-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI ASIA MARKETS ANALYSIS - Yields and USD Jump On Retail Sales, Solid Mega-Bank Earnings

- Markets see surprisingly strong reaction to US retail sales, UMich Sentiment and hawkish Fedspeak

- Treasuries sold off with the front end tipping 2Y yields near 4.10% for the first time since Apr 3

- Equity futures shake off support from firm earnings as real yields spiked sentiment

US TSYS: Holding Cheaper After Retail Sales and Broader Confluence Of Factors

- Cash Tsys heading nearer the close with the 2Y +13bps after most of the action came early with retail sales. Even though the ex-autos & gas/control group beats were small, they were treated as at least ruling out consumers coming under the cosh following banking stresses and built on better-than-expected large bank earnings landing beforehand.

- Moves were further stoked by hawkish commentary from the Fed’s Waller before a surprise jump in near-term U.Mich inflation expectations.

- The front end drags the rest of the yield curve higher, with 10YY +7.5bps (real yields +5.5bps), whilst in futures space, TYM3 trades at 114-28+ (-18) off a post-retail low of 114-23 that stopped short of 114-18 (Apr 3 low).

- Fed Funds: 20bp hike for May FOMC, a cumulative 24bp of hikes for Jun, mostly reversed by Sep and moving onto 35bp of cuts from current levels to year-end vs closer to 50bps yesterday.

FOREX: Dollar Index Snaps Losing Streak, NZD Sharply lower

- A mixture of solid bank earnings and potential profit taking ahead of the weekend worked in favour of the USD on Friday. The DXY has risen around 0.6%, snapping a three-day losing streak in the process. The greenback rally picked up momentum following the bumper University of Michigan sentiment release: 1y inflation expectations came in well ahead of forecast (4.6% vs. Exp. 3.7%, the biggest beat on consensus since 2021) and the associated moves in US yields (2-yr +13bps).

- Weakness for equities left antipodean currencies at the bottom of the G10 pile, with a notable 1.5% drop for NZD. However, it is worth noting that the moves are just an unwind of the prior day’s significant rally. GBPUSD sits close behind, declining 0.95% and hovers just above the 1.2400 handle approaching the weekend close.

- This is potentially an important turnaround for cable given the bullish significance of the recent breach of 1.2448, the Jan 23 high and the top of a broad 3.5 month range. The weekly close back below this point could test the resolve for bulls, especially ahead of next week’s UK CPI data.

- In similar vein, EURUSD has been unable to consolidate above the 1.10 handle and the recent trend highs of 1.1033, sliding 0.55% on Friday and halving the week’s advance.

- Overall, the USD Index remains over 1% below the Monday high, but has steadily been paring these losses throughout the session. 101.80 marks the 50% retracement of the week's range, of which a breach may prove constructive for a further recovery towards the 50-dma which intersects at 103.45.

- Monday’s docket sees US Empire State Manufacturing as well as potential comments from ECB’s Lagarde. China GDP data, along with other activity metrics, all cross early on Tuesday.

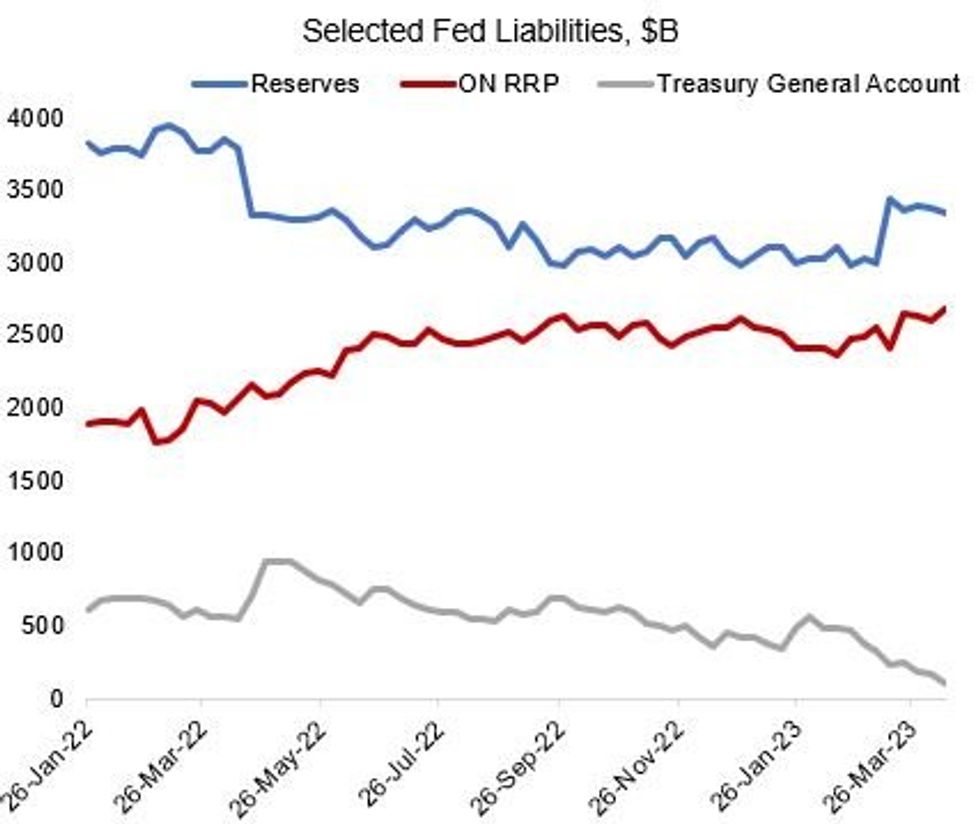

MNI Fed Balance Sheet Tracker - April 14, 2023

In the latest sign of relief for the US banking sector following March’s turmoil, Fed balance sheet data shows that banks paid back some of their recent “emergency” borrowing.

- We would still expect takeup of the Fed's new Bank Term Funding Program to increase over the coming months, given its generous terms, but some of the early analyst estimates for the eventual size may prove to have been overblown.

- With the Treasury's account at the Fed nearly depleted, the April 18 tax deadline looms large.

- Full analysis in PDF here

BANK EARNINGS: Big Banks off to Strong Start - but can Regionals follow?

- Earnings season now well underway for Q2, with large-cap financials (WFC, C, JPM) topping street consensus this week.

- Financials and large cap banks remain the focus in the coming week, with Bank of America, Goldman Sachs, US Bancorp and BNY Mellon set to follow. Market focus remains on any gaps in performance between mega-cap and smaller-cap regional names following the SVB crisis.

- The rally across banking names Friday has also lent support to the greenback and supports Fed implied pricing, which took a further leg higher today.

- Full schedule including EPS & revenue expectations here: https://roar-assets-auto.rbl.ms/files/52491/MNIUSEARNINGS170423.pdf

EGBs-GILTS CASH CLOSE: Yields End Week On Highs

European yields closed at one-month highs Friday, with markets taking a hawkish cue from US data.

- The German and UK curves bear flattened, with ECB and BoE terminal rate expectations pushing 6-7bp higher.

- A strong US UMichigan consumer inflation survey and hawkish comments by Fed's Waller exacerbated the global move.

- For the ECB, not only is a 25bp now fully priced in, but the debate is increasingly over whether they will go 50bp (30% priced).

- A Reuters sources piece and comments by Belgium's Wunsch set a hawkish tone by suggesting a more aggressive QT stance may be ahead.

- Periphery EGB spreads were mixed but basically flat, coming off wides in the afternoon as Bunds sold off.

- Next week sees huge EGB issuance (E45bln) and several key data points, including UK CPI and flash PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 10.2bps at 2.881%, 5-Yr is up 8.1bps at 2.473%, 10-Yr is up 6.8bps at 2.44%, and 30-Yr is up 4.5bps at 2.507%.

- UK: The 2-Yr yield is up 10.1bps at 3.618%, 5-Yr is up 10.2bps at 3.508%, 10-Yr is up 9.2bps at 3.667%, and 30-Yr is up 7.9bps at 4.021%.

- Italian BTP spread up 0.7bps at 185.7bps / Spanish down 0.8bps at 103.7bps

US RATES OPTIONS: SOFR Downside And Large TY Call Spread Feature Friday

Friday's U.S. rates / bond options flow included:

- SFRK3 95.12/95.00/94.87p fly, bought for 3.25 in 4k

- SFRM3 95.12/95.06/95.00/94.93p condor, bought for 1 in 20k total

- SFRJ3 95.12/95.06ps traded 5 in 7k

- SFRJ3 95.00p, traded 0.25 in 7.5k

- SFRJ3 95.12/95.06/95.00p fly traded 3.5 in 1k

- SFRJ3 95.00/95.18/95.37c fly traded 6 in 2k

- SFRK3 95.12/95.00/94.87p fly traded 3.5 in 1k

- SFRM3 95.00/12/31/43c condor traded 2.5 in 2k

- SFRM3 95.12/25/35/50c condor traded 1.5 in 2.5k

- SFRM3 95.31/95.18/95.06p fly traded 1.25 in 2k

- SFRM3 94.81/94.68/94.56p fly traded 1 in 6k

- SFRZ3 96.00/96.50cs traded 13.5 in 5k

- SFRZ3 94.75/95.00/95.25 put-fly bought for 3.5 in 5k

- TYM3 115/116 cs bought for 26 in 50k

EU RATES OPTIONS: Outright Put Buying And Risk Reversals In Euribor

Friday's Europe rates / bond options flow included:

- DUM3 105.80/106.20cs, bought for 11 in 3k

- ERU3 95.25/97.50 combo, sold at the put at 0.25 in 8k

- ERK3 96.25/96.00ps 1x2, bought for 1 in 4k and 6k

- ERU3 95.50p, bought for 8 in 10k (ref 96.24)

FX OPTIONS: AUD/USD Slips to Within a Few Pips of Sizeable Strike

Larger options rolling off at Monday's cut include some sizeable strikes for EUR/USD and USD/JPY - while AUD/USD has already pulled lower to trade just a few pips above a A$2.3bln mixed strike at the 0.67 handle.

- EUR/USD: $1.0920(E528mln), $1.0935(E931mln), $1.0950-55(E637mln), $1.1050(E2.0bln)

- USD/JPY: Y132.50($1.0bln) Y133.00-11($1.1bln)

- AUD/USD: $0.6700(A$2.3bln)

US STOCKS: Real Yields Outweigh Initial Bank Optimism

- The S&P E-mini has pulled back off lows of 4138 but remains under pressure at 4149 at typing (-0.6%) as it unwinds half of yesterday’s push higher.

- It comes with the 10Y real yield pushing back towards session highs seen after retail sales, currently +5bps on the day with real yields behind most of the sell-off in nominal yields.

- Nasdaq trims earlier losses to see similar declines (-0.6%) whilst in banks, the KBW index (+0.7%) still sees striking contrast between large banks after positive earnings this morning and regionals currently -2.7%.

- North of the border, the TSX outperforms with 0.0%, with banks gaining +0.5%.

COMMODITIES: Gold Slumps On USD Bounce Whilst Oil Holds Week’s Gain

- Crude oil is edging higher on the day having seen a volatile session, holding on for reasonable gains on the week, buoyed for the most part by dollar weakness except for today’s snap higher for the DXY.

- The IEA has also warned that rising demand from China and developing economies will outpace production in 2H23.

- WTI is +0.3% at $82.45, earlier remaining under key resistance at $83.53 (Jan 23 high) but also off support at $79.00 (Apr 3 low).

- The day sees most active strikes in the CLK3 seeking protection at $80/bbl puts.

- Brent is +0.2% at $86.24,with resistannce seen at $87.49 (Apr 12 high) and support at $83.50 (Apr 3 low).

- Gold is -1.8% at $2003.71, sliding with the lurch higher in the dollar having overnight come close to yesterday’s high of $2048.74. It unwinds large gains for the week although the abruptness of prior gains still leaves support at $1981.7 (Apr 10 low) despite today’s slide.

- Weekly moves; WTI +2.2%, Brent +1.3%, Gold -0.2%, US nat gas +5.1%, EU TTF nat gas -7.7%

USDCAD Slides Back From Oversold Territory Despite CAD Outperforming Peers

- USDCAD little swayed by Macklem’s comments. At 1.3374 for +0.27% on the day, CAD has notably outperformed other majors amidst the day’s trend of dollar strength after a strong reaction to US retail sales.

- It has pulled back from today’s earlier dip into oversold territory although the 14-day RSI at 35 remains depressed (more context on that found here).

- Having pulled back off a low of 1.3302 for lows since mid-Feb, the pair is back within yesterday’s range whilst resistance is eyed at 1.3407 (Apr 4).

- Next week sees CAD CPI on Tue with Macklem and Senior DG Rogers speaking Tue/Thu at the House/Senate.

US DATA: A Small Beat For Retail Sales Control Group In Otherwise Weak Report

- Retail sales -1.0% (cons -0.4%) in March in greater than expected continued payback after January’s 3.1% M/M surge (only very small net upward revision to Jan/Feb).

- Sales ex auto & gas (-0.3% M/M) and control group sales see a small beat though, the latter falling -0.3% (cons -0.5%) after an unrevised +0.5% M/M - it's a small beat for a series that increased 2.4% M/M in Jan.

- The control group sees an unchanged (nominal) 3-month trend at a strong 10.4% annualized.

- The retail sales data have lately given a good indication of broader consumer spending, but with real consumer spending clearly lagging with 2% annualized as of Feb data.

- Chicago Fed’s Goolsbee cites today’s data as showing a bit of the lag [from the Fed previously raising rates “a lot”].

US DATA: U.Mich 1Y Inflation Expectations Surge, Long-Run Steady

- Consumer sentiment firmed more than expected in the preliminary April survey, up from 62.0 to 63.5 (cons 62.1).

- 1Y inflation surprisingly jumps to 4.6% (cons 3.7) from 3.6% (itself having dropped -0.5pps since Feb), the largest monthly increase since 2021.

- 5-10Y inflation meanwhile unchanged at 2.9% (cons 2.9) sticking to the range of 2.9-3.1% seen in all but one month since Jul’21.

- The jump in near-term expectations further support the day’s significant cheaper in Treasuries, with 2YY +14.5bps on the day.

US DATA: Industrial Production Boosted By Utilities, Tepid Mfg Trend

- Industrial production was stronger than expected in March at 0.4% M/M (cons 0.2) but it was led by an 8.4% surge in utilities after two unusually mild months.

- Manufacturing production meanwhile underwhelmed (-0.5% vs cons -0.1) but offset by strong prior revisions.

- Monthly gyrations aside, both IP and manufacturing production saw a 3M/3M trend of near enough 0% although that is up from -2.5/3% as of December. The trend in ISM manufacturing suggests little improvement ahead.

FED: Reverse Repo Operation

- RRP uptake fell by $68B to $2,254B today having held elevated levels either side of $2300B for most of the week.

- The number of counterparties increased by 3 to 104 to somewhat typical levels for recent months having spiked to a record 115 on Monday.

..

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.