($1.1bln), Cny7.2500($544mln)

Equities Roundup: Communication Services, Financials Lead Gainers

- Stocks remain off recede from midmorning highs, SPX in mildly negative territory after the bell, Tsy bonds extending lows as well in a delayed reaction to a weak 30Y auction. Currently, DJIA shares are up 65.96 points (0.19%) at 35181.85, S&P E-Mini futures steady at 4485.75, Nasdaq up 21 points (0.2%) at 13740.75.

- Leading gainers: Communication Services and Financials sectors are outperforming. Shares of Disney +4.45% buoyed Communication Services after their parks division reported $8.3 billion in revenue, up 13%, and an operating income of $2.43 billion—despite a slowdown at Walt Disney World.

Other gainers included - Other gainers included Charter Communication +1.65%, Netflix +1.25%, Verizon +1.1%. Financials see some relief from better selling in the first half of the week following Moody's regional bank downgrades: FleetCor +4.05%, Northern Trust +1.38%, Bank of NY Mellon +1.1%.

- Laggers: Industrials, Real Estate and Energy sectors underperformed. Construction, engineering and building products names weighed on Industrials: Parker Hannifin -2.15%, Quanta Services -2.0%, Johnson Controls -1.85%. Meanwhile, management/development services shares weighed on the Real Estate sector with Ventas -1.85, Weyerhaeuser -1.2%.

E-MINI S&P TECHS: (U3) Support At The 50-Day EMA Remains Exposed

- RES 4: 4681.35 Bull channel top drawn from the Mar 13 low

- RES 3: 4670.58 2.00 proj of the Jun 26 - 20 - Jul 7 price swing

- RES 2: 4593.50/4634.50 High Aug 2 / Jul 27

- RES 1: 4560.75 High Aug 4

- PRICE: 4495.00 @ 1500 ET Aug 10

- SUP 1: 4478.25 Low Aug 9

- SUP 2: 4460.64 50-day EMA

- SUP 3: 4440.13 Bull channel base drawn from the Mar 13 low

- SUP 4: 4411.25 Low Jul 10

Bearish conditions in the E-mini S&P contract remain intact and price is trading closer to its recent lows. Last week’s sell-off resulted in a break of support at the 20-day EMA following a recent failure at the top of the bull channel - this also highlights a bearish development and the risk of an extension lower near-term. Further downside would open 4460.64, the 50-day EMA. Resistance to watch is 4560.75, the Aug 4 high.

COMMODITIES WTI Pulls Back From Fresh YTD Highs And Gold Reverses CPI Boost

- After briefly pushing on to fresh YTD highs in London trading, crude oil has steadily eased lower both before and after US CPI and OPECs MOMR, with Treasury sell-off and resumption of USD strength in the second half of the NY session adding a further headind.

- OPEC has kept its world oil demand growth forecast steady at 2.4m b/d for this year and at 2.2m b/d for 2024, in line with last month’s forecast. Non-OPEC liquid supply growth has been revised upwards slightly from July by 100k b/d to 1.5m b/d. Saudi Arabian output declined by 968k b/d last month.

- The WTI crude second month 25 delta put skew has risen to the least bearish since March with a trend higher in place since mid May. The options market is reflecting the tight market expectations for H2 amid OPEC+ supply cuts and current risks from tensions in the Black Sea.

- Panama Canal wait times have continued to rise to 21 days as of Aug 8, up from 18 days on Aug 4.

- WTI is -1.7% at $82.99 back near the low end of yesterday’s range. It keeps resistance at the round $85 after which lies $85.94 (Aug 23, 2022 high), and support at $82.36 (Aug 3 low).

- Brent is -1.1% at $86.56 with resistance at the intraday high of $88.10 and support at $82.36 (Aug 3 low).

- Gold is +0.01% at $1914.74 after a short-lived spike to $1930.14 post US CPI. It’s back close to lows of $1913.0 that pushed through yesterday’s $1914.1 to open support at $1902.8 (Jul 6 low)

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/08/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 11/08/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 11/08/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 11/08/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 11/08/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 11/08/2023 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 11/08/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 11/08/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 11/08/2023 | - | *** |  | CN | Money Supply |

| 11/08/2023 | - | *** |  | CN | New Loans |

| 11/08/2023 | - | *** |  | CN | Social Financing |

| 11/08/2023 | 1230/0830 | *** |  | US | PPI |

| 11/08/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 11/08/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.