-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

MNI ASIA MARKETS ANALYSIS: Yields Climbing Ahead Tuesday CPI

HIGHLIGHTS

- CHINA FILES DISPUTE AT WTO AGAINST US CHIP EXPORT CURBS, Bbg

- QIN GANG SAYS CHINA COVID MEASURES WILL BE FURTHER RELAXED, Bbg

- EUROPEAN COUNCIL LIFTS COVID-19 TRAVEL RESTRICTIONS, Bbg

US TSYS: Holding Lows After Large 10Y Auction Tail

Tsys weaker after the close, holding narrow range, near lows through the second half. Two significant periods where Tsys sold off/extended lows.- FI market support evaporated midmorning after domino effect of: surge in crude prices (WTI tapped 73.94 high) triggered fast sell-off in Bunds, Gilts and Tsys. Others, however, suggested midmorning sale was tied to WSJ economist Timiraos story suggesting the Fed is "divided" over path of monetary policy.

- Tsy 10Y auction reopen spurred the second sell-off in rates (10YY tapped 3.2620% high; 30YY 3.5939% high). Little react to in-line: $40B 3Y note auction (91282CGA3) 4.093% high yield vs. 4.092% WI; Tsys gapped lower after $32B 10Y note auction re-open (91282CFV8) tailed w/ 3.625% high yield vs. 3.590% WI - largest for the year, surpassing last month's 3.2bp tail.

- No data Monday, markets await Nov CPI release on Tuesday (MoM 0.3% est, 7.3% YoY), final FOMC of 2022 Wed afternoon.

- FOMC will step down the pace of rate hikes to 50bp at the December meeting. But it will likely signal via the Dot Plot that it intends to tighten by a further 75bp to a terminal rate above 5% in 2023.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00614 to 3.81186% (+0.00527 total last wk)

- 1M +0.02185 to 4.29214% (+0.08543 total last wk)

- 3M +0.01957 to 4.75271% (+0.00057 total last wk)*/**

- 6M +0.02129 to 5.16100% (-0.00943 total last wk)

- 12M +0.02614 to 5.52557% (+0.07000 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $102B

- Daily Overnight Bank Funding Rate: 3.82% volume: $271B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.058T

- Broad General Collateral Rate (BGCR): 3.76%, $418B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $398B

- (rate, volume levels reflect prior session)

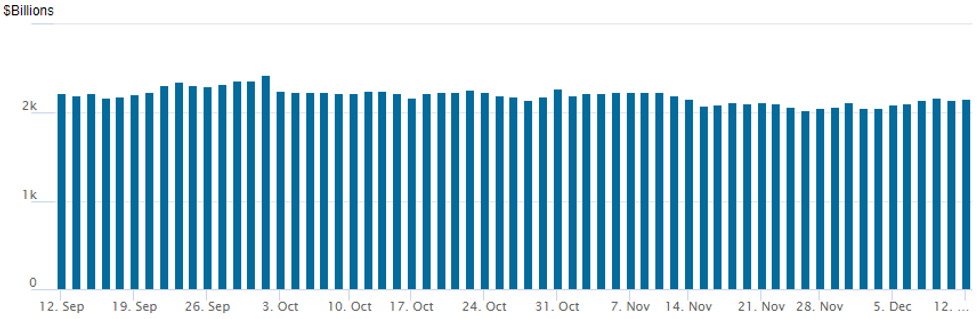

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,158.517B w/ 96 counterparties vs. $2,146.748B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Session trade remained mixed, moderate volumes amid slightly better upside call hedging on the day. Gist of trade leading up to the final FOMC policy announcement for 2022: While market is pricing in 50bp hike in Dec and another in February, major accts well positioned for larger than expected rate hike in early 2023. Rate hike positioning through mid-2023. Things get opaque in late 2023, but Fed pundits forecasting less inflation late next year. Salient trade:

- SOFR Options:

- Block, 5,000 SFRZ2 95.43/95.50 2x1 put spds, 0.25 net, 2-legs over ref 95.46

- +10,000 SFRZ2 97.00/98.00 call spds, 9.5-10.0

- +10,000 Green Mar SOFR 97.12/97.50/97.87 call flys, 5.75 ref 96.98

- +10,000 SFRZ 95.31/95.43 call spds ref 95.4625

- 2,000 SFRZ 95.50/95.75 2x1 put spds

- 2,000 short Jan SOFR 94.75/95.25 2x1 put spds ref 96.03

- 2,000 SFRU3 95.50/95.75/96.00/96.50 broken call condors ref 95.245

- 2,000 short Dec SOFR 95.50/95.75 call spds, ref 95.585

- Treasury Options:

- 2,000 FVH 105/106/107 put trees

- 2,300 TYF 112/113 put spds, 14

- 2,000 TYH 108.5/110 put spds ref 114-08.5

- 2,500 TYF 114/115.5 call spds, 42

- Block, 5,000 TYF3 114/116 call spds, 47 ref 114-10

- 8,500 TYF 113 puts, 21 ref 114-09

- 2,000 TYH 110 puts, 27 ref 114-10

- 4,000 wk3 TY 115.5/116/117 broken call flys ref 114-10.5

- 1,800 TYF 113/114.25 put spds ref 114-09.5

- 1,100 FVG 108/110 strangles ref 108-30

FOREX: USDJPY Corrective Cycle Remains In Play, Rises 0.9%

- Despite a fairly lacklustre start to the week, in terms of data and newsflow, USDJPY has rallied 0.9% on Monday, extending the post-PPI bounce from Friday’s lows of 135.63 to trade within close proximity of the 138 handle.

- The short-term outlook is bullish and a corrective cycle remains in play, following the recovery from 133.63, the Dec 2 low. This phase has allowed an oversold trend condition to unwind. An extension higher would open 138.70, the 20-day EMA. This average marks the first key short-term resistance.

- Overall, the USD index has risen 0.35% with higher front-end US yields supporting the greenback throughout the session ahead of tomorrow’s critical US CPI release and Wednesday’s December Fed meeting.

- Weaker metals prices added some pressure on commodity-tied currencies, with the likes of AUD falling around 0.8% against the dollar. In similar vein, the south African Rand is the worst performer across emerging markets, plummeting 1.4% to start the week, while the Phala Phala saga surrounding the South African president remains front and centre.

- UK employment and German ZEW sentiment data headline the European docket on Tuesday before the much-anticipated US inflation figures are released. Focus then quickly shifts to policy decisions from the Fed, the BOE and the ECB.

FX: Expiries for Dec13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E752mln), $1.0500(E717mln), $1.0550-55(E1.3bln), $1.0600-15(E1.3bln)

- AUD/USD: $0.6750(A$613mln), $0.6800(A$708mln)

- USD/CAD: C$1.3700($674mln)

Late Equity Roundup: Keystone Delay Underpins O&G Servicer Shares

Stocks extending highs in late trade, Energy sector outperforming after crude prices bounced earlier (WTI tapped 73.94 high), likely tied to report of Keystone pipeline delay. SPX eminis currently trade +26.75 (0.67%) at 3995.5; DJIA +316.36 (0.95%) at 33796.59; Nasdaq +48.5 (0.4%) at 11054.72.

- SPX leading/lagging sectors: Energy (+2.23%) lead by equipment and services outperforming O&G (SLB +4.05%, BKR +3.36%, HAL +3.44%). Utilities (1.47%) and Information Technology (+1.52%) up next, software and services names driving the latter (CDAY +4.62%). Laggers: Consumer Discretionary (-0.09%), Communication Services (+0.16%, autos weighing on the former with Tesla -5.66%.

- Dow Industrials Leaders/Laggers: Microsoft (MSFT) +5.12 at 250.54, Home Depot (HD) +5.12 at 325.6, Boeing (BA) +4.76 at 184.30. Laggers: Amgen (AMGN) -3.99 at 274.66, MMM -0.14 at 125.62, Merck (MRK) -0.10 at 108.68.

E-MINI S&P (H3): Key Support Is At The 50-Day EMA

- RES 4: 4250.00 High Aug 26

- RES 3: 4194.25 High Sep 13 and a key resistance

- RES 2: 4164.94 76.4% retracement of the Aug 16 - Oct 13 downleg

- RES 1: 4142.50 High Dec 1 and the bull trigger

- PRICE: 4004.5 @ 1500ET Dec 10

- SUP 1: 3951.09 50-day EMA

- SUP 2: 3782.750 Low Nov 9

- SUP 3: 3735.00 Low Nov 3

- SUP 4: 3670.00 Low Oct 21

S&P E-Minis are trading closer to last week's lows. The recent move down is - for now - considered corrective. The uptrend that started on Oct 13 remains intact, however, attention is on support at the 50-day EMA, which intersects at 3951.09. A clear break of this EMA would threaten bullish conditions and suggest potential for a deeper reversal. The bull trigger, to resume recent bullish activity, is at 4142.50.

COMMODITIES: Crude Supported By Keystone Delay

- Crude oil has bounced today after last week’s double digit percentage decline, rising more than 2%. It is bolstered by TC Energy saying there is no timeline for the restart of the Keystone conduit plus some potential substitution effect from US nat gas prices surging on colder than usual weather.

- China’s ambassador to the US Qin Gang saying he believes there will be further relaxation of Covid measures has seen relatively little boost for the space.

- WTI is +3.0% at $73.18 in a reversal having earlier cleared the round number support at $71.00. Resistance remains some way off at $78.23 (20-day EMA) after sliding last week.

- Brent is +2.5% at $77.98 having come close to testing support at $75.11 (Dec 8 low) and with resistance remaining some way off at $80.81 (Nov 28 low).

- Gold is -1.0% at $1779.32, suffering with US yields and the USD climbing. Resistance remains at $1807.9 (Aug 10 high) having come very close to testing it on Friday, whilst support remains at the 20-day EMA of $1761.8.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/12/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 13/12/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 13/12/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 13/12/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 13/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/12/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/12/2022 | 1330/0830 | *** |  | US | CPI |

| 13/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/12/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 13/12/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.