-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Rates and Equities Perform U-Turn

EXECUTIVE SUMMARY

- MNI BRIEF: Kaplan--Fed Should Take Foot Gently Off Accelerator

- MNI: Bank of Canada Says Housing Risks Are Climbing Further

- MNI INTERVIEW: Enhanced UI End Not US Jobs Gain Driver: SF Fed

- Fed Chair Powell: FED TO ISSUE REPORT IN SUMMER ON U.S. DIGITAL CURRENCY; FED TO PLAY KEY ROLE ON INTERNATIONAL CBDC STANDARDS; CBDC COULD COMPLEMENT, NOT REPLACE CASH DIGITAL DOLLARS, Bbg

- ISRAELI SECURITY CABINET APPROVES GAZA CEASE-FIRE: WALLA NEWS

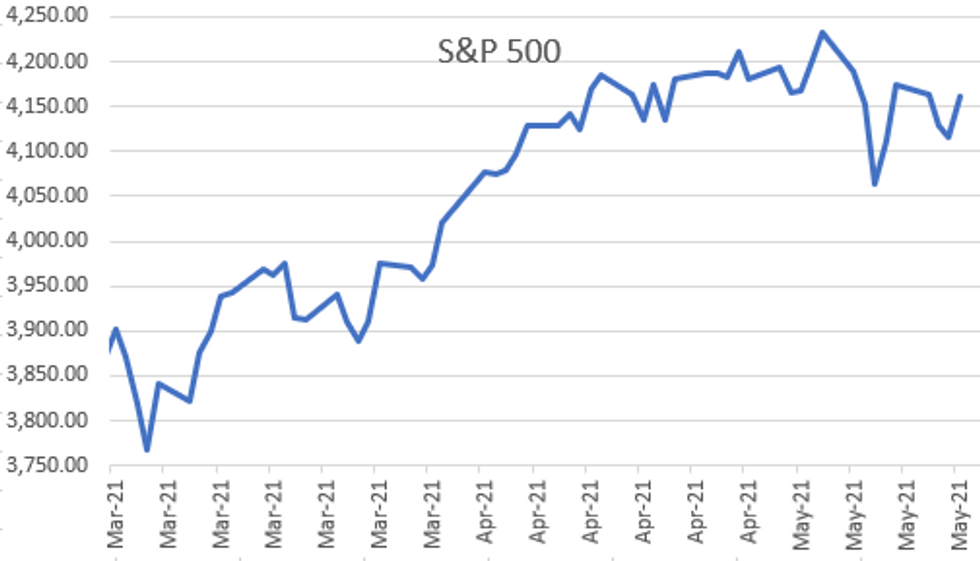

US TSY SUMMARY: Discounting the Taper Talk

Rates and equities rebounded strongly Thursday, apparently discounting the prior session's taper talk on the heels of the April FOMC minutes amid better buying/short covering as accts.- Bonds lead move higher after Philly Fed came out weaker than exp, 31.5 vs. 41.5 exp. (May prices paid 76.8 vs. 69.1 in April, however), weekly claims little lower than exp at 444k vs. 450k exp.

- Tsy futures quietly extended session highs in the lead up to Tsys $13B 10Y TIPS auction re-open, while a 10Y Block buy (+8.4k TYM1 132-15) contributed to the move. Decent volumes partially tied to surge in Jun/Sep quarterly futures rolling, well over 330k total between 5s and 10s. Reminder, Jun quarterly options expire Fri

- Thursday's $13B 10Y TIPS auction re-open drew high yield of -0.805% w/2.50x bid-to-cover, high yld compares to -0.580% on prior auction on March 18, and 5-month average of -0.866%. Indirect take-up was 68.60%, down from 73.91% in March; Primary dealer take-up 15.55%, little better than a 15.29% 5M average; Direct take-up 15.86% vs. 15.22% in March.

- The 2-Yr yield is down 0.8bps at 0.1472%, 5-Yr is down 4.4bps at 0.813%, 10-Yr is down 4.1bps at 1.6301%, and 30-Yr is down 3.1bps at 2.3386%.

US

FED: Dallas Fed President Rob Kaplan Thursday said Thursday the Fed should consider taking its foot off the accelerator and talking about tapering its monthly asset purchases, to avoid potentially having to hit the brakes harder down the road.

- "My job as a central banker is not to predict the future with 100% accuracy because I know I'm not capable of that, but it is to look at a range of possible outcomes and not get intellectually wedded to any one of them and then to manage the risks," he said. "This is one of the reasons, among other imbalances I'm seeing that I've talked about in risk-taking in the housing market, this is one of the reasons why I've said, sooner rather than later as it's clear we're weathering the pandemic and making progress in the economy, I'd like to sooner rather than later begin a discussion of adjusting our asset purchases."

FED: Employment gains in states planning to cut enhanced unemployment insurance benefits are unlikely to be tied to those programs' premature end, labor economists at the San Francisco Fed told MNI, although a small number of workers on the margins could be affected.

- It's unlikely that cutting federal pandemic-related unemployment benefits will trigger a "rush" of workers to the labor market, as some state policymakers have suggested, said Robert Valletta, senior vice president and associate director of research at the Fed bank, and other concurrent factors, like declining Covid-19 case counts, widespread vaccine availability, and state reopenings will have a more significant impact on hiring.

- "For all of those reasons, we might see a rapid opening up of activity and lots of hiring going on over the next few months," he said. "But our research suggests that whatever pickup in activity occurs, it's not because of the elimination of the enhanced UI benefits, but because of these other factors." For more see MNI Policy main wire at 1301ET.

FED: Skepticism On The Significance Of "A Number"

Most attention in the April FOMC minutes was on the line citing the potential for "talking about talking about tapering" : "A number of participants suggested that if the economy continued to make rapid progress toward the Committee's goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases."

- In its initial take on the minutes, Goldman Sachs wrote that the "disappointing" April employment report - which was of course released after the meeting - "likely postpones the potential start of such discussions".

- For similar reasons, TD remains "skeptical that officials will be ready to send what might be construed as a 'taper countdown signal' as soon as the June meeting, or even the July meeting, which would likely be needed for tapering to be announced before year-end".

- They suspect "a number" of participants means around 4 or 5 officials.

- If that assumption is correct, we note that would be more or less equivalent to the 4 2022 hike 'dots' in the March SEP, which would in turn be consistent with desiring a conversation about tapering in the upcoming meetings. So even if we don't consider the minutes stale as a result of the April payrolls report, there's not necessarily much new information contained in the much-scrutinized sentence.

CANADA

CANADA: Canada's housing market and consumer debts have become even riskier in the last year, leaving the nation vulnerable to a correction that could derail the consumer spending that's carried the economy over the last decade, the central bank said Thursday.

- "Two key household vulnerabilities—high household indebtedness and imbalances in the housing market—have intensified over the past year," the Bank of Canada's Financial System Review said. "The housing market boom and the corresponding rise in mortgage debt support economic growth in the short term but increase the risk to the Canadian economy and financial system over the medium term." For more see MNI Policy main wire at 1000ET.

OVERNIGHT DATA

- US MAY PHILADELPHIA FED MFG INDEX 31.5

- US JOBLESS CLAIMS -34K TO 444K IN MAY 15 WK

- US PREV JOBLESS CLAIMS REVISED TO 478K IN MAY 08 WK

- US CONTINUING CLAIMS +0.111M to 3.751M IN MAY 08 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 244.35 points (0.72%) at 34141.06

- S&P E-Mini Future up 49 points (1.19%) at 4160.25

- Nasdaq up 238.4 points (1.8%) at 13538.02

- US 10-Yr yield is down 4.1 bps at 1.6301%

- US Jun 10Y are up 14.5/32 at 132-15.5

- EURUSD up 0.0045 (0.37%) at 1.222

- USDJPY down 0.42 (-0.38%) at 108.8

- WTI Crude Oil (front-month) down $1.31 (-2.07%) at $62.05

- Gold is up $5.37 (0.29%) at $1874.90

European bourses closing levels:

- EuroStoxx 50 up 63.17 points (1.6%) at 3999.91

- FTSE 100 up 69.59 points (1%) at 7019.79

- German DAX up 256.7 points (1.7%) at 15370.26

- French CAC 40 up 81.03 points (1.29%) at 6343.58

US TSY FUTURES CLOSE:

- 3M10Y -3.417, 162.419 (L: 161.992 / H: 166.09)

- 2Y10Y -2.72, 148.263 (L: 147.381 / H: 151.868)

- 2Y30Y -1.779, 219.015 (L: 217.512 / H: 222.106)

- 5Y30Y +1.387, 152.308 (L: 150.297 / H: 152.893)

- Current futures levels:

- Jun 2Y up 0.625/32 at 110-13.125 (L: 110-12.5 / H: 110-13.25)

- Jun 5Y up 7.75/32 at 124-7.5 (L: 123-31.5 / H: 124-08)

- Jun 10Y up 14/32 at 132-15 (L: 132-01 / H: 132-16)

- Jun 30Y up 30/32 at 157-0 (L: 156-04 / H: 157-06)

- Jun Ultra 30Y up 52/32 at 184-18 (L: 183-03 / H: 185-02)

US EURODOLLAR FUTURES CLOSE

- Jun 21 +0.005 at 99.855

- Sep 21 steady at 99.845

- Dec 21 +0.005 at 99.80

- Mar 22 +0.005 at 99.815

- Red Pack (Jun 22-Mar 23) +0.010 to +0.035

- Green Pack (Jun 23-Mar 24) +0.035 to +0.060

- Blue Pack (Jun 24-Mar 25) +0.060 to +0.065

- Gold Pack (Jun 25-Mar 26) +0.065

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00050 at 0.06113% (-0.00088/wk)

- 1 Month -0.00400 to 0.09250% (-0.00500/wk)

- 3 Month +0.00088 to 0.15013% (-0.00500/wk) ** (Record Low 0.14925% on 5/19)

- 6 Month +0.00062 to 0.18425% (-0.00338/wk)

- 1 Year +0.00050 to 0.26400% (-0.00188/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $60B

- Daily Overnight Bank Funding Rate: 0.05% volume: $249B

- Secured Overnight Financing Rate (SOFR): 0.01%, $891B

- Broad General Collateral Rate (BGCR): 0.01%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $351B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $5.802B submission

- Next scheduled purchases:

- Fri 5/21 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

EGBs-GILTS CASH CLOSE: BTPs Lead Recovery

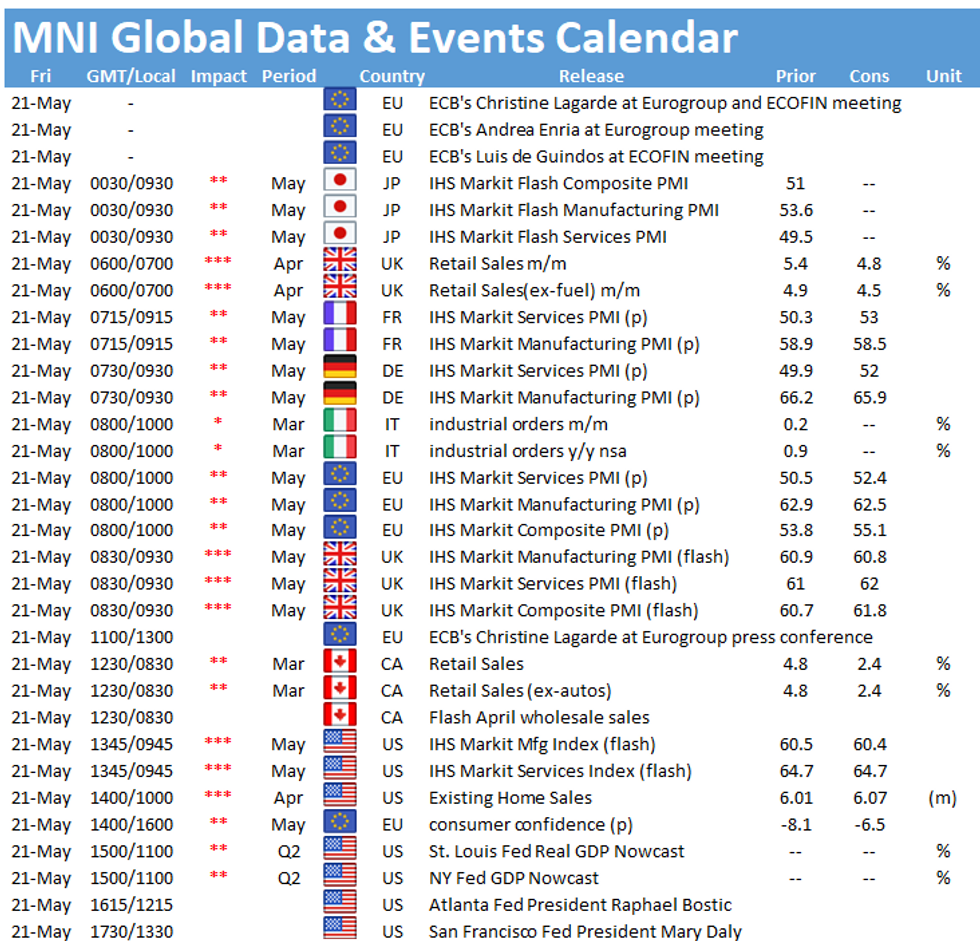

Core European bonds recovered early losses Thursday as yields turned largely flat on the session in the afternoon. Limited data/news-flow, with some anticipation of Friday's flash May PMI readings.

- The risk-on tone (as equities continued to rebound from Wednesday's mini-rout) saw BTP spreads compress sharply, outperforming peers.

- A few central bank speakers today, but the main comments were by ECB's Lane who said the eurozone economy was still "in a hole", and stressed both that short-term data would be "noisy" and that a sustained recovery should be assumed.

- With no supply, PMIs are the highlight of Friday's calendar; we get ECB's Lagarde speaking following the Eurogroup meeting as well.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.2bps at -0.645%, 5-Yr is up 0.6bps at -0.5%, 10-Yr is up 0.1bps at -0.109%, and 30-Yr is down 1bps at 0.437%.

- UK: The 2-Yr yield is down 2.6bps at 0.049%, 5-Yr is down 1.3bps at 0.361%, 10-Yr is down 0.9bps at 0.839%, and 30-Yr is down 0.7bps at 1.391%.

- Italian BTP spread down 6.1bps at 116.7bps/Spanish spread down 3.7bps at 68.1bps

FOREX: Dollar Gradually Reverses Post FOMC-Minutes Strength

- A subdued session saw a consistent offered tone for the greenback. The US dollar gradually gave up all the gains made following the release of the FOMC minutes on Wednesday, with minor US data in the form of Philly Fed and Initial Jobless claims unable to spark any movement in FX markets.

- The Swiss franc and the Canadian dollar were the biggest beneficiaries on Thursday, advancing roughly 0.6%.

- Strength in US equities and a stabilisation of the cryptocurrency space left risk on a firmer footing. Most other G10 currencies strengthened roughly 0.4% in line with dollar index losses. CNH underperformed, rising just 0.08%. Emerging Market FX was also buoyant, with ZAR, TRY, RUB and MXN all in the green.

- USDCAD traded back to 1.2050, hovering roughly 40 pips above the most recent lows at 1.2013, representing the lowest levels since mid-2015. The immediate recovery for the Canadian dollar after a 1% squeeze in USDCAD enhances the likelihood of the bearish theme continuing. Markets will eye the weekly close below 1.2062, an important pivot chart point that either marks the base of a broad range or the midpoint of a double top reversal pattern.

- Attention turns to global flash PMI releases on Friday, as well as retail sales figures for Australia, the UK and Canada.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.