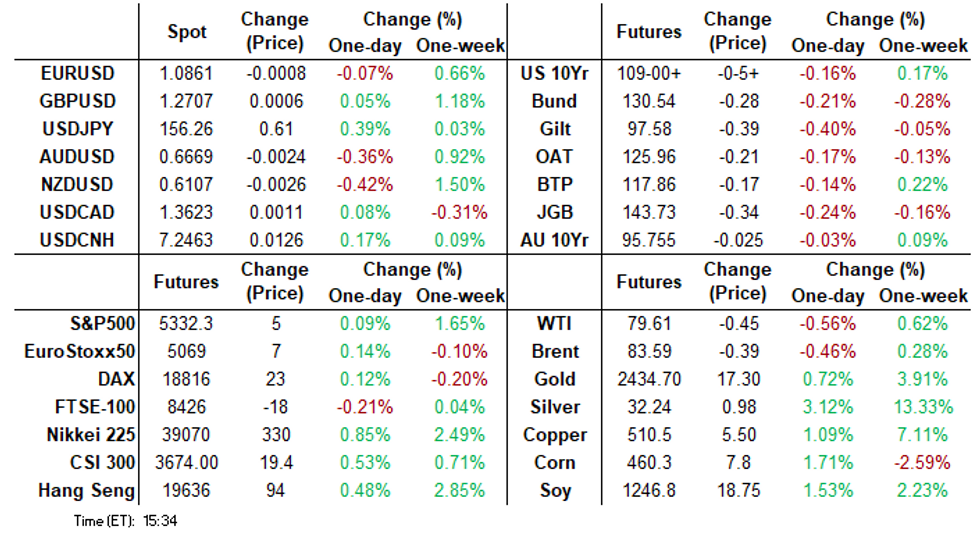

May 20, 2024 19:37 GMT

MNI ASIA MARKETS ANALYSIS: US$ Gain, Corporate Supply Weighed

HIGHLIGHTS

- Treasuries broke a narrow overnight range, extended lows early Monday, several factors in play

- Generally quiet start to the week with no data until Wednesday, dip in rates coincided with rebound in USD

- Decent corporate debt issuance climbed over $15B, rate lock hedging contributed to the early sale.

- Rates traded sideways after recovering approximately half the move by midmorning.

US TSYS Mildly Weaker, Off Lows, Focus on Wednesday's May 1 FOMC Minutes

- Treasuries trading modestly weaker after the bell, generally quiet start to the week with no data until Wednesday, dip in rates coincided with rebound in USD. Treasuries broke a narrow overnight range, extended lows early Monday, traded sideways after recovering approximately half the move by midmorning.

- Decent corporate debt issuance climbed over $15B, rate lock hedging contributed to the early sale. Pick-up in Tsy quarterly futures roll from Jun'24 to Sep'24.

- Vice Chair for Supervision Barr says in prepared remarks for a keynote address that restrictive policy needs further time to do its work and that the Fed is in a good position to hold rates steady whilst it watches. The economy is strong, growth is solid and unemployment is low.

- Rate cut projections have receded vs. this morning's levels (*): June 2024 at -5% w/ cumulative rate cut -1.2bp at 5.318%, July'24 at -20% w/ cumulative at -6.3bp (-7.5bp) at 5.267%, Sep'24 cumulative -19.6bp (-20.9bp), Nov'24 cumulative -27.1bp (-29bp), Dec'24 -41.5bp (-43.9bp).

- Look ahead to Tuesday, similar to Monday: no economic data and a raft of Fed speakers. Focus on the minutes from the May 1 FOMC this Wednesday.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00083 to 5.32059 (-0.00011 total last wk)

- 3M +0.00092 to 5.32672 (+0.00382 total last wk)

- 6M +0.00458 to 5.28779 (-0.00110 total last wk)

- 12M +0.01689 to 5.13941 (-0.01641 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.964T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $722B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $711B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $77B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $269B

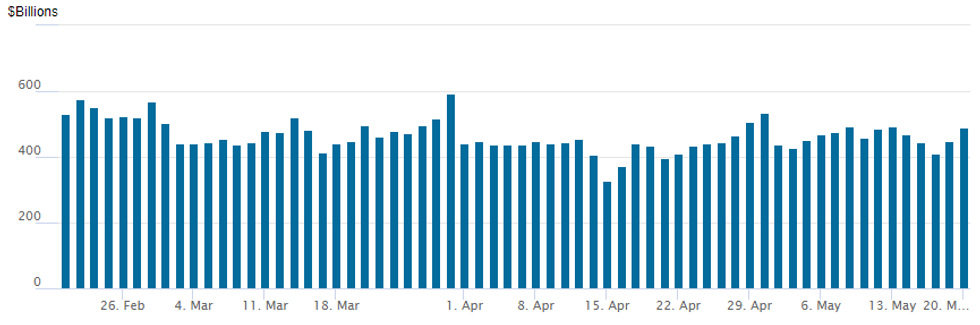

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $489.728B from $449.373B prior; number of counterparties 75. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Rather modest overall volumes stuck with better call call interest in Treasury options, SOFR option more pared on the day. Underlying futures modestly weaker - near the middle of the session range after gradually climbing off early session lows. Rate cut projections have receded vs. this morning's levels (*): June 2024 at -5% w/ cumulative rate cut -1.2bp at 5.318%, July'24 at -20% w/ cumulative at -6.3bp (-7.5bp) at 5.267%, Sep'24 cumulative -19.6bp (-20.9bp), Nov'24 cumulative -27.1bp (-29bp), Dec'24 -41.5bp (-43.9bp).SOFR Options:

- Block, 5,000 SFRM4 95.37/95.50 call spds 0.25, vs. 94.7125/0.05%

- +17,000 0QH5 94.25/94.75 put spds vs. 95.97/0.08%/0.08%

- +15,000 SFRH5 97.00/98.00 call spds, 3.5 ref 95.34

- +7,000 SFRU6 96.37/96.87 call spds, 18.0 vs. 96.06/0.10%

- -5,000 SFRM4 94.81 calls, .75 ref 94.69

- -5,000 SFRM4 94.62/94.68 put spds vs. 94.75/94.81 call spds, 1.25

- 8,000 SFRU4 95.00/95.12 put spds ref 94.875

- 3,000 0QZ4 96.87/97.75/98.25 broken put flys ref 95.895

- 2,500 TYM4 109.5/109.75 1x2 call spds, 1 net 2-legs over ref 109-00.5

- 3,000 FVN4 107/107.5/108 call flys ref 106-05

- 16,000 TYM4 110 calls vs. 4,000 TYN4 110/110.5 call spds

- Block, -10,000 TYM4 109.25 straddles, 32 ref 109-06.5

- -14,500 TYM4 109.25 calls, 12 ref 109-06

- 2,600 TYM4 110.75/111.25 1x2 call spds ref 109-06

- 19,000 FVM4 106.5/107 call spds ref 105-28.25

- 2,500 TYM4 108/108.75 2x1 put spds, 5 ref 109-05.5

- 4,400 TYM4 108.75/109 put spds, 4 ref 109-07.5

- Block/screen, 28,500 TYM4 110 calls, 3 ref 109-07.5

EGBs-GILTS CASH CLOSE: Gilts Underperform With UK CPI Eyed Ahead

European curves lightly bear steepened Monday as the weakness seen late last week extended, with Gilts underperforming.

- Amid light trading volumes on the Whit Monday holiday observed in various European countries, there were few notable catalysts.

- BoE's Broadbent noted it's "possible" rates will be cut in the summer, though gave little away on his view of a June reduction.

- Around 2bp of 2024 BoE cuts were pared from the path on the day with 54bp in reductions now seen; the ECB counterpart was little changed at 67bp.

- A moderate pullback in oil prices helped core FI tick up from session lows in early afternoon trade, though downside resumed from there into the cash close.

- While Bunds and Gilts have now more than reversed last week's rally, today's ranges were relatively tight. Periphery spreads tightened slightly, against a fairly benign risk backdrop with equities higher.

- Tuesday brings an appearance by ECB's Lagarde and German PPI, with UK inflation and flash PMIs featuring later in the week.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.7bps at 2.993%, 5-Yr is up 1.2bps at 2.573%, 10-Yr is up 1.4bps at 2.529%, and 30-Yr is up 1.3bps at 2.666%.

- UK: The 2-Yr yield is up 3.6bps at 4.346%, 5-Yr is up 3.8bps at 4.047%, 10-Yr is up 4.2bps at 4.169%, and 30-Yr is up 4.9bps at 4.649%.

- Italian BTP spread down 1.5bps at 128.4bps / Spanish down 0.2bps at 75.5bps

EGB Options: Mostly Eyeing Downside Monday

Monday's Europe rates/bond options flow included:

- RXN4 130.50/128.00/125.50p fly, bought for 36 in 1.5k

- RXM4 131.50c, sold at 8 in 6k

- ERH5 97.00/96.75/96.50p ladder, bought for 3.25 in 2k

- ERU4 96.375/96.50/96.625/96.75c condor vs 96.25p, bought the condor for 5.5 in 3k

- SFIM4 95.05/95.00/94.90p ladder, bought for 1.5 in 5.5k

- SFIM4 94.50p, bought for half in 4k

FOREX Greenback Consolidates Moderate Gains, Antipodeans Underperform

- While most European markets are open, the observance of the Whit Monday holiday initially tempered activity to start the week, with most G10 currencies exhibiting narrow ranges as we approached the NY crossover. A brief bout of weakness for Treasuries saw the USD index pop to fresh session highs, however, gains have been partially reversed throughout the remainder of the session.

- The index approaches the APAC crossover 0.10% higher on the day, although just 45 pips off the recent lows. Market participants will monitor the April lows just below the 104 handle as the next notable support as markets await further US data to assess short-term Fed pricing.

- The higher US yields prompted a notable move higher for USDJPY, breaking back above 156.00 and printing a high of 156.23. 156.74 remains the notable resistance to watch.

- Ahead of Tuesday’s RBA minutes, AUDUSD has also pulled back slightly. However, a bullish remains intact following last week’s gains where the move higher resulted in the break of a number of short-term resistance points, including a key short-term resistance at 0.6668, the Mar 8 high.

- NZDUSD (-0.33%) is a relative underperformer following a Q2 RBNZ survey of inflation expectations showed households saw a slightly lower median expected inflation rate for the next two years at 3% from 3.2% in 1Q. This comes ahead of the RBNZ meeting on Wednesday, where markets expect an unchanged decision.

- Tuesday’s data calendar will be highlighted by Canada inflation data. Elsewhere, ECB’s Lagarde and another plethora of Fed members will speak.

Late Equities Roundup: Off New Highs, DJIA Underperforming

- Stocks are mixed in late Monday trade, the DJIA weaker after climbing to new all-time highs in the first half. S&P Eminis and Nasdaq also marked new highs before profit taking trimmed gains in the second half. Trading desks pointed to reversal in JPM shares after CEO Jamie Dimon stated stock buy-backs would be muted at current levels.

- Currently, the DJIA is down 168.29 points (-0.42%) at 39835.48 (40073.06 high), S&P E-Minis up 6 points (0.11%) at 5333 (5348.25 high), Nasdaq up 108.2 points (0.6%) at 16793.53 (16804.15 high).

- IT and Communication Services sectors led gainers in late trade, semiconductor makers continued to buoy the former with Teradyne +5.36%, Applied Materials +3.54%, Micron +3.24%. Media and entertainment shares supported the Communication Services sector: Netflix +3.29%, Live Nation Entertainment +2.45%, Take Two Entertainment +1.68%.

- Laggers: Financials and Energy sectors underperformed in late trade, banks weighing on the former: JPM -3.57% after Dimon comments as noted, Comerica -1.71%, Truist Financial -1.63%. Equipment and services shares weighed on the latter: Schlumberger -1.09%, Baker Hughes -0.97%, Halliburton -0.40%.

- Reminder: a few late cycle corporate earnings expected this week: Zoom Video Conf and Palo Alto Networks after today's close. Later in the week: Macy's Inc, Lowe's Inc, AutoZone Inc, Target, Petco, Analog Devices, TJX, Synopsys, Nvidia, Autodesk, Dollar Tree Inc.

E-MINI S&P TECHS: (M4) Bulls Remain In The Driver’s Seat

- RES 4: 5417.75 2.00 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5400.00 Round number resistance

- RES 2: 5372.73 1.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5349.00 High May 16

- PRICE: 5332.00 @ 1505 BST May 20

- SUP 1: 5218.92 20-day EMA

- SUP 2: 5173.24 50-day EMA

- SUP 3: 5036.25 Low May 2

- SUP 4: 4963.50 Low Apr 19 and bear trigger

S&P E-Minis traded higher last week as the contract extends the bull cycle from Apr 19. Bullish trend conditions remain intact. Recent gains have resulted in a break of key resistance at 5333.50, Apr 1 high. This confirms a resumption of the primary uptrend and signals scope for a climb to 5372.73, a Fibonacci projection. Moving average studies remain in a bull-mode set-up, highlighting a clear uptrend. Initial support is at 5218.92, the 20-day EMA.

COMMODITIES Spot Gold, Copper Rise To Fresh Record Highs

- Spot gold is up 0.8% on the day at $2,435/oz, having earlier in the session hit a fresh all-time high of $2,450. There was no headline flow of note, with markets generally shaking off weekend political risk.

- Having traded through resistance at $2431.5, the Apr 12 high and bull trigger, focus turns to 2452.5 next, a Fibonacci projection.

- Meanwhile, silver is outperforming again, currently up 2.4% today at $32.3/oz, its highest level since end-2012.

- Sights are on $33.887 next, a Fibonacci projection. Short-term pullbacks would be considered a correction. A key support zone lies between $27.229-36.948, the 20- and 50-day EMA values.

- Copper is up another 1.0% at $510/lb, albeit off from its record high of almost $520 reached earlier today.

- Analysts continue to flag tight supply due to output cuts from smelters in China, even as demand from EV’s and renewables picks up.

- Copper futures have pierced a key resistance at $503.95, the Mar 2022 high and a clear break would open $520.65, a Fibonacci projection.

- Crude prices are headed for US close trading lower after reversing much of Friday’s gains. However, they are largely rangebound over the last three days. Traders are awaiting clearer signals for direction ahead of OPEC’s key production meeting in June.

- WTI Jun 24 is down 0.6% at $79.6/bbl.

- For WTI futures, scope is seen for a move to $76.07, the Mar 11 low. On the upside, initial firm resistance is at $84.46, the Apr 26 high.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/05/2024 | 0130/1130 |  | AU | RBA Minutes | |

| 21/05/2024 | 0600/0800 | ** |  | DE | PPI |

| 21/05/2024 | 0800/1000 | ** |  | EU | Current Account |

| 21/05/2024 | 0900/1100 | ** |  | EU | Construction Production |

| 21/05/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 21/05/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 21/05/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 21/05/2024 | 1230/0830 | *** |  | CA | CPI |

| 21/05/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/05/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/05/2024 | 1300/0900 |  | US | Fed Governor Christopher Waller | |

| 21/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 21/05/2024 | 1545/1145 |  | US | Fed Vice Chair Michael Barr | |

| 21/05/2024 | 1700/1800 |  | UK | BOE's Bailey Lecture at LSE | |

| 21/05/2024 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/05/2024 | 2300/1900 |  | US | Cleveland Fed President Loretta Mester |

Keep reading...Show less

1753 words