-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI ASIA OPEN: Ylds Back in Range, Focus on June Employ Data

EXECUTIVE SUMMARY

- MNI: Fed's Quarles Skeptical of Benefits of Digital Dollar

- US: McConnell-Bipartisan Infra Bill Only Possible If Delinked From Reconciliation

- Richmond Fed Barkin: TIPS MARKET SHOWING INFLATION AT ABOUT 2%; MAY SEE WORKFORCE EXPAND IN SEPT., FILLING SOME JOBS; MAY SEE INFLATION `GO BACKWARD' AS PRICES NORMALIZE, Bbg

- ECB'S HOLZMANN: NO ROOM TO RAISE RATES GIVEN WEAK INFLATION, Bbg

US

US: Senate minority leader Mitch McConnell (R-KY), speaking in Louisville, Kentucky says that the only way to get a bipartisan infrastructure bill through the Senate would be to 'delink' it from the larger Democrat-only infra plan that Congressional Democrats are seeking to pass via a reconciliation process. Says that "I appreciate the President saying he's willing to deal with [infrastructure] separately, but he doesn't determine that."

- Garrett Hake at Politico tweets "McConnell, having been majority leader, knows that the Democratic leaders won't do this [delink the infra plan from reconciliation]. They need to keep both flanks of their caucus supporting both bills, and the surest way to do that is offer those who are wishy-washy on one bill the carrot of the other."

- Says that he has not decided yet whether he supports the bipartisan deal but adds "I'd like to see us get there."

- "First, the U.S. dollar payment system is very good, and it is getting better. Second, the potential benefits of a Federal Reserve CBDC are unclear. Third, developing a CBDC could, I believe, pose considerable risks," he said. For more see MNI Policy main wire at 1313ET.

OVERNIGHT DATA

Dallas Fed Manufacturing Activity (31.1 vs .34.9 est, 32.5 prior)

MARKETS SNAPSHOT

Key late session market levels- DJIA down 173.32 points (-0.5%) at 34260.25

- S&P E-Mini Future up 2.25 points (0.05%) at 4273.5

- Nasdaq up 104.4 points (0.7%) at 14464.24

- US 10-Yr yield is down 4.8 bps at 1.4765%

- US Sep 10Y are up 13/32 at 132-8.5

- EURUSD down 0.0007 (-0.06%) at 1.1928

- USDJPY down 0.2 (-0.18%) at 110.55

- WTI Crude Oil (front-month) down $1.19 (-1.61%) at $72.86

- Gold is down $1.79 (-0.1%) at $1779.70

- EuroStoxx 50 down 30.75 points (-0.75%) at 4089.91

- FTSE 100 down 63.1 points (-0.88%) at 7072.97

- German DAX down 53.79 points (-0.34%) at 15554.18

- French CAC 40 down 64.85 points (-0.98%) at 6558.02

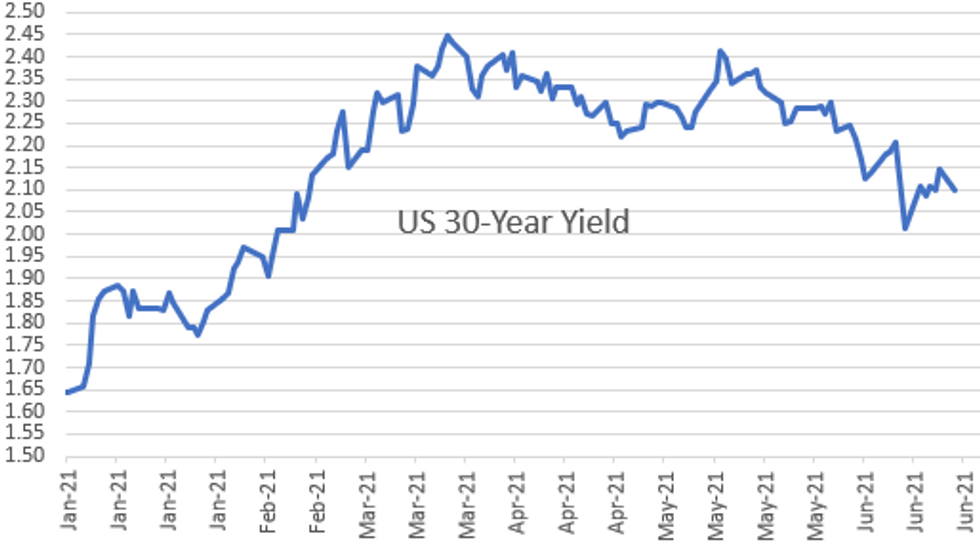

US TSY SUMMARY: Rate Reversal, Ylds Back in Range After Fri Gains

Bonds lead Tsys higher after a muted overnight session, strong support topping out around noon with markets trading sideways into the closing bell. No data to trade off of and no revelations from the Fed speakers on tap -- all-in-all a quiet start to the week on light volume (TYU1 only 870k by the closing bell).- First-half support was not deemed headline driven -- more positioning related, trading desks said as 10YYmoving back near last week's level of 1.475-1.50% before climbing to 1.54% on Friday.

- Muted trade from sidelined desks ahead Fri's headline June NFP (+700k est vs.

- +559k prior). Modest deal-tied selling on supra-sovereign issuance, light option related flow as well.

- Other potential drivers adding impetus to the bid in rates: doubts over getting the infrastructure deal and month-end extensions (MBS climbed to 0.17 from 0.11 on prelim read).

- The 2-Yr yield is down 1.2bps at 0.2543%, 5-Yr is down 2.7bps at 0.8942%, 10-Yr is down 4.8bps at 1.4765%, and 30-Yr is down 5.3bps at 2.0959%.

US TSY FUTURES CLOSE

- 3M10Y -4.585, 142.583 (L: 141.906 / H: 147.511)

- 2Y10Y -3.407, 122.025 (L: 121.348 / H: 126.479)

- 2Y30Y -3.898, 184.171 (L: 183.143 / H: 189.579)

- 5Y30Y -2.349, 120.057 (L: 119.474 / H: 123.742)

- Current futures levels:

- Sep 2Y up 1/32 at 110-4.625 (L: 110-03.75 / H: 110-04.75)

- Sep 5Y up 4.25/32 at 123-10.75 (L: 123-06.5 / H: 123-12)

- Sep 10Y up 13/32 at 132-8.5 (L: 131-28.5 / H: 132-10.5)

- Sep 30Y up 1-9/32 at 160-1 (L: 158-27 / H: 160-07)

- Sep Ultra 30Y up 2-17/32 at 191-13 (L: 189-02 / H: 191-28)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.855

- Dec 21 steady at 99.785

- Mar 22 steady at 99.790

- Jun 22 +0.005 at 99.715

- Red Pack (Sep 22-Jun 23) +0.015 to +0.020

- Green Pack (Sep 23-Jun 24) +0.025 to +0.035

- Blue Pack (Sep 24-Jun 25) +0.025 to +0.030

- Gold Pack (Sep 25-Jun 26) +0.040 to +0.060

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00037 at 0.08375% (+0.00288 last wk)

- 1 Month +0.00812 to 0.10425% (+0.00513 last wk)

- 3 Month +0.00125 to 0.14725% (+0.01112 last wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month +0.00113 to 0.16663% (+0.00925 last wk)

- 1 Year -0.00175 to 0.24750% (+0.00912 last wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $77B

- Daily Overnight Bank Funding Rate: 0.08% volume: $267B

- Secured Overnight Financing Rate (SOFR): 0.05%, $850B

- Broad General Collateral Rate (BGCR): 0.05%, $346B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $319B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.668B submission

- Next scheduled purchases:

- Tue 6/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 6/30 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

- Thu 7/1 1100-1120ET: Tsy 22.5Y-30Y, appr $2.025B

FED: Repo and Reverse Repo Operations

Off last Thursday's record high of $813.573B, NY Fed reverse repo usage climbs to $803.019B from 75 counterparties Monday. Friday's usage fell to $770.830B.

MONTH-END EXTENSION: Updated Barclays/Bbg Extension Estimates for US

Updated forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.01Y; US Gov infl-linked -0.4Y. Note, MBS extension estimate climbs to 0.17 from 0.11 preliminary est.

| Indices | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.12 | 0.04 | 0.06 |

| Credit | 0.05 | 0.12 | 0.09 |

| Govt/Credit | 0.07 | 0.10 | 0.09 |

| MBS | 0.17 | 0.06 | 0.08 |

| Aggregate | 0.06 | 0.09 | 0.09 |

| Long Gov/Cr | 0.06 | 0.09 | 0.12 |

| Iterm Credit | 0.07 | 0.10 | 0.10 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.07 | 0.09 | 0.08 |

| High Yield | 0.10 | 0.11 | 0.09 |

PIPELINE: $3B Philippines 2pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/28 $3B #Philippines $750M 10.5Y +60, $2.25B 25Y 3.25%

- 06/28 $1B #Suzano Austria 10Y +180

- 06/28 $1B *LG Chem $00M 5Y +60, $500M 10Y +90

- 06/28 $1B #Mongolia $500M 6Y 3.75%, $00M 10Y 4.7%

- 06/28 $700M #Protective Life $350M 3Y +32, $350M 7Y +65

- 06/28 $Benchmark Qatar Petroleum multi-tranche investor calls

- 06/?? $Benchmark CIBC 5Y

EGBs-GILTS CASH CLOSE: UK Case Surge And Some PEPP Talk

Gilts outperformed Monday, as the German and UK curves bull flattened. Periphery spreads tightened modestly as well.

- The UK recorded the highest number of COVID cases since January (22k+), though this surge largely appeared to be expected; Gilts gained all day, with 10s to 30 yields down 5+bps.

- The ECB taper debate widened, with hawks Weidmann and Holzmann calling for winding down PEPP earlier rather than later; dove Panetta said flexibility in purchases should be maintained. VP de Guindos said the ECB was mindful of second-round inflation effects.

- ECB weekly net PEPP purchases hit the highest in a year.

- Belgium sold E3.8bln of OLO; EU mandated banks for dual-tranche 5-/30Y NGEU, subject to be launched Tuesday.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is down 0.5bps at -0.652%, 5-Yr is down 2.3bps at -0.574%, 10-Yr is down 3.5bps at -0.19%, and 30-Yr is down 3.4bps at 0.311%.

- UK: The 2-Yr yield is down 2.7bps at 0.057%, 5-Yr is down 3.4bps at 0.341%, 10-Yr is down 5.6bps at 0.722%, and 30-Yr is down 6.6bps at 1.221%.

- Italian BTP spread down 1.5bps at 106.3bps / Spanish down 0.3bps at 63.2bps

FOREX: USDJPY Rejects 111 Mark Once More

- Unable to make a meaningful break above 111.00 last week, USDJPY once again retreated from the notable March highs as US equity indices also headed south following fresh record high prints earlier in the session.

- Although a technical uptrend remains in place, bulls will be wary following the inability of the pair to extend above the previous bull trigger at 110.97. Initial key support remains unchanged at 109.72, Jun 21 low. A break of this level is required to signal a top.

- Furthermore, yen crosses suffered the most on Monday, with AUDJPY and NZDJPY sliding the best part of 0.75% from their highs. Particular weakness was likely exacerbated by Sydney beginning a two-week lockdown on Sunday as a cluster of cases of the highly infectious coronavirus Delta variant rose to 110 in Australia's largest city.

- The Dollar Index continued it's consolidation trend with some initial strength being reversed throughout the latter half of Monday. With the DXY broadly unchanged, most G10 pairs are respecting most recent ranges. EM volatility was also capped with the biggest move seen in TRY (+0.77%).

- No notable price action around today's WMR fix. Citi's prelim month-end model for June indicates slight USD sales with their signal strength under half the historical norm.

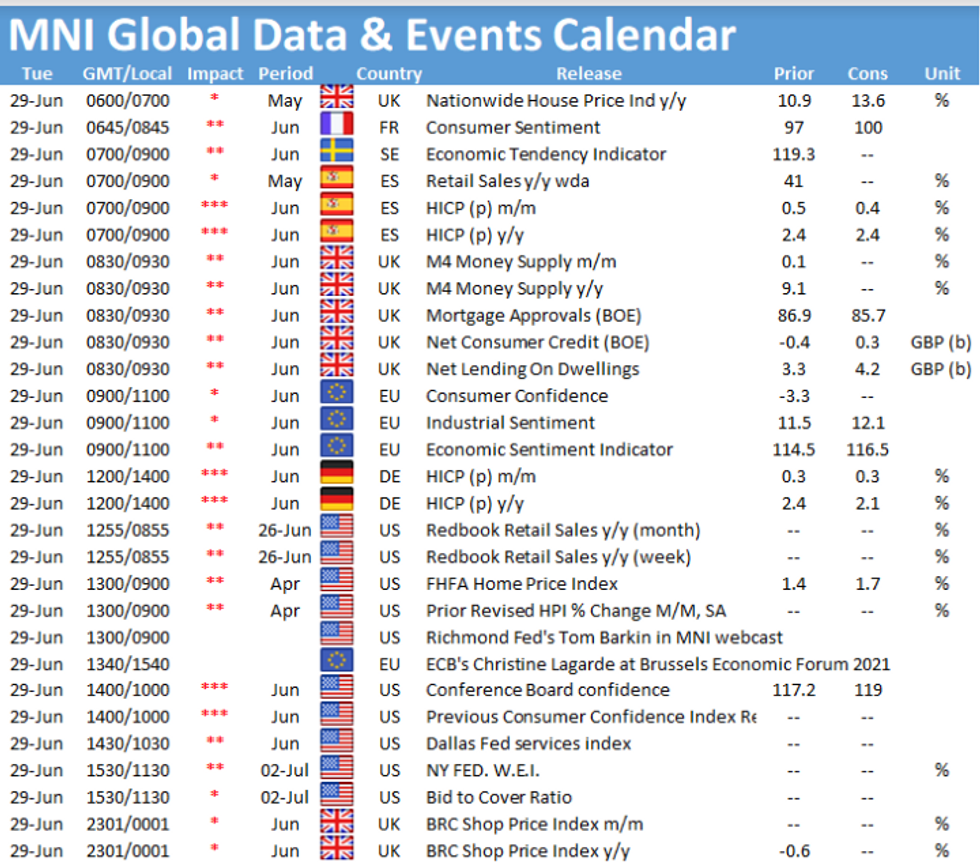

- RBNZ Governor Orr due to speak overnight as well as further comments expected from Fed's Barkin tomorrow. Eurozone CPI Flash Estimate on Thursday, however, markets likely keeping firm focus on the US NFP report due Friday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.