-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Stocks Continue Climb to New Highs

EXECUTIVE SUMMARY

- MNI POLICY: BOC Advances Rate-Hike Timeline and Tapers QE

- MNI STATE OF PLAY: BOC May Lead the Way on Stimulus Exit

CANADA

BOC: The BOC on Wednesday scaled back weekly bond purchases to at least CAD3 billion from CAD4 billion and said it now sees the economy reaching full output and sustainable 2% inflation -- its prior conditions for a rate increase -- in the second half of 2022 instead of 2023. It continued to hold rates at 0.25%.

- "We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. Based on the Bank's latest projection, this is now expected to happen some time in the second half of 2022," Governor Tiff Macklem said in a statement Wednesday.

- "The Bank is continuing its QE program to reinforce this commitment and keep interest rates low across the yield curve. Decisions regarding further adjustments to the pace of net purchases will be guided by Governing Council's ongoing assessment of the strength and durability of the recovery."

- Wednesday's "adjustment to the amount of incremental stimulus being added each week reflects the progress made in the economic recovery," it added. The BOC said in its previous statement QE would remain "until the economic rebound is well underway."

- Markets expected a taper to CAD3 billion and a hold on the record low 0.25% interest rate, though there was far less certainty policy makers would advance the timeline for restoring full output. For more see MNI Policy main wire at 1028ET.

- "Any further adjustments of our quantitative easing program will reflect our assessment of the strength of the recovery and its durability," Macklem told reporters Wednesday after the BOC said it would reduce QE to a minimum CAD3 billion a week from CAD4 billion, and last year's original pace of CAD5 billion. The BOC will maintain the maturity profile of its purchases and further adjustments will be gradual, Macklem said. For more see MNI Policy main wire at 1306ET.

OVERNIGHT DATA

- US MBA: REFIS +10% SA; PURCH INDEX +6% SA THRU APR 16 WK

- US MBA: UNADJ PURCHASE INDEX +57% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.20% VS 3.27% PREV

- US MBA: MARKET COMPOSITE +8.6% SA THRU APR 16 WK

- CANADIAN MAR CONSUMER PRICE INDEX INFLATION +2.2% YOY

- CANADA MOM CPI INFLATION WAS +0.5% IN MAR

MARKETS SNAPSHOT

Kew late session market levels

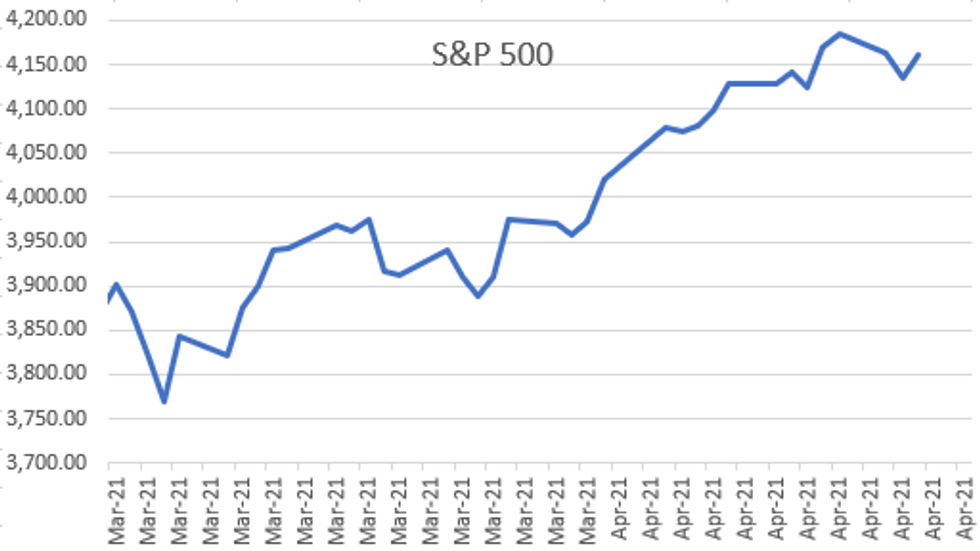

- DJIA up 246.97 points (0.73%) at 34068.97

- S&P E-Mini Future up 26.5 points (0.64%) at 4153.25

- Nasdaq up 99.5 points (0.7%) at 13885.92

- US 10-Yr yield is up 0.4 bps at 1.5626%

- US Jun 10Y are down 1/32 at 132-17

- EURUSD down 0.0007 (-0.06%) at 1.2029

- USDJPY down 0.03 (-0.03%) at 108.09

- Gold is up $14.89 (0.84%) at $1793.58

- EuroStoxx 50 up 35.95 points (0.91%) at 3976.41

- FTSE 100 up 35.42 points (0.52%) at 6895.29

- German DAX up 66.46 points (0.44%) at 15195.97

- French CAC 40 up 45.44 points (0.74%) at 6210.55

US TSY SUMMARY: Waiting for US Data and ECB Policy Annc

Tsys see-sawed in a narrow range Wednesday, trading steady to marginally mixed by the close on the third consecutive session of no economic data to draw guidance from.- Bonds had pared gains following the decent $24B 20Y Bond auction re-open (2.144% high yld (2.290% last month) vs. 2.150% WI) as flow turned two-way, modest positioning ahead return of economic data Thursday (weekly claims, leading index, existing home sales). Focus also turns to ECB policy annc after Bank of Canada held rates steady but tapered QE by CAD1B to CAD3B. (Spurious headline prior to official release clearly said NO change to weekly bond buying causing some volatility in CAD).

- Near another $10B in high-grade corporate supply priced in day, $38B total in first half of the week largely supra-sovereign.

- Lead quarterly Eurodollar futures traded higher after 3M LIBOR dropped to new record low: -0.01087 to 0.17288% (-0.01537/wk) compares to prior record Low of 0.17525% on 2/19/21.

- The 2-Yr yield is down 0.2bps at 0.1472%, 5-Yr is up 0.7bps at 0.7985%, 10-Yr is up 0.4bps at 1.5626%, and 30-Yr is up 1.2bps at 2.2634%.

US TSY FUTURES CLOSE

- 3M10Y +0.617, 154.228 (L: 153.095 / H: 156.245)

- 2Y10Y +0.562, 141.336 (L: 140.279 / H: 142.871)

- 2Y30Y +1.343, 211.346 (L: 209.9 / H: 212.701)

- 5Y30Y +0.495, 146.258 (L: 144.925 / H: 147.532)

- Current futures levels:

- Jun 2Y up 0.25/32 at 110-12.75 (L: 110-12.375 / H: 110-12.875)

- Jun 5Y down 0.5/32 at 124-3.25 (L: 124-01 / H: 124-05.75)

- Jun 10Y down 1/32 at 132-17 (L: 132-11.5 / H: 132-20.5)

- Jun 30Y steady at 158-5 (L: 157-25 / H: 158-12)

- Jun Ultra 30Y down 4/32 at 187-12 (L: 186-21 / H: 187-28)

US EURODOLLAR FUTURES CLOSE

- Jun 21 +0.005 at 99.815

- Sep 21 +0.005 at 99.805

- Dec 21 +0.005 at 99.745

- Mar 22 steady at 99.775

- Red Pack (Jun 22-Mar 23) -0.01 to -0.005

- Green Pack (Jun 23-Mar 24) -0.02 to -0.01

- Blue Pack (Jun 24-Mar 25) -0.005 to -0.005

- Gold Pack (Jun 25-Mar 26) -0.005

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00075 at 0.07213% (-0.00063/wk)

- 1 Month +0.00275 to 0.11025% (-0.00563/wk)

- 3 Month -0.01087 to 0.17288% (-0.01537/wk) ** New record vs. 0.17525% on 2/19/21)

- 6 Month -0.00613 to 0.21650% (-0.00713/wk)

- 1 Year -0.00475 to 0.28225% (-0.01013/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.01%, $896B

- Broad General Collateral Rate (BGCR): 0.01%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $351B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, appr $6.001B accepted vs. $18.560B submission

- Next scheduled purchases:

- Thu 4/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

PIPELINE: Coca-Cola, Glencore, P&G Launched

- $9.7B To price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 04/21 $2B #Coca-Cola Eur Ptnrs $850M 2Y +40, $650M 3Y +50, $500M 5.75Y +73

- 04/21 $2B *International Development Assn (IDA) 5Y +4

- 04/21 $2B #P&G $1B 5Y +20, $1B 10Y +42

- 04/21 $1.7B #Glencore Funding $600M 5Y +85, $600M 10Y +130, $500M 30Y +160

- 04/21 $1B *Kommunivest (Koomins) 3Y +0

- 04/21 $500M *Kommunalbanken Norway (KBN) 2Y SOFR+16

- 04/21 $500M Western Southern Life Ins 40Y +150

- 04/21 $Benchmark Malaysia sukuk 10Y +50, 30Y +80

- 04/21 $Benchmark Equate Petrochem 7Y +150a

FOREX: CAD Shoots Higher After BoC Head Fake

- A wild ride for CAD, as erroneous reports circulated pre-BoC decision that the Bank had decided to maintain the pace of their QE purchase programme, which prompted a notable rally in USD/CAD before the decision itself confirmed otherwise.

- The BoC tapered their bond purchase programme for the second time, pressuring USD/CAD through the week's lows and toward the mid-March low and bear trigger of 1.2365.

- After early signs that US yields were recovering after the flattening pressure Tuesday, the greenback initially rallied during the European morning before yields returned lower, dragging the USD in tandem, which fell closer to the bottom of the G10 leaderboard.

- CHF, GBP and USD traded poorly, CAD AUD and NZD were the more solid currencies Wednesday.

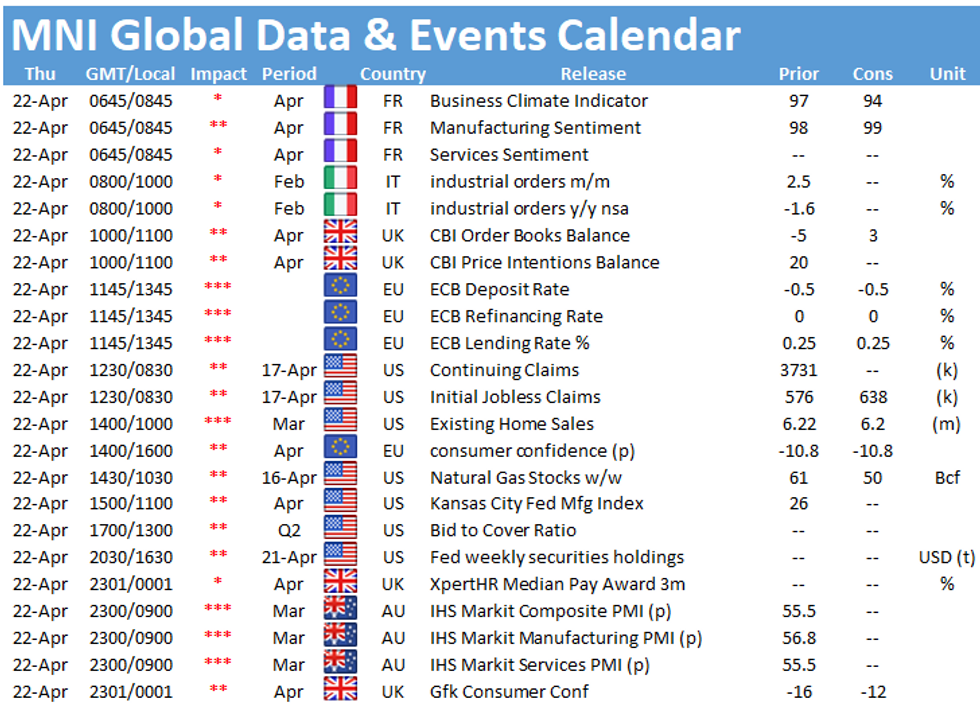

- Focus Thursday turns to the ECB rate decision, with markets watching closely for any hints on the future of the APP and, in particular, the pace of future bond purchases.

- Weekly US jobless claims and existing home sales data also cross. ECB's Lagarde conducts her usual post-decision press conference, but other than that there are no major central bank speakers.

EGBs-GILTS CASH CLOSE: BTPs Gain Ground On German Court Ruling

Core FI gained a bit of ground Thursday, with BTPs outperforming on the periphery. The Bund and Gilt curves saw very modest steepening, in Germany's case off the bull variety.

- Highlight of the session was the German federal court ruling paving the way for Germany to ratify the EU recovery fund; with that (modest) uncertainty out of the way, BTP spreads compressed.

- Germany allotted E3.42bn of 10-yr Bund; UK GBP2.50bn of Jul-35 Gilt.

- Otherwise, with little in the way of impactful speakers/data during the session (UK Mar inflation was broadly in line with expectations), attention was more on ECB tomorrow.

- MNI ran an exclusive this afternoon citing sources saying there are deep differences on the Governing Council over the strength of the eurozone recovery and thus the future of stimulus.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.3bps at -0.696%, 5-Yr is down 0.2bps at -0.607%, 10-Yr is unchanged at -0.262%, and 30-Yr is unchanged at 0.281%.

- UK: The 2-Yr yield is unchanged at 0.038%, 5-Yr is up 0.2bps at 0.316%, 10-Yr is up 0.9bps at 0.74%, and 30-Yr is up 2bps at 1.285%.

- Italian BTP spread down 2.6bps at 101.5bps / Spanish down 1.2bps at 65.4bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.