-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Let's Put Recovery Before Reflation

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Next Fed SEP Set to Show Growing Optimism

- MNI BRIEF: MMF Reform Proposals Coming July: FSB's Quarles

- MNI BRIEF: US Inflation Rise Unsustainable: Fed's Athreya

- MNI BRIEF: Optimism Isn't Enough to Adjust Rates - Fed Quarles

- MNI SOURCES: Covid Surge Threatens To Delay EU Debt Rule Review

- No set time for Pres Biden's "Economic Vision" speech Wednesday from Pitt

- BOSTIC: HOPEFUL THAT U.S. WILL SEE "LARGE" JOB NUMBERS IN COMING MONTHS, Bbg

- NY FED'S WILLIAMS: SEES A STRONG U.S. ECONOMIC RECOVERY, Bbg

US TSY SUMMARY: Reflation? Tell That To Bonds

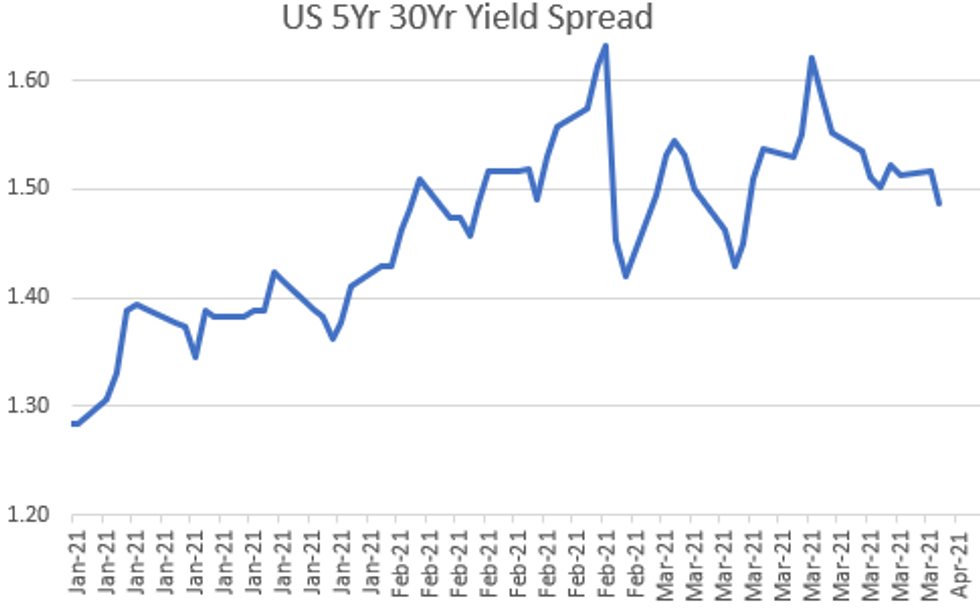

Tsys traded weaker on Tue's open, gradual rebounding until Consumer Confidence, futures gapped lower after better than expected read 109.7 for March vs. 90.4 last month.- Tsys gradually rebounded, 30Y Bonds and Ultra-Bond futures making new session highs by noon. Couple long end block buys (+4,250 USM 154-31, buy through 154-28 post-time offer; +3,010 WNM1 182-28, buy-through 182--22 post-time offer) contributed to curves flattening while 2s-10s held lower levels after the bell.

- No unifying driver cited for continued carry-over weakness in rates, except for a reflation narrative that helped push yields to 1+ year highs late Feb into first half of March.

- Not market moving, Fed speak contributing to the reflation theme: Atlanta Fed Bostic: HOPEFUL THAT U.S. WILL SEE "LARGE" JOB NUMBERS IN COMING MONTHS, Bbg; and NY Fed Williams: SEES A STRONG U.S. ECONOMIC RECOVERY, Bbg. Aside, Pres Biden to deliver his "economic vision" from Pittsburg Wednesday (no set time).

- Month/quarter-end positioning and squaring ahead Friday's March employment data generated decent volumes on two-way flow. Tsy options downside insurance highlights: over +26,000 FVM 121/122/123 put flys, 9.5-10, FVM currently trading 123-14.5; wk1 TY midcurve put flys tactical buys for strong data Friday.

- The 2-Yr yield is up 0.6bps at 0.1465%, 5-Yr is up 1.9bps at 0.907%, 10-Yr is up 1.4bps at 1.7225%, and 30-Yr is down 1.5bps at 2.39%.

US

FED: The Federal Reserve could become more bullish about the economy's prospects by the time it issues the next round of forecasts in June, complicating the central bank's message that it is in no hurry to tighten monetary policy, current and former Fed officials told MNI.

- "Fast forward to June, if all goes well, they're going to have to mark up their forecast," said Joseph Gagnon, a former Fed board economist, in an interview. He noted first quarter data were already coming in stronger-than-expected despite a Covid surge. For more see MNI Policy main wire at 0557ET.

- "The proposals should also reduce the likelihood that government interventions and taxpayer support will be needed to halt future MMF runs," he said at the Peterson Institute for International Economics.

- In November, the FSB issued a report that the turmoil in markets last spring exposed vulnerabilities throughout the financial sector, but concluded that further investigation was warranted into money market and open-ended funds. US regulators in December said policymakers needed to consider major changes to make money market funds less vulnerable to investor runs, but their report stopped short of making specific recommendations.

- Quarles said he is "one of the biggest optimists on the Committee," seeing unemployment falling pretty quickly and substantially. But "the fact that I am an optimist is not really relevant under our new framework," he said. "We shouldn't jump the gun until we see those outcomes" on inflation and employment, he added. For more see MNI Policy main wire at 1022ET.

- The President will travel to Pittsburgh, Pennsylvania to deliver remarks on his economic vision for the future and the Biden-Harris Administration's plan to Build Back Better for the American people.

EUROPE

EU: The review of the eurozone's strict rules on public borrowing may be delayed beyond its expected autumn start-date due as a third wave of Covid 19 infections hits harder than expected, sapping the bloc's economy, officials in Brussels told MNI.- The Stability and Growth Pact has already been suspended until the end of 2022 due to the pandemic, but countries including France and Italy have called for a review to loosen its limits on public borrowing and stipulations for how quickly excessive debt must be reduced. But officials said there is no hurry to start that difficult discussion, in which fiscally more hawkish countries like the Netherlands are likely to oppose proposals for easier rules, while the economy is still on convalescence. For more see MNI Policy main wire at 0831ET.

OVERNIGHT DATA

US CONF BOARD CONSUMER CONFIDENCE 109.7 IN MAR V FEB 90.4

- US REDBOOK: MAR STORE SALES -17.4% V FEB THROUGH MAR 27 WK

- US REDBOOK: MAR STORE SALES +8.9% V YR AGO MO

- US REDBOOK: STORE SALES +9.8% WK ENDED MAR 27 V YR AGO WK

- US JAN CASE-SHILLER SEAS ADJ HOME PRICE INDEX +1.2% M/M

- US JAN CASE-SHILLER UNADJ HOME INDEX +0.9% M/M; +11.1% Y/Y

- US JAN CASE-SHILLER NATIONAL IDX +1.2% SA, +0.8% NSA, +11.2% Y/Y

MARKETS SNAPSHOT

Key late session market levels- DJIA down 24.88 points (-0.08%) at 33150.02

- S&P E-Mini Future down 3.25 points (-0.08%) at 3956

- Nasdaq down 3.9 points (0%) at 13057.6

- US 10-Yr yield is up 1.4 bps at 1.7225%

- US Jun 10Y are down 5.5/32 at 131-6

- EURUSD down 0.0043 (-0.37%) at 1.1722

- USDJPY up 0.53 (0.48%) at 110.34

- WTI Crude Oil (front-month) down $1.09 (-1.77%) at $60.45

- Gold is down $29.91 (-1.75%) at $1682.13

- EuroStoxx 50 up 43.33 points (1.12%) at 3926.2

- FTSE 100 up 35.95 points (0.53%) at 6772.12

- German DAX up 190.89 points (1.29%) at 15008.61

- French CAC 40 up 72.53 points (1.21%) at 6088.04

MONTH-END EXTENSIONS: Updated Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS 0.01Y; Govt inflation-linked, 0.02. Note: Update MBS extension figure doubled from 0.12 prelim estimate while intermediate Gov climbed from steady.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.09 | -0.03 |

| Agencies | 0.03 | 0.05 | -0.03 |

| Credit | 0.11 | 0.09 | 0.16 |

| Govt/Credit | 0.08 | 0.09 | 0.06 |

| MBS | 0.24 | 0.06 | 0.03 |

| Aggregate | 0.13 | 0.08 | 0.04 |

| Long Gov/Cr | 0.11 | 0.09 | 0 |

| Iterm Credit | 0.11 | 0.08 | 0.09 |

| Interm Gov | 0.08 | 0.08 | 0.01 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.05 |

| High Yield | 0.15 | 0.1 | 0.12 |

US TSY FUTURES CLOSE:

- 3M10Y +0.754, 170.04 (L: 167.663 / H: 175.647)

- 2Y10Y +0.868, 157.219 (L: 156.173 / H: 161.807)

- 2Y30Y -2.125, 223.913 (L: 222.732 / H: 230.568)

- 5Y30Y -3.664, 147.903 (L: 146.079 / H: 152.976)

- Current futures levels:

- Jun 2Y down 0.25/32 at 110-12.375 (L: 110-11.625 / H: 110-12.875)

- Jun 5Y down 3.5/32 at 123-18 (L: 123-11.5 / H: 123-22)

- Jun 10Y down 4.5/32 at 131-7 (L: 130-26 / H: 131-13.5)

- Jun 30Y up 12/32 at 155-5 (L: 153-29 / H: 155-10)

- Jun Ultra 30Y up 1-7/32 at 182-20 (L: 180-03 / H: 183-04)

US EURODOLLAR FUTURES CLOSE:

- Jun 21 -0.005 at 99.820

- Sep 21 -0.005 at 99.805

- Dec 21 -0.005 at 99.735

- Mar 22 -0.010 at 99.770

- Red Pack (Jun 22-Mar 23) -0.02 to -0.015

- Green Pack (Jun 23-Mar 24) -0.035 to -0.015

- Blue Pack (Jun 24-Mar 25) -0.04

- Gold Pack (Jun 25-Mar 26) -0.04 to -0.02

Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00412 at 0.07700% (+0.00362/wk)

- 1 Month +0.00663 to 0.11513% (+0.00788/wk)

- 3 Month -0.00087 to 0.20163% (+0.00263/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00387 to 0.20675% (+0.00350/wk)

- 1 Year +0.00513 to 0.28663% (+0.00588/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $252B

- Secured Overnight Financing Rate (SOFR): 0.01%, $858B

- Broad General Collateral Rate (BGCR): 0.01%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $329B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $3.146 submitted

- Next scheduled purchases:

- Wed 3/31 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Pause for Easter Holiday, Resume April 5:

- Mon 4/05 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: Deutsche Bank Launched, FRN Dropped

- Date $MM Issuer (Priced *, Launch #)

- 03/30 $2.5B #Pakistan $1B 5Y 6.0%, $1B 10Y 7.375%, $500M 30Y 8.875%

- 03/30 $1.5B *Dexia Credit 5Y +12

- 03/30 $1.2B *Jardine Matheson $800M 10Y +87.5, $400M 15Y 127.5

- 03/30 $750M #Deutsche Bank 4NC3 +112.5, 4NC3 FRN SOFR dropped

- 03/30 $Benchmark Chile 32Y Formosa/30Y +140a

FOREX SUMMARY

Main story of the day for FX has been the continued better buying of the Dollar across the board.

- The Greenback is bid against all majors, but the SEK is now the worst performer down 0.65%, closely followed by the JPY on higher US yields, now down 0.53%, after Treasuries futures move off their lows.

- Next target in USDJPY is seen further out towards 110.63 0.764 proj of Mar - Apr 2020 rally from Jan 6 low

- Also note, that 110.67 is the May 2019 high

- EURUSD broke out lower and tested MNI tech support at 1.1711 (05/11 low), printed 1.1712 low at the time of typing.

- Cable is looking to test the figure at 1.3700, now at 1.3709.

- Further downside traction in Cable would open towards next support at 1.3670/63 Low Mar 25 / Low Feb 5.

- CHF is down 0.40% versus the Dollar, as safe haven FX loses ground with risk tilted to the upside.

- USDCHF trades at 0.9434, just off the session high at 0.9438 (at the time of typing).

- Looking ahead, Riksbank Ingves and Fed Williams are the speakers left on the calendar for today

EGBs-GILTS CASH CLOSE: Reflation Narrative Maintains Steepening Pressure

The UK and German curves bear steepened yet again Tuesday as the reflation narrative has driven global core FI yields higher this week. Periphery spreads were little changed.

- EGBs mainly took their cue from US Treasuries, with 10-Yr yields hitting 14-month highs on expectations of strong US economic activity and further fiscal stimulus.

- Germany and Spain posted above-expected CPI prints in the morning. Upside surprises in French and Eurozone sentiment indicators added a bit of reflationary sentiment.

- That said, Bund and Gilt yields ended the session off the highs, with some citing month-end extension dynamics as a possible support.

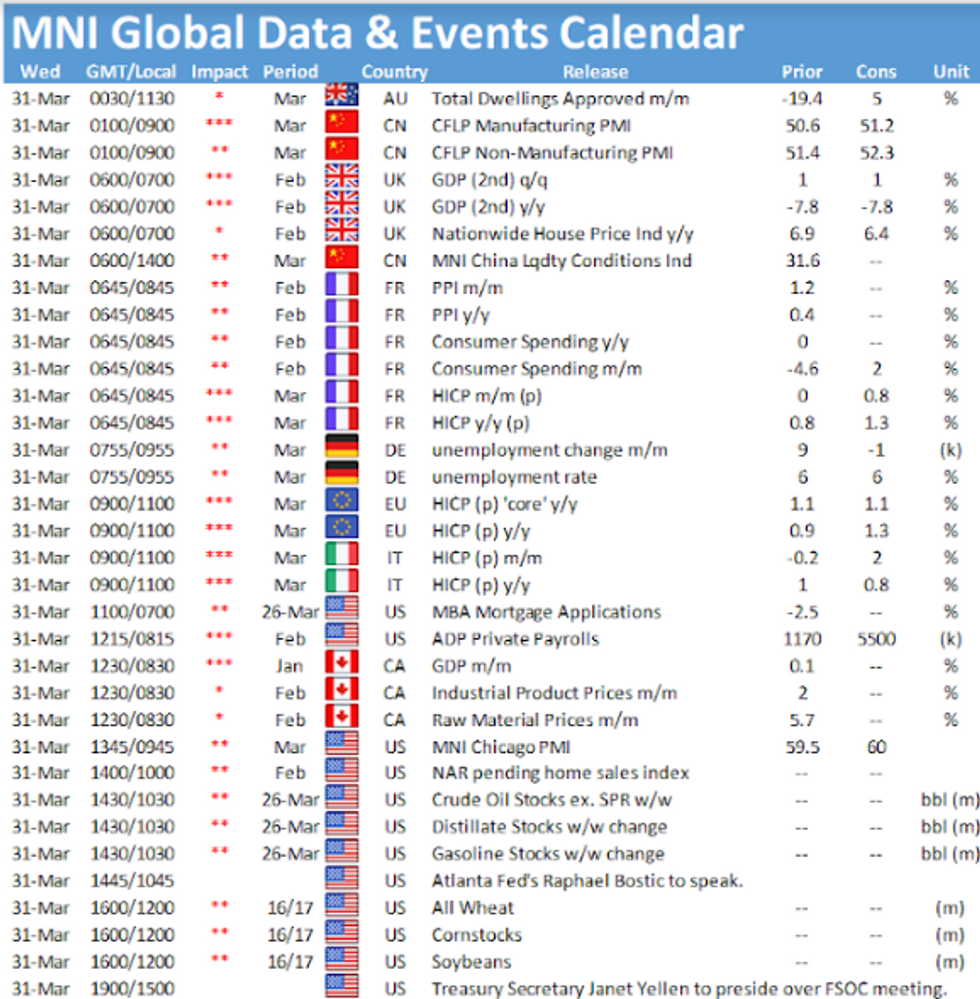

- Wed sees EZ/French/Italian CPI and revised Q4 UK GDP in data, as well as German 15-Yr supply. A few speakers as well with ECB's Lagarde, Rehn, Visco and Villeroy appearing.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1.7bps at -0.692%, 5-Yr is up 3.2bps at -0.625%, 10-Yr is up 3.2bps at -0.286%, and 30-Yr is up 2bps at 0.268%.

- UK: The 2-Yr yield is up 0.7bps at 0.074%, 5-Yr is up 2.3bps at 0.364%, 10-Yr is up 3.6bps at 0.824%, and 30-Yr is up 4.1bps at 1.36%.

- Italian BTP spread up 0.9bps at 96.6bps / Spanish down 0.2bps at 62.9bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.