-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: This Indecision's Buggin' Me

EXECUTIVE SUMMARY:

- MNI INTERVIEW: Fed To Avoid More QE Unless Another Shock-Sheard

- MNI SOURCES: UK, EU Close In On Post-Brexit Deal

- MNI BRIEF: Provisional Approval Likely For Any Brexit Deal

- TRUMP DEFIES CONGRESS AND VETOES BIPARTISAN DEFENSE-POLICY BILL bbg

- FAUCI SAYS HE SEES MOST AMERICANS VACCINATED BY END OF SUMMER, Bbg

US

FED: The Federal Reserve will only go further on asset purchases if the world's largest economy has another significant shock, and more likely will take a long and patient march back to its full employment and inflation goals, former S&P Global Vice Chairman Paul Sheard told MNI.

- With the program running at an annual pace approaching USD1.5 trillion and yields already low, further moves will have limited punch, while fiscal policy is better positioned to lift demand, Sheard said. The main options from here would be a faster pace of purchases or yield curve control, perhaps at the 10-year mark, he said. For more see MNI Policy MainWire at 1045ET.

EUROPE

UK/EU: The EU and the UK seemed to be closing in on a post-Brexit trade agreement on Wednesday, though EU sources cautioned that a deal was still not in the bag. For more see MNI Policy MainWire at 1116ET.

- Following the announcement of a deal, the Commission would send the deal to the European Council for its approval.

OVERNIGHT DATA

US DATA: MNI DATA IMPACT: US Jobless Claims Fall To 803,000

- U.S. weekly jobless claims dropped by 89,000 after a recent spike but remained

- elevated at 803,000 in the week ended Dec. 19. The Labor Department also reported 5,337,000 continuing claims in the week ended Dec. 12, down 170,000.

- There were 9,271,112 individuals filing continued weekly claims for Pandemic Unemployment Assistance benefits and 4,793,230 continued claims for Pandemic Emergency Unemployment Compensation benefits, for the week ended Dec. 5.

- US JOBLESS CLAIMS -89K TO 803K IN DEC 19 WK

- US PREV JOBLESS CLAIMS REVISED TO 892K IN DEC 12 WK

- US CONTINUING CLAIMS -0.170M to 5.337M IN DEC 12 WK

- US NOV PERSONAL INCOME -1.1%; NOM PCE -0.4%

- US NOV PCE PRICE INDEX +0.0%; +1.1% Y/Y

- US NOV CORE PCE PRICE INDEX +0.0%; +1.4% Y/Y

- US NOV UNROUNDED PCE PRICE INDEX +0.014%; CORE +0.012%

- US NOV DURABLE NEW ORDERS +0.9%; EX-TRANSPORTATION +0.4%

- US OCT DURABLE GDS NEW ORDERS REV TO +1.8%

- US NOV NONDEF CAP GDS ORDERS EX-AIR +0.4% V OCT +1.6%

- US NOV NEW HOME SALES -11% TO 0.841M SAAR

- US OCT NEW HOME SALES REVISED TO 0.945M SAAR

- MICHIGAN DEC. FINAL CONSUMER SENTIMENT AT 80.7; EST. 81.1

- CANADA OCT GROSS DOMESTIC PRODUCT +0.4% MOM

- CANADA OCT GOODS INDUSTRY GDP +0.1%, SERVICES +0.5%

- CANADA REVISED SEP GROSS DOMESTIC PRODUCT +0.8% MOM

MARKETS SNAPSHOT

- DJIA up 221.48 points (0.74%) at 30243.99

- S&P E-Mini Future up 17.75 points (0.48%) at 3695.5

- Nasdaq up 11.7 points (0.1%) at 12820.95

- US 10-Yr yield is up 3.8 bps at 0.9546%

- US Mar 10Y are down 7.5/32 at 137-24

- EURUSD up 0.0017 (0.14%) at 1.2184

- USDJPY down 0.03 (-0.03%) at 103.61

- WTI Crude Oil (front-month) up $0.99 (2.11%) at $48.02

- Gold is up $10.85 (0.58%) at $1871.47

- European bourses closing levels:

- EuroStoxx 50 up 41.77 points (1.19%) at 3512.6

- FTSE 100 up 42.59 points (0.66%) at 6433.82

- German DAX up 169.12 points (1.26%) at 13484.47

- French CAC 40 up 60.73 points (1.11%) at 5488.7

US TSY SUMMARY:

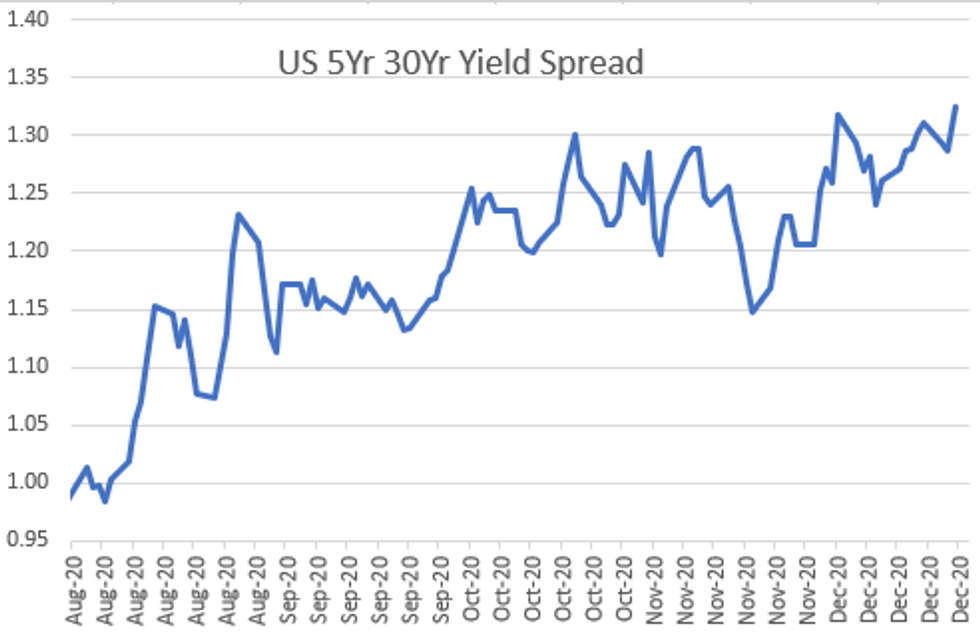

Tsys weaker across the curve by the bell, more than making up for Tue's rally with yield curves bear steepening back to mid-2017 levels before scaling back slightly in late trade.

- Risk-on: Seasonal bid for equities (ESH1 +17.0) despite Pres Trump not signing Covid relief bill in favor of $2k checks, spurred partially by late hour hopes of UK/EU Brexit deal (GBP surged to 1.3571 high on midmorning chatter deal was done only for Sterling to recede back to 1.3476 when wires walked back the rumor).

- After early post-data chop, Tsy futures extended pre-open lows, yld curves rebounding after flattening last couple sessions. Noted pick-up in sell volumes in 10s-30s, TYH appr 320k at moment; sources reported prop and fast$ selling 5s-10s.

- Jan serial Tsy options expire Thursday due to Friday Christmas holiday.

- The 2-Yr yield is up 0.6bps at 0.1189%, 5-Yr is up 1.3bps at 0.375%, 10-Yr is up 3.5bps at 0.9513%, and 30-Yr is up 4.6bps at 1.6938%.

US TSY FUTURES CLOSE: Bear Steepening

Weaker across the curve by the bell, more than making up for Tue's rally w/ yield curves bear steepening back to mid-2017 levels before scaling back slightly in late trade:

- 3M10Y +3.745, 86.762 (L: 80.676 / H: 89.016)

- 2Y10Y +3.29, 83.033 (L: 78.417 / H: 84.664)

- 2Y30Y +4.627, 157.353 (L: 151.067 / H: 159.999)

- 5Y30Y +3.348, 131.789 (L: 127.286 / H: 133.719)

- Current futures levels:

- Mar 2Y down 0.25/32 at 110-15.12 (L: 110-14.87 / H: 110-15.62)

- Mar 5Y down 1.5/32 at 126-0.5 (L: 125-30.5 / H: 126-03.75)

- Mar 10Y down 7/32 at 137-24.5 (L: 137-20 / H: 138-03)

- Mar 30Y down 30/32 at 172-3 (L: 171-16 / H: 173-14)

- Mar Ultra 30Y down 1-27/32 at 211-11 (L: 210-01 / H: 214-04)

US EURODLR FUTURES CLOSE: Weaker

Weaker across the strip, long end underperforming. Lead quarterly EDH1 only mildly weaker despite 3M LIBOR gap set' +0.01287 to 0.25100% (+0.01525/wk). Current levels:

- Mar 21 -0.005 at 99.815

- Jun 21 -0.005 at 99.820

- Sep 21 -0.005 at 99.815

- Dec 21 -0.005 at 99.775

- Red Pack (Mar 22-Dec 22) -0.005

- Green Pack (Mar 23-Dec 23) -0.010

- Blue Pack (Mar 24-Dec 24) -0.015 to -0.020

- Gold Pack (Mar 25-Dec 25) -0.025 to -0.035

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00050 at 0.08563% (+0.00125/wk)

- 1 Month +0.00475 to 0.14800% (+0.00425/wk)

- 3 Month +0.01287 to 0.25100% (+0.01525/wk)

- 6 Month +0.00100 to 0.26375% (+0.00525/wk)

- 1 Year +0.00138 to 0.33863% (+0.00463/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $66B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $158B

- Secured Overnight Financing Rate (SOFR): 0.07%, $923B

- Broad General Collateral Rate (BGCR): 0.06%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $328B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $11.485B submitted

- Next scheduled announcement:

- Mon 12/28 Forward schedule release at 1500ET

PIPELINE: Still No Issuance For Week

No new high-grade issuance since December 15; running total for month remains $52.24B

FOREX: GBP Shoots Higher as Brexit Deal Seen as Done

A veritable flurry of source reports from various outlets drove GBP higher, as news rolled in that a Brexit deal was as good as done, with negotiators going over the final details ahead of a convening of EU ambassadors on Thursday to go over the details.

- As a result, GBP firmed sharply, prompting GBP/USD to add well over a cent and narrow the gap with (but not quite challenge) the Dec17 highs of $1.3624.

- The sole currency outstripping the GBP Wednesday was NOK, which firmed well alongside a near 3% oil price rally. USD/NOK remains well within reach of the 8.5520 cycle lows.

- Focus Thursday turns to the passage of any Brexit bill and the Turkish central bank rate decision. Outside of that, volumes are likely to be light, with news flow thin ahead of the Christmas break.

EGBs-GILTS CASH CLOSE: UK Long End Blows Out As Brexit Deal Said Imminent

Long-end UK yields blew out Wednesday (5s30s rose the most since June) and German Bunds weakened alongside as the UK and EU appeared to be on the precipice of a Brexit deal as soon as today.

- Many headlines from multiple sources to that effect began in earnest around 1340GMT when the UK curve really began to sell off. MNI's Policy team reported "the EU and the UK seemed to be closing in on a post-Brexit trade agreement on Wednesday, though EU sources cautioned that a deal was still not in the bag."

- Elsewhere, Italy and Greece unveiled their 2021 funding plans; see our Bullets service for details. With little on the calendar on a holiday-shortened Thursday, all attention will be on Brussels and London to see if a deal finally crosses the line.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 3.2bps at -0.704%, 5-Yr is up 4.3bps at -0.719%, 10-Yr is up 4.8bps at -0.547%, and 30-Yr is up 4.8bps at -0.15%.

- UK: The 2-Yr yield is up 1.2bps at -0.121%, 5-Yr is up 6.9bps at -0.037%, 10-Yr is up 10.3bps at 0.286%, and 30-Yr is up 3bps at 0.863%.

- Italian BTP spread down 1.8bps at 113.2bps / Spanish spread down 2.4bps at 62.1bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.