-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Eco Outlooks Improving On Vaccine Supply Hopes

EXECUTIVE SUMMARY

- U.S. VACCINE SUPPLY POISED TO MORE THAN DOUBLE BY APRIL, Bbg

- US: Upgrade 2021 Outlooks from Jefferies, NatWest

- MNI INTERVIEW: Job Participation May Never Recover-Fed Adviser

- MNI BRIEF: ECB Can't Rule Out Temporary Inflation Spike In '21

- US: Pelosi: House To Vote On USD1.9trn COVID-19 Relief Bill At End Of Next Week

- MNI EXCLUSIVE: Eurozone Seen Extending Debt Rule Waiver To 2022

US

US: Jefferies updated their 2021 eco-outlook after Wed's better than expected retail sales. "2021 growth now looks to be even more front-loaded than we previously thought. We now forecast Q1 growth of 9.5% (vs. 5.1%)."- The Fed's base case is for 4.2% growth, with strength skewed toward the second half. Expect significant upward revisions at the March and June FOMC meetings, as Fed officials incorporate the fiscal package and better incoming data.

- Once the vaccine-related impetus to economic growth has passed and as the boost from fiscal support wanes, real GDP growth is likely to moderate in 2022; we forecast 2.5% growth next year. Given this path for growth, labor markets will continue to improve slowly (as the labor force participation rate picks back up), and we expect unemployment will edge down to 5.5% by the end of 2021 and 4.7% by the end of 2022—well above its pre-pandemic level of 3.5%.

US: The U.S. may never lure back all the workers laid off during the pandemic even if hiring gets back on track later this year, driving the jobless rate associated with full employment above 4%, Dallas Fed adviser Aysegul Sahin told MNI.

- Labor force participation "barely stabilized" even when the economy was booming, Sahin, also an economics professor at the University of Texas at Austin, said in an interview. Female labor force participation was on a downtrend before Covid-19 and the "baby boomer" cohort was rapidly approaching retirement age. For more see MNI Policy main wire at 0945ET.

- Says "At the same time, there is communication with the Senate as to what the Byrd Rule allows,". This relates to potential difficulties in passing the bill in the Senate even with the reconciliation process only requiring majority support.

- Byrd rule limits the ability of provisions to reconciliation budget proposal that can affect future federal deficits. The proposed USD15/hour minimum wage would almost certainly do this and as such may be struck down. Senator Joe Manchin (D-WV) has already stated he will not support a COVID-19 relief bill that breaches the Byrd rule.

EUROPE

ECB: Eurozone inflation could surprise to the upside at some point in 2021, but a temporary spike should not be mistaken for a sustained increase and inflation was likely to remain below target for the foreseeable future, an account of the European Central Bank's January meeting showed.

- The odds of very low inflation have decreased, Governing Council members said, but the medium-term outlook for prices was surrounded by a high level of uncertainty, given the unprecedented pandemic situation and long-standing questions about changes in the underlying determinants of inflation. Adding to the uncertainty, weightings in the eurozone's harmonized inflation index were set to change substantially this year, due to changes in consumption patterns during the pandemic.

- Meanwhile, underlying price pressures were expected to remain muted owing to weak demand, the account showed. Headline inflation was only expected to hit 1.7% in five years, according to a Survey of Professional Forecasters estimatecited in the account.

- "2021 already will see significantly smaller fiscal support than 2020, although what is expected to be a bad Q1 in some countries and longer lockdowns in France and Germany will boost automatic stabilizers. But that will be reduced as people return to work," the official said. For more see MNI Policy main wire at 1249ET.

OVERNIGHT DATA

- US JOBLESS CLAIMS +13K TO 861K IN FEB 13 WK

- US PREV JOBLESS CLAIMS REVISED TO 848K IN FEB 06 WK

- US CONTINUING CLAIMS -0.064M to 4.494M IN FEB 06 WK

- US JAN IMPORT PRICES +1.4%

- US JAN EXPORT PRICES +2.5%; NON-AG +2.2%; AGRICULTURE +6.0%

- US FEB PHILADELPHIA FED MFG INDEX 23.1

- U.S. housing starts in January fell to a seasonally adjusted annual rate of 1.580 million, below forecasts for a saar of 1.669 million. From one year ago, starts were down 2.3%.

- December's 1.669 million saar was revised down to 1.680 million.

- Meanwhile, building permits surged in January, reaching a saar of 1.881 million when markets had expected permits to slow to 1.680 million from December's unrevised 1.704 million pace. From one year ago, permits were up 22.5%.

- Completions fell 2.3% in January to a 1.336 million unit pace, down slightly from December but up 2.4% from one year ago.

MARKET SNAPSHOT

Key late session market levels- DJIA down 85.41 points (-0.27%) at 31527.72

- S&P E-Mini Future down 12.25 points (-0.31%) at 3915.75

- Nasdaq down 66.2 points (-0.5%) at 13898.52

- US 10-Yr yield is up 1.5 bps at 1.2855%

- US Mar 10Y are up 3.5/32 at 135-27.5

- EURUSD up 0.0054 (0.45%) at 1.2092

- USDJPY down 0.23 (-0.22%) at 105.64

- WTI Crude Oil (front-month) down $1.05 (-1.72%) at $60.09

- Gold is down $1.19 (-0.07%) at $1774.97

- EuroStoxx 50 down 18.81 points (-0.51%) at 3681.04

- FTSE 100 down 93.75 points (-1.4%) at 6617.15

- German DAX down 22.34 points (-0.16%) at 13886.93

- French CAC 40 down 37.51 points (-0.65%) at 5728.33

US TSY SUMMARY: Fiscal Stimulus Hopes Continue To Push Markets

Good is Bad / Bad is Good theme held (at least for rates in the first half) on premise bad data improves chances on the margin of robust fiscal stimulus. Disappointing weekly claims (+13K TO 861K), Jan Housing Starts below expected at 1.58M, weighed on rates in the first half. But equities, US$, gold and WTI crude all traded weaker as well (though equities were recovering losses in second half: ESH1 3915.0 vs. 3881.0 low. Bbg headline noted US vaccine supply more than double by April.- Midmorning reversal: Tsys have bounced back into mildly higher territory after nearly trading through late Tue lows (Yds neared 1Y highs tapped late Tue: 10YY 1.3159H vs. 1.3310% late Tue; 30YY 2.099% vs. 2.110% late Tue). Gold bounced off lows around the same time while US$ and equities remained weaker.

- Sources report real$ buying 10s, rolling in 20s as rates consolidated on equity weakness on desk said. Mar/Jun rolls continue at slower than expected pace.

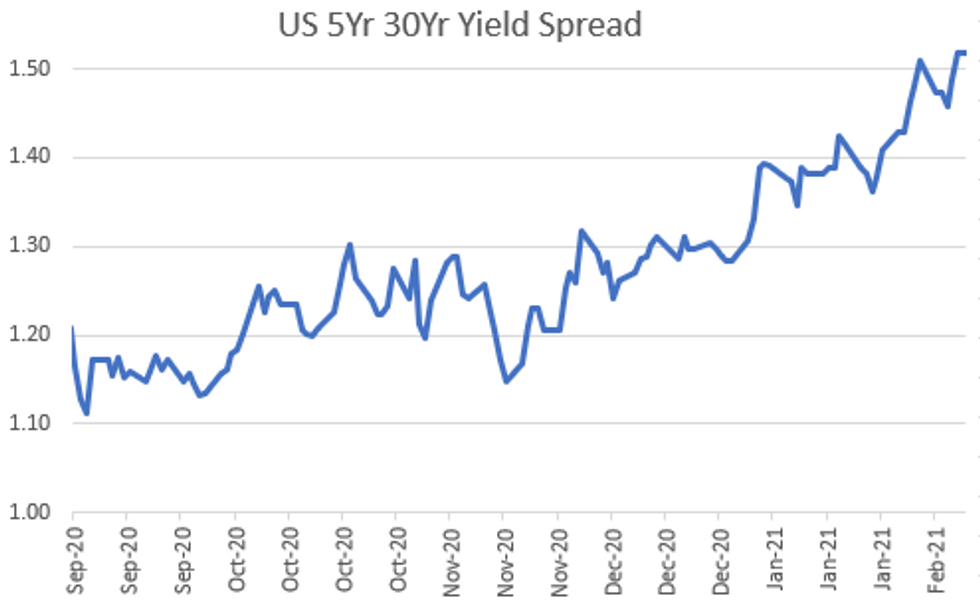

- Some chatter made the rounds that another duration drop on Tue's magnitude could usher in mortgage convexity selling (unlikely). Some insurance portfolio unwinds in swaps Tuesday did add to the rout, however. Yield curves back to bear steepening mode, futures volumes picking up while Mar/Jun rolls improved: TYH >1.8M; TYH/TYM> 96k.

- The 2-Yr yield is up 0.4bps at 0.1069%, 5-Yr is up 0.3bps at 0.5497%, 10-Yr is up 1.5bps at 1.2855%, and 30-Yr is up 3.7bps at 2.0745%.

US TSY FUTURES CLOSE: Well Off Morning Lows

Choppy day for rates, nearly matching late Tue lows in post-morning data trade then surging to mildly higher/narrow range by midday, yield curves steeper again.

- 3M10Y +2.448, 125.422 (L: 120.868 / H: 127.532)

- 2Y10Y +1.489, 117.824 (L: 114.989 / H: 120.293)

- 2Y30Y +3.249, 196.266 (L: 191.662 / H: 198.689)

- 5Y30Y +3.116, 152.028 (L: 148.272 / H: 153.184)

- Current futures levels:

- Mar 2Y up 0.25/32 at 110-16.25 (L: 110-15.75 / H: 110-16.375)

- Mar 5Y up 2/32 at 125-15 (L: 125-11.75 / H: 125-17)

- Mar 10Y up 3.5/32 at 135-27.5 (L: 135-20 / H: 136-02)

- Mar 30Y up 3/32 at 164-16 (L: 163-25 / H: 165-08)

- Mar Ultra 30Y down 10/32 at 196-6 (L: 195-03 / H: 198-03)

US EURODOLLAR FUTURES CLOSE: Heavy Green Pack Volumes

Tail end of Reds (EDZ2 w/288k) through the Greens (EDH3-EDZ3) are leading volume trade today: EDH3 >320k, a lot of selling there while the Green Sep'23 futures just hit 25,000 at 99.36 and goes offered. Lead quarterly EDH1 back to steady after trading mildly weaker on 3M LIBOR set: +0.00100 to 0.18238% (-0.01137/wk) vs. (Record Low 0.18138% on 2/17/21).

- Mar 21 steady at 99.843

- Jun 21 +0.005 at 99.855

- Sep 21 +0.005 at 99.840

- Dec 21 +0.005 at 99.795

- Red Pack (Mar 22-Dec 22) steady to +0.005

- Green Pack (Mar 23-Dec 23) -0.005 to +0.020

- Blue Pack (Mar 24-Dec 24) +0.025 to +0.035

- Gold Pack (Mar 25-Dec 25) +0.030 to +0.035

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00050 at 0.08013% (+0.00050/wk)

- 1 Month +0.00013 to 0.11113% (+0.00375/wk)

- 3 Month +0.00100 to 0.18238% (-0.01137/wk) ** (Record Low 0.18138% on 2/17/21)

- 6 Month -0.00087 to 0.19688% (-0.00387/wk)

- 1 Year -0.00513 to 0.29100% (-0.00875/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $66B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $199B

- Secured Overnight Financing Rate (SOFR): 0.06%, $957B

- Broad General Collateral Rate (BGCR): 0.05%, $373B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $343B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $22.626B submission

- Next scheduled purchase:

- Fri 2/19 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: $3B Charter Comm's Launched

- Date $MM Issuer (Priced *, Launch #)

- 02/18 $3B #Charter Comm $1.5B 20Y +162.5, $1B 30Y +183, $500M 2061 Tap +205

- 02/18 $1.5B #Masco $600M 7Y +60, $600M 10Y +80, $300M 30Y +105

- 02/18 $1.5B *Prov of Ontario 10Y +26

- 02/18 $1.25B #BNP Paribas PerpNC10 4.625%

FOREX: GBP/USD Narrows Gap With $1.40

GBP/USD traded particularly well Thursday, with the pair hitting new cycle highs and narrowing the gap with the $1.40 handle - a level not topped since early 2018 and major psychological resistance. Continued strength in the UK vaccine rollout twinned with further pricing out of negative interest rates remain the key drivers, with EUR/GBP also looking unapologetically bearish.

- The USD lagged, recoupling with equity markets which traded in the red across both the continent and the US. The gravitational pull of the 50-dma in the USD index continues to draw influence at 90.421, with the 90.05 support seen as key.

- Elsewhere, commodity-tied currencies trade softer alongside a modest pullback in WTI and Brent crude futures prices. CAD was one of the poorest performers Thursday.

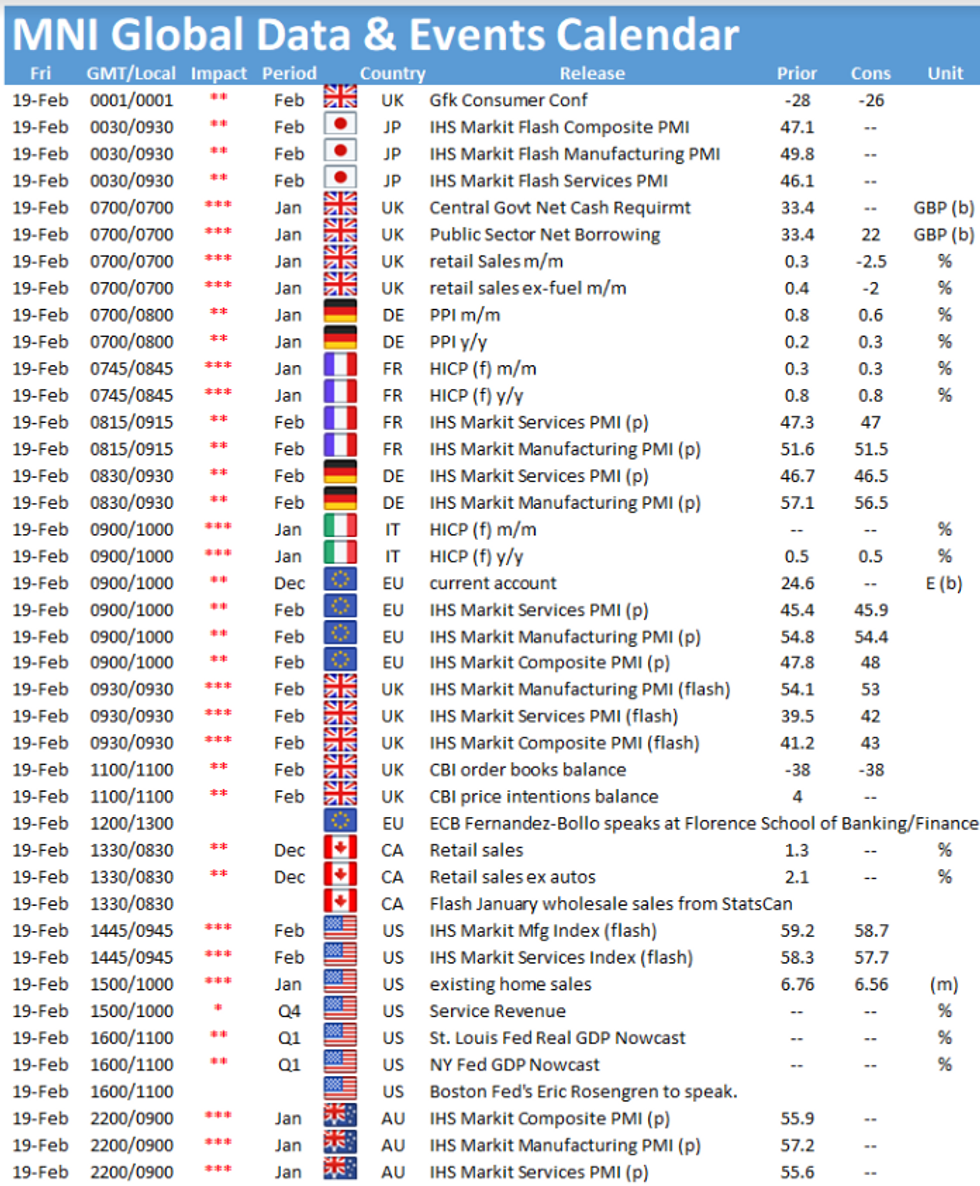

- Focus Friday turns to UK and Canadian retail sales as well as prelim manufacturing and services PMIs globally.

BONDS: EGBs-GILTS CASH CLOSE: BTPs Underperform In Broad Selloff

Gilts and BTPs underperformed Thursday, with the FI space getting hit despite a simultaneous decline in equities. No particular trigger for today's moves, more of an exaggerated continuation of trends in the past few sessions (Italy spread widening, core bear steepening).

- Some moderation of moves in the latter 2 hours of the session, with Gilt and Bund yields coming off highs. BTPs were an exception, with 10Y spreads finishing just under the 100bps handle.

- Bond supply seen as a contributory factor: France sold E10bn and Spain E5.1bn this morning.

- Friday sees UK retail sales data and prelim PMIs.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1bps at -0.688%, 5-Yr is up 2.1bps at -0.629%, 10-Yr is up 2.2bps at -0.346%, and 30-Yr is up 2bps at 0.157%.

- UK: The 2-Yr yield is up 0.6bps at -0.038%, 5-Yr is up 3.3bps at 0.14%, 10-Yr is up 5bps at 0.622%, and 30-Yr is up 4.8bps at 1.202%.

- Italian BTP spread up 4bps at 99.4bps / Spanish spread up 3bps at 68.6bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.