-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Rally Goes Cold Turkey

EXECUTIVE SUMMARY

- MNI POLICY: Fed Rate Hike Seen in 2022 By Half NABE's Survey

- BARKIN: FED FORWARD GUIDANCE OUTCOME BASED, NOT CALENDAR BASED, Bbg

- U.S. and allies set to announce coordinated sanctions on China over Uyghurs 'genocide' Politico

- GERMANY LOCKDOWN TO BE EXTENDED UNTIL APRIL 18: SPIEGEL, Bbg

- SAUDI ANNOUNCES UN-BACKED INITIATIVE TO END YEMEN CONFLICT, Bbg

US TYS SUMMARY: Low Conviction Rally

Rather a muted start to week, Tsy futures higher on moderate volumes (TYM 1.1M) but holds to narrow range since much of rally occurred early overnight on mkt destabilizing concerns picked up after Turkey Pres Erdogan fired CBRT Gov just days after 200bps rate hike.- USD/TRY Surges 15%, Sharpest one-day slide in TRY for decades. Blowback on broader markets in general relatively contained by Monday NY open, FI futures climbed back to early Friday levels, equities gaining as well (ESM1 +40.0 late).

- Rally conviction not very strong ahead heavy data, Fed speakers on wk. Richmond Fed Barkin: will "Look Through" Y/Y Inflation Rises: took a reasonably dovish stance Mon, saying has not yet seen sufficient progress to warrant an asset purchase taper: "I want to get a good part of the way there before having the conversation about whether we've made substantial forward progress".

- Chicago Fed National Activity Index (CFNAI) fell to –1.09 in February from +0.75 in January; existing home sale: -6.6% MOM TO 6.22M SAAR.

- Rates sold off briefly after Oracle annc 6Pt jumbo debt (last Mar sold $20B) spurred early rate locks. Late launch: $15B spurred some spec unwinds.

- Heavy selling Eurodollar Sep'21 and Dec'21 noted early (-120k EDZ1 around the open). Tsy yld curves flattened. The 2-Yr yield is down 0.2bps at 0.1472%, 5-Yr is down 2.4bps at 0.8562%, 10-Yr is down 4.1bps at 1.6804%, and 30-Yr is down 5.4bps at 2.3795%.

US

FED: The Federal Reserve is likely to raise interest rates in either 2022 or 2023, according to respondents in a National Association of Business Economics survey published Monday, showing that expectations for rate hikes have been pushed back despite an outlook for faster economic growth.

- Half of a 205-person panel of members saw an interest rate hike in 2022, with nearly 30% seeing a hike sometime in 2023, according to the survey. This is down from August when NABE last conducted the survey. then showing 84% expecting interest rates to be higher by the end of 2022. For more, see MNI Policy main wire at 1202ET.

- "FED'S QUARLES SAYS IT'S TIME TO TRANSITION AWAY FROM LIBOR" Bbg

- "QUARLES: NOBODY SHOULD EXPECT USD LIBOR PAST JUNE 2023" Bbg

- "QUARLES: BANKS' FUTURE LIBOR USE POSES SAFETY, SOUNDNESS RISKS" Bbg

- "QUARLES: LIBOR TRANSITION TO FACE `INTENSE SUPERVISORY FOCUS'" Bbg

- "QUARLES: LEGISLATION IS NECESSARY TO ADDRESS LIBOR CONTRACTS" Bbg

- "QUARLES: NO ONE SHOULD ASSUME EXISTENCE OF SYNTHETIC USD LIBOR" Bbg

- As far as higher market yields are concerned, he said that they reflected more optimism on the economy, and that firming inflation expectations are "a good thing" as long as "they don't get out of whack".

- He also noted a few metrics that he is watching to assess economic developments. For one thing, he said he would "look through" annualized inflation spikes over the next six months (as they will be distorted by pandemic base effects), but will pay attention to other metrics, including trimmed mean inflation and M/M changes.

- Likewise with the employment to population ratio, which he said he "closely" follows as a measure of labor market slack (Fed Chair Powell among others has also pointed to this metric).

- The comments come after a number of notable comments Barkin made over the weekend, which alternatively could have been interpreted as both hawkish and dovish - including that it's straightforward for the Fed to keep its "foot on the gas", even though the US economy may be "on the brink" of a complete recovery.

OVERNIGHT DATA

- US FEB EXISTING HOMES SALES -6.6% MOM TO 6.22M SAAR; +9.1% YOY

- NAR: INVENTORY MATCHES JANUARY'S RECORD LOW; 1.03M, -29.5% YOY

- NAR'S YUN: EXISTING HOMES SALES HINDERED BY INVENTORY PROBLEMS

- NAR'S YUN: TODAY'S DATA NOT IMPACTED BY RECENT RISE IN MORTGAGE RATES

MARKETS SNAPSHOT

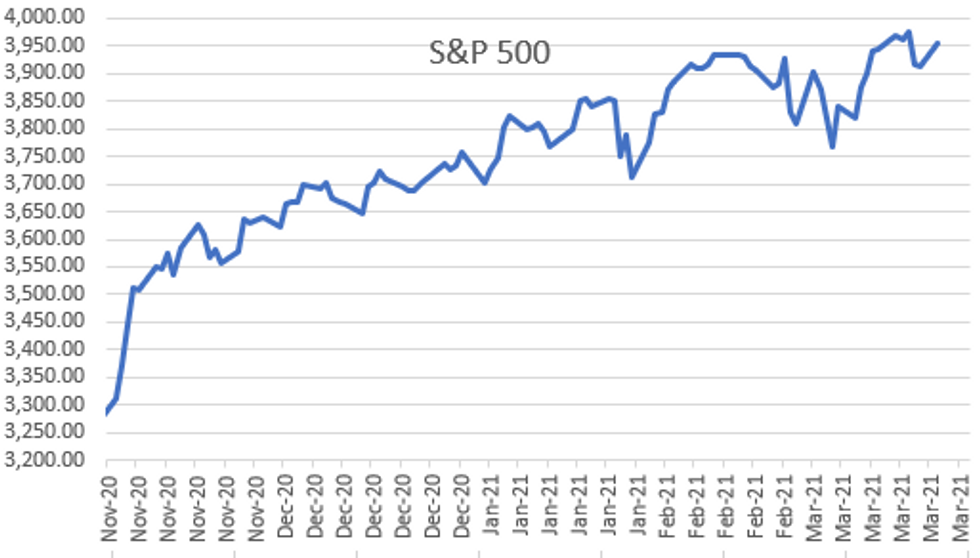

Key late session market levels- DJIA up 173.56 points (0.53%) at 32802.82

- S&P E-Mini Future up 42.75 points (1.1%) at 3943

- Nasdaq up 229.6 points (1.7%) at 13444.88

- US 10-Yr yield is down 4.1 bps at 1.6804%

- US Jun 10Y are up 10.5/32 at 131-17.5

- EURUSD up 0.0035 (0.29%) at 1.1939

- USDJPY down 0.09 (-0.08%) at 108.79

- WTI Crude Oil (front-month) up $0.13 (0.21%) at $61.55

- Gold is down $5.04 (-0.29%) at $1740.24

European bourses closing levels:

- EuroStoxx 50 down 3.18 points (-0.08%) at 3833.84

- FTSE 100 up 17.39 points (0.26%) at 6726.1

- German DAX up 36.21 points (0.25%) at 14657.21

- French CAC 40 down 29.48 points (-0.49%) at 5968.48

Stronger on Narrow Range

Futures holding stronger across the board after the bell, long end outperforming all session, yield curves flatter.

- 3M10Y -3.985, 166.852 (L: 165.085 / H: 169.494)

- 2Y10Y -3.839, 152.942 (L: 151.983 / H: 155.587)

- 2Y30Y -4.9, 223.023 (L: 222.316 / H: 226.736)

- 5Y30Y -2.946, 152.159 (L: 151.609 / H: 155.121)

- Current futures levels:

- Jun 2Y up 0.25/32 at 110-12.25 (L: 110-11.75 / H: 110-12.875)

- Jun 5Y up 3.5/32 at 123-22.5 (L: 123-18 / H: 123-26.75)

- Jun 10Y up 10.5/32 at 131-17.5 (L: 131-07 / H: 131-24)

- Jun 30Y up 38/32 at 155-9 (L: 154-10 / H: 155-14)

- Jun Ultra 30Y up 78/32 at 182-24 (L: 180-31 / H: 183-00)

US EURODOLLAR FUTURES CLOSE: Heavy Short End Sales

Futures held modestly weaker levels in Whites despite heavy early selling: on the heels of -120k EDZ1 from 99.74-.725 after the open, near 40,000 EDU1 sold from 99.815 to .81, EDZ1 >300k, EDU1 >239k total volume by the close. Reds-Golds held gains all session. Current levels:

- Jun 21 -0.005 at 99.830

- Sep 21 -0.005 at 99.815

- Dec 21 -0.005 at 99.740

- Mar 22 steady at 99.785

- Red Pack (Jun 22-Mar 23) +0.005 to +0.015

- Green Pack (Jun 23-Mar 24) +0.020 to +0.030

- Blue Pack (Jun 24-Mar 25) +0.035 to +0.040

- Gold Pack (Jun 25-Mar 26) +0.040 to +0.050

Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00025 at 0.07663% (-0.00125 total last wk)

- 1 Month -0.00100 to 0.10738% (+0.00225 total last wk)

- 3 Month -0.00638 to 0.19050% (+0.00738 total last wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00175 to 0.20413% (+0.00838 total last wk)

- 1 Year +0.00000 to 0.27625% (-0.00188 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $226B

- Secured Overnight Financing Rate (SOFR): 0.01%, $885B

- Broad General Collateral Rate (BGCR): 0.01%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $337B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $9.607B submission

- Next scheduled purchases:

- Tue 3/23 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 3/24 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Thu 3/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/26 No buy operation

PIPELINE: $15B Oracle 6Pt Launched

Notice the substantial narrowing in spds from last year's $20B issuance:

- Date $MM Issuer (Priced *, Launch #)

- 03/22 $15B #Oracle 6pt, $2.75B 5Y +80, $2B 7Y +100, $3.25B 10Y +120, $2.25B 20Y +140, $3.25B 30Y +155, $1.5B 40Y +170a. Last year, Oracle issued $20B over 6 tranches on March 30: $3.5B 5Y +210, $2.25B 7Y, $3.25B 10Y, $3B 20Y, $4.5B 30Y +225, $3.5B 40Y +250

- 03/22 $1B *DTE Electric $575B 7Y +58, $425B 10Y +90

- 03/22 $Benchmark OMERS Finance Trust 5Y +21a

- 03/22 $750M *American Honda Finance 7Y +70 (adds to $1.75B issued on Jan 11: $900M 3.5Y +35, #300M 3.5Y FRN L+35, $550M10Y +700

- On tap for Tuesday

- 03/23 $Benchmark Rentenbank 5Y +5a

FOREX: Markets Shake Off Sluggish Open to Retain Risk-On Feel

- Currency markets shied away from risk-proxies and commodity-tied currencies at the open, with the concern of any spillover impact from TRY volatility keeping a lid on risk appetite. As it became increasingly clear that the risk was relatively contained, markets picked the likes of EUR and CNH off the day's lows, both of which improved into the NY close.

- USD, CAD traded poorly into the close, with NOK and CHF the day's best performers.

- TRY recovered a decent portion of the opening losses, but remains on track for a considerably weaker close. Offshore TRY borrowing rates shot higher as the session progressed, which may have stemmed some of the spot losses as shorting the currency became prohibitively expensive.

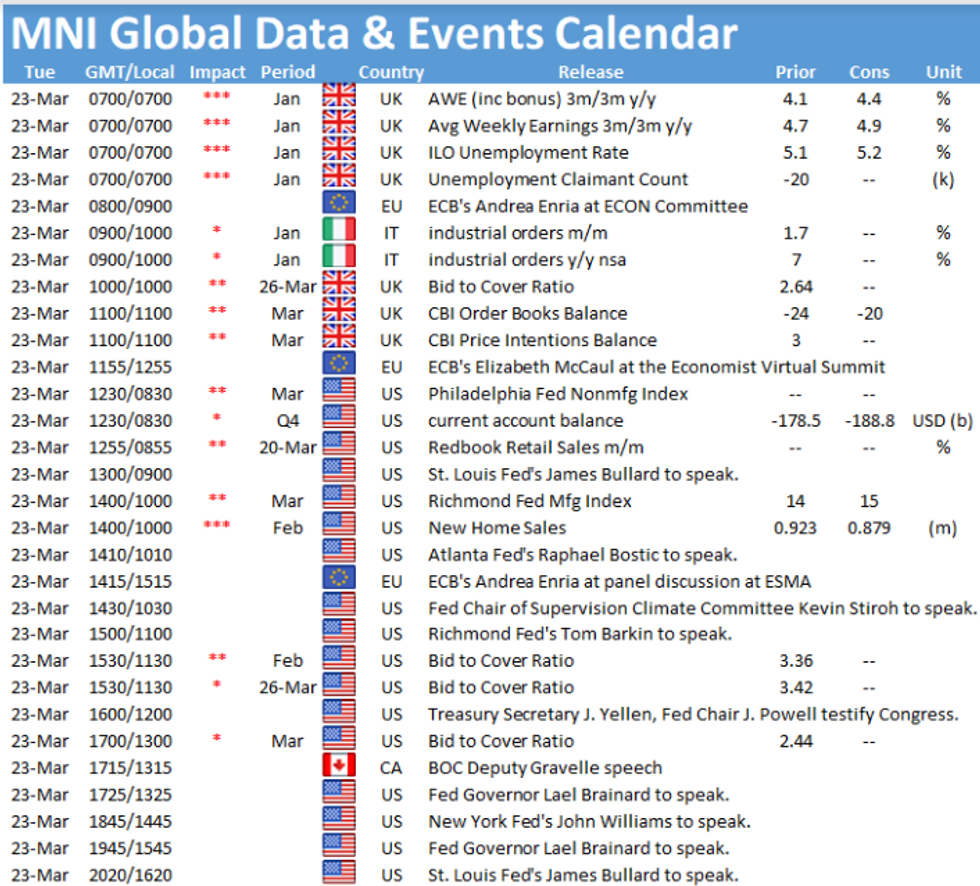

- Focus Tuesday turns to jobs data from the UK as well as February new home sales data from the US.

- A number of central bank speakers cross, with BoE's Baily, Haldane & Cunliffe, ECB's Villeroy and no fewer than 7 different Fed speakers.

EGBs-GILTS CASH CLOSE: ECB Starts Putting PEPP Talk Into Action

Core FI curves bull flattened, with Gilts outperforming Monday, though yields came off lows as early risk-off (related to Turkey concerns and EU-UK vaccine rhetoric) faded.

- Eagerly anticipated data showed ECB net asset purchases picked up last week, with PEPP purchases the fastest since early December (E21.1bn). The muted reaction suggested that markets were prepared for a figure around this level, 11 days after the ECB pledged to accelerate buys, though BTP spreads tightened steadily after the release.

- Earlier, ECB's Knot said the ECB may be able to begin talks on unwinding accommodation later this year if there is "good progress with vaccinations". Nothing new in a Pres Lagarde blog post.

- Tues sees UK labor market data, EU SURE double-tranche syndication and Dutch DSL auction; speakers including BOE's Haldane and ECB's Villeroy.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.5bps at -0.7%, 5-Yr is down 0.9bps at -0.654%, 10-Yr is down 1.7bps at -0.311%, and 30-Yr is down 1.7bps at 0.265%.

- UK: The 2-Yr yield is down 1.9bps at 0.074%, 5-Yr is down 1.7bps at 0.37%, 10-Yr is down 2.4bps at 0.814%, and 30-Yr is down 2.5bps at 1.341%.

- Italian BTP spread unchanged at 95.8bps/ Spanish spread up 0.8bps at 64.9bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.