-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI ASIA MARKETS ANALYSIS: Weekly Claims, Core PCE Weigh on FI

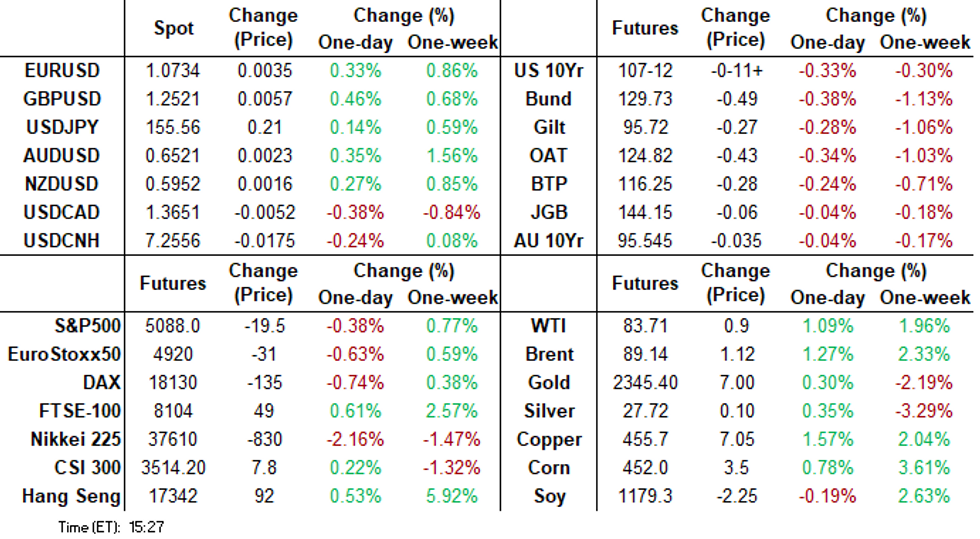

- Treasuries gapped lower following lower than expected weekly claims and strong PCE data.

- Volumes surged as 10Y yield climbed to 4.735% and projected rate cut vacated 2024 pricing.

- Late cross asset rebound, stocks recovered from post-data lows to opening levels, Gold and Crude rallied.

US TSYS Weekly Claims Miss, Strong Core PCE Weighs on Tsys, 7Y Sale In-Line

- Treasury futures held weaker levels after this morning's lower than expected weekly claims and strong core PCE (3.7% vs. 3.4% est) saw chances of a rate cut in 2024 evaporate.

- Jobless claims printed a seasonally adjusted 207k (cons 215k) in the week to Apr 20 after an unrevised 212k. Meanwhile, Real GDP was softer than expected in Q1 at 1.6% (cons 2.5) after 3.4% in Q4 (no revisions in this advance release), and Pending home sales were stronger than expected in March as they increased 3.4% M/M (cons 0.4) after 1.6% in Feb.

- Projected rate cut pricing vs. pre-data levels: May 2024 -2.6% w/ cumulative -2.6bp at 5.322%; June 2024 at -8.9% from -16.2% earlier w/ cumulative rate cut -2.9bp at 5.300%. July'24 cumulative at -8.6bp from -12.1bp, Sep'24 cumulative -18.6bp from -24.4bp.

- Little reaction in Tsys futures (TYM4 107-13.5 last) after the $44B 7Y note auction (91282CKN0) in line with WI of 4.716%; bid-to-cover slips to the lowest since November at 2.48x vs. 2.61x last month.

- Focus turns to Friday's Data Calendar: Personal Income/Spending, UofM Sentiment, while May Treasury options expire.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00131 to 5.31816 (+0.00006/wk)

- 3M +0.00090 to 5.32445 (+0.00035/wk)

- 6M -0.00805 to 5.28965 (-0.00885/wk)

- 12M -0.02235 to 5.18826 (+0.00045/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.778T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $673B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $664B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $71B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $248B

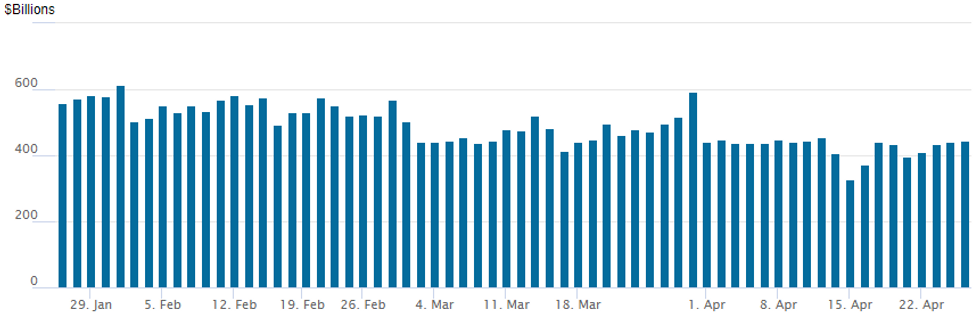

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage inches up to $443.928B vs. $441.215B Wednesday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties recedes to 74 vs. 82 prior.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury option trade remained mixed Thursday, Treasury options leaning toward upside 5- and 10Y calls while SOFR options revolved around downside puts since midmorning. Underlying futures held weaker levels after this morning's lower than expected weekly claims and strong PCE data saw chances of a rate cut in 2024 evaporate. Projected rate cut pricing vs. pre-data levels: May 2024 -2.6% w/ cumulative -2.6bp at 5.322%; June 2024 at -8.9% from -16.2% earlier w/ cumulative rate cut -2.9bp at 5.300%. July'24 cumulative at -8.6bp from -12.1bp, Sep'24 cumulative -18.6bp from -24.4bp.

- SOFR Options:

- Block, +5,000 SFRZ4 94.50 puts, 8.0 vs. 95.01/0.22%

- Block, 12,000 SFRZ4 94.00/94.25 put spds, 1.5 vs. 95.065/0.02%

- +5,000 SFRM4 94.50/94.62 put spd vs SFRM4 94.81/94.93/95.06 call flys 0.0

- +7,000 SFRM4 94.68/94.75 2x1 put spds, 2.25 ref 94.71

- Block, +25,970 SFRM4 94.75 puts, 9.0 ref 94.705

- -5,000 SRFZ4 94.87 puts, 21.0 ref 94.99

- -12,000 0QK4 95.56 calls, 5.5 vs. 95.375/0.28%

- -5,000 SFRU4 94.87 calls, 14.5 ref94.86

- +5,000 SFRZ4 96.00/97.00 call spds 5.5 ref 95.01

- +5,000 SFRM4 94.88/95.00 call spds 1.0 ref 94.72

- +10,000 SFRZ4 96.00/97.00 call spds 5.75 ref 95.03

- 2,000 0QN4 95.87/96.12/96.37 call flys ref 95.505

- 1,500 3QM4 95.25/95.75/96.25 put flys ref 95.92

- 3,000 0QN4 94.75 puts ref 95.595

- Treasury Options: Reminder, May options expire Friday

- -5,000 TYM4 108 puts, 113 ref 107-14

- -10,000 TYM4 107.5 puts, 59 ref 107-13

- +5,000 TYU4 110.5 calls, 46

- +50,000 wk1 FV 105.5 calls, 9.5 ref 104-24 opener, expires May 3

- 2,800 FVK4 105.75/106.25 1x2 call spds

- 9,000 TYM4 111/112/113/114 call condors

- 4,000 FVM4 103.5/104.5 put spds ref 104-26

- 5,000 FVM4 106/107 call spds ref 104-26.75

- 3,200 TYK4 107.25/107.5 put spds, 4 ref 107-23.5

- 1,600 USM4 119 calls, 15 ref 113-30

- over 6,600 TYK4 107.5 puts, 7 last

- 5,000 FVM4 106/107 call spds ref 105-03

FOREX USD Index Reverses Data-Inspired Spike, Approaching Session Lows

- The greenback has been slowly edging lower over the course of the US session as the post-data spike for the USD index slowly recedes. Most G10 pairs are now trading back towards pre-data levels, with the likes of EURUSD and GBPUSD hovering just below the best levels of the week. The reaction to the above estimate core PCE price index appears to have been tempered by the poorer GDP print and keeps G10 currency market adjustments relatively contained.

- JPY weakness was once again the market focus on Thursday, as USDJPY's ascent continued, printing a new cycle high of 155.75. Markets continue to test the resolve of the Japanese authorities, as several 'lines in the sand' at Y152.00 and Y155.00 go by with little sign of intervention. The BoJ are expected to discuss the weakening currency at their ongoing policy meeting - on which MNI understands that the USDJPY at current levels is insufficient to prompt any immediate rate hike from the BoJ.

- Overnight JPY options vols are pricing a sizeable swing across the BoJ decision on Friday, with markets pricing options at their most sensitive level of the year so far.

- As noted, GBP trades more favourably despite the lower equity benchmarks and higher US yields. The trend condition in GBPUSD remains bearish and this week’s recovery appears to be a correction. However, initial resistance at 1.2512, the 20-day EMA, has been pierced and eyes will be on further strength towards 1.2586, the 50-day EMA.

- In emerging markets, USDMXN experienced some sharp volatility on the US data, bouncing over 2% from session lows and briefly testing resistance around 17.38 as the initial impact on stocks and bonds pressured the renewed sensitivity of the peso.

- The BOJ decision and press conference takes focus Friday before the US PCE Core Deflator crosses. UMich consumer sentiment and inflation expectations will round off the week’s data calendar.

FX Expiries for Apr26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E1.1bln), $1.0645-50(E3.2bln), $1.0665-85(E2.3bln), $1.0700(E843mln), $1.0730-50(E1.2bln)

- USD/JPY: Y155.00($1.1bln), Y156.50($531mln)

- GBP/USD: $1.2430(Gbp1.1bln), $1.2500(Gbp678mln)

- AUD/USD: $0.6540-50(A$545mln)

- NZD/USD: $0.5925-40(N$616mln), $0.6100(N$605mln)

- USD/CAD: C$1.3770-75($676mln), C$1.3860-70($2.1bln)

- USD/CNY: Cny7.2500($1.1bln)

Late Equities Roundup: Recovering From Post-Data Lows

- Still weaker, stocks have completely recovered from this morning's post-data lows to near overnight levels. Stocks sold off after this morning's lower than expected weekly claims and strong PCE data saw chances of a rate cut in 2024 evaporate. Currently, DJIA is down 446.94 points (-1.16%) at 38014.52, S&P E-Minis down 38 points (-0.74%) at 5069.75, Nasdaq down 145.3 points (-0.9%) at 15567.6.

- Laggers: Communication Services and Information Technology sectors continued to underperform in late trade: off lows, Meta is still -9.95%, Comcast -6.09%, IBM -8.14%, Microsoft -2.32%. Chip stocks continued to extend gains for the fourth day running: Teradyne +7.84%, Nvidia +4.26%, Monolithic Power +3.65%.

- Leading gainers: Materials and Energy sectors outperformed in the second half, metals and mining stocks trading strong: Newmont +12.93%, Freeport McMoRan +2.40%. Oil equipment and services shares supported the Energy sector: Baker Hughes +1.58%, Hess +1.31%, Diamondback Energy +0.83%.

- Corporate earnings announcements expected after the close: Capital One, L3Harris, Intel, Microsoft, Western Digital, Juniper Networks, KLA Corp, T-Mobile, Alphabet, Gilead Sciences, Snap Inc.

E-MINI S&P TECHS: (M4) Resistance At The 20-Day EMA Remains Intact

- RES 4: 5285.00/5333.50 High Apr 10 / 1 and the bull trigger

- RES 3: 5213.25 High Apr 15

- RES 2: 5144.86 20-day EMA

- RES 1: 5135.07 50-day EMA

- PRICE: 5043.75 @ 14:05 BST Apr 25

- SUP 1: 4963.50 Low Apr 19

- SUP 2: 4907.57 50.0% retracement of the Oct 27 ‘23 - Apr 1 bull leg

- SUP 3: 4863.75 Low Jan 19

- SUP 4: 4799.50 Low Jan 17

The short-term trend condition in S&P E-Minis remains bearish and the latest recovery appears - for now - to be a correction. Last week’s bearish extension reinforced current short-term conditions. The contract has recently cleared the 50-day EMA, signalling scope for a continuation lower. Sights are on 4907.57 next, a Fibonacci retracement. Firm resistance is 5144.86, the 20-day EMA. A clear break of the average would signal a possible reversal.

COMMODITIES Crude Finds Late Rebound, Spot Gold Range Trading

- Crude markets have rebounded to approach US close trading higher. A reversal in US dollar strength has offered support to WTI. Demand concerns continue to be weighed against fears for Middle East supply.

- WTI Jun 24 is up 1.0% at $83.7/bbl.

- WTI futures have recovered from their recent lows and price remains above key short-term support at $81.03, the 50-day EMA. On the upside, key resistance and the bull trigger has been defined at $86.97, the Apr 12 high.

- In contrast, Henry Hub is trading lower on the day, driven by a slightly higher than expected build in US gas storage inventories.

- US Natgas May 24 is down 2.1% at $1.62/mmbtu.

- Meanwhile, spot gold is up 0.7% at $2,333/oz.

- The precious metal has recently pierced the 20-day EMA and a continuation lower would signal scope for an extension towards $2229.4, the 50-day EMA. Key resistance and the bull trigger has been defined at $2431.5, the recent Apr 12 high.

- Copper is up by 1.3% at $454.6/lb, having hit a near 23-month high of $458.6 earlier in the session.

- A bullish theme in copper futures remains intact, with attention on $460.76 next, a Fibonacci projection. Key support is seen at $415.53, the 50-day EMA.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2024 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 26/04/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 26/04/2024 | 0130/1130 | ** |  | AU | Trade price indexes |

| 26/04/2024 | 0200/1100 | *** |  | JP | BOJ Policy Rate Announcement |

| 26/04/2024 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/04/2024 | 0800/1000 | ** |  | EU | M3 |

| 26/04/2024 | 0800/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 26/04/2024 | 0800/1000 |  | EU | ECB's De Guindos at Academia Europea Leadership | |

| 26/04/2024 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/04/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 26/04/2024 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 26/04/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.