-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Hawks Tempered, Rates & Equities Climb

EXECUTIVE SUMMARY

- MNI: Daly Sees Fall Taper Clarity, Hike Talk Not Yet on Table

- MNI: Fed's Mester: Expects Clarity on Labor Progress In Sept

- MNI BRIEF: No Preemptive Hike Amid Fleeting Inflation-Powell

- Powell: Fed Will Wait for Actual Inflation as Trigger for a Rate Rise (DJ)

US

FED: Federal Reserve Chair Jerome Powell told Congress Tuesday he will be patient before pulling back from near-zero interest rates as the economy reopens with solid job growth and more regular production that slows down price gains.

- "We will not raise rates preemptively" because employment appears too high, Powell said in testimony to the House select subcommittee on the coronavirus. Policy makers still have work to do on on having a more inclusive recovery even as "job creation will be moving up well over the rest of the year."

- "We've made a lot of good progress. I'd like to see some further progress, especially on participation. I think we'll get more clarity in September," when schools reopen, more people get vaccinated and enhanced unemployment benefits expire, she said. For more see MNI Policy main wire at 1229ET.

Fed Will Wait for Actual Inflation as Trigger for a Rate Rise: Powell

Fed Chair Powell Answers Questions During House Panel Hearing

- *Powell: Fed Will Wait for Actual Inflation as Trigger for a Rate Rise (DJ)

- *Powell: Rising Income Inequality Holds Back US Economy (DJ)

- *Powell: Best Way For Fed To Ease Inequality Is Focus On Jobs (BBG)

- *Powell: Pandemic Inflation Impacts Have Been Bigger Than Expected

- *Powell: Fed Will Act If Inflation Stays Too High

- US Dollar continuing its gradual slide with EURUSD and GBPUSD making fresh highs. NZDUSD a notable performer on Tuesday (+0.56%) now trading above Friday's highs, approaching the 200-day MA at 0.7046.

OVERNIGHT DATA

- US JUN PHILADELPHIA FED NONMFG INDEX 59.6

- US REDBOOK: JUN STORE SALES +16.2% V YR AGO MO

- US REDBOOK: STORE SALES +17.6% WK ENDED JUN 19 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

MARKETS SNAPSHOT

Key late session market levels

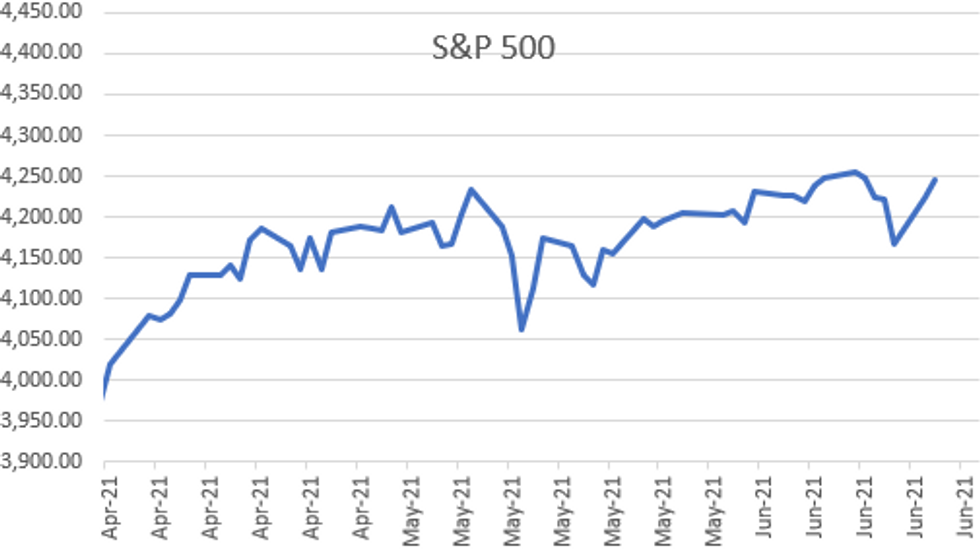

- DJIA up 68.61 points (0.2%) at 33945.58

- S&P E-Mini Future up 25.75 points (0.61%) at 4236.25

- Nasdaq up 111.8 points (0.8%) at 14253.27

- US 10-Yr yield is down 2 bps at 1.4683%

- US Sep 10Y are up 5/32 at 132-11.5

- EURUSD up 0.0021 (0.18%) at 1.1941

- USDJPY up 0.41 (0.37%) at 110.65

- WTI Crude Oil (front-month) down $0.6 (-0.81%) at $73.06

- Gold is down $5.22 (-0.29%) at $1777.39

European bourses closing levels:

- EuroStoxx 50 up 10.8 points (0.26%) at 4123.13

- FTSE 100 up 27.72 points (0.39%) at 7090.01

- French CAC 40 up 8.96 points (0.14%) at 6611.5

US TSY FUTURES CLOSE

- 3M10Y -2.961, 141.847 (L: 141.424 / H: 147.259)

- 2Y10Y +0.109, 123.141 (L: 121.206 / H: 126.73)

- 2Y30Y +0.364, 185.503 (L: 183.07 / H: 190.85)

- 5Y30Y +1.116, 123.156 (L: 119.838 / H: 126.806)

- Current futures levels:

- Sep 2Y up 1.75/32 at 110-5.5 (L: 110-03.5 / H: 110-05.625)

- Sep 5Y up 5.5/32 at 123-15.75 (L: 123-07.5 / H: 123-16)

- Sep 10Y up 6.5/32 at 132-13 (L: 132-00.5 / H: 132-14)

- Sep 30Y up 8/32 at 160-6 (L: 159-08 / H: 160-12)

- Sep Ultra 30Y up 23/32 at 191-29 (L: 189-21 / H: 192-07)

US EURODOLLAR FUTURES CLOSE

- Sep 21 +0.015 at 99.870

- Dec 21 +0.010 at 99.795

- Mar 22 +0.005 at 99.795

- Jun 22 +0.020 at 99.735

- Red Pack (Sep 22-Jun 23) +0.020 to +0.030

- Green Pack (Sep 23-Jun 24) +0.025 to +0.030

- Blue Pack (Sep 24-Jun 25) +0.015 to +0.025

- Gold Pack (Sep 25-Jun 26) +0.010 to +0.015

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00063 at 0.08538% (+0.00488/wk)

- 1 Month -0.00513 to 0.09075% (-0.00025/wk)

- 3 Month -0.00413 to 0.13375% (-0.00113/wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month -0.00312 to 0.16063% (+0.00438/wk)

- 1 Year -0.00525 to 0.24563% (+0.00550/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $66B

- Daily Overnight Bank Funding Rate: 0.08% volume: $253B

- Secured Overnight Financing Rate (SOFR): 0.05%, $894B

- Broad General Collateral Rate (BGCR): 0.05%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $335B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $1.999B accepted vs. $3.954B submission

- Next scheduled purchases:

- Wed 6/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 6/24 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/25 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Repo and Reverse Repo Operations, New Record High

NY Fed reverse repo usage climbs to new record high of $791.605B from 74 counterparties, compares to last Mon's record high of $765.141B -- continued knock-on effect of FOMC's IOER technical adjustment to 0.15% from 0.10%.

MONTH-END EXTENSION: PRELIMINARY Barclays/Bbg Extension Estimates for US

PRELIMINARY forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.01Y; US Gov infl-linked -0.4Y.

| Indices | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.11 | 0.04 | 0.06 |

| Credit | 0.05 | 0.12 | 0.09 |

| Govt/Credit | 0.07 | 0.10 | 0.09 |

| MBS | 0.11 | 0.06 | 0.08 |

| Aggregate | 0.08 | 0.09 | 0.09 |

| Long Gov/Cr | 0.07 | 0.09 | 0.12 |

| Iterm Credit | 0.07 | 0.10 | 0.10 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.08 | 0.09 | 0.08 |

| High Yield | 0.07 | 0.11 | 0.09 |

PIPELINE: High-Grade Debt Issuance

$6.75B Priced Tuesday; $17.85B total for week- Date $MM Issuer (Priced *, Launch #)

- 06/22 $2B *Kexim $750M 3Y +20, $750M 5.5Y +35, $500M 20Y +50

- 06/22 $1.25B *Standard Chartered 11NC10 +120

- 06/22 $1B *Ford Motor Credit 10Y 3.625%

- 06/22 $1B *IFC 2Y FRN/SOFR+9

- 06/22 $1B *PSP Cap WNG 5Y+7

- 06/22 $500M *Block Fncl 7Y +135

EGBs-GILTS CASH CLOSE: Steepening Once Again

Long-end Gilts underperformed, with both the UK and German curves bear steepening once again Tuesday - though not before some early flattening. Periphery spreads traded flat/slightly wider.

- Gilt underperformance came amid Sterling weakness and ahead of the BoE meeting Thursday. Front-end yields actually fell on the day.

- Spain sold E8B of 10Y via syndication; Netherlands sold E2B DSL at auction.

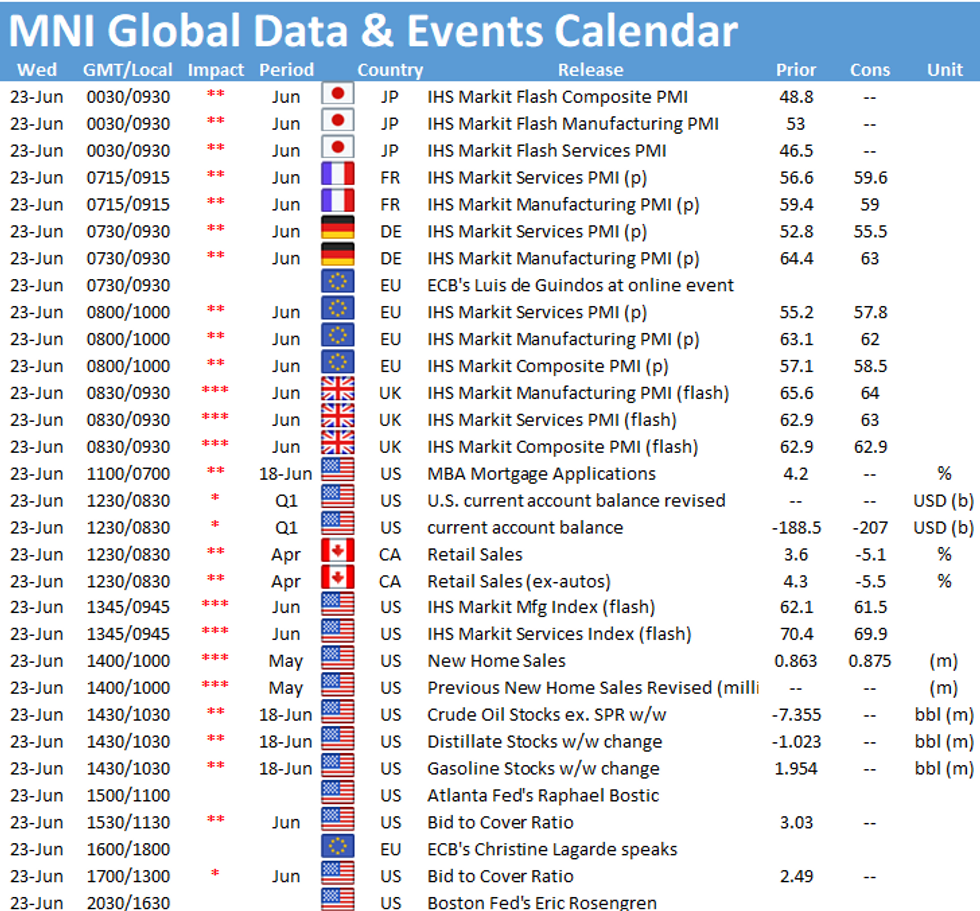

- Wednesday's highlight is June flash PMIs; Germany sells 15-Yr bonds and UK sells Linkers.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is up 0.5bps at -0.647%, 5-Yr is up 0.5bps at -0.556%, 10-Yr is up 0.7bps at -0.164%, and 30-Yr is up 1.4bps at 0.317%.

- UK: The 2-Yr yield is down 1.7bps at 0.108%, 5-Yr is up 0.4bps at 0.389%, 10-Yr is up 1.1bps at 0.78%, and 30-Yr is up 4bps at 1.267%.

- Italian BTP spread up 1.5bps at 106.2bps / Spanish spread unchanged at 62.5bps

FOREX: Further Cross/JPY Demand As Equities Inch Higher, Greenback Slips

- With little conviction, risk tied currency pairs continued to edge higher on Tuesday. The Japanese Yen continued its gradual decline and following the late reversal in the greenback, cross/JPY led the way higher.

- NZDJPY, CADJPY and EURJPY are the notable performers, rising between 0.5-0.8% as the S&P500 index continues to reverse the fed-inspired losses and close in on fresh record highs.

- The Dollar Index spent much of the session consolidating in positive territory. However, a late bout of selling prompted the index to slip below Monday's lows and continue to unwind the substantial gains following the FOMC statement last week.

- EUR running higher after the London close, with EUR/USD inching through the overnight highs to trade 1.1940. Modest uptick in futures volumes, with some of the best activity of the day going through on the last lurch higher.

- Markets now in close proximity to nearest resistance at the 23.6% retracement for the May - Jun downtick. Break above here narrows the gap with the 200-dma at 1.1998.

- Global Flash Manufacturing and Services PMI's headline the data docket on Wednesday. French and German figures kick off the European releases at 0815/0830 BST with Canadian Retail Sales also on the agenda.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.