-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA MARKETS ANALYSIS: Week Opener Sees Risk-Off Unwound

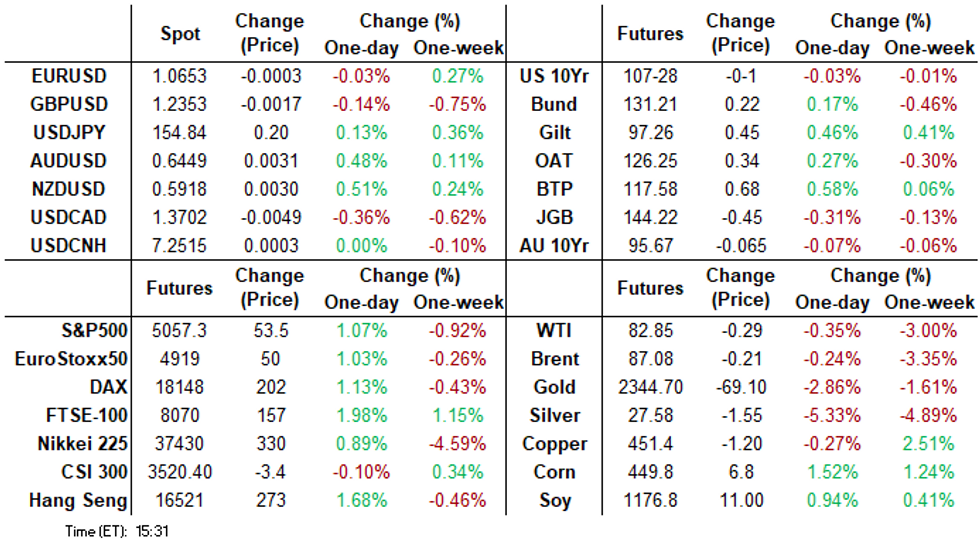

- Treasuries remained weaker in late Monday trade after paring losses by midday

- No economic data or Fed speak with the Bank in Blackout, the bounce is partially tied to Middle East risk not gaining

- Appetite for risk improved with stocks trading stronger, while safe haven assets like Gold fell sharply on the day.

US TSYS Rates Off Lows, Fed in Blackout, Earning Cycle Accelerates

- Mildly weaker after the bell, Treasury futures are see-sawing near the top end of the session range, curves steeper with the short end outperforming. Rebound partially tied to Middle East risk not gaining.

- Currently, Jun'24 10Y futures are trading 107-28 (-1), well below initial technical resistance of 108-22.5 (High Apr 19). The 2s10s curve is currently +1.479 at -35.458.

- No data or Fed speakers on the week open, the latter in Blackout through May 2.

- Corporate issuance rather muted as the latest earnings cycle gathers steam, though American Express issued $3.5B debt over 4 tranches that generated some rate lock hedging in the short end.

- Corporate earnings: Verizon and Albertsons announced ahead of the open, Nucor, Alexandria Real Estate, Globe Life after the close. Expected Tuesday: Pepsico, UPS, GM, Halliburton, Philip Morris, Pulte, Freeport McMoRan, Lockheed Martin, JetBlue, GE, Kimberly-Clark, Sherwin-Williams, Baker Hughes, Tesla, Texas Instruments, Visa, Enphase, Seagate.

- Projected rate cut pricing running steady to mildly lower vs. late Friday lvls: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -16.2% w/ cumulative rate cut -4.7bp at 5.282%. July'24 cumulative at 11.6bp, Sep'24 cumulative -22.3bp.

- Look ahead: economic data picks up Tuesday with regional manufacturing data from Philly and Richmond Fed, S&P PMIs and New Home Sales.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00119 to 5.31571 (-0.00239 total last wk)

- 3M -0.00346 to 5.32294 (-0.00116 total last wk)

- 6M -0.00487 to 5.29803 (-0.00047 total last wk)

- 12M +0.00153 to 5.21604 (+0.02823 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.01), volume: $1.780T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $701B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $689B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $256B

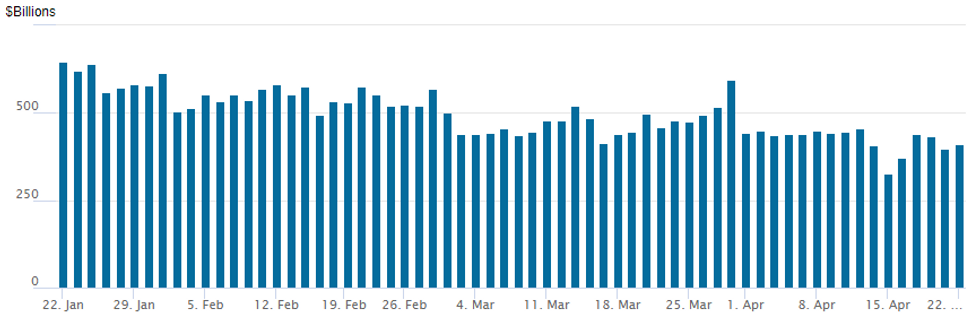

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage back over $400B to $409.816B Monday vs. $397.234B Friday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties climbs to 73 vs. 68 prior.

SOFR/TEASURY OPTION SUMMARY

SOFR option trade has segued from better downside puts in early trade to upside calls in late morning trade as underlying futures continue to pare losses - extending top end of the session range. Treasury options continued to revolve around 5Y-30Y puts. Projected rate cut pricing running steady to mildly lower vs. late Friday lvls: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -16.2% w/ cumulative rate cut -4.7bp at 5.282%. July'24 cumulative at 11.6bp, Sep'24 cumulative -22.3bp.

- SOFR Options:

- -5,000 SFRU4 95.00/95.18/95.43/95.62 call condors, 2.5

- -4,000 SFRU4 95.00/95.12/95.43/95.62 call condors 2.5 vs. 94.885/0.05%

- +15,000 SFRZ4 94.00/94.12/94.37/94.50 1.25 vs. 95.075

- +30,000 SFRK4 96.00 calls, 0.5

- -7,500 0QN4 95.00 puts, 6 vs. 95.585/0.18%

- +4,000 SFRM4 95.25/95.75 call spds, 0.75 vs. 94.74/0.06%

- +5,000 SFRU4 95.12/95.25 call spds, 2.0 vs. 94.90/0.05%

- +4,000 SFRM4 94.87 puts, 17.5 vs. 94.74/0.80%

- +10,000 0QZ4 95.75/96.25 call spds, 17.25-17.50 vs.95.66 to -.67/0.16%

- -4,000 SRU4 95.50 calls, 6.5 vs. 9489/ 0.16%

- +5,000 0QZ4 96.25/96.75 call spds vs 2QZ4 96.37/96.75 call spds 2.0

- +7,000 0QU4 94.62/95.00/95.25/95.50 broken put condor, 4.0 vs. 95.545/0.10%

- 2,000 SFRM4 94.68/94.75/94.81 put flys ref 94.73

- 1,600 0QM4 94.75/95.00 put spds ref 95.375

- Treasury Options: Reminder, May options expire Friday

- +6,000 USM4 110 puts, 25

- -4,000 TYK4 107.5/108 put spds, 18

- +4,000 USK4 112 puts, 8

- 2,000 FVM4 104 puts, ref 104-27.5

- over 5,400 FVM 105.75 puts, 105 last

- over 3,700 FVM4 107 calls, 7 last

EGBs-GILTS CASH CLOSE: Dovish ECB/BoE Repricing Spurs Bull Steepening

Core FI reversed early losses to close Monday stronger, with Gilts outperforming Bunds.

- In a quiet day for European data, central banker commentary continued to be the driving force in rates.

- UK short-end yields fell further as last week's dovish BoE speak continued to be priced. Implied 2024 BoE cuts increased by 7bp to 59bp, the most since April 10.

- While he is a noted dove, ECB's Centeno's comment Monday that easing this year could exceed 100bp helped implied 2024 ECB rate cuts rise 4bp on the day to 78bp.

- Against this backdrop, both the German and UK curves bull steepened.

- Periphery EGBs benefited from benign ratings announcements Friday as well as the softer central bank rate outlook, with BTP spreads compressing the most in 2 months despite an otherwise mixed backdrop.

- Tuesday's scheduled highlight is the April round of flash PMIs, while we also get UK public finance data - which is likely to lead to an upward revision to the FY24/25 gilt remit (as we note in our Gilt Week Ahead).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.5bps at 2.965%, 5-Yr is down 2.9bps at 2.495%, 10-Yr is down 1.4bps at 2.486%, and 30-Yr is up 0.4bps at 2.627%.

- UK: The 2-Yr yield is down 6.3bps at 4.32%, 5-Yr is down 4.8bps at 4.08%, 10-Yr is down 2.5bps at 4.205%, and 30-Yr is down 1.8bps at 4.682%.

- Italian BTP spread down 7.1bps at 136.1bps / Spanish bond spread down 3.7bps at 77.5bps

EGB Options: Limited Trade To Start The Week

Monday's Europe rates/bond options flow included:

- DUM4 105.60/80 call spread 5K given at 3.75.

FOREX More Stable Sentiment Shores Up Antipodean FX, GBP Underperforms

- Diminishing geopolitical tensions have moderately bolstered risk sentiment to start the week with global indices in the green and higher beta currencies firmer in G10. Both AUD and NZD have risen around 0.4%, modestly extending the pullback from Friday’s sharp selloff.

- Overall, the AUDUSD trend condition remains bearish, and the pair is trading close to key support at 0.6443, the Feb 13 low, which has recently been cleared. Scope remains seen for an extension towards 0.6339, the Nov 10 ‘23 low. Firm resistance is seen at 0.6532, the 50-day EMA.

- The Japanese yen has had a subdued start to the week, however, continues to trade with a downward bias. USDJPY has matched the recent cycle highs at 154.79, however, low volumes capped topside momentum for the pair, as well as notable option expiries at the 155.00 mark.

- We wrote last week that while the technical trend condition in USDJPY remains positive, the next phase of strength could be harder to come by without another major shift in Fed policy pricing, as positioning looks stretched and diplomatic blockers to potential intervention appear to peel away.

- Elsewhere, GBP was a notable laggard on Monday, with EURGBP extending outperformance to trade fresh multi-month highs. The shift higher coincides with the confirmed close and break above the late March highs at the Friday close as well as the 200-dma at 0.8607, with momentum possibly picking up on the slippage through the 1.16 handle in GBP/EUR also - a cross closely watched by UK importers/exporters.

- Eurozone flash PMIs will take focus on Tuesday and markets will most likely then turn their attention to the April inflation round, commencing next week. US GDP (Thursday) will be the highlight for the global calendar this week, with Fed speakers notably absent as the FOMC enter their pre-meeting media blackout period.

FX Expiries for Apr23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E904mln), $1.0650(E746mln)

- USD/JPY: Y153.00($1.3bln), Y155.00($770mln)

- AUD/NZD: N$1.0825(A$593mln)

- AUD/USD: $0.6415-20(A$2.4bln), $0.6525-30(A$2.2bln), $0.6630(A$1.4bln)

- USD/CAD: C$1.3500($505mln)

Late Equities Roundup: Chip Stocks, Banks Continue to Buoy Market

- Stocks continued to gain in the second half, rising back to early Thursday levels in late Monday trade with banks and microchip stocks outperforming. Currently, DJIA is up 449.85 points (1.18%) at 38435.65, S&P E-Minis up 72.5 points (1.45%) at 5076, Nasdaq up 254.2 points (1.7%) at 15535.9.

- Information Technology and Financial sectors led gainers in the second half, IT buoyed by chip stocks as they recovered from better selling late last week: Nvidia +4.64%, Enphase +3.69%, Seagate +3.08%. Banks supporting the former: Truist +3.89%, Citigroup +2.93%, Bank of America +2.41%.

- Laggers: Materials and Real Estate sectors underperformed late, metals and mining stocks weighed on the former as Gold prices tumbled over $63.0 in late trade: Newmont -3.66%, Freeport McMoRan -0.43%. Meanwhile, real estate investment trusts weighed on the latter: Crown Castle -0.12%, Ventas -0.07%, Digital Realty Trust +0.2%.

- Corporate earnings: Verizon and Albertsons announced ahead of the open, Nucor, Alexandria Real Estate, Globe Life after the close. Expected Tuesday: Pepsico, UPS, GM, Halliburton, Philip Morris, Pulte, Freeport McMoRan, Lockheed Martin, JetBlue, GE, Kimberly-Clark, Sherwin-Williams, Baker Hughes, Tesla, Texas Instruments, Visa, Enphase, Seagate.

E-MINI S&P TECHS: (M4) Corrective Bear Cycle Still In Play

- RES 4: 5400.00 Round number resistance

- RES 3: 5285.00/5333.50 High Apr 10 / 1 and the bull trigger

- RES 2: 5164.38 20-day EMA

- RES 1: 5095.25/5141.21 High Apr 18 / 50-day EMA

- PRICE: 5025.75 @ 14:31 BST Apr 22

- SUP 1: 4963.50 Low Apr 19

- SUP 2: 4907.57 50.0% retracement of the Oct 27 ‘23 - Apr 1 bull leg

- SUP 3: 4863.75 Low Jan 19

- SUP 4: 4799.50 Low Jan 17

The short-term trend condition in S&P E-Minis is unchanged and remains bearish. Friday’s extension reinforces current short-term conditions. The contract has cleared support at the 50-day EMA, signalling scope for a continuation lower near-term. Sights are on 4907.57 next, a Fibonacci retracement. Firm resistance is seen at 5164.38, the 20-day EMA. A clear break of the average would signal a possible reversal.

COMMODITIES Spot Gold, Crude Eases Back

- Spot gold is down 2.7% at $2,327/oz early on Monday, bringing the yellow metal to its lowest level in a week, as geopolitical tensions in the Middle East eased.

- The move was not isolated to gold, with silver also now off by 5.2% on the day at $27.2/oz, leaving it 8.7% off the April high.

- As a result, the gold/silver ratio is back above the 200-dma, after dipping below earlier in the month.

- The trend condition in gold is unchanged and the outlook remains bullish, with sights on $2452.5, a Fibonacci projection, on the upside. Initial firm support is at $2310.2, the 20-day EMA.

- Meanwhile, crude has eased back on the day, although it has moderated some of its earlier losses. While the geopolitical risk premium linked to Middle East supply concerns is easing, conflict remains a concern for the market.

- WTI Jun 24 is down 0.5% at $81.8/bbl.

- Further sanctions against Iran’s oil sector were included in the foreign aid bill passed by the US House at the weekend.

- From a technical perspective, a bull theme in WTI futures remains intact, although last week’s move lower highlights the start of a short-term bearish corrective cycle.

- The contract has traded through the 20-day EMA and this signals scope for an extension towards the 50-day EMA, at $80.70. On the upside, key resistance and the bull trigger has been defined at $86.97, the Apr 12 high.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/04/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 23/04/2024 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 23/04/2024 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/04/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/04/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/04/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/04/2024 | 0800/0900 |  | UK | BOE's Haskel Panelist at Econometric Seminar | |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/04/2024 | 1115/1215 |  | UK | BOE's Pill Speech at University of Chicago | |

| 23/04/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/04/2024 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/04/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/04/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 23/04/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/04/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.