-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - 2020, Where'd The Yield Go?

EXECUTIVE SUMMARY

- SCHUMER:DEMOCRATS WILLING TO VOTE ON TRUMP ISSUES ONE AT A TIME, Bbg

- US TO MOVE AIRCRAFT CARRIER OUT OF MIDEAST: AP

- SPAIN, U.K. REACH PRELIM. ACCORD ON POST-BREXIT GIBRALTAR DEAL, Bbg

US TSY SUMMARY

Futures trading steady to mildly higher ahead the NY open, volumes light on the shortened final session of 2020 (TYH just over 750k on late duration extension trade).

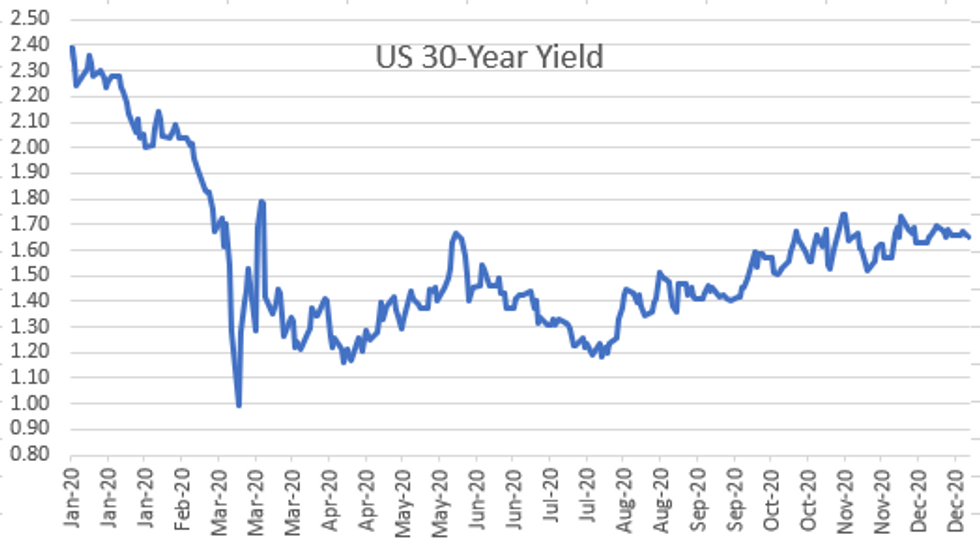

- Where'd the Yield Go? 30YY currently at 1.6389% compares to 2.3896% 2019 EOY; 10YY at 0.9098% vs. 1.9175% 2019 EOY.

- Market moves more a function year-end asset allocation than a reaction to headline risk or data: Little react to lower than expected weekly claims (787k vs. 833k exp); same for limited Covid and stimulus relief related headlines as debate of latter stalled in Senate Wednesday.

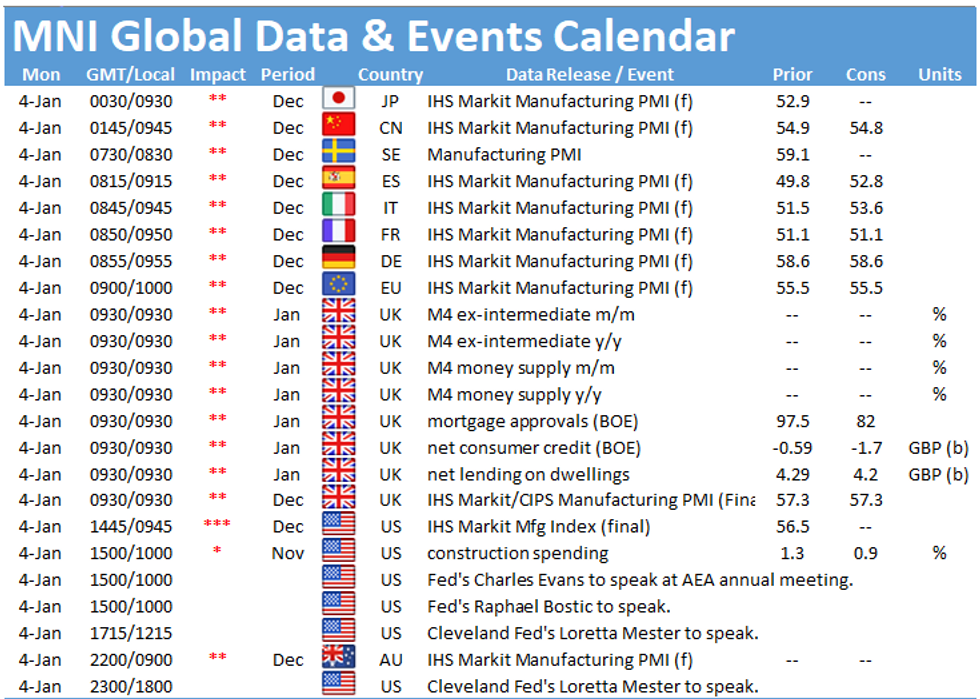

- Markets eager to put 2020 behind them will contend with a hectic start to 2021 with Electoral vote count on Jan 6, FOMC minutes Wed as well, and December employment data next week Friday (+245k prior, +50k est).

- The 2-Yr yield is unchanged at 0.1211%, 5-Yr is down 0.6bps at 0.3608%, 10-Yr is down 0.7bps at 0.9165%, and 30-Yr is down 0.7bps at 1.6482%.

OVERNIGHT DATA

US DATA: Initial Jobless Claims Below Expected

- U.S. initial jobless claims dipped to 787,000 through December 26, far below expectations for 833,00 claims, according to figures released Thursday by the Labor Department.

- Initial claims filed through December 19 were revised up to 806,000 (prev 803,000).

- Continuing claims through December 19 fell to 5.219 million, down from 5.322 million through December 12.

- Pandemic Unemployment Assistance claims fell to 308,262 through December 26, down from 396,948 through December 19.

- Through December 12, a total of 19.6 million Americans were claiming UI benefits, down 800,000 from the previous week's 20.4 million.

MARKETS SNAPSHOT: Key Market Levels

- DJIA down 27.92 points (-0.09%) at 30382.78

- S&P E-Mini Future down 2 points (-0.05%) at 3722.5

- Nasdaq down 28.9 points (-0.2%) at 12840.92

- US 10-Yr yield is down 1 bps at 0.9132%

- US Mar 10Y are up 3/32 at 138-2

- EURUSD down 0.0068 (-0.55%) at 1.223

- USDJPY up 0.03 (0.03%) at 103.22

- WTI Crude Oil (front-month) down $0.27 (-0.56%) at $48.13

- Gold is up $0.03 (0%) at $1894.78

European bourses closing levels:

- EuroStoxx 50 down 18.95 points (-0.53%) at 3552.64

- FTSE 100 down 95.3 points (-1.45%) at 6460.52

- French CAC 40 down 48 points (-0.86%) at 5551.41

MONTH-END EXTENSIONS

Final Bloomberg-Barclays US Extension Estimates Forecast summary compared to the avg increase for prior year and the same time in 2019. TIPS -0.03Y; Govt inflation-linked, -0.04. Note MBS extension climbs to 0.14Y from 0.09 in preliminary.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.1 | 0.07 |

| Agencies | 0.08 | 0.05 | 0.09 |

| Credit | 0.07 | 0.12 | 0.07 |

| Govt/Credit | 0.07 | 0.1 | 0.07 |

| MBS | 0.14 | 0.07 | 0.09 |

| Aggregate | 0.08 | 0.09 | 0.06 |

| Long Gov/Cr | 0.07 | 0.09 | 0.06 |

| Iterm Credit | 0.05 | 0.1 | 0.06 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.08 | 0.09 | 0.06 |

| High Yield | 0.08 | 0.12 | 0.09 |

US TSY FUTURES CLOSE: Surge Into Early Close

Nice surge in volume on the closing bell (TYH1 near 700k). Tsy futures make new session highs then recede. No Block prints, but desks keeping eye out for. Yld curves flatter:

- 3M10Y -0.312, 83.125 (L: 82.697 / H: 85.876)

- 2Y10Y -0.737, 78.878 (L: 78.847 / H: 80.982)

- 2Y30Y -1.009, 151.785 (L: 151.785 / H: 154.799)

- 5Y30Y -0.557, 127.973 (L: 127.856 / H: 129.986)

- Current futures levels:

- Mar 2Y up 0.37/32 at 110-15.62 (L: 110-15.25 / H: 110-15.75)

- Mar 5Y up 1.75/32 at 126-5.5 (L: 126-03.25 / H: 126-06)

- Mar 10Y up 3/32 at 138-2 (L: 137-28.5 / H: 138-03.5)

- Mar 30Y up 11/32 at 173-6 (L: 172-18 / H: 173-08)

- Mar Ultra 30Y up 25/32 at 213-19 (L: 212-08 / H: 213-22)

US EURODOLLAR FUTURES CLOSE: Mostly Bid

Futures mostly bid, short end holding steady after the early close. Lead quarterly EDH1 unchanged since 3M LIBOR set +0.00090 to 0.23840% (-0.00173/wk).

- Mar 21 steady at 99.830

- Jun 21 steady at 99.835

- Sep 21 +0.005 at 99.830

- Dec 21 +0.010 at 99.795

- Red Pack (Mar 22-Dec 22) +0.010 to +0.015

- Green Pack (Mar 23-Dec 23) +0.010 to +0.015

- Blue Pack (Mar 24-Dec 24) +0.015 to +0.020

- Gold Pack (Mar 25-Dec 25) +0.015

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00800 at 0.07763% (-0.00337/wk)

- 1 Month -0.00010 to 0.14390% (-0.00123/wk)

- 3 Month +0.00090 to 0.23840% (-0.00173/wk)

- 6 Month -0.00190 to 0.25760% (-0.00903/wk)

- 1 Year -0.00050 to 0.34188% (+0.00150/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $62B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $155B

- Secured Overnight Financing Rate (SOFR): 0.09%, $916B

- Broad General Collateral Rate (BGCR): 0.08%, $338B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $315B

- (rate, volume levels reflect prior session)

Updated NY Fed operational purchase schedule, $40.2B from 1/04-1/14

- Mon 1/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 1/05 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Wed 1/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 1/07 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/08 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Mon 1/11 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Tue 1/12 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 1/13 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

PIPELINE: 2020 Sets New High-Grade Corporate Debt Issuance

2020's Record $2.196.5B High-Grade Corporate Issuance TotalsNote, 2020 started off with a bang, jumbo issuance largely from domestic names pushed issuance to $1.4T by the end of June, surpassed 2019 total of $1.156T.

- Dec $52.24B; $796.54B Second half of 2020

- Nov $126.83B

- Oct $111.65B

- Sep $207.82B

- Aug $204.5B

- Jul $93.5B

- Jun $180.5B; Whopping $1.400T for first half of year,

- May $270.9B

- Apr $401.325B* one-month record

- Mar $275.48B

- Feb $107.5B

- Jan $165.18B

FOREX: US$ Index Bounce

EUR continued the theme of the European morning, trading with a heavy tone throughout the US session. EURUSD made fresh session lows of 1.2225.

- The USD index had a fairly aggressive bounce as we approached the WMR month/year end fixing window. AUD, NZD and CAD giving up prior gains.

- GBP (+0.29%) remained well bid with EURGBP the notable mover as markets focused on the trade deal rather than the stricter Covid measures enforced throughout the country. Additionally, flows around month end saw EURGBP print fresh lows at 0.8947 (Down 0.85%).

- The USD index was certainly driven by its heavily weighted EUR component. Overall, G10 FX performance was mixed. AUD, CAD, GBP held onto gains, with NZD slipping into the red.

- USDCHF traded in tandem with EURUSD gaining 0.4% as of writing. USDCNH and USDJPY largely unchanged amid light volumes. Markets will continue to digest the news that China will adjust the weightings of currencies in its currency basket that helps set the yuan's daily reference rate, effective from Jan. 1.

- Lower than expected U.S. initial jobless claims (787,000 through December 26, far below expectations for 833,00 claims) was a sideshow as expected. In general, turnovers in FX have remained on the lower side, as we close out the year.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.