-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Vaccine Monday

EXECUTIVE SUMMARY

- MODERNA REPORTS LONGER SHELF LIFE FOR COVID-19 VACCINE, Bbg

- MODERNA VACCINE SEEN STABLE 30 DAYS AT REFRIGERATOR TEMPS, Bbg

- MNI POLICY: US at Risk of Rising Permanent Unemployment-SF Fed

- MNI REALITY CHECK: US Retail Sales Slowing After Strong Summer

- FED VC CLARIDA: SIGNALS INTEREST RATES LOWER FOR LONGER

- CLARIDA: FOMC CHOSE ONE-YEAR INFLATION MEMORY IN NEW FRAMEWORK

EU: European Medicines agency (EMA) Starts Rolling Review Of Moderna COVID-19 Vaccine

"EMA's human medicines committee has started a 'rolling review' of data on a vaccine for COVID-19 known as mRNA-1273, which is being developed by Moderna Biotech Spain, S.L. The CHMP's decision to start the rolling review of

mRNA-1273 is based on preliminary results from non-clinical studies and early clinical studies in adults which suggest that the vaccine triggers the production of antibodies and T cells (cells of the immune system, the body's natural defences) that target the virus."

- "The Committee has started evaluating the first batch of data on the vaccine, which come from laboratory studies (non-clinical data). Large-scale clinical trials involving several thousands of people are ongoing, and results are

- expected shortly."

- "These results will provide information on how effective the vaccine is in protecting people against COVID-19 and will be assessed once submitted to the agency. All the available data on the safety of the vaccine as well as its pharmaceutical quality (such as its ingredients, the way it is produced, stability and storage conditions) will also be reviewed as they become available."

- Wires reported Moderna as saying that the candidate vaccine is now expected to remain stable at standard refrigerator temperatures of 2 to 8 degrees Celsius (36 to 46 degrees Fahrenheit) for 30 days, up from previous estimate of 7 days.

US

FED: Most U.S. layoffs this year have been temporary instead of more damaging permanent reductions, though that good news is at risk if the pandemic continues to hit the economy, San Francisco Fed researchers wrote in a paper published Monday. For more, see 11/16 main wire at 1300ET.

US DATA: U.S. retail sales likely rose only modestly in October, figures due Tuesday should show, as resurgent Covid-19 cases across the nation and waning prospects for another stimulus package before the end of the year curbed demand and spending, industry experts told MNI. For more, see 11/16 main wire at 1323ET.

FED: JPMorgan Now Sees Tsy Maturity Extension At Dec FOMC

- JPMorgan now sees the FOMC opting to extend the maturity of Treasury purchases at the next meeting in December.

- JPM cites the surge in COVID cases as presenting a "considerable downside risk" to the near-term economic outlook, and "recent Fed rhetoric [indicating] growing concern about the months between now and when a vaccine is widely available".

- With Powell at the November pressure suggesting that the acceleration of COVID cases may spur the Fed and Congress to "do more", JPM sees the FOMC finding consensus on the approach suggested by Boston Fed Pres Rosengren.

- This could involve a doubling of the current weighted average maturity, per JPM rate strategists.

FED: Shelton Likely To Be Confirmed To Fed Board Tues Or Weds

- Bloomberg cites an aide saying that a Senate confirmation vote "could happen Tuesday or Wednesday" on Judy Shelton to join the board of governors of the Federal Reserve for a term running to 2024.

- Reports that Alaska Republican Senator Murkowski would cast her vote in favor of Shelton likely means that there is likely sufficient support for the nomination to pass.

- It remains unclear when Christopher Waller's nomination will see a vote, though his nomination is seen as relatively uncontroversial and can wait until later this month or December.

- The likely reason for Republican leadership pushing Shelton's vote now and not Waller's is that the Democrats' Mark Kelly will be sworn in following his defeat of Martha McSally in this month's Arizona special senate election. This would have made the Shelton approval margin too close for comfort.

- In any event, while Shelton is seen as a controversial appointment due to "unorthodox" economic leanings, the political debate over her nomination is less fraught following the presidential election, as she was seen by some as a possible eventual replacement for Chair Powell by President Trump.

OVERNIGHT DATA

U.S. NOV. EMPIRE STATE FACTORY INDEX FALLS TO 6.3 VS EST. 13.5

CANADIAN SEP MANUFACTURING SALES +1.5% MOM

CANADA SEP FACTORY INVENTORIES +0.7%; INVENTORY-SALES RATIO 1.62

MARKETS SNAPSHOT

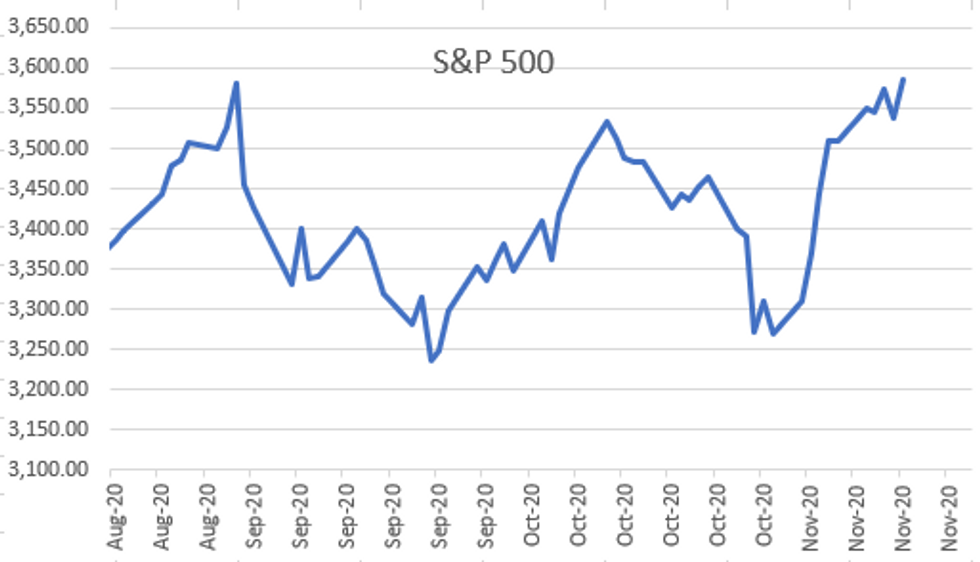

- DJIA up 364.57 points (1.24%) at 29805.43

- S&P E-Mini Future up 28.25 points (0.79%) at 3605.75

- Nasdaq up 61.1 points (0.5%) at 11867

- US 10-Yr yield is up 1 bps at 0.9061%

- US Dec 10Y are down 2.5/32 at 138-1

- EURUSD up 0.0012 (0.1%) at 1.1842

- USDJPY down 0.05 (-0.05%) at 104.58

- WTI Crude Oil (front-month) up $1.26 (3.14%) at $41.38

- Gold is down $2.36 (-0.12%) at $1887.14

- European bourses closing levels:

- EuroStoxx 50 up 34.14 points (0.99%) at 3466.21

- FTSE 100 up 104.9 points (1.66%) at 6421.29

- German DAX up 61.89 points (0.47%) at 13138.61

- French CAC 40 up 91.32 points (1.7%) at 5471.48

US TSY SUMMARY: Vaccine Monday

Risk assets get a boost, much like a week ago. Tsys gapped lower, equities plowed higher (ESZ0 +48.0) on back of Moderna headlines: vaccine more stable at normal refrigerated temps (36F-46F) and for longer period (30 days) as well as near 95% efficacy compared to Pfizer's 90%.

- Ostensibly better news, markets did not react anywhere near with as much euphoria as last week: Tsy futures recovered half the initial move and traded sideways through the close while equities looked to finish higher on the day were back near pre-announcement levels in late trade (ESZ0 +32.0).

- Sources posited the reason for the lack of follow through is that as chances of a vaccine grow, chances of additional fiscal remedies decline. Needless to say, the surge in cases globally is still going to weigh on economies while markets await distribution of a vaccine to the broader populace.

- Multiple fed speakers this week, little react Mon w/Clarida underscoring lower for longer, yield curve control in their toolkit but not needed at the moment. The 2-Yr yield is down 0.2bps at 0.1771%, 5-Yr is up 0bps at 0.4063%, 10-Yr is up 0.8bps at 0.9045%, and 30-Yr is up 1.1bps at 1.6582%.

US TSY FUTURES CLOSE: Weaker, Off Early Lows

Futures holding weaker after the bell, trading sideways since midmorning when rates recovered about half the gap-sale move after Moderna annc positive news re: COVID-19 vaccine (longer shelf life, easier to handle, higher efficacy at 95% vs. Pfizer's 90% last week). Yld curves mildly steeper. Starting to see Dec/Mar rolling ahead Nov 30 first notice. Currently:

- 3M10Y +2.163, 82.411 (L: 77.539 / H: 83.534)

- 2Y10Y +1.341, 72.665 (L: 69.662 / H: 74.637)

- 2Y30Y +1.724, 148.104 (L: 144.198 / H: 150.513)

- 5Y30Y +1.522, 125.427 (L: 122.68 / H: 126.689)

- Current futures levels:

- Dec 2Y -0.25/32 at 110-11.25 (L: 110-11.125 / H: 110-11.75)

- Dec 5Y -1/32 at 125-14.25 (L: 125-12.5 / H: 125-17.25)

- Dec 10Y -3/32 at 138-0.5 (L: 137-27 / H: 138-08)

- Dec 30Y -11/32 at 171-27 (L: 171-09 / H: 172-22)

- Dec Ultra 30Y -21/32 at 214-17 (L: 213-13 / H: 216-10)

US EURODOLLAR FUTURES CLOSE: Short End Buoyed

Mostly steady in the short end to mildly lower out the strip. Lead quarterly holds marginally higher since 3M LIBOR set' -0.00162 to 0.22038% (+0.01612 last wk), Update:

- Dec 20 +0.002 at 99.752

- Mar 21 steady at 99.780

- Jun 21 steady at 99.785

- Sep 21 steady at 99.780

- Red Pack (Dec 21-Sep 22) -0.005 to steady

- Green Pack (Dec 22-Sep 23) -0.01

- Blue Pack (Dec 23-Sep 24) -0.015 to -0.01

- Gold Pack (Dec 24-Sep 25) -0.015

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00038 at 0.08363% (+0.00062 last wk)

- 1 Month +0.00712 to 0.14350% (+0.00863 last wk)

- 3 Month -0.00162 to 0.22038% (+0.01612 last wk)

- 6 Month +0.00300 to 0.24900% (+0.00262 last wk)

- 1 Year +0.00025 to 0.33963% (+0.00605 last wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.09%, volume: $165B

- Secured Overnight Financing Rate (SOFR): 0.09%, $904

- Broad General Collateral Rate (BGCR): 0.07%, $344

- Tri-Party General Collateral Rate (TGCR): 0.07%, $315

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $18.843B submission

- Next scheduled purchases:

- Tue 11/17 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/17 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Wed 11/18 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 11/19 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 11/20 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: Goldman Sachs Lead

$9.5B To Price Monday

- Date $MM Issuer (Priced *, Launch #)

- 11/16 $2.5B #Goldman Sachs $2B 3NC2 +45, $500M FRN SOFR+54

- 11/16 $1.75B #Phillips 66 $450M +3NC1 FRN L+62, $800M +3NC1 +70, $500M +5Y +90

- 11/16 $1.6B #Georgia Pacific $900M +3Y +40, $700M +5Y +55

- 11/16 $1B #Avalon Holdings +5Y +385

- 11/16 $1B FFCB 2Y

- 11/16 $650M #Athene Global Funding 10Y +165

- 11/16 $500M *Kommunalbanken 2Y tap, +3

- 11/16 $500M #Guardian Life 7Y +65

FOREX: Moderna Update Sees AUD, NZD Outperform

News that Moderna's vaccine candidate was found to have a 95% efficacy rate sent stocks soaring ahead of the Monday open, putting the S&P 500 on track to clock a record high close. This filtered through into USD sales, favouring high beta currencies and putting the likes of AUD and NZD at the top of the G10 board.

- USD sales but the USD index at its lowest levels since last Monday, and a further 0.5% decline from here would see the index touch levels not seen since the start of September.

- GBP traded poorly, with the ebb and flow of Brexit news still proving to be the primary driver. EU diplomatic sources noted that gaps remain between the two sides - no surprise after UK's chief negotiator Frost confirmed there would be no change in approach after the staff turnover in Downing Street last week.

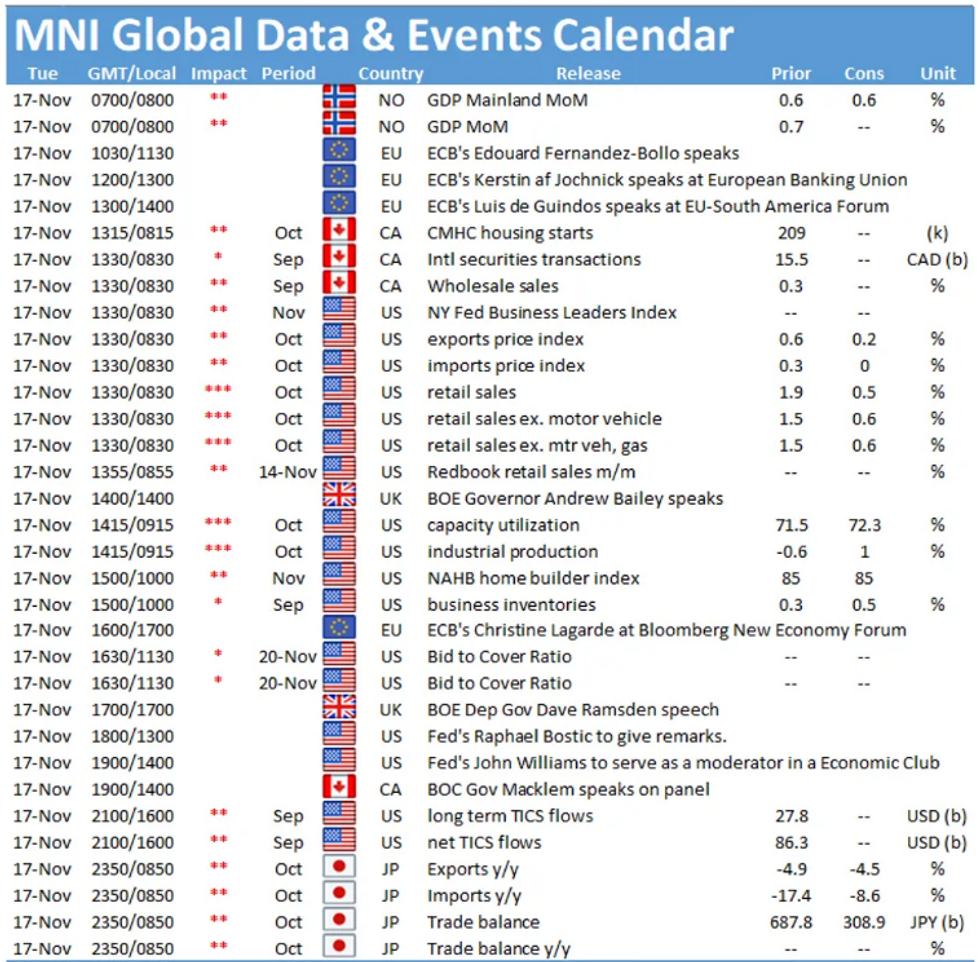

- Focus Tuesday turns to the RBA minutes and US retail sales & industrial production data. Central bank speak includes RBA's Debelle, BoE's Bailey, ECB's Lagarde and BoC's Macklem.

EGBs-GILTS CASH CLOSE: Recovery After Vaccine Jab

Bunds and Gilts were hit by a promising Moderna COVID vaccine report around midday GMT hurting safe havens, but yields settled back down as exuberance waned. Periphery spreads tightened modestly on the day.

- A fairly quiet session apart from the vaccine news - ECB speakers basically reiterated what we already anticipated about the Dec meeting (e.g. de Cos noting TLTROs and PEPP are under discussion), while there was no new clarity on the state of the ongoing Brexit talks.

- Tuesday sees appearances by BOE's Bailey and Ramsden, and ECB's Lagarde. Germany sells E5bn of Schatz and the UK sells GBP5.25bn in 2024 and 2050 Gilts.

Closing Levels / 10-Yr Periphery EGB Spreads: - Germany: The 2-Yr yield is up 0.6bps at -0.721%, 5-Yr is up 0.4bps at -0.732%, 10-Yr is up 0.2bps at -0.545%, and 30-Yr is down 0.7bps at -0.135%.

- UK: The 2-Yr yield is up 0.2bps at -0.025%, 5-Yr is up 0.4bps at 0.019%, 10-Yr is up 1.1bps at 0.349%, and 30-Yr is up 1.9bps at 0.945%.

- Italian BTP spread down 1.5bps at 119.7bps

- Spanish bond spread down 1.4bps at 64.4bps

- Portuguese PGB spread down 1.2bps at 62.2bps

- Greek bond spread down 4.1bps at 126.3bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.