-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: BOC, ECB Policy Focus This Week

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: BOC Likely Tapering QE to CAD3B a Week

- MNI BRIEF: Record Canadian Home Starts in March Adds to Risks

US TSY SUMMARY: Knock-On Rates Sales Started With EGBs

Tsys reversed early strength along with equities Monday, both finishing near session lows. Early duration selling pushed Tsys back to early Thursday levels, knock-on pressure as EGBs hit after dealer recommendations ahead Thursday's policy announcement (Bank of Canada rate annc Wednesday includes Monetary Policy Report).- No significant data Monday through Wednesday after the Fed entered media blackout regarding monetary policy through Apr-29 late Friday, Bill auctions and NY Fed Buy-backs on tap.

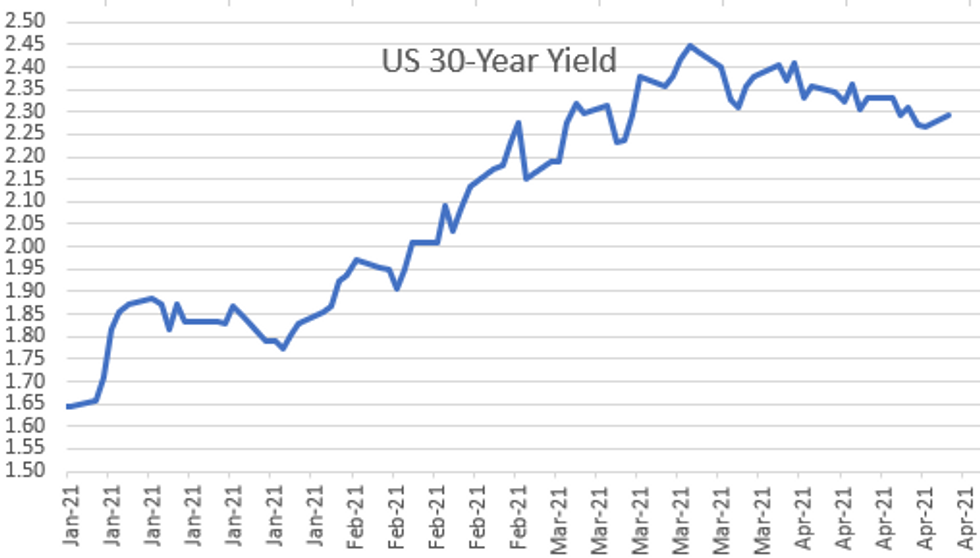

- While risk metrics remain (US/Russia tensions tied to Ukraine border troop build not to mention calls for mass protests over Kremlin opposition leader Navalny's health while incarcerated, debate over restarting J&J vaccine), Monday's move deemed more short term tactical selling than headline driven at the moment as 30YY climbs to 2.3002% high, 2.2902% last.

- Deal-tied selling in the mix as Morgan Stanley issued $7.5B debt over 3 tranches, total swappable supply for week estimated over $30B.

- The 2-Yr yield is down 0.2bps at 0.1592%, 5-Yr is down 0.2bps at 0.8292%, 10-Yr is up 1.8bps at 1.5976%, and 30-Yr is up 2.5bps at 2.2902%.

CANADA

BOC: Canada's central bank will likely reduce its weekly target for government bond purchases to CAD3 billion from CAD4 billion at a meeting Wednesday on signs the economy will rebound from the pandemic this year.The BOC is set to leave its overnight lending rate at 0.25% in its decision at 10am EST from Ottawa, and officials may also stress their intention is to keep meaningful stimulus in place for some time, with Deputy Governor Toni Gravelle saying in a recent speech that unwinding of QE would be done in "gradual and in measured steps."

BOC: Sell-side analysts widely anticipate the Bank of Canada to keep rates on hold at 0.25 this Wednesday, while better than expected economic outlook since the beginning of the year should pull forward rate hike guidance from 2023 to 2022.

- Some anticipation of a slightly more hawkish tone and potential removal of the reference to a closing output gap in 2023 when BOC Governor Tiff Macklem discusses the MPR report an hour later.

- Most are also expecting a reduction in weekly asset purchases by CAD1B to CAD3B, citing statement from Bank Deputy Governor Toni Gravelle on March 23:

- "At the time of our January Monetary Policy Report, we indicated that if the economy plays out in line with or stronger than our economic projection, we won't need as much QE stimulus over time. And in our March policy decision statement, we said that as we continue to gain confidence in the strength of the recovery, we will gradually adjust the pace of our QE purchases. We also indicated that first-quarter growth appears to be better than we expected in January. We will have a new full economic projection at our April policy decision. As new information on the strength of the recovery arrives, Governing Council will continue discussions about gradually adjusting the pace of our QE-related purchases."

- Work on new homes rose 22% to a seasonally adjusted annualized pace of 335,200 units in March, Canada Mortgage and Housing Corp. reported Monday, shattering the previous record of 288,600 set in 2007. The six-month moving average preferred by the agency also climbed to 273,664 units in March 2021 from 252,636 in February. For more see MNI Policy main wire at 0918ET.

OVERNIGHT DATA

No significant data Monday through Wednesday after the Fed entered media blackout regarding monetary policy through Apr-29 late Friday, Bill auctions and NY Fed Buy-backs on tap.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 117.56 points (-0.34%) at 34081.35

- S&P E-Mini Future down 22.5 points (-0.54%) at 4154.5

- Nasdaq down 150.8 points (-1.1%) at 13898.13

- US 10-Yr yield is up 1.8 bps at 1.5976%

- US Jun 10Y are down 4.5/32 at 132-7.5

- EURUSD up 0.0054 (0.45%) at 1.2036

- USDJPY down 0.66 (-0.61%) at 108.12

- WTI Crude Oil (front-month) up $0.19 (0.3%) at $63.32

- Gold is down $5.82 (-0.33%) at $1770.86

European bourses closing levels:

- EuroStoxx 50 down 13.08 points (-0.32%) at 4019.91

- FTSE 100 down 19.45 points (-0.28%) at 7000.08

- German DAX down 91.36 points (-0.59%) at 15368.39

- French CAC 40 up 9.62 points (0.15%) at 6296.69

US TSY FUTURES CLOSE

- 3M10Y +1.094, 157.556 (L: 152.896 / H: 159.324)

- 2Y10Y +1.796, 143.462 (L: 139.081 / H: 144.827)

- 2Y30Y +2.572, 212.743 (L: 207.682 / H: 213.494)

- 5Y30Y +2.381, 145.949 (L: 142.295 / H: 146.325)

- Current futures levels:

- Jun 2Y up 0.25/32 at 110-11.875 (L: 110-11.375 / H: 110-12)

- Jun 5Y down 0.25/32 at 123-30.5 (L: 123-25.5 / H: 124-01.25)

- Jun 10Y down 4.5/32 at 132-7.5 (L: 132-01.5 / H: 132-18)

- Jun 30Y down 15/32 at 157-17 (L: 157-07 / H: 158-13)

- Jun Ultra 30Y down 1-2/32 at 186-16 (L: 186-03 / H: 188-13)

US EURODOLLAR FUTURES CLOSE

- Jun 21 steady at 99.810

- Sep 21 steady at 99.80

- Dec 21 +0.005 at 99.740

- Mar 22 +0.005 at 99.775

- Red Pack (Jun 22-Mar 23) steady to +0.020

- Green Pack (Jun 23-Mar 24) steady to +0.015

- Blue Pack (Jun 24-Mar 25) -0.015 to -0.005

- Gold Pack (Jun 25-Mar 26) -0.025 to -0.015

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00000 at 0.07275% (-0.00200 total last wk)

- 1 Month -0.00213 to 0.11375% (+0.00463 total last wk)

- 3 Month -0.00225 to 0.18600% (+0.00075 total last wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00188 to 0.22175% (+0.01325 total last wk)

- 1 Year -0.00563 to 0.28675% (+0.00663 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $66B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $246B

- Secured Overnight Financing Rate (SOFR): 0.01%, $913B

- Broad General Collateral Rate (BGCR): 0.01%, $387B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $358B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, appr $8.801B accepted vs. $28.148B submission

- Next scheduled purchases:

- Tue 4/20 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 4/21 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

PIPELINE: $7.5B Morgan Stanley 3Pt Kicks-Off Week

- Date $MM Issuer (Priced *, Launch #)

- 04/19 $7.5B #Morgan Stanley $2B 3NC2 +57, $3.5B 6NC5 +77, $2B 21NC20 +105

- 04/19 $3B #Republic of Colombia $2B 11Y +175, $1B 20Y +205

- 04/19 $1.5B #Bank of NY Mellon $600M 3Y +20, $400M 3Y FRN SPOFR+26, $500M 7Y +42

- 04/19 $1B Charter Communications Holdings 12NC6 +3a

- Expected over next few days:

- 04/20 $4B EIB 3Y -1a

- 04/20 $500M Japan Int Cooperation Agcy 10Y +32a

- 04/20 $Benchmark New Development Bank (NDB) 5Y +27a

- 04/26 $Benchmark Tokyo Metropolitan, investor calls re: 3-10Y

- 04/?? $Benchmark EQUATE Petrochemical B.V. 7Y

- 04/?? $Benchmark Abu Dhabi National Energy Company PJSC ("TAQA") investor calls re: 7Y, 30Y Formosa bonds

FOREX: USD Hits the Skids, Tests 100-dma Support

- As was the case throughout the European morning, the USD remained weaker across the NY session, keeping the USD index under pressure throughout. The USD index hit the lowest level since early March and tests key 100-dma support at 91.051. A break below here opens another test on the multi-month low printed on Feb 25 at 89.683.

- GBP was the strongest currency Monday, reversing much of the early April weakness. GBP/USD convincingly cleared the 50-dma at 1.3869, opening further strength in the coming sessions. The next resistance is layered ahead of March's 1.4001/05.

- The USD, CAD were the weakest in G10, while GBP, JPY and NOK were the strongest performers in G10.

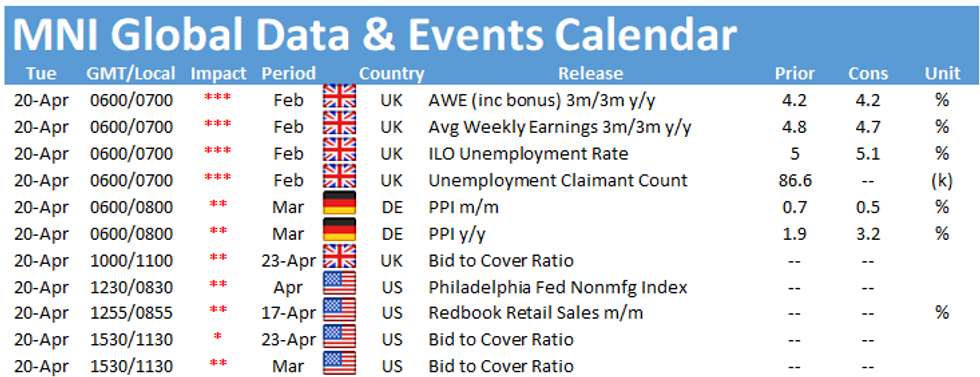

- Focus Tuesday turns to UK jobs data and a speech from ECB's de Cos. The RBA minutes also cross from their unchanged April meeting.

EGB/Gilt Summary: Core and semi core stay offered

Core and semi core remains better offered throughout the European session. Bund saw short term play long, bail out.

- This morning piece on Bond strategist recommending shorting Bunds into the ECB (Thursday) has been one of the contributing factor.

- "Barclays short via swaps, Goldman says sell 30-year bunds"

- Also, news that Pfizer, BioNTech will raise the delivery amount to the EU, which will bring the total number of doses this yr to 600mln,have been the contributing factors.

- Peripheral spreads are tighter against the German 10yr.Greec leads at 2.9bps.

- Looking ahead, at 13.15ET, The US President meets with a bipartisan group of Members of Congress to discuss historic investments in the American Jobs Plan

- Bund futures are down -0.54 today at 170.37 with 10y Bund yields up 3.4bp at -0.230% and Schatz yields up 1.2bp at -0.684%

- BTP futures are down -0.45 today at 147.88 with 10y yields up 4.1bp at 0.787% and 2y yields up 1.3bp at -0.347%.

- OAT futures are down -0.48 today at 161.05 with 10y yields up 3.0bp at 0.019% and 2y yields up 1.1bp at -0.653%.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.