-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - G7 Leaders Back Biden Call For Further Stimulus

MNI ASIA OPEN - G7 Leaders Back Biden Call For Further Stimulus

HIGHLIGHTS:

- Fed's Powell To Downplay 2023 Liftoff Dots -Ex-Officials (MNI)

- Higher Chance EU Debt Rules Significantly Eased (MNI)

- Blinken, Yang Hold Testy Phone Call With G7 Ongoing (MNI)

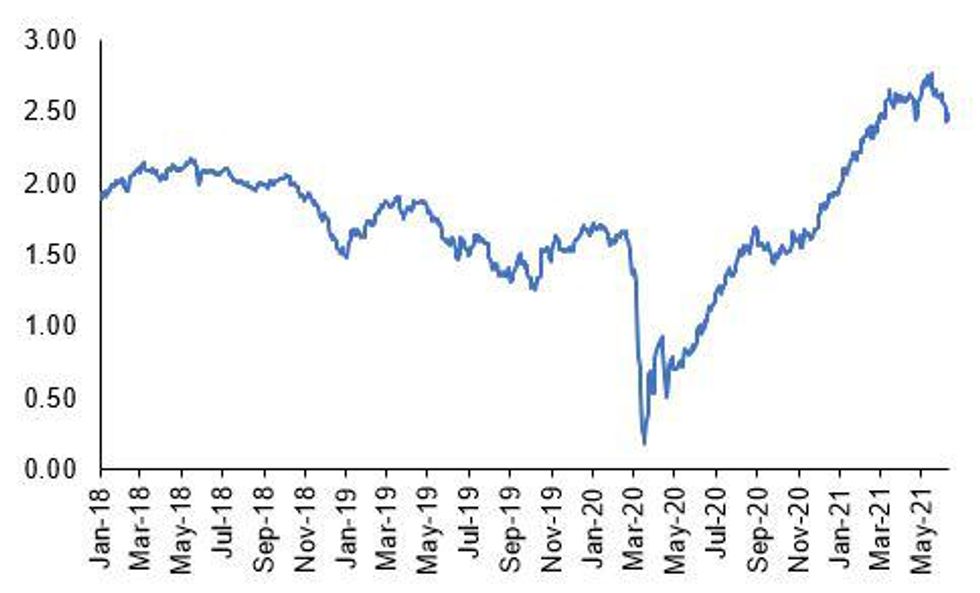

Fig 1. US 5-Year Breakeven, %

Source: MNI, Bloomberg

AMERICAS

US (MNI): Fed's Powell To Downplay 2023 Liftoff Dots -Ex-Officials

Federal Reserve Chair Jay Powell next week will downplay the significance of additional FOMC members penciling in an earlier rate hike even if the median projection for liftoff shifts forward to 2023, former officials told MNI.

US-CHINA (MNI): Blinken, Yang Hold Testy Phone Call With G7 Ongoing

Following a phone call earlier today between US Secretary of State Anthony Blinken - who is in the UK for the G7 summit - and senior Chinese diplomat Yang Jiechi, the former tweets: "Constructive discussion today with the People's Republic of China Director Yang Jiechi on pressing global issues. We will continue to conduct practical, results-oriented diplomacy with Beijing on global challenges."

US-RUSSIA (MNI): NBC To Air Interview w/President Putin, First On US TV In Three Years

NBC has announced that it will broadcast an exclusive interview:http://press.nbcnews.com/2021/06/11/nbc-news-world... with Russian President Vladimir Putin, his first on US television in over three years.

EUROPE

UK (MNI): Sunak: BOE Responsible For Reserve Remuneration

Chancellor of the Exchequer Rishi Sunak, in a written response to the Lords Economic Affairs Committee, said that the UK Treasury is not considering ending remuneration of central bank reserves and that it was a matter for the Bank of England. Sunak said that the idea of ending reserve remuneration, an idea floated by some high profile economists, such as former Monetary Policy Committee member Charles Goodhart, "is not one that is being considered by the Treasury" adding that "the independent MPC has sole responsibility for the operation of monetary policy."

EUROPEAN UNION (MNI): MNI SOURCES: Higher Chance EU Debt Rules Significantly Eased

A European Commission signal that it will continue to go easy on high-debt states through at least 2023 gives more time for a major overhaul of the European Union's Stability and Growth Pact and raises the chances that national borrowing limit rules will be significantly loosened, officials told MNI.

EUROZONE (MNI): Fiscal-MonPol Cooperation Vital, New Book Argues

Europe and the European Central Bank have come of age as a result of the Covid-19 crisis, a new book co-authored by the ECB's Director General of Monetary Policy argues:https://global.oup.com/academic/product/monetary-p..., thanks not least to the "disposition towards pre-emptive action, a playbook for implementing unconventional policy in short order," left behind by the 2008 financial crisis.

DATA

US University of Michigan Sentiment (Jun P) M/M 86.4 vs. Exp. 84.2 (Prev. 82.9)

- Current Conditions 90.6 vs. Exp. 91.3 (Prev. 89.4)

- Expectations 83.8 vs. Exp. 78.7 (Prev. 78.8)

- 1-yr Inflation 4.0% vs. Exp. 4.7% (Prev. 4.6%)

- 5-10-yr Inflation 2.8% (Prev. 3.0%)

From the report: "Rising inflation remained a top concern of consumers, although the expected rate of inflation declined in early June. Spontaneous references to market prices for homes, vehicles, and household durables fell to their worst level since the all-time record in November 1974. These unfavorable perceptions of market prices reduced overall buying attitudes for vehicles and homes to their lowest point since 1982. These declines were especially sharp among those with incomes in the top third, who account for more than half of the dollar volume of retail sales."

An all-time record number of consumers anticipating a net decline in unemployment

The expected year-ahead inflation rate declined to 4.0% in early June, although down from 4.6% in May, it was still higher than any other time in the past decade.

MNI: CANADA Q1 INDUSTRIAL CAPACITY UTILIZATION RATE 81.7%

FACTORY CAPACITY UTILIZATION RATE 76.5%

UK (MNI): Trade Gap Falls As Non-EU Imports Outperform

The UK's April headline trade deficit narrowed to GBP0.935 billion from GBP1.966 billion as EU imports remain weak after the UK left the transitional trading period with the EU at the end of 2020. Imports from non-EU countries hit GBP20.1 billion, topping the GBP 18.4 billion from EU nations, extending a trend that began in January. Exports to the EU rose by 2.0% in April, but remain 5.1% below the level of December (compared to a 7.0% shortfall in March).

UK (MNI): UK GDP Higher In April As Services Reopen

UK output rose by 2.3% between March and April, a shade below expectations, powered by a higher-than-forecast 3.4% jump in services as non-essential shops, outdoor dining and personal services reopened on 12 April, the Office for National Statistics said:https://www.ons.gov.uk/economy/grossdomesticproduc.... Services accounted for 2.87 percentage points of total growth, led by a 8.9% surge in wholesale and retail trading, the biggest rise since June of 2020.

US TSYS SUMMARY: Ending The Week On A Soft Note

USTs have gradually sold off through the session with yields holding near the weaker end of the day's range.

- Cash yields are 1-4bp higher with the curve 2bp steeper. Last yields: 2-year 0.1489%, 5-year 0.7484%, 10-year 1.4603%, 30-year 2.1496%.

- TYU1 trades at 132-27+, near the lows of the day (132-25).

- President Joe Biden's call for continued economic stimulus has been warmly received by other national leaders at the G7 summit.

- The University of Michigan survey update for June came in better than expected (86.4 vs 84.2) with the expectations component reading 83.8 vs 78.7 expected.

- The Fed takes centre stage next week, with this week's strong inflation report upping the ante on policymakers.

FOREX: Greenback Eyes Monthly High as Yields Find Bottom

- The greenback was solidly the best performer Friday, with the USD Index narrowing in on a one-month high and the 50-dma resistance at 90.7538. Dollar strength wasn't consistent throughout the session, however, with the dollar starting poorly as US yields plumbed new multi-month lows of 1.4266%. This reversed during NY hours, however, giving FX markets the greenlight to buy into recent dollar weakness and stage a bounce.

- Dollar strength worked against the NZD most notably, which extended underperformance from the Asia-Pac session well into the NY close. This resulted in new multi-month lows of $0.7116.

- GBP rose alongside the USD, while NOK and SEK traded poorly into the Friday close.

- Focus in the coming week rests on the Fed. Markets will eye Powell's press conference for any clues on the future of the Fed's asset purchase program - with many sell-side analysts forecasting a full taper by the end of 2021. Rate decisions are also due from the Norwegian, Swiss, Brazilian, Turkish, Indonesian and Japanese central banks.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.