-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Weekly Claims Rise Ahead NFP

HIGHLIGHTS

- MNI CHINA-EU: Von Der Leyen Cautions Against "Decoupling" From China

- MNI CHINA-EU: Xi To Macron: 'Europe Is Independent Pole In Multipolar World'

- MNI CHINA-EU: Macron-I Can Count On China To Bring Russia To The Negotiating Table

- MNI MIDEAST: Iran, Saudi Agree To Reopen Embassies, Examine Flights Resuming & Visas

- MNI ITALY: PM Meloni Tightens Grip On Rightist Bloc With Strong Regional Election

- FED BULLARD: RATES NOW IN LOW END OF SUFFICIENTLY RESTRICTIVE, Bbg

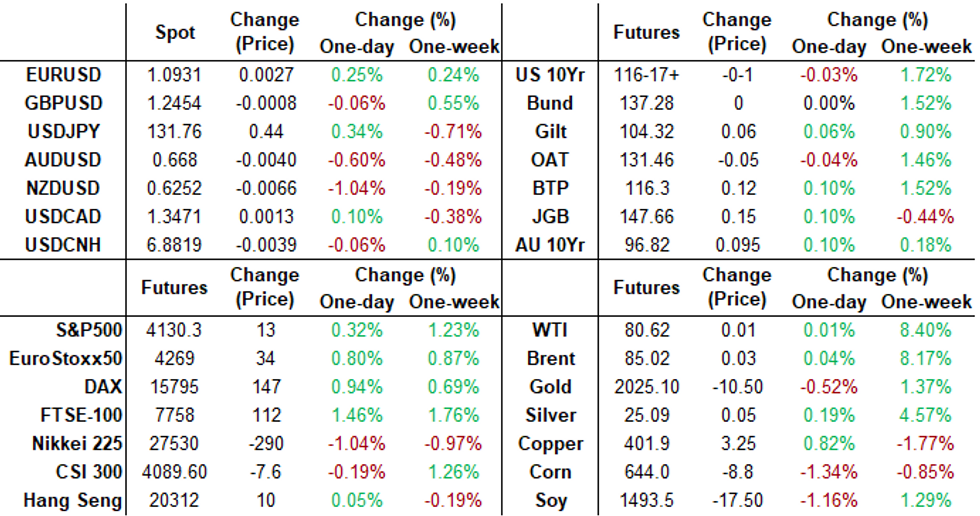

US TSYS: Short End Extends Lows Ahead Fri's March Employment Data

- Front month Jun'23 Treasury futures trading mildly weaker after quickly reversing the knee-jerk bid anticipated in the event of a large claims up-revision.

- Tsy futures initially gapped higher (10s 116-30 high) following weekly claims: 18k drop to 228k vs. 200k est, prior revision to 246k, but quickly retraced to opening levels: 10s 116-23.5 (+5), 10Y yield 3.2662%.

- Yield curves have traded in a wide range today, well off early "highs" (2s10s -42.798 high), curves reversed course as the short end extended lows in the second half: 2s10s -52.850 at the moment (-4.710).

- Implied rate hikes gained slightly while rate cuts through year end have subsequently pared back from this morning's "highs".

- Fed funds implied hike for May'23 is currently at 12.6bp vs. 11.1bp, Jun'23 +8.1bp vs. 5.6bp cumulative at 4.893%.

- Projected rate cuts later in the year continue to recede from Wednesday's post-ADP levels: Sep'23 cumulative -33.3bp vs -36.6bp earlier to 4.490%, to -69.9bp vs. -75.5bp for Dec'23 (-84.9bp Wed) at 4.119.

- Focus turns to Friday's employment data for March at 0830ET. Reminder: Early close tomorrow in observance of Good Friday: 1100ET, Globex close at 1115ET. Full session on Monday. Side note: UK markets closed Friday and Monday.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00042 to 4.80971% (+0.00885/wk)

- 1M +0.01015 to 4.90029% (+0.04258/wk)

- 3M -0.01314 to 5.19786% (+0.00515/wk)*/**

- 6M -0.05471 to 5.23743% (-0.07557/wk)

- 12M -0.07386 to 5.12571% (-0.17958/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.22257% on 4/3/23

- Daily Effective Fed Funds Rate: 4.83% volume: $102B

- Daily Overnight Bank Funding Rate: 4.82% volume: $255B

- Secured Overnight Financing Rate (SOFR): 4.81%, $1.427T

- Broad General Collateral Rate (BGCR): 4.79%, $524B

- Tri-Party General Collateral Rate (TGCR): 4.79%, $510B

- (rate, volume levels reflect prior session)

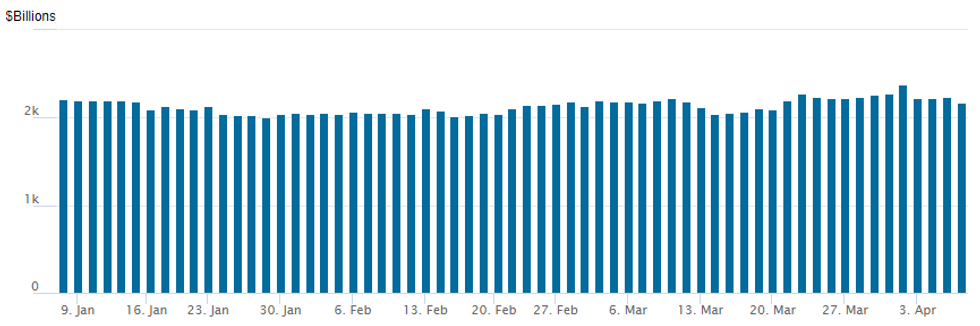

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $2,173.663B w/ 105 counterparties, compares to yesterday's $2,243.011B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Overall session volume on SOFR and Treasury options has been relatively muted this week with many desks partially staffed in the lead-up to Easter Sunday. Others sidelined to await the latest employment data for March scheduled on Friday's shortened session. Better Treasury call structures reported overnight into early NY trade followed by slight pick-up in low delta puts in SOFR options as underlying futures through early 2024 traded weaker - implied rate cuts through year end receding. Salient trade:- SOFR Options:

- +5,000 SFRM3 94.93/95.00/95.18 put trees 1.0-1.25

- -2,500 SFRZ3 94.75/95.50 2x1 put spds, 11.0

- +1,000 SFRU3 97.00/98.50 1x2 call spds, 7.0

- Block, 6,000 OQM3 95.87/96.25 3x2 put spds, 10.5 2-legs over ref 96.885

- 2,500 SFRM3 95.00/95.25/95.50 call flys ref 95.22

- 3,000 SFRM3 94.62 puts, 1.5 ref 95235

- 2,200 OQJ3 97.37/97.50 call spds, ref 96.89

- Treasury Options:

- 2,000 TYK3 114.5 puts, 11 ref 116-17

- 2,500 TYK3 115/115.75 put spds, 12 ref 116-19.5

- +4,000 TUK3 103/103.5 put spds, 9.5

- 1,500 FVK3 111/112/112.5 broken call flys ref 110-27.5

- 1,500 FVK3 110.75 puts, ref 110-25

- 2,000 TYK 118 calls, 25 ref 116-17.5

- 2,000 TUM3 104.75/105 call spds ref 103-28

- 1,500 FVM3 109 puts, 22 ref 110-28.5

- 1,300 TYK3 117/118/119 call flys, ref 116-20

- 2,200 TYK3 118 calls, 25 ref 116-15

EGBs-GILTS CASH CLOSE: Busy Week Finishes On Flatter Pre-Holiday Note

The UK and German curves bear flattened Thursday to end an otherwise strong holiday-shortened week, with early strength at the short end reversing toward the close.

- The session was characterised by limited volumes and few event catalysts of note.

- Softer-than-expected US data has been the driving force in markets all week, and a jobless claims reading to the high side of expectations pushed Bund and Gilt yields to session lows in a knee-jerk move in the early European afternoon.

- But the move quickly faded, in large part due to seasonal adjustment revisions at play, and global core FI retreated ahead of the long weekend - with the US nonfarm payrolls reading Friday also on traders' minds.

- Equities rallied into the close, weighing on safe havens too. Periphery spreads were fairly steady throughout the session though, widening only mildly.

- BoE terminal rate hike pricing was little changed (4.63% for Sept); ECB terminal rose 5.6bp (to 3.52%, also for Sept). Little reaction to ECB Lane's reiteration that a May hike is the baseline case (futures continued to price in 22bp, unchanged).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3bps at 2.554%, 5-Yr is up 0.2bps at 2.18%, 10-Yr is up 0.1bps at 2.183%, and 30-Yr is up 1.6bps at 2.282%.

- UK: The 2-Yr yield is up 3.1bps at 3.372%, 5-Yr is up 1.5bps at 3.271%, 10-Yr is up 0.4bps at 3.432%, and 30-Yr is down 0.1bps at 3.771%.

- Italian BTP spread up 1.6bps at 184.9bps / Spanish up 1.8bps at 104.5bps

EGB Options: Euribor Upside Features Again Ahead Of The Holiday Weekend

Thursday's Europe rates / bond options flow included:

- RXK3 131.50/130.00ps 1x2, bought for 1 in ~4.3k.

- ERU3 97.00/98.00 call spread bought for 12.75 in 10k (ref: 96.53)

FOREX: NZD Remains Poorest Performer, DXY Unchanged Ahead Of NFP

- Despite the firmer sentiment across equity markets through the US session on Thursday, antipodean currencies have consolidated earlier losses. This sees NZD as the weakest in G10, declining 1% against the greenback amid a slightly weaker commodity complex. Despite the sharp drop, price remains around 50 pips shy of the weekly lows at 0.6208.

- In similar vein, AUDUSD is 0.6% lower as iron ore prices continue their slide to around 6% on the week.

- Overall, the USD index remains just south of unchanged as we approach tomorrow’s non-farm payrolls. The single currency has outperformed and has prompted EURUSD to regain some ground back above the 1.09 handle.

- With 1.0930 marking a key short-term hurdle for EURUSD bulls a sustained break would reinstate the recent bull theme and signal scope for a move to 1.1033, the Feb 2 high.

- USDJPY maintained an upward bias, edging around 1% higher from the overnight 130.78 lows but remains comfortably below the pre-JOLTS data levels of 132.70.

- For tomorrow’s data, Bloomberg consensus looks for still solid nonfarm payrolls growth of 230k in March as it falls back to closer to December’s pace with a return of more typical weather. However, actual expectations might be a little lower now after a recent string of weak data labour indicators.

FX: Large option expiry could be at play

- Not much change in the Dollar against G10s, NZD is still the worst performer down 0.82%, albeit off its worst levels.

- The Greenback is around flat versus GBP, EUR, NOK, and CHF.

- Latest mover is the USDJPY, pushing higher, but well within yesterday's range, and still short of yesterday's high at 131.84.

- Note that we have some large option expiry for today (expiry at 15.00BST/10.00ET), that could act as magnets and keep the EURUSD and USDCAD inside those strikes..

Of note: - EURUSD 3.95bn between 1.0875/1.0950.

- USDCAD 5.47bn between 1.3430/1.3500.

- USDJPY 1.85bn at 131.00/131.50.

Equity Roundup: Near Late Session Highs

- US stocks continue to hold mildly higher levels in late trade: SPX Eminis (4134.0 +16.75) and Nasdaq (12,092.0 +95.0) outperforming Dow Industrials (33,489.5 +7.0) all near modest session highs marked recently.

- Modest two-way positioning remains thin ahead of Friday's March employment data (+230k est vs. +311k prior).

- Energy, Consumer Staples and Materials sectors the top three S&P index laggers. Lead gainers include Communication Services, Information Technology and Financials (regional banks outperforming insurance and financial services names): First Republic (FRC +4.39%, Key Bank +3.95%, Well Fargo +3.0%.

- For a technical point of view, S&P E-minis maintains a bullish tone after the index recently breached resistance at 4119.50, the Mar 6 high, reinforcing a bullish theme.

- The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension towards 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key M/T resistance. Firm support lies at 4039.75, the 50-day EMA.

E-MINI S&P (M3): Outlook Remains Bullish

- RES 4: 4244.00 High Feb 2 and a bull trigger

- RES 3: 4223.00 High Feb 14

- RES 2: 4205.50 High Feb 16

- RES 1: 4171.75 High Apr 4

- PRICE: 4133.00 @ 1445ET Apr 6

- SUP 1: 4078.00 Low Mar 31

- SUP 2: 4039.75 50-day EMA

- SUP 3: 3980.75 Low Mar 28

- SUP 4: 3937.00 Low Mar 24

S&P E-minis maintains a bullish tone and the latest pullback is considered corrective. Price has recently breached resistance at 4119.50, the Mar 6 high, reinforcing a bullish theme. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension towards 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key M/T resistance. Firm support lies at 4039.75, the 50-day EMA.

COMMODITIES: Crude Sees A Steady Session To End Week Bolstered By OPEC+

- Crude oil sees an unusually steady session, largely tracking sideways and in doing so broadly consolidating the jump seen first thing in the week after the surprise OPEC+ cut announcement for a large weekly gain. Tomorrow’s US nonfarm payrolls could provide the latest, more significant macro steer for demand implications.

- WTI is +0.04% at $80.64, with resistance at 81.81 (Apr 4 high) and support at $77.60 (23.6% retrace of Mar 20 - Apr 3 rally).

- Brent is +0.06% at $85.04 with resistance at $86.44 (Apr 3 high) and support at $82.57 (23.6% retrace of Mar 7 – Apr 3 uptrend).

- Gold is -0.5% at $2009.80 as it pulls back further off yesterday’s high of $2032.1 (forming initial resistance) despite the USD on balance moving softer today. Intraday correlation with the US dollar has softened these past two days but still holds over the week as a whole, with gold benefiting from an on net weaker USD.

- Weekly moves: WTI +8.4%, Brent is +7.2%, Gold is +1.5%, US nat gas -4.9%, EU TTF -1.1%.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/04/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/04/2023 | 1230/0830 | *** |  | US | Employment Report |

| 07/04/2023 | 1900/1500 | * |  | US | Consumer Credit |

| 10/04/2023 | - |  | EU | ECB Lagarde at IMF/World Bank Spring Meetings | |

| 10/04/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/04/2023 | 2015/1615 |  | US | New York Fed's John Williams | |

| 11/04/2023 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 11/04/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 11/04/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 11/04/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank Spring Meetings | |

| 11/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/04/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 11/04/2023 | 1730/1330 |  | US | Chicago Fed's Austan Goolsbee | |

| 11/04/2023 | 2200/1800 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.