-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Let's Talk Turkey

EXECUTIVE SUMMARY

- Turkish President removes CBRT Governor just days after 200bps rate hike

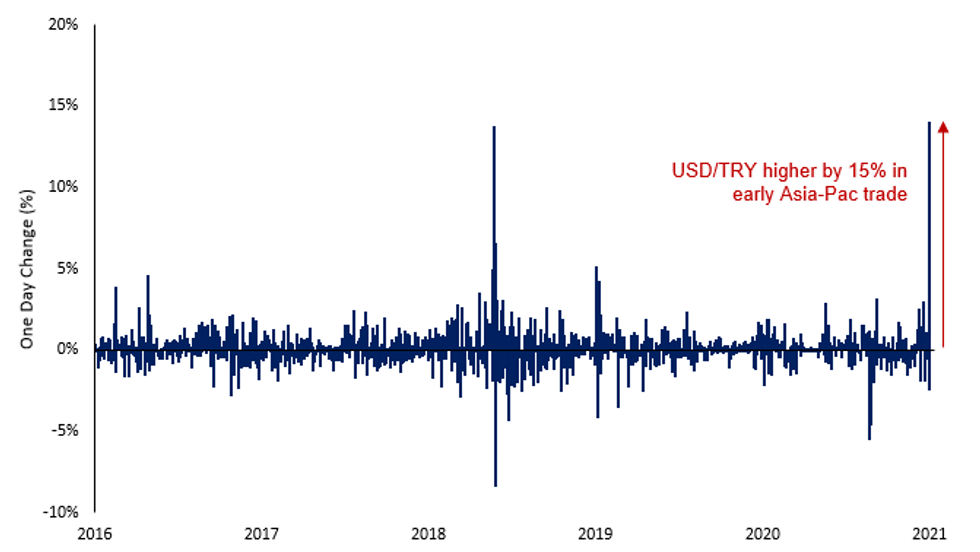

- USD/TRY Surges 15%, Sharpest one-day slide in TRY for decades

- MNI POLICY: Fed To Let SLR Exemption Expire As Scheduled

- MNI INTERVIEW: Fed Focused on Jobs Recovery, Not Yield Rise

- CDC REDUCES DISTANCING GUIDELINES TO 3FT FOR K-12 STUDENTS:CNBC

- MERKEL SAYS GERMANY TO STEP UP PACE OF VACCINE CAMPAIGN

USD/TRY One-Day Change – Sharpest one-day slide in TRY for decades

TURKEY

MNI MARKET ANALYSIS: TRY Blindsided as Erdogan Drops CBRT Governor -- Agbal's removal has had a major destabilising effect on markets, and will raise significant questions about Turkey's monetary policy approach going forward. As the linch pin and core catalyst behind the recent redevelopment of CBRT credibility, TRY stability, investor confidence in Turkey and budding de-dollarisation. Especially as Erdogan's human rights and economic reforms delivered negligible effect in markets. For more click on link: TURKEY

US

FED: The Federal Reserve said Friday it would allow a temporary rule easing banks' supplementary leverage ratios to expire as scheduled on March 31 while launching a public comment process on more permanent changes to the SLR at a time of unprecedented expansion of reserves from QE.

- Fed officials said in a call with reporters that they were confident that the move will not have an adverse effect on Treasuries trading by impairing liquidity or functionality.

- The eight U.S. globally systemically important banks currently have close to a trillion dollars of Tier I capital, with an aggregate SLR of 6.2%. That amounts to a buffer of USD200 billion of excess capital over the SLR, which officials deemed to be substantial. For more see MNI Policy main wire at 0904ET.

- "Our job is not done," Wright said. "We're very, very far away from where we want to be, and that just overwhelms everything else." For more see MNI Policy main wire at 1539ET.

FED: Excerpt from the latest NY Fed Underlying Inflation Gauge full data set: "is currently estimated at 1.7%, a 0.2 percentage point increase from the previous month."

- For February 2021, trend CPI inflation is estimated to be in the 1.7% to 2.3% range. The width of the range is similar to that in January, but both bounds are 0.2 percentage point higher. Note that the COVID-19 outbreak continues to impact data collection for the CPI release.

OVERNIGHT DATA

- CANADA FLASH FEB RETAIL SALES +4.0%

- CANADIAN JAN RETAIL SALES -1.1%; SALES EX-AUTOS/PARTS -1.2%

- CANADA JAN RETAIL SALES EX-AUTOS/PARTS-GASOLINE -1.4%

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 120.3 points (-0.37%) at 32742.22

- S&P E-Mini Future up 6.75 points (0.17%) at 3912

- Nasdaq up 94.3 points (0.7%) at 13209.03

- US 10-Yr yield is up 2.4 bps at 1.7317%

- US Jun 10Y are down 1.5/32 at 131-7

- EURUSD down 0.0006 (-0.05%) at 1.1909

- USDJPY down 0.01 (-0.01%) at 108.89

- WTI Crude Oil (front-month) up $1.42 (2.37%) at $61.42

- Gold is up $6.3 (0.36%) at $1742.59

European bourses closing levels:

- EuroStoxx 50 down 30.52 points (-0.79%) at 3837.02

- FTSE 100 down 70.97 points (-1.05%) at 6708.71

- German DAX down 154.52 points (-1.05%) at 14621

- French CAC 40 down 64.83 points (-1.07%) at 5997.96

US TYS SUMMARY: So Long SLR Exemption

Some decent movement and heavier volumes in rates on a zero data session. Two main factors at play:

- Tsys bounced overnight on apparent reversal of what spurred sell-off on prior overnight session: Nikkei report that the BoJ will widen 10Y JGB yield band +/- .25% vs +/- 0.2% around zero) at Fri's policy annc. During Fri Asia hours Bbg headline spurred short cover bid: KURODA: BOJ CLARIFIED ITS VIEW ON YIELD TARGET RANGE. Apparently, Kuroda had previously expressed his belief that there was no need to widen the band.

- Treasuries sold off midmorning when the Fed confirmed they would let the Supplementary Leverage Ratio (SLR) exemption expire as planned on Mar 31. Rates recovered following the initial gap sale: after much speculation over the past few weeks over what would happen if the exemption wasn't extended, fear of forced unwinds by financial institutions was unwarranted. FED CONFIDENT ALLOWING RULE TO EXPIRE WILL NOT IMPAIR TREASURY MARKET LIQUIDITY OR CAUSE MARKET DISRUPTION- FED OFFICIALS," Rtrs.

Markets calmed in second half, geo-pol angst simmered after some misc Pres Biden headlines, will speak to Russia's Putin "at some point"; also "U.S. SEEKS `PREDICTABLE AND STABLE' TIES WITH RUSSIA" Bbg State Dept Reeker on Blinken's trip to Brussels. Nothing really market moving from a geopolitical standpoint, but Tsys are bouncing off low end of range with equities bouncing as well: ESM1 near steady.

US TSY FUTURES CLOSE:

- 3M10Y +2.226, 170.837 (L: 165.27 / H: 173.758)

- 2Y10Y +2.057, 156.781 (L: 151.442 / H: 158.843)

- 2Y30Y -0.996, 227.923 (L: 223.879 / H: 232.017)

- 5Y30Y -3.203, 155.105 (L: 154.694 / H: 160.286)

- Current futures levels:

- Jun 2Y up 0.625/32 at 110-12 (L: 110-10.62 / H: 110-13.12)

- Jun 5Y down 1/32 at 123-19 (L: 123-15 / H: 123-25.75)

- Jun 10Y down 1.5/32 at 131-7 (L: 131-01 / H: 131-21.5)

- Jun 30Y up 3/32 at 154-3 (L: 153-26 / H: 155-09)

- Jun Ultra 30Y up 23/32 at 180-10 (L: 179-19 / H: 182-09)

US EURODOLLAR FUTURES CLOSE:

- Jun 21 steady at 99.835

- Sep 21 +0.005 at 99.820

- Dec 21 -0.005 at 99.745

- Mar 22 steady00 at 99.785

- Red Pack (Jun 22-Mar 23) -0.015 to +0.005

- Green Pack (Jun 23-Mar 24) -0.045 to -0.025

- Blue Pack (Jun 24-Mar 25) -0.06 to -0.05

- Gold Pack (Jun 25-Mar 26) -0.055

Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00187 at 0.07688% (-0.00125/wk)

- 1 Month -0.00250 to 0.10838% (+0.00225/wk)

- 3 Month +0.01025 to 0.19688% (+0.00738/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00150 to 0.20238% (+0.00838/wk)

- 1 Year +0.00037 to 0.27625% (-0.00188/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $75B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $239B

- Secured Overnight Financing Rate (SOFR): 0.01%, $868B

- Broad General Collateral Rate (BGCR): 0.01%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $339B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.401B accepted vs. $6.266B submission

- Next scheduled purchases

- Mon 3/22 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 3/23 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 3/24 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Thu 3/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/26 No buy operation

PIPELINE: $6.75B ATT 4Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/19 $6.75B #ATT 4pt offering to fund Spectrum; $2.25B 3NC1 +60, $750M 3YFRN SOFR+64, $3B 5NC2 +85, $750M 5YFRN/SOFR+64

- 03/19 $550M #Athene Global Funding 7Y +118

FOREX: Fed Turn Down Opportunity to Extend SLR, Boosting USD

- In a surprise for many in markets, the Fed confirmed Friday that the pandemic era SLR policy would not be extended beyond the March 31st deadline, leading to an abrupt (albeit short-lived) slide in US Treasury prices. This, in turn, drove yields and the US dollar higher - which kept the USD among the session's strongest performers in G10.

- GBP was among the session's poorest performers, with EUR/GBP bouncing off multi-month lows, but holding below the week's best levels. GBP weakness pressured GBP/USD briefly below 1.3850 before the pair recovered into the US close.

- The JPY was non-directional despite the Bank of Japan decision to extend some flexibility to their into their yield band target.

- NZD outperformed, but largely reversed modest weakness posted earlier in the week, doing little to rejig the technical outlook for now.

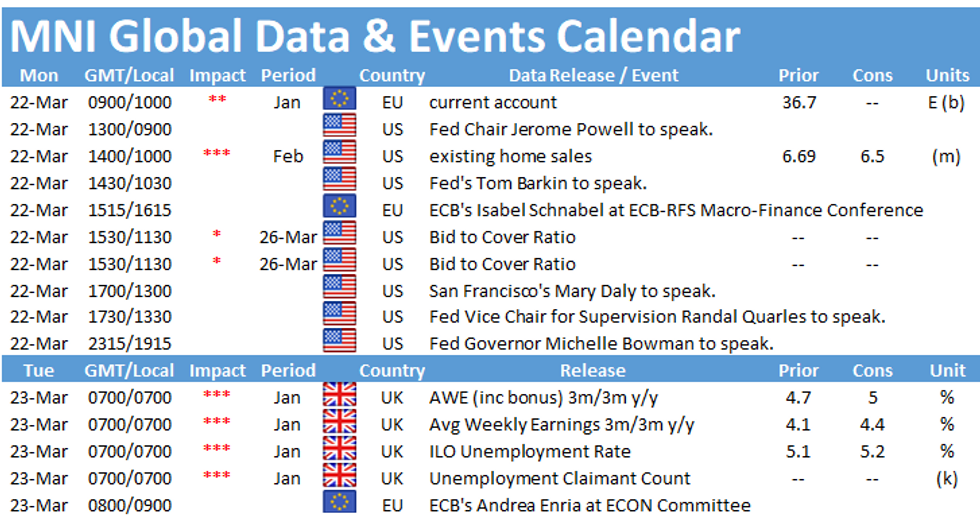

- Focus for the coming week turns to UK jobs, retail sales and inflation data and prelim global March PMIs. Central bank decisions are due from Mexico, South Africa, Hungary and Thailand.

EGBs-GILTS CASH CLOSE: Holding On To Early Gains

Friday saw a relatively quiet end to a very active week, with yields drifting a little higher over the course of the day following an initial drop.

- Overall, the UK and German curves bull flattened, with periphery spreads nudging wider.

- The biggest event of the day came out of the US, where the Fed surprisingly decided against extending SLR bank regulatory relief, sending Treasury yields higher and Bunds/Gilts higher on the follow.

- After hours we get ratings decisions on Spain, Portugal, and Greece among others. The highlights next week include UK labour market and CPI data, and March flash PMIs across Europe.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 1bps at -0.695%, 5-Yr is down 2.7bps at -0.645%, 10-Yr is down 3bps at -0.294%, and 30-Yr is down 1.9bps at 0.282%.

- UK: The 2-Yr yield is down 1.7bps at 0.093%, 5-Yr is down 3.2bps at 0.387%, 10-Yr is down 3.7bps at 0.838%, and 30-Yr is down 3.9bps at 1.366%.

- Italian BTP spread up 0.5bps at 95.8bps / Spanish spread up 0.2bps at 64.1bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.