-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY177.8 Bln via OMO Wednesday

MNI ASIA OPEN: 'Powerful' Disinflation Forces, Barkin Says What?

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed's Barkin Sees 'Powerful' Disinflation Forces

- US DATA: MNI Chicago Business Barometer Surges to 32-Month High

- BOC: GOVERNOR TIFF MACKLEM SAYS HE IS SEEING WORRYING SIGNS THAT HOUSEHOLD INDEBTEDNESS IS WORSENING AS HOUSING PRICES RISE - NEWSPAPER INTERVIEW, Rtrs

- FR Pres Macron annc nationwide lockdown for 4 weeks to combat Covid spread

- SEC to probe blowup of Archegos fund

US

FED: Richmond Fed President Tom Barkin said in an interview Wednesday that long-term inflation expectations have remained stable through the start of an economic boom triggered by Covid-19 vaccines, and there's still lots of slack in the economy to hold down prices overall.

- "What I'm hearing is a real reluctance to use short-term supply chain issues to change the long-term price structure," said Barkin, a voter on the FOMC this year. "Part of that is firms haven't changed their expectations, and part of that is some of the disinflationary forces that are out there are still very powerful," such as online price transparency, he said. For more see MNI Policy main wire at 1510ET.

FED: Atlanta Fed President Raphael Bostic said he does not fear an undue spike in U.S. inflation despite his fairly optimistic outlook for the economic recovery.

- "Right now I'm not concerned," Bostic told an online event hosted by the University of Miami. While he expects a rebound in activity as the economy emerges from Covid and the fiscal stimulus boosts, he says it will be a while before policymakers can gauge whether that bump will be sustained.

- MNI has reported growing inflation concerns both within and outside the U.S. central bank given a mix of robust fiscal and monetary policies.

US TSY SUMMARY: Follow the Bouncing Ball That Is Tsys

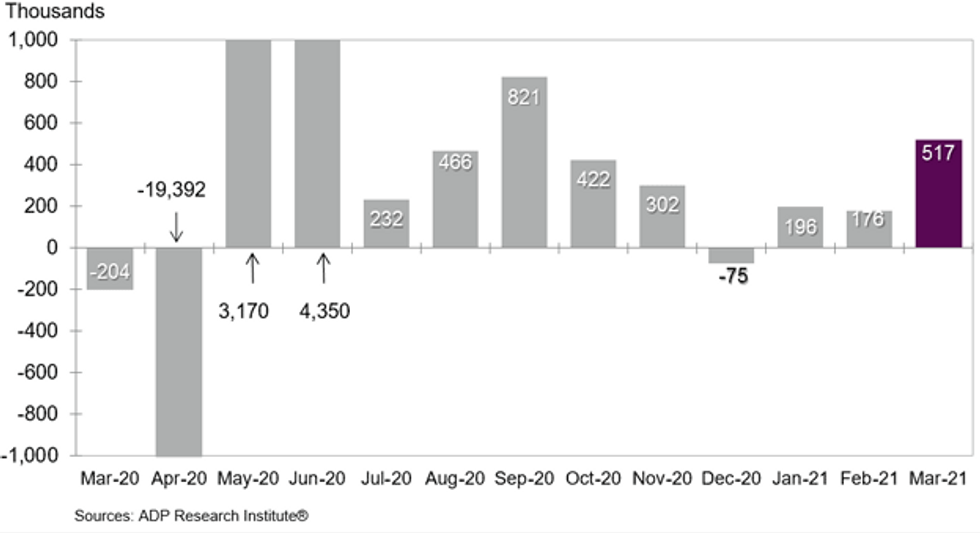

Choppy late session trade tied to month/quarter-end flows Wednesday, Tsys weaker but well off session lows from the closing bell, while equities pared gains after making new all-time highs in SPUs (ESM1 3983.75). Late chop exacerbated by thinning markets ahead Fri's March NFP (+650k est vs. +379k last for Feb) and participation heading into Easter holiday (early 1100ET close Fri).- Post-ADP Bounce: Tsy futures blipped higher after ADP private employ data came out a little less optimistic than estimated (+517k vs. +550k) with futures inside the

- overnight range on the open, curves mixed with short end steeper.

- Tsys inched off early lows into midday, loosely following equities, amid two-way trade, positioning ahead the extended holiday weekend, but reversed course/extended lows during the second half as equities plowed higher. Brief bounce in rates after French Pres Emmanuel Macron anncd will extend nationwide lockdown measures for the next four weeks.

- Tsys see-sawed lower yet again, making session lows on the bell (10YY 1.7494%H; 30YY 2.4289%H) -- only to gap higher on hevy volumes in the hour that followed with couple ultra-band Block buys adding impetus +2,000 WNM1 181-19, buy through 181-16 post-time offer; +3,500 WNM1 182-05 buy through 182-01 post-time).

- The 2-Yr yield is up 1bps at 0.1564%, 5-Yr is up 3.1bps at 0.9264%, 10-Yr is up 2.9bps at 1.7315%, and 30-Yr is up 4bps at 2.4082%.

OVERNIGHT DATA

ADP RESEARCH INSTITUTE SAYS U.S. ADDED 517,000 JOBS IN MARCH

US NAR FEB PENDING HOME SALES INDEX 110.3 V 123.4 IN JAN

- MNI CHICAGO BUSINESS BAROMETER 66.3 MAR VS 59.5 FEB

- MNI CHICAGO: PRODUCTION SHOWED LARGEST M/M INCREASE

- MNI CHICAGO: SUPPLIER DELIVERIES AT HIGHEST SINCE APR 1974

- MNI CHICAGO: EMPLOYMENT AT HIGHEST SINCE AUG 2018

- US MBA: MARKET COMPOSITE -2.2% SA THRU MAR 26 WK

- US MBA: REFIS -3% SA; PURCH INDEX -2% SA THRU MAR 26 WK

- US MBA: UNADJ PURCHASE INDEX +39% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.33% VS 3.36% PREV

- CANADA JAN GROSS DOMESTIC PRODUCT +0.7% MOM

- CANADA JAN GOODS INDUSTRY GDP +1.5%, SERVICES +0.4%

- CANADA REVISED NOV GROSS DOMESTIC PRODUCT +0.1% MOM

- CANADA FLASH FEB GROSS DOMESTIC PRODUCT +0.5%

- CANADA FEB INDUSTRIAL PRICES +2.6% MOM; EX-ENERGY +2.0%

- CANADA FEB RAW MATERIALS PRICES +6.6% MOM; EX-ENERGY +2.4%

MARKETS SNAPSHOT

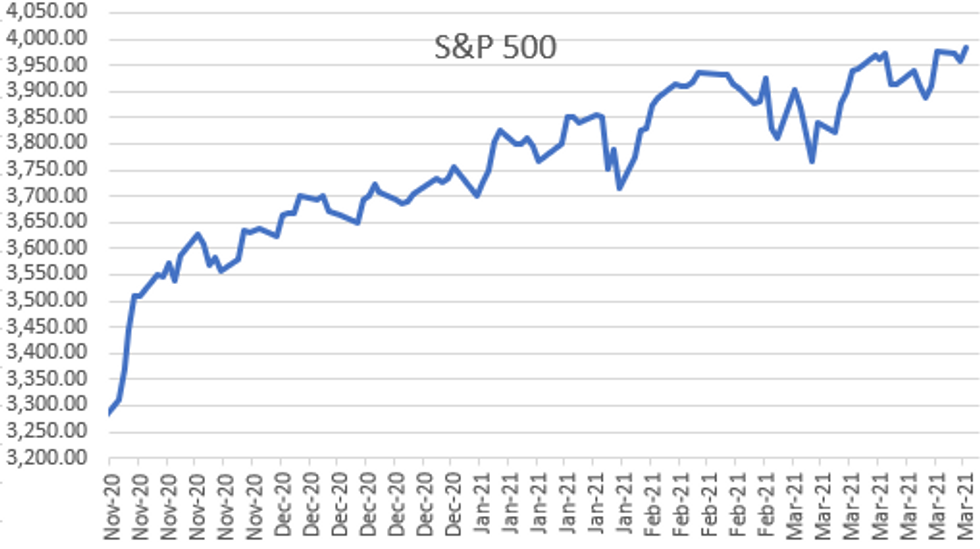

Key late session market levels- DJIA up 19.5 points (0.06%) at 33087.04

- S&P E-Mini Future up 28.75 points (0.73%) at 3976.25

- Nasdaq up 253 points (1.9%) at 13297.84

- US 10-Yr yield is up 2.9 bps at 1.7315%

- US Jun 10Y are down 4/32 at 131-2

- EURUSD up 0.0008 (0.07%) at 1.1724

- USDJPY up 0.4 (0.36%) at 110.76

- WTI Crude Oil (front-month) down $1.21 (-2%) at $59.34

- Gold is up $22.11 (1.31%) at $1707.35

- EuroStoxx 50 down 6.99 points (-0.18%) at 3919.21

- FTSE 100 down 58.49 points (-0.86%) at 6713.63

- German DAX down 0.27 points (0%) at 15008.34

- French CAC 40 down 20.81 points (-0.34%) at 6067.23

MONTH-END EXTENSIONS: Updated Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS 0.01Y; Govt inflation-linked, 0.02. Note: Update MBS extension figure doubled from 0.12 prelim estimate while intermediate Gov climbed from steady.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.09 | -0.03 |

| Agencies | 0.03 | 0.05 | -0.03 |

| Credit | 0.11 | 0.09 | 0.16 |

| Govt/Credit | 0.08 | 0.09 | 0.06 |

| MBS | 0.24 | 0.06 | 0.03 |

| Aggregate | 0.13 | 0.08 | 0.04 |

| Long Gov/Cr | 0.11 | 0.09 | 0 |

| Iterm Credit | 0.11 | 0.08 | 0.09 |

| Interm Gov | 0.08 | 0.08 | 0.01 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.05 |

| High Yield | 0.15 | 0.1 | 0.12 |

US TSY FUTURES CLOSE:

- 3M10Y +4.186, 172.372 (L: 168.632 / H: 172.908)

- 2Y10Y +2.735, 157.981 (L: 155.399 / H: 159.144)

- 2Y30Y +3.204, 225.034 (L: 221.203 / H: 226.858)

- 5Y30Y +0.385, 147.527 (L: 145.524 / H: 149.052)

- Current futures levels:

- Jun 2Y down 0.75/32 at 110-11.625 (L: 110-11.5 / H: 110-12.5)

- Jun 5Y down 5.25/32 at 123-12.75 (L: 123-12 / H: 123-19.5)

- Jun 10Y down 7.5/32 at 130-30.5 (L: 130-29 / H: 131-09.5)

- Jun 30Y down 10/32 at 154-23 (L: 154-16 / H: 155-14)

- Jun Ultra 30Y down 22/32 at 181-22 (L: 181-02 / H: 183-08)

US EURODOLLAR FUTURES CLOSE:

- Jun 21 +0.005 at 99.825

- Sep 21 +0.005 at 99.810

- Dec 21 -0.005 at 99.730

- Mar 22 -0.010 at 99.760

- Red Pack (Jun 22-Mar 23) -0.02 to -0.01

- Green Pack (Jun 23-Mar 24) -0.05 to -0.025

- Blue Pack (Jun 24-Mar 25) -0.065 to -0.055

- Gold Pack (Jun 25-Mar 26) -0.055 to -0.05

Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00363 at 0.08063% (+0.00725/wk)

- 1 Month -0.00400 to 0.11113% (+0.00388/wk)

- 3 Month -0.00738 to 0.19425% (-0.00475/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00150 to 0.20525% (+0.00200/wk)

- 1 Year -0.00350 to 0.28313% (+0.00238/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $76B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $246B

- Secured Overnight Financing Rate (SOFR): 0.01%, $808B

- Broad General Collateral Rate (BGCR): 0.01%, $338B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $324B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $4.646 submitted

- Next scheduled purchase:

- Pause for Easter Holiday, Resume April 5:

- Mon 4/05 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: Rounding Out March With $232.62B High-Grade Debt Issuance

Modest issuance ahead Easter Holiday, March still leads 2021 with stellar $232.62B high-grade corporate issuance vs. $157.865B in February and $227.55B in January. March 2020 saw $275.48B corporate debt issued -- second to all-time record of $401.325B in April 2020.

- Date $MM Issuer (Priced *, Launch #)

- 03/31 $1B *Ooredoo Qatar 10Y +100

- 03/31 $1B #Goodyear $500M 10Y 5.25%, $450M 12Y 5.625%

- 03/31 $500M #Element Fleet 3Y +130

- 03/31 $500M #Inversiones CMPC 10Y +135

FOREX: JPY Seals Worst Monthly Performance since 2016

- JPY was comfortably the poorest performer Wednesday, helping buoy USD/JPY toward the Y111.00 handle. A break above this level would be the first since March, and could open another leg higher toward 2020's best levels at 112.23.

- The greenback started the session well, pressuring EUR/USD to new 2021 lows before month-end flow conspired against the greenback and boosted most major pairs into the month-end fix.

- At the upper end of the table, GBP outperforms as the contrast between the UK's approach to COVID lockdowns and the Eurozone widens further. Both France and Italy extended their domestic lockdowns Wednesday, leaving vaccine politics as a key issue headed into Q2.

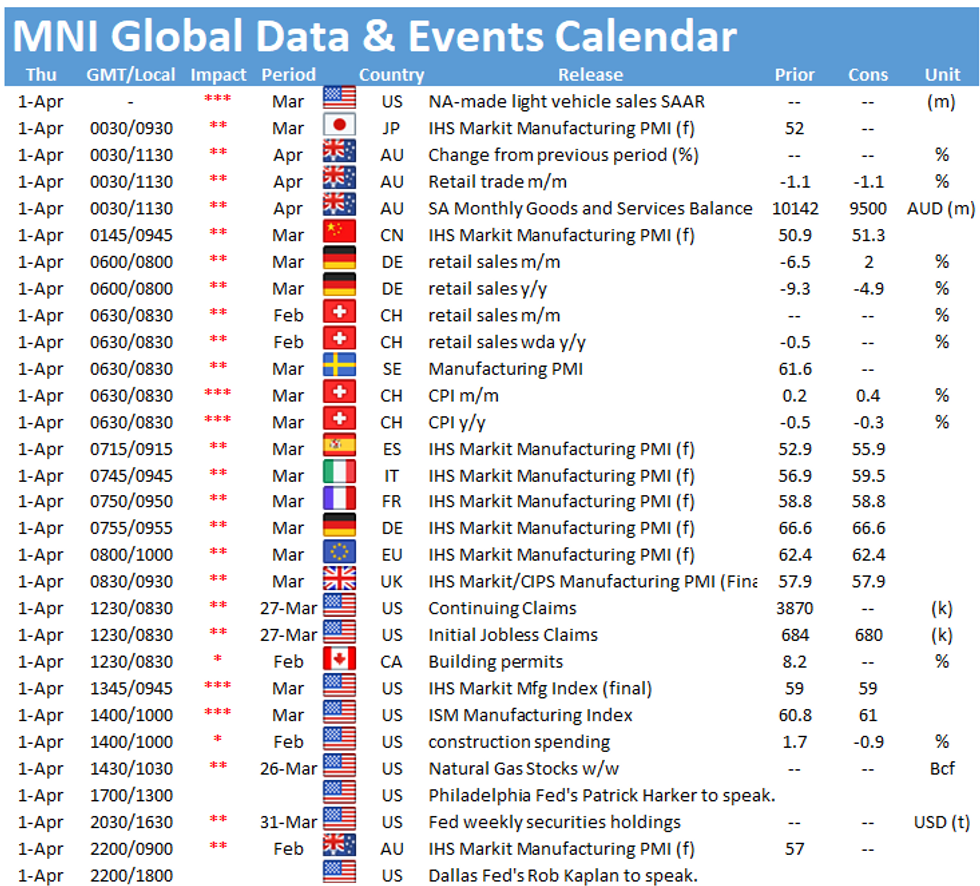

- Focus Thursday turns to Japan's Tankan survey, US weekly jobless claims and March ISM manufacturing. Thursday also marks the final full trading day of the week, with markets only seeing a limited open Friday.

EGBs-GILTS CASH CLOSE: Wary Of Tighter Lockdowns At Month-End

Curves traded mixed Wednesday with a combination of factors at play at various points in the session, including more stringent lockdown measures in Europe, lower-than-expected inflation data, and some degree of month-end buying. Gilts underperformed, fading quickly after hitting session highs mid-afternoon. Conversely, Bunds rallied from a weak open. Periphery spreads were mixed.

- Early data showed UK Q4 GDP revised higher, while FR, IT and EZ CPI was softer than expected.

- ECB Pres Lagarde said markets can test the ECB "as much as they want", as the bank has "exceptional tools".

- French Pres Macron is reportedly to announce tighter lockdown measures this evening, while Italy's set to extend restrictions to April 30 (from Apr 6th currently).

- Thu's pre-holiday session sees final Mar PMIs.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.1bps at -0.691%, 5-Yr is down 0.3bps at -0.628%, 10-Yr is down 0.6bps at -0.292%, and 30-Yr is down 1bps at 0.258%.

- UK: The 2-Yr yield is up 3bps at 0.104%, 5-Yr is up 3bps at 0.394%, 10-Yr is up 2.1bps at 0.845%, and 30-Yr is up 3.7bps at 1.397%.

- Italian BTP spread down 0.6bps at 96bps / Spanish spread unchanged at 62.9bps

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.