-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Ylds Recede Despite Weak Auctions

- MNI FED WATCH: On Hold Again As Rate Cut Speculation Builds

- MNI FOMC: Fed SEP To Show Two '24 Cuts, Slower Growth- Ex Officials

- MNI US CPI Preview: Core Seen Re-Accelerating As Lodging Hit Unwinds

- MNI US Employment Insight, Dec'23: Five Fed Cuts In 2024 Deemed Excessive

- MNI US DATA: NY Fed Inflation Expectations Don’t Echo U.Mich Volatility

US

FED WATCH (MNI): On Hold Again As Rate Cut Speculation Builds

The Federal Reserve is expected to keep interest rates on hold for a third straight meeting Wednesday and keep the door open to hiking again next year if progress stalls on getting inflation back to 2%, but anticipation is building for cuts starting as early as spring.

FOMC (MNI): Fed SEP To Show Two '24 Cuts, Slower Growth- Ex Officials

The Federal Reserve will likely lower its median "dot plot" estimate for policy interest rates at the end of 2024 to around 4.9%, former officials and staffers told MNI, as expectations build for the first rate cut to come as early as the first half of the year.

NEWS

US CPI Preview (MNI): Core Seen Re-Accelerating As Lodging Hit Unwinds

Consensus puts core CPI inflation at 0.3% M/M in November, reaccelerating to 0.3% after a surprise moderation to 0.23% M/M in October. Both the Bloomberg survey and the analysts covered below imply downside skew.

US Employment Insight Dec'23 (MNI): Five Fed Cuts In 2024 Deemed Excessive

Nonfarm payrolls growth was close to expectations in November, even if private job creation was more underwhelming including a relative lack of breadth. However, every other main aspect of the report came in stronger than expected, even if rounding flattered some of the surprise to consensus.

US TSYS Markets Roundup: Fast Recovery After Weak Auctions

- Treasury futures have fully recovered from today's weak 3Y (1.8bp tail) and 10Y (1.4bp tail) auctions - have climbed to current session highs across the board and breaching early overnight highs.

- At the moment, Mar'24 2Y futures +.38 at 102-05.75, 10Y futures +3.5 at 110-12; curves steeper but off highs (3M10Y +.318 at -116.682, 2Y10Y +.578 at -48.942).

- The 10Y contract is through initial technical resistance of 111-09+ High Dec 7, focus on 111-19: 1.236 proj of the Oct 19 - Nov 3 - Nov 13 price swing.

- Unusual to see rates improve so quickly after weak auction performance, one desk chalking it up to nothing more than the "auction process going well and putting supply in the rearview ahead of CPI/PPI and the Fed" one desk posited.

- While Dec remains static, the rebound has seen projected rate cuts gain traction in late trade, see 1421ET bullet.

OVERNIGHT DATA

US DATA: NY Fed Inflation Expectations Don’t Echo U.Mich Volatility

NY Fed inflation expectations for November didn’t match the acceleration seen in the U.Mich survey before its subsequent slide lower in last week’s preliminary December release.

- The 1Y ahead measure fell from 3.57% to 3.36%, whilst the 3Y and 5Y measures held steady at 3.0% and 2.7% respectively.

- The 3Y has held at 3% for three months now, relatively steady having averaged 2.9% through 2023 after 3.4% in 2022.

- The 5Y holds 2.7% for the second month, in line with the 2.7% averaged in the year to date but after 2.6% in 2022 (biased lower by particularly low readings in fall 2022).

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 114.41 points (0.32%) at 36360.89

- S&P E-Mini Future up 14.25 points (0.31%) at 4674.5

- Nasdaq up 18.9 points (0.1%) at 14423.29

- US 10-Yr yield is up 1.3 bps at 4.239%

- US Mar 10-Yr futures are up 2/32 at 110-10.5

- EURUSD down 0.0001 (-0.01%) at 1.0762

- USDJPY up 1.26 (0.87%) at 146.21

- WTI Crude Oil (front-month) up $0.09 (0.13%) at $71.31

- Gold is down $23.25 (-1.16%) at $1981.41

- European bourses closing levels:

- EuroStoxx 50 up 16.88 points (0.37%) at 4540.19

- FTSE 100 down 9.58 points (-0.13%) at 7544.89

- German DAX up 35.21 points (0.21%) at 16794.43

- French CAC 40 up 24.98 points (0.33%) at 7551.53

US TREASURY FUTURES CLOSE

- 3M10Y +0.703, -116.298 (L: -118.91 / H: -110.511)

- 2Y10Y +0.752, -48.768 (L: -50.327 / H: -47.036)

- 2Y30Y +2.572, -39.36 (L: -43.229 / H: -38.444)

- 5Y30Y +1.885, 7.978 (L: 4.749 / H: 8.157)

- Current futures levels:

- Mar 2-Yr futures up 0.25/32 at 102-5.625 (L: 102-02.375 / H: 102-06)

- Mar 5-Yr futures up 0.25/32 at 106-31 (L: 106-24.25 / H: 107-00.5)

- Mar 10-Yr futures up 2/32 at 110-10.5 (L: 109-31.5 / H: 110-13)

- Mar 30-Yr futures down 1/32 at 118-31 (L: 118-09 / H: 119-05)

- Mar Ultra futures down 4/32 at 126-22 (L: 125-27 / H: 127-05)

(H4) Corrective Pullback

- RES 4: 112-16 1.50 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 112-03 1.382 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 2: 111-19 1.236 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 1: 111-09+ High Dec 7

- PRICE: 110-05+ @ 11:29 GMT Dec 11

- SUP 1: 109-23+ 20-day EMA

- SUP 2: 108-18+ Low Nov 27 and a key short-term support

- SUP 3: 107-22 Low Nov 14

- SUP 4: 107-11+ Low Nov 13 and a reversal trigger

The trend direction in Treasuries remains up. The contract has pulled back from its recent highs, however, the move lower appears to be a correction. 110-25, the 1.00 projection of the Oct 19 - Nov 3 - Nov 13 price swing, has recently been cleared. This reinforces the bull theme and a continuation higher would open 111-19, the 1.236 projection. Note that MA studies are also in a bull-mode position. Initial key support is at 108-18+, the Nov 27 low.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00480 to 5.35978 (+0.00832 total last wk)

- 3M +0.01313 to 5.37917 (-0.00919 total last wk)

- 6M +0.03725 to 5.32936 (-0.04879 total last wk)

- 12M +0.07804 to 5.09816 (-0.09829 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.610T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $617B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $605B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $101B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $252B

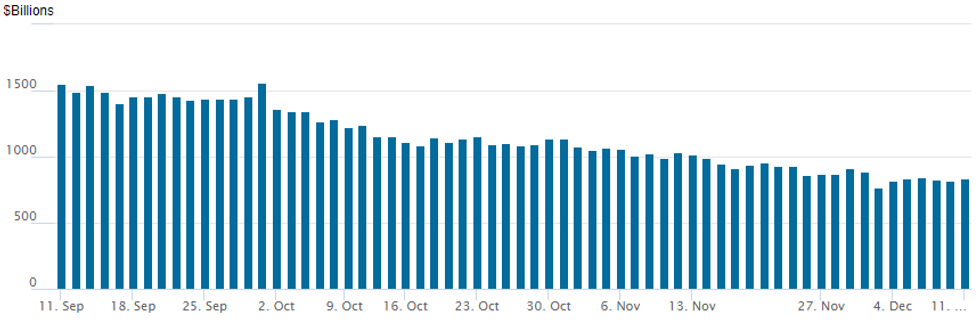

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage climbs to $838.507B w/ 82 counterparties vs. $821.408B Friday. Operation usage fell to the lowest level since early July 2021 of $768.543B on December 1 after falling below $1T for the first time since August 2021 last on November 9 ($993.314B).

PIPELINE $1B National Bank of Canada 5Y Launched

- Date $MM Issuer (Priced *, Launch #)

- 12/11 $1B #National Bank of Canada 5Y +137.5

- 12/11 $750M Community Health Systems 8NC3

- 12/11 $750M #Ally Financial 6NC5 +260

FOREX USDJPY Consolidates Back Above 146.00 Ahead of US CPI

- The US session saw G10 currencies hold narrow ranges as markets await key US inflation data on Tuesday and major central bank decisions due later this week. Early losses for the Japanese Yen saw USDJPY recover back above 146.00 and the pair has consolidated strong 1% gains on the session.

- USDJPY (+0.90%) price action saw the pair further erase last week's sharp sell-off on Bloomberg headlines citing sources that said the BoJ see little need to reverse negative interest rate policy at next week's policy meeting.

- The latest recovery - for now - appears to be a correction. Key short-term resistance to watch is 147.32, the Dec 7 high, a break of which would undermine the bearish theme. EUR/JPY's recovery toward 158.73 has confirmed the 154.08 200-dma as solid support, a level which should hold focus as the week progresses.

- WTI rebounding back towards overnight highs has provided a small relative boost for CAD, which tops the G10 FX leaderboard today, along with the Swiss Franc.

- Broadly, the dollar index holds close to last week's post-NFP highs, making 104.26 the level of focus ahead. G10 spot ranges across US hours remained very contained as market participants remain on the sidelines ahead of key event risk this week, including tomorrow’s US inflation data.

- Consensus puts US core CPI inflation at 0.3% M/M in November, reaccelerating to 0.3% after a surprise moderation to 0.23% M/M in October. Both the Bloomberg survey and analyst previews seen by MNI imply downside skew.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/12/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 12/12/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 12/12/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/12/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/12/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/12/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/12/2023 | - | *** |  | CN | Money Supply |

| 12/12/2023 | - | *** |  | CN | New Loans |

| 12/12/2023 | - | *** |  | CN | Social Financing |

| 12/12/2023 | 1330/0830 | *** |  | US | CPI |

| 12/12/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/12/2023 | 1500/1000 | * |  | US | Services Revenues |

| 12/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/12/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/12/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 13/12/2023 | 2145/1045 | ** |  | NZ | Current account balance |

| 13/12/2023 | 2350/0850 | *** |  | JP | Tankan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.