-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Inflation Expectations Rising

EXECUTIVE SUMMARY

- MNI BRIEF: Inflation Expectations Rise on More Govt Debt-Paper

- MNI BRIEF: Yellen Says Demand for 100-Yr Bond Would Be Tiny

- Richmond Fed Barkin: "FIRST QUARTER OF 2021 IS GOING TO BE 'BUMPY" Bbg

- Richmond Fed Barkin: "Yield Rise Reflects Market Optimism on Economy" while "Long Term Yields Are Still Low"

- Tsy Sec Yellen: "SENDING $1,400 WIDELY IS BETTER THAN NARROW TARGETING" Bbg

- YELLEN: CAPITAL GAINS TAX HIKE MIGHT BE WORTH CONSIDERING, Bbg

- YELLEN: WEALTH TAX WOULD HAVE TOUGH IMPLEMENTATION PROBLEMS, Bbg

US

US: News about rising government debt can trigger higher consumer inflation expectations according to a paper by two regional Fed advisers, backing former Treasury Secretary Larry Summers' warning that more fiscal stimulus "will set off inflationary pressures of a kind we have not seen in a generation."

- Households ramp up inflation views as they anticipate some monetization of the debt, according to the paper by Yuriy Gorodnichenko and Michael Weber, advisers to regional Federal Reserve banks. The third author, Olivier Coibion, teaches at University of Texas at Austin. For more see MNI Policy main wire at 1127ET.

- "Most people feel that the market for that would be very tiny," Yellen said about the prospect for a 100-year bond in a New York Times event. "There might be some interest but it would probably be a very thin market with very limited interest. But issuing longer-term securities certainly seems to make some sense."

US TSYS: Quicktake On Tapering: Tsy yield shave surged as US economic outlook improves amid drop in Covid-19 cases well ahead of Spring, improved vaccine inventory and distribution, prospect for $1.X trillion fiscal stimulus. Chatter over when the Fed will scale back buybacks (tapering) and/or normalize rates sooner than currently expected is on the rise.

- TD: Security analysts "think the market is priced for tapering in H1 2022 and the first hike by mid-2023; an earlier Fed exit would have serious repercussions across asset classes." How will markets react?

- TD said there is a "general agreement that r* is lower today and the Fed is aiming for an inflation overshoot." However, current Tsy market "is less liquid (especially in large tail events) and there is significantly more duration supply coming to market compared with 2013." Forward expectations:

- The Fed will start to prepare markets for tapering only in early-2022, and announce taper in September 2022 ... with a 10-month tapering period and for the Fed to then keep rates and the balance sheet on hold for a little more than a year.

- Expect the first hike in September 2024 and believe the market may be getting ahead of itself in pricing in taper and hiking risks.

OVERNIGHT DATA

- U.S. JAN. INDEX OF LEADING ECONOMIC INDICATORS UP 0.5%

- US Conference Board: Jan Lagging Index -0.6%

- US Conference Board: Jan Coincident Index +0.2%

- US Conference Board: Jan Leading Index 110.3

- Jan. Chicago Fed National Activity Index at 0.66 vs 0.41 Prior

MARKET SNAPSHOT

Key late session market levels- DJIA up 138.78 points (0.44%) at 31633.96

- S&P E-Mini Future down 11.75 points (-0.3%) at 3891.75

- Nasdaq down 228.8 points (-1.6%) at 13650.09

- US 10-Yr yield is up 3.6 bps at 1.3721%

- US Mar 10Y are down 5/32 at 135-9.5

- EURUSD up 0.0046 (0.38%) at 1.2168

- USDJPY down 0.42 (-0.4%) at 105.02

- WTI Crude Oil (front-month) up $2.25 (3.8%) at $61.49

- Gold is up $23.45 (1.31%) at $1808.29

- EuroStoxx 50 down 13.61 points (-0.37%) at 3699.85

- FTSE 100 down 11.78 points (-0.18%) at 6612.24

- German DAX down 43.19 points (-0.31%) at 13950.04

- French CAC 40 down 6.11 points (-0.11%) at 5767.44

US TSY SUMMARY: Higher Ylds, Steeper Curves, 5s30s Breach 2015 Triple Top

Futures have quietly drifted back to pre-NY open levels, weaker across the board to around middle of overnight range. Heavy overall volumes (3.35M TYH1) closer to average when taking surge in March/June rolls into account (835k TYH/TYM).

- Active participants have migrated to sidelines ahead Fed Chair Powell's semi-annual mon-pol testimony to Senate Banking Comm at 1000ET Wed. Note, officials have pre-released testimony around 0830ET in past - have not advised intention to do so. Unless Senate chooses to disclose the release time and advisory comes from the Fed then details are technically off the record and for planning only.

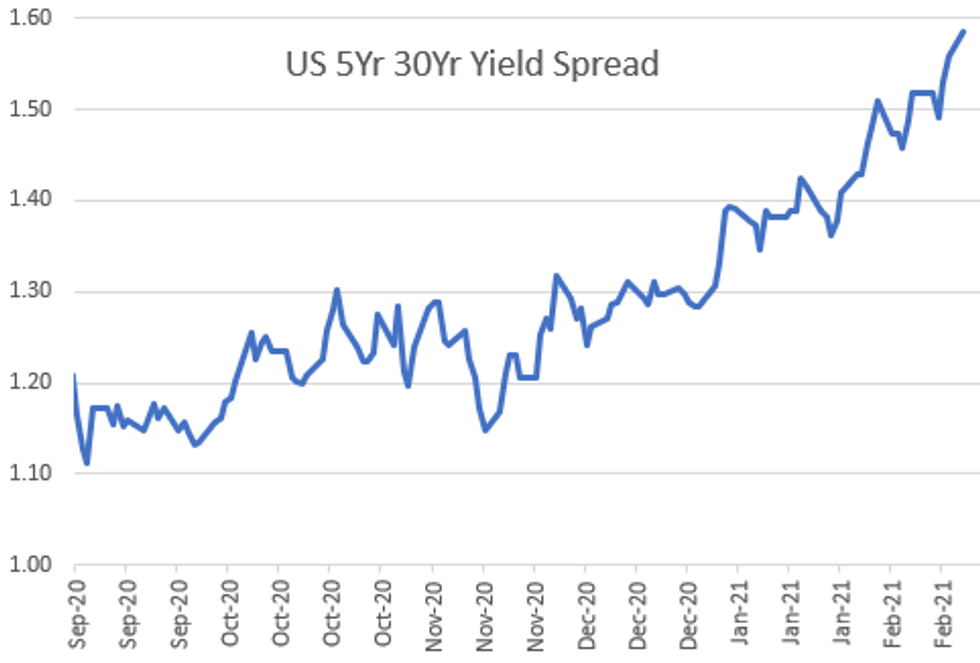

- Carry-over reflation theme from last week weighed on Treasury futures overnight, pushed yields to new 1Y highs (10YY 1.3925%; 30YY 2.1919%) yield curves climbed to new 5+ year highs (5s30s 159.336 vs. triple top from 2015 of 157.445, ).

- Early short covering, while LaGarde comment ECB is "CLOSELY MONITORING LONGER-TERM NOMINAL BOND YIELDS" Bbg and large TYH block buy (15,435 at 135-13) added impetus to gap bids in first half. Sporadic selling from fast$ and prop accts weighed followed by decent option-tied hedging vs. large 10Y puts trade, pick-up in deal-tied hedging and swap-tied selling in the short-end (2s-5s).

- The 2-Yr yield is up 0.8bps at 0.1129%, 5-Yr is up 2.3bps at 0.5986%, 10-Yr is up 3.9bps at 1.3755%, and 30-Yr is up 5.8bps at 2.1919%.

US TSY FUTURES CLOSE: Session Lows

Early gap bids on sporadic buying evaporated by midmorning, yields making new 1+ year highs (10YY 1.3925%; 30YY 2.1919%) yield curves climbed to new 5+ year highs (5s30s 159.336 vs. triple top from 2015 of 157.445, ).

- 3M10Y +2.894, 133.657 (L: 122.067 / H: 135.959)

- 2Y10Y +2.662, 125.209 (L: 121.505 / H: 128.37)

- 2Y30Y +4.401, 206.661 (L: 200.743 / H: 208.002)

- 5Y30Y +3.013, 158.617 (L: 153.718 / H: 159.336)

- Current futures levels:

- Mar 2Y down 0.375/32 at 110-15.875 (L: 110-15.75 / H: 110-16.25)

- Mar 5Y down 2.25/32 at 125-9 (L: 125-06 / H: 125-12.5)

- Mar 10Y down 3.5/32 at 135-11 (L: 135-01 / H: 135-19)

- Mar 30Y down 24/32 at 162-11 (L: 162-02 / H: 163-13)

- Mar Ultra 30Y down 1-23/32 at 191-29 (L: 191-16 / H: 194-09)

US EURODOLLAR FUTURES CLOSE: Weaker, But Well Off Lows

While Treasury futures fell back to overnight session low range, Eurodollar futures have drifted to the upper half of range. Lead quarterly EDH1 marginally weaker after 3M LIBOR bounced off last Fri's all-time low: 3 Month +0.00025 to 0.17550% (-0.01850 net last wk).

- Mar 21 -0.0025 at 99.840

- Jun 21 -0.005 at 99.850

- Sep 21 -0.005 at 99.830

- Dec 21 -0.005 at 99.785

- Red Pack (Mar 22-Dec 22) -0.01 to steady

- Green Pack (Mar 23-Dec 23) -0.035 to -0.02

- Blue Pack (Mar 24-Dec 24) -0.035 to -0.015

- Gold Pack (Mar 25-Dec 25) -0.02 to -0.005

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00312 at 0.08125% (-0.00150 net last wk)

- 1 Month -0.00062 to 0.11488% (+0.00812 net last wk)

- 3 Month +0.00025 to 0.17550% (-0.01850 net last wk) ** Record Low (0.17525% on 2/19/21)

- 6 Month +0.00900 to 0.20400% (-0.00575 net last wk)

- 1 Year -0.00100 to 0.28550% (-0.01325 net last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $204B

- Secured Overnight Financing Rate (SOFR): 0.02%, $873B

- Broad General Collateral Rate (BGCR): 0.01%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $331B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $5.580B submission

- Next scheduled purchases:

- Tue 2/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 2/24 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 2/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 2/26 1010-1030ET: Tsy 0Y-2.25Y, appr 12.825B

PIPELINE: $6.65B To Price Monday

- Date $MM Issuer (Priced *, Launch #)

- 02/22 $1.75B *Caterpillar $1B 2Y +18, $750M 5Y +35

- 02/22 $1B #Societe Generale 20Y tier 2 +160

- 02/22 $1B *Federal Farm Credit Bank 3Y +4

- 02/22 $800M #Spirit Realty $450M 7Y +120, $350M 11Y +140

- 02/22 $750M #Public Service of Colorado 10Y +58

- 02/22 $750M #Georgia Power 30Y +107

- 02/22 $600M #National Rural Utilities 5Y, +45

FOREX: Range Breaks Keep Trends in Tact

Weaker equity markets across the continent and in US futures space contrasted with the moves in the likes of AUD, NZD and GBP Monday, which all hit new multi-year highs against the USD as underlying positivity in risk sentiment (evident in roaring commodities) kept the ball rolling.

- GBP/USD has now traded higher for 11 of the past 13 sessions, with the outlining of the UK's plans to emerge from Coronavirus restrictions being received positively by the market. The UK PM Johnson laid out June 21st as the date to watch for all legal limits on social restrictions to be removed.

- AUD was buoyed by persistent and continued strength in commodities, with WTI and Brent bouncing as much as 3%, while copper hit new decade highs. The Bloomberg Commodities Index reflected the sentiment, touching the best levels since late 2018.

- Implied vol reflected the break to new highs in many developed markets, with front-end vol contracts in USD/JPY and USD/CHF posting the most notable gains.

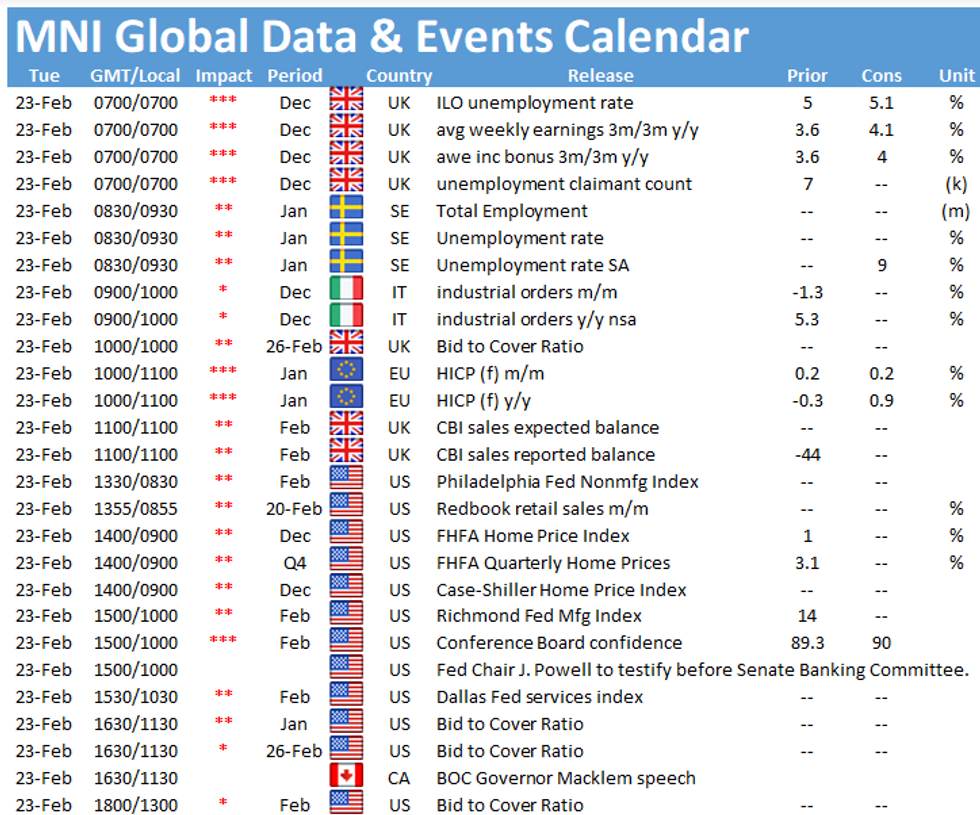

- Focus Tuesday turns to the UK jobs numbers for January, final Eurozone CPI readings and the February US consumer confidence release.

BONDS/EGBs-GILTS CASH CLOSE: Big Rally On Lagarde's "Close Monitoring"

Gilts and Bunds rallied after a weak open to the session, on comments by ECB Pres Lagarde that "the ECB is closely monitoring the evolution of longer-term nominal bond yields".- This was seen as an unambiguously dovish development given that her comments come amid a rise in yields, and were in reference to banks passing through higher rates to clients.

- This overshadowed UK PM Johnson's announcement re the schedule to end lockdown over the coming months, the details of which had been largely anticipated.

- Periphery spreads came off early wides on Lagarde's comments as well.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.5bps at -0.686%, 5-Yr is down 2.1bps at -0.629%, 10-Yr is down 3.4bps at -0.339%, and 30-Yr is down 4.6bps at 0.167%.

- UK: 10-Yr is down 1.9bps at 0.679%, and 30-Yr is down 1.3bps at 1.255%.

- Italian BTP spread up 0.7bps at 93.6bps / Spanish spread up 0.6bps at 66.6bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.