-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Yields Climb On Double Auction Tails

HIGHLIGHTS

- Treasury bear steepen, with a sizeable climb in yields on the Conference Board consumer survey before sizeable tails at double 2Y and 5Y auctions.

- Equity futures reverse earlier gains amidst large sell programs to move the S&P 500 e-mini further away from cycle highs.

- The DXY index also reverses earlier losses but only back to yesterday's close after Memorial Day thinned trade.

- WTI increases strongly, driven by expectations that OPEC+ will rollover voluntary cuts and keep a lid on supply.

- Australia CPI is in focus for the APAC docket whilst the US session sees further supply with the $44bn of 7Y notes.

US TSYS: Sizeable Bear Steepening Amidst Consumer Confidence Beat and Heavy Supply

- Treasuries have seen a sizeable bear steepening today, driven by stronger than expected Conference Board consumer confidence (despite a weak labor differential) and then more notably sizeable 1.0bp and 1.3bp tails for double 2Y and 5Y auctions with their particularly low bid-to-cover metrics (lowest since Nov’21 and Feb’21 respectively).

- Kashkari (non-voter) earlier saying he doesn’t think anyone has taken rate increases off the table, albeit with him seeing quite low odds of a hike, had little immediate impact. Similarly, WTI gains of 3.2% have done little to stop the steepening on the day.

- Cash yields sit between +2.4bp (2s) and +8.6bps (30s) on the day, with 2s10s at -43bps for a firm lift from Friday’s YtD low of -48.3bps.

- 10Y yields have easily cleared 4.50% and hold around 4.54% for now, at highs since the May 3 payrolls report.

- 2Y yields meanwhile at 4.972% have already cleared pre-payrolls levels but could see more resistance to hit 5% having last briefly breached that handle on Apr 30 for one day before the FOMC May 1 announcement.

- TYM4 cleared a key support at 108-15 (May 14 low) with the 5Y auction before hitting a low of 108-08. Next support is seen at 108-06 (May 3 low) after which lies 108-06 (May 2 low).

- Fed Funds implied rates have lifted to show just 19bp of cumulative cuts priced for Nov and 32bp for Dec.

- Tomorrow sees the Beige Book but greater focus is likely on continued supply with $44bn of 7Y supply on the docket after a combined $139bn over 2Y and 5Y notes today.

- Data focus lies on second estimates of Q1 national accounts Thu before the April PCE report on Fri.

FOREX: USD Bounces On Hot US Consumer Confidence And Post-Auction Yield Climb

- Stronger-than-expected US consumer confidence provided the greenback with a temporary boost on Tuesday before receiving a second wind from higher US Treasury yields after tails at two- and five-year auctions in a holiday-shortened week.

- The DXY at 104.63 has reversed earlier losses, which saw it notable pierce the 200-dma support of 104.41 earlier in the session, although it’s yet to recoup Monday’s decline in Memorial Day thinned trade.

- SEK has outperformed its G10 peers, rising around 0.45% against the dollar, whilst the JPY is bottom of the pack against the sharply higher yield backdrop, with USDJPY hitting 157.16 to step close to resistance at 157.20 (May 23 high).

- With Eurozone inflation data highlighting the calendar over the next 48 hours, EURUSD traded solidly around the 1.0875 mark but has since dipped to sub-1.0860. The current trend condition is bullish following a bear channel breakout on May 15 - price cleared the top of a channel drawn from the Dec 28 high. Sights are on 1.0933 next, a Fibonacci retracement.

- USDCNH traded firmer again in early London hours, extending recent outperformance and putting the pair to new monthly highs at 7.2642. Today's price action narrows the gap with next major resistance into 7.2739.

- SEK extends recent outperformance to press EUR/SEK below the 200-dma of 11.4988 – and looks set to close below this average for the first time since early April.

- Australian April CPI will be a focus for the APAC docket on Wednesday after the RBA revised up its Q2 forecast for both headline and core to 3.8% and cited upside risks to inflation. Last week’s move lower in AUDUSD appears to have been a correction and a bullish cycle that started Apr 19 still remains in play. The pair has recently breached a key short-term hurdle at 0.6668, the Mar 8 high, strengthening a bullish theme and a resumption of gains would open 0.6751, a Fibonacci retracement. On the downside, support to watch lies at 0.6581, the 50-day EMA.

FX Expiries for May29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.3bln), $1.0835-40(E782mln), $1.0850-55(E640mln), $1.0875(E1.3bln), $1.0880-00(E2.3bln)

- USD/JPY: Y154.70-75($1.3bln), Y156.20-30($743mln), Y156.50($629mln), Y157.90-10($1.6bln)

- GBP/USD: $1.2650(Gbp814mln)

- USD/CAD: C$1.3550($510mln), C$1.3800($722mln), C$1.4050($1.0bln)

- USD/CNY: Cny7.2200($975mln)

Larger FX Option Pipeline

- EUR/USD: May30 $1.0825-35(E1.3bln), $1.0850($1.3bln), $1.0900-01(E1.2bln); Jun03 $1.0850-70(E1.5bln)

- USD/JPY: May30 Y155.00($2.2bln), Y155.90-10($5.6bln), Y158.40($1.5bln); Jun03 Y154.93-00($1.3bln)

US STOCKS: Equities Under Pressure From Yields But Declines Limited By Nvidia and Energy Surge

- ESM4 has lifted slightly off an earlier low of 5296.75 but at 5307.25 remains under pressure after the strong push higher in Treasury yields.

- Some notably large sell program have helped the downward pressure, including 1634 names per the NYSE’s TICK index for its largest since Apr 15.

- 10Y yields are currently +7.3bps from Friday’s close at ~4.54% for highs since payrolls on May 3, with real yields +5.5bps.

- ESM4 remains easily above support at 5259.02 (20-day EMA) whilst resistance is seen at cycle highs of 5368.25 (May 23 high).

- E-minis: S&P 500 (-0.2%), Nasdaq 100 (unch), Dow Jones (-0.8%) and Russell 2000 (-0.5%).

- SPX movers: IT (+1.1%, dominated by Nvidia +6.9%) and energy (+1.0%, aided by 3.1% for WTI from Friday’s close). Most other sectors are in the red, most notably health care (-1.5%), industrials (-1.3%), financials (-1.3%) and consumer staples (-1.1%).

- Those Nvidia gains extend last week’s post-earnings gains with a boost by Elon Musk’s artificial intelligence startup, xAI, raising $5.2bn in an equity offering with a remaining $2bn to be sold, and looking to construct a supercomputer connecting groups of Nvidia’s H100 GPUs.

COMMODITIES: WTI Crude Rises, Silver Approaches 11-Year High

- Oil markets are headed for US close trading higher, driven by expectations that OPEC+ will rollover voluntary cuts and keep a lid on supply.

- WTI Jul 24 is up 1.4% at $79.7/bbl.

- WTI futures are trading inside a range. A bearish theme remains intact and the sideways move is seen as a pause in the downtrend.

- Scope is seen for a move to $75.64, the Mar 11 low. Initial resistance to watch is at $80.11, the May 20 high. Key resistance and the bull trigger is at $86.16, the Apr 12 high.

- Henry Hub is headed for US close with robust gains on the day. Two-month high LNG feedgas export flows and a likely rise in upcoming cooling demand across the US will be supportive.

- US Natgas Jun 24 is up 2.1% at $2.58/mmbtu.

- Spot gold has edged up by 0.1% to $2,353/oz Tuesday.

- The trend structure remains bullish and the move down from last week’s highs appears to be a correction. A resumption of gains would open $2452.5 next, a Fibonacci projection. The 50-day EMA, at $2,304.0, represents a key support.

- Silver is outperforming and is up by 0.6% at $31.8/oz, bringing the precious metal close to last week’s 11-year high of $32.5.

- A break of this level would open $33.887 next, a Fibonacci projection.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIX - Source BBG/CME

- 1M 5.32838 0.0006

- 3M 5.34625 0.00337

- 6M 5.32377 0.00743

- 12M 5.21487 0.01458

- Secured Overnight Financing Rate (SOFR): 5.32%, 0.01%, $1909B

- Broad General Collateral Rate (BGCR): 5.31%, 0.01%, $728B

- Tri-Party General Collateral Rate (TGCR): 5.31%, 0.01%, $718B

- A 1bp increase for SOFR after a particularly steady run at 5.31% since May 1, but it's still comfortably smaller than previous uplifts in recent months.

New York Fed EFFR for prior session (rate, chg from prev day):

- Daily Effective Fed Funds Rate: 5.33%, no change, volume: $90B

- Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $268B

RRP Edges Lower Prior To Likely Month-End Inflow

- RRP uptake fell back to $418bn today, a $13bn decline from Friday as it continued to decline in what looks like typical GSE seasonality.

- It sees the lowest update since May 16 but remains off the Apr 15 low of $327bn.

- This latest decline is likely to be reversed in the next few days as we approach month-end.

- The number of counterparties fell to 71 from 79, to its lowest since May 6.

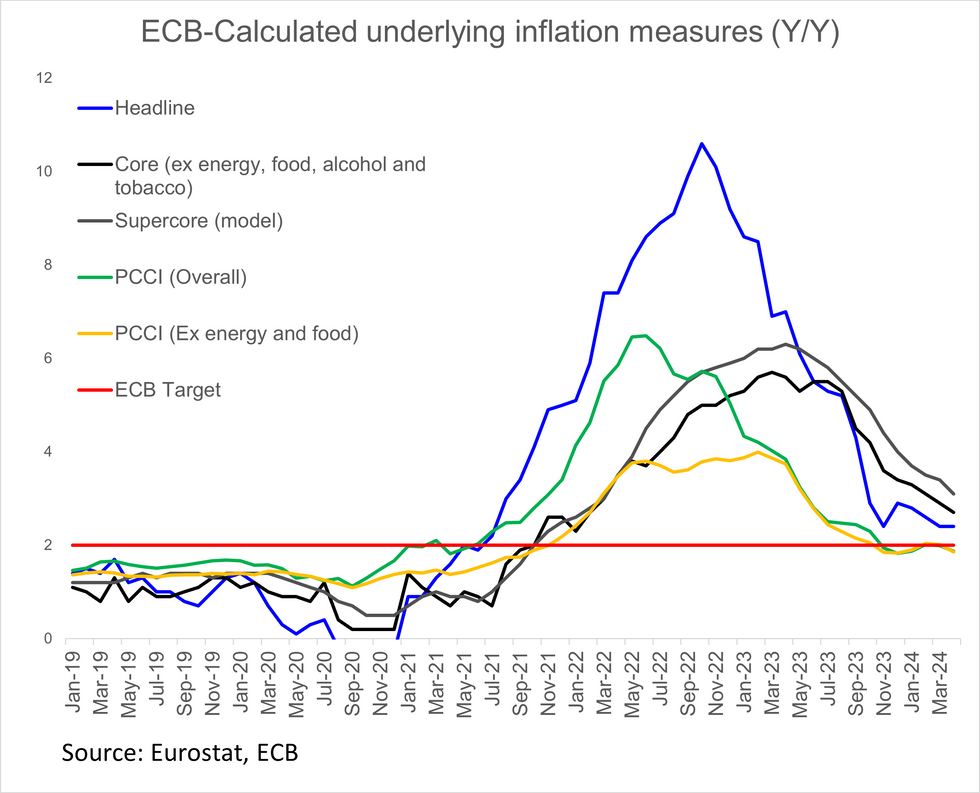

MNI Eurozone Inflation Preview – May 2024

German Travel Ticket to Push Services Higher

- After nine consecutive months of disinflation, Eurozone core HICP is expected to remain steady at 2.7% Y/Y in May. Meanwhile, headline inflation is expected to rise a tenth to 2.5% Y/Y.

- The May flash inflation round provides one the of the last key data inputs before the ECB’s June meeting, where a 25bp cut is virtually unanimously expected.

- With a June cut all but confirmed, May’s inflation figures will help inform the broader question of “what next?” for the ECB.

- After March and April’s services inflation prints were distorted by the impact of the early Easter weekend on some components, the May data is expected to provide a “cleaner” indication of underlying Eurozone services inflation pressures.

- However, the inclusion of the 49 euro German public transport ticket (introduced in May 2023) into the annual comparison may complicate this interpretation, with the ticket set to be a key driver in pushing services HICP back toward 4.0% Y/Y and keeping core HICP steady versus April.

- Our preview includes analysis of price categories to watch, assessments of underlying inflation trends, outlooks for the French, German, Spanish, and Italian national inflation prints, and sell-side analyst previews.

FOR FULL PDF ANALYSIS:

US DATA: Conf. Board Consumer Confidence Bounces But Labor Differential Soft

- The Conference Board consumer survey saw a surprise bounce in overall confidence in May, to 102.0 (cons 96.0) from an upward revised 97.5 (initial 97.0).

- It contradicts the recent decline in U.Mich consumer sentiment although confidence remains below March levels.

- Both the present situation (from 140.6 to 143.1) and expectations (from 68.8 to 74.6) indices drove the monthly increase, with expectations also including a solid upward revision.

- “Consumers cited prices, especially for food and groceries, as having the greatest impact on their view of the U.S. economy.” Average 12-mth inflation expectations ticked up from 5.3% to 5.4%.

- However, the labor differential was weak on balance, lifting to 24.0 in May but only after what was a downward revised 22.9 (initial 25.3).

- These two monthly readings are back below the 24.7 averaged in Q4 having bounced to 30.4 in 1Q24. They are below the 33.15 averaged through 2019 and at similar levels to 1H18 – see chart.

- The perception of jobs plentiful is also of note here, falling from 38.4% to 37.5% for its lowest since Apr’21.

US DATA: Home Prices Show Resilience To Uptick In Relative Supply

- FHFA home prices disappointed in March, rising just 0.09% M/M (cons 0.5) in a sharper moderation than expected from the particularly strong 1.24% jump in Feb.

- Separately, the S&P CoreLogic 20-city index was in line, rising 0.33% M/M (cons 0.30) in March after a slightly downward revised 0.55% M/M (initial 0.61).

- Prices are still up a strong 6.7% Y/Y and 7.4% Y/Y respectively though, supporting the recent strength in median prices from existing (5.7% Y/Y) and new (3.9% Y/Y) home sales data.

- They for now remain robust to the steady normalization in relative supply of existing home sales and the already sizeable increase in relative supply of new homes.

CANADA DATA: Limited Impact On CAD Assets From Strong Input Cost Inflation

- There has been limited initial market reaction to stronger than expected industrial product and raw materials prices in April.

- USDCAD dips ~10 pips to 1.3620 but only to reverse an uptick seen shortly ahead of the data and with earlier lows of 1.3615 intact (bear trigger at 1.3590).

- Can-US 2Y yield differentials have increased just 0.5bp to -68bps to increase the move away from Friday’s close at -71.5bps.

- BOC-dated OIS shows between 16-17bps of cuts for the Jun 5 decision.

- Industrial prices increased 1.5% M/M (cons 0.9) in April after a marginally upward revised 0.9% (initial 0.8) in March, with the ex-energy component driving a large share of the April increase at +1.4%.

- The StatsCan press release notes primary non-ferrous metal products rose 8.3% M/M (largest since Mar’22, owing to unwrought silver and gold price increases) on geopolitical tensions, along with strong increases for industrial metals (unwrought copper and unwrought aluminium) following China manufacturing strength.

- The separate raw materials index also increased 5.5% M/M (cons 3.0) after a downward revised 4.3% (initial 4.7), again with large gains for the ex-energy component at 5.3%.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.