-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Headline Vol In FOMC Lead-Up

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: Fed Stays Patient as Outlook Improves

- MNI REALITY CHECK: Feb Storms Checks US Retail Sales

- BIDEN EYES FIRST MAJOR TAX HIKE SINCE 1993 IN NEXT ECONOMY PLAN; CORPORATE, INDIVIDUAL, ESTATE TAXES AMONG CHANGES CONSIDERED, Bbg

- MNI STATE OF PLAY: UK, US Spending Tilt Against BOE Stimulus

- MNI INTERVIEW: Canada Adding Home Resale Price Data to CPI

- GERMANY SUSPENDS ASTRAZENECA VACCINE USE, HEALTH MINISTRY SAYS, Bbg

- EU BEGINS LEGAL ACTION AGAINST U.K. OVER BREXIT DEAL VIOLIATION; EU OFFICIAL SAYS U.K. MOVE ON N. IRELAND IS ENORMOUS PROBLEM, Bbg

US

FED: The Federal Reserve on Wednesday will reiterate that it remains far from hitting its employment and inflation objectives and that it will be some time before it starts winding down QE, even as upgraded forecasts are likely to show officials moving forward the timing for pulling back policy support.

- Investors betting on an "Operation Twist"-style switch from shorter-dated to longer-dated bond buying to cap a spike in Treasury yields are likely to be disappointed, former officials told MNI, although the FOMC could raise the rates it pays on excess reserves and overnight repurchase agreements to support short-end rates as the Treasury releases over a trillion dollars in reserves into the financial system. For more, see MNI Policy main wire at 0853ET.

US: Severe winter storm disruptions in Texas kept a lid on overall U.S. retail sales last month but further re-openings and increased vaccinations alongside the December rescue package continued to support momentum coming into the traditionally weak month for spending, industry experts told MNI.

- "I'm looking for February to be a good print, because I think that the pluses are going to outweigh the minuses," said Jack Kleinhenz, chief economist at the National Retail Federation. "There are a number of forces at work that are a push and pull on the February data. You have these winter storms but you have at the same time households having purchasing power and some reopening of the United States." For more, see MNI Policy main wire at 0810ET.

CANADA

CANADA: Canada will soon incorporate home resale data into its Consumer Price Index from StatsCan's Residential Property Price Index, a government economist told MNI, referring to a recently-created survey of residential prices currently increasing at more than an annual 10%.

- The resale price data will be added to the CPI's MICI index of mortgage interest costs, which has a 3.57% weight in the CPI basket, Andrew Barclay, an economist at Statistics Canada's consumer prices division, said in a phone interview. He declined to say whether the change would tend to push inflation higher. For more, see MNI Policy main wire at 1137ET.

EUROPE

UK: The Bank of England Monetary Policy Committee will have its first chance to debate the impact of the UK budget and the U.S.'s USD1.9 trillion fiscal stimulus package at its meeting on Thursday, with the chances for near-term easing receding and a cut likely to the Bank's jobless forecast in May.

- Independent members who have been sympathetic to the case for further easing are already on the back foot, with their preferred policy tool, negative interest rates, still a work in progress with banks instructed to be ready for them by August. For more, see MNI Policy main wire at 0946ET.

OVERNIGHT DATA

- US NY FED EMPIRE STATE MFG INDEX 17.4 MAR

- US NY FED EMPIRE MFG NEW ORDERS 9.1 MAR

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 9.4 MAR

- US NY FED EMPIRE MFG PRICES PAID INDEX 64.4 MAR

- CANADA JAN MANUFACTURING SALES +3.1% MOM

- CANADA JAN FACTORY INVENTORIES +1.9%; INVENTORY-SALES RATIO 1.57

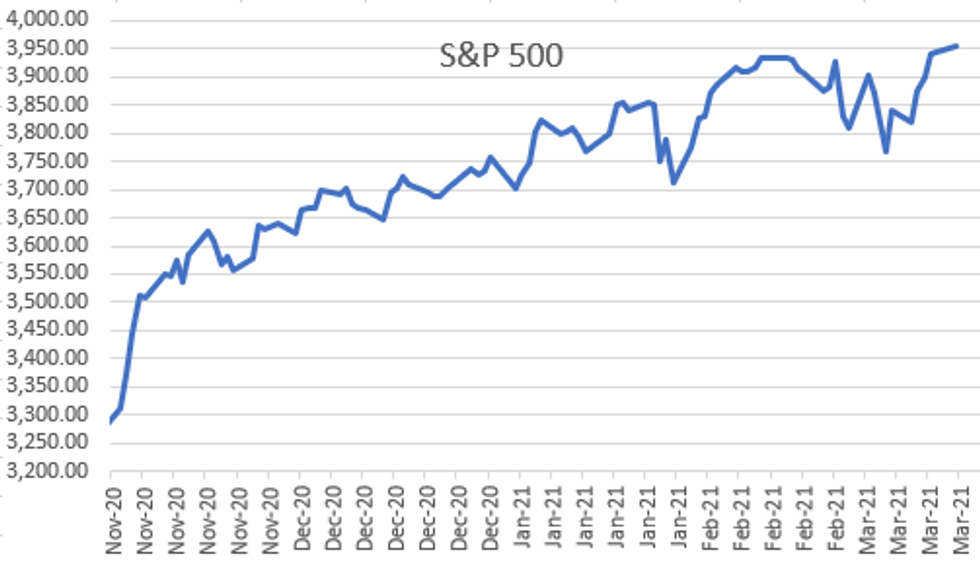

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 66.72 points (0.2%) at 32842.83

- S&P E-Mini Future up 12.5 points (0.32%) at 3945.25

- Nasdaq up 92.5 points (0.7%) at 13411.47

- US 10-Yr yield is down 1.6 bps at 1.609%

- US Jun 10Y are up 5/32 at 131-30

- EURUSD down 0.0026 (-0.22%) at 1.1927

- USDJPY up 0.12 (0.11%) at 109.15

- WTI Crude Oil (front-month) down $0.34 (-0.52%) at $65.26

- Gold is up $1.84 (0.11%) at $1728.99

European bourses closing levels:

- EuroStoxx 50 down 3.52 points (-0.09%) at 3829.84

- FTSE 100 down 11.77 points (-0.17%) at 6749.7

- German DAX down 40.97 points (-0.28%) at 14461.42

- French CAC 40 down 10.58 points (-0.18%) at 6035.97

US TSY SUMMARY: Overcoming Vaccine Induced Vol

Rates and equities held moderate gains after the bell Monday, off early lows following negative vaccine related headlines for Astrazeneca. Italy, Germany and Spain suspended use earlier, now awaiting word from France (expected to make announcement later). Headline from Germany weighed on broader equities earlier:

GERMANY'S VACCINE REGULATOR PAUL EHRLICH INSTITUTE SAYS MORE THROMBOTIC EVENTS HAVE BEEN REPORTED SINCE THURSDAY AFTER VACCINATION WITH ASTRAZENECA, Rtrs- Rates and equities rebounded late morning after: EMA REITERATES BENEFITS ASTRAZENECA VACCINE OUTWEIGH RISKS, Bbg

- Otherwise, fairly sedate session, two-way positioning on net as markets await the next FOMC policy annc on Wednesday. Deal-tied hedging in the mix, better buying upside calls as well.

- Some trepidation ahead Tuesday's 20Y auction re-open: If last week's auctions are any indicator, there is some trepidation over how well Tuesday's US Tsy $24B 20Y bond auction re-open will be received. WI currently running 2.280% / 2.275%.

- This compares to the Feb 17 auction when Treasuries gapped lower after WEAK US Tsy $27B 20Y bond auction (912810SW9) draws 1.920% vs. 1.897% WI, bid/cover 2.15% (2.28% previous).

- The 2-Yr yield is up 0.4bps at 0.151%, 5-Yr is down 1bps at 0.8305%, 10-Yr is down 1.6bps at 1.609%, and 30-Yr is down 0.5bps at 2.3722%.

US TSY FUTURES CLOSE: Choppy Trade Book-Ends Week Opener

Rates trade stronger after the bell but off highs following knee-jerk move with equity rally to new highs likely tied to headline: "HOUSE WILL CONSIDER PPP EXTENSION ON TUESDAY" Bbg. Astrazeneca headlines generated vol earlier after Italy, Germany and Spain suspended covid vaccine use after some deaths reported.

- 3M10Y -0.746, 157.921 (L: 156.792 / H: 160.657)

- 2Y10Y -2.471, 144.902 (L: 144.226 / H: 148.236)

- 2Y30Y -2.548, 220.118 (L: 219.105 / H: 224.198)

- 5Y30Y -1.061, 152.533 (L: 151.512 / H: 154.848)

- Current futures levels:

- Jun 2Y down 0.25/32 at 110-11.875 (L: 110-11.625 / H: 110-12.375)

- Jun 5Y up 2.75/32 at 123-24.75 (L: 123-20.25 / H: 123-25.5)

- Jun 10Y up 6/32 at 131-31 (L: 131-23 / H: 132-02)

- Jun 30Y up 24/32 at 156-10 (L: 155-13 / H: 156-14)

- Jun Ultra 30Y up 1-16/32 at 183-24 (L: 182-10 / H: 184-03)

US EURODOLLAR FUTURES CLOSE: Short End Underperforms

Whites mildly weaker, new lead quarterly EDM1 off steady late, 3M LIBOR set -0.00750 to 0.18200% (+0.00412 total last wk). Long end of strip follows Tsy lead.

- Jun 21 -0.005 at 99.830

- Sep 21 -0.005 at 99.805

- Dec 21 -0.005 at 99.750

- Mar 22 +0.006 at 99.818

- Red Pack (Jun 22-Mar 23) -0.005 to +0.010

- Green Pack (Jun 23-Mar 24) +0.015 to +0.020

- Blue Pack (Jun 24-Mar 25) +0.020 to +0.025

- Gold Pack (Jun 25-Mar 26) +0.030 to +0.030

Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00013 at 0.07800% (+0.00050 total last wk)

- 1 Month +0.00137 to 0.10750% (+0.00288 total last wk)

- 3 Month -0.00750 to 0.18200% (+0.00412 total last wk) (Just above Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00350 to 0.19750% (-0.00188 total last wk)

- 1 Year +0.00287 to 0.28100% (+0.00038 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $63B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $217B

- Secured Overnight Financing Rate (SOFR): 0.01%, $889B

- Broad General Collateral Rate (BGCR): 0.01%, $369B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $342B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.743B accepted vs. $6,725B submission

- Next scheduled purchases

- Tue 3/16 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 3/17 No buy operation due to FOMC

- Thu 3/18 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/19 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

PIPELINE: $8.2B To price Monday

- Date $MM Issuer (Priced *, Launch #)

- 03/15 $2.5B #NextEra Energy $2B 2Y +50, $500M 2Y FRN SOFR+54

- 03/15 $2.5B #Charles Schwab NC5 4.0%

- 03/15 $1B #Anglo American Capital $00M 7Y +107, $500M 10Y +130

- 03/15 $900M #Northwestern Mutual Life 30Y +112

- 03/15 $800M #Tampa Electric $400M 10Y +83, $400M 30 Y+108

- 03/15 $500M #CBRE Services 10Y +107

- On tap for Tuesday:

- 03/16 $Benchmark African Development Bank (AFDB) 5Y +6a

FOREX: Oxford Vaccine Questioned, Keeping EU Rollout Lumpy

- The USD was mixed ahead of the Fed's Wednesday rate decision, with the USD index creeping very slightly higher, but failing to make any progress beyond Friday's high.

- Vaccine politics became a market focus as the session progress, with Germany, France and Spain adding their names to the list of countries to pause the rollout of the AstraZeneca COVID vaccine. The EMA issues their ruling decision Tuesday, but have already reiterated that the benefits outweigh the risks.

- Scandi currencies underperformed, with both NOK and SEK among the poorest performers in G10 for relatively idiosyncratic reasons. Firstly, Swedish CPI came in well below expectations, with prices rising just 0.3% on the month vs. Exp. 0.6%.

- In Norway, concerning COVID virus figures are emerging from Oslo, in which the reproduction rate has risen to 1.5 - prompting the authorities to introduce the strictest measures since the beginning of the pandemic.

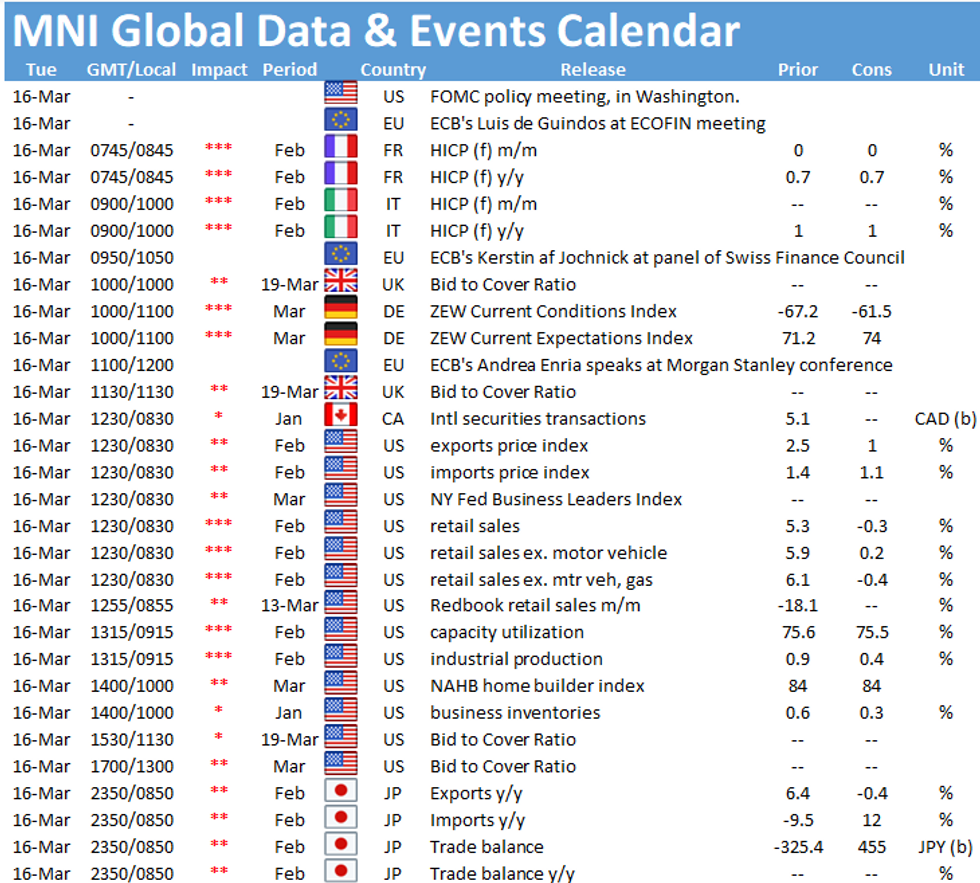

- Focus Tuesday turns to Germany's March ZEW survey, US retail sales and import/export price indices. Market moves could be muted, however, with all focus on Wednesday's Fed decision.

EGBs-GILTS CASH CLOSE: EU Legal Action Further Undermines Future Deal On Financial Services

The gilt sell-off peaked at midday and then recovered back towards Friday's close.

- The EU has launched legal action against the UK after Westminster unilaterally decided to extend the grace period for checks on goods passing through Northern Ireland. The move has been widely suspected in recent weeks and comes amid conflict over the distribution of Covid vaccines and the regulation equivalency for the financial services sector.

- The BoE earlier purchased GBP1.48bn of short-dated gilts with offer-to-cover of 2.87x.

- Focus this week will be on the Bank of England, which comes in a week of heavy central bank activity that includes Federal Reserve and Bank of Japan monetary policy meetings.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.