-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Kyiv Ready for Ceasefire, Russia Sceptical

MNI China Daily Summary: Wednesday, March 12

MNI BRIEF: EU Targets Retaliation Tariffs On US Red States

MNI ASIA OPEN - Pandemic Policies At A Crossroads

MNI ASIA OPEN - Pandemic Policies At A Crossroads

EXECUTIVE SUMMARY:

- MNI: Chicago Business Barometer Falls To 4-Month Low in June

- MNI: ECB Strategy Review In Tussle Over Covid Response

- MNI: BOE Haldane: MPC Debating Tightening Strategy Now

- MNI: Delta Variant Worries RBA Ahead Of Key Meeting

NORTH AMERICA

US (MNI): Fed Community Advisers Say Housing Eating at Labor Gains

The Federal Reserve's monthly purchases of mortgage bonds are driving up housing costs and creating obstacles for a more inclusive recovery, members of the Federal Reserve Board's Community Advisory Council told MNI.

US (MNI): US Labor Market Frictions Hurting Job Gains-ADP

U.S. labor market frictions such as childcare challenges and lingering virus fears kept the monthly ADP payrolls report from being even stronger than the 692,000 gain, Chief Economist Nela Richardson told reporters Thursday.

CANADA (MNI): Freeland Has Spoken to Macklem About BOC Diversity

Canadian Finance Minister Chrystia Freeland said Wednesday she's spoken to BOC Governor Tiff Macklem about diversity at a central bank that has been seeking a new top deputy since December.

EUROPE

ECB (MNI): ECB Strategy Review In Tussle Over Covid Response

The European Central Bank's strategy review is seeing a debate over how much a new monetary policy framework should allow for responses to extreme situations such as the Covid pandemic, while a tussle continues over how to define a new "symmetrical" inflation target, Eurosystem sources told MNI. With September seen as an informal deadline for concluding the review, some national central bank governors want the new strategy to not only clearly give room to policies such as the EUR1.85 trillion Pandemic Emergency Purchase Programme, but also guide decisions over what follows once it concludes net purchases next March.

BoE (MNI): BOE Haldane: MPC Debating Tightening Strategy Now

Bank of England Chief Economist Andy Haldane said at an Institute for Government event Wednesday that the central bank could tighten policy either by quantitative tightening (QT) or rate hikes and that he personally favoured balance sheet reduction. Haldane said that the question of QT or rate hikes was "a debate that the MPC (Monetary Policy Committee) is having almost as we speak."

ASIA / AUSTRALASIA

JAPAN (MNI): Tankan To Flag Services Recovery: Ex-BOJ Aide

Japan's June Tankan business sentiment survey, due out on Thursday, will show a clearer picture of the current K-shaped economic recovery, although the difference between the manufacturing and service sectors is likely to be shown narrowing three months ahead, a former Bank of Japan executive director and chief economist told MNI on Tuesday.

AUSTRALIA (MNI): Delta Variant Worries RBA Ahead Of Key Meeting

Fresh Covid-19 outbreaks and the slow pace of Australia's vaccine rollout are having more of an impact on the economy than the Reserve Bank of Australia expected when it made its most recent forecasts in May, weighing on its calculations as it considers an extension of its yield guidance, MNI understands.

DATA

US (MNI): Chicago Business Barometer Falls To 4-Month Low in June

- Chicago Business Barometer 66.1 June Vs 75.2 May

The Chicago Business Barometer fell in June, with the headline index dropping to 66.1 from 75.2 in May, driven by a sharp decline in new business and order backlogs. However, through Q2 the index surged 7.9 points to 71.1, its highest quarterly reading since Q4 1973. Among the main five indicators, Order Backlogs saw the largest decline, with Supplier Deliveries posting the only gain.

MNI: US NAR MAY PENDING HOME SALES INDEX 114.7 V 106.2 IN APR

CANADA (MNI): Canada's GDP declined 0.3% in April, less than the expected -0.8%, offering a sign that the economy showed continued resilience during a third-wave pandemic lockdown, government figures showed Wednesday.

Statistics Canada also reported a flash estimate for May of another 0.3% decline, far less than the steep drops a year ago when the pandemic first struck. In another positive surprise, the agency also boosted its estimate of March output growth to 1.3% from 1.1%.

MNI: EZ JUN FLASH CORE HICP +0.3% M/M; +0.9% Y/Y; MAY +1.0% Y/Y

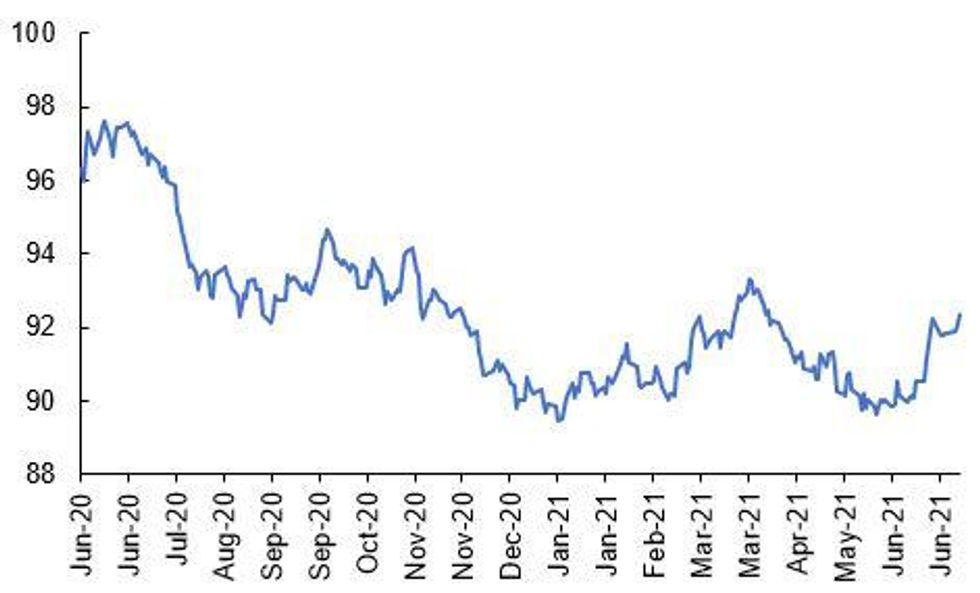

US TSYS SUMMARY: UST Curve Bull Flattens, Dollar Index Marches Higher

USTs have rallied through the day and the curve has bull flattened with most of the early gains retained. This came on the back of a weak session for European equities and broad gains for the dollar.

- Yields are 1-3bp lower with the curve 2-3bp flatter on the day. Last yields: 2-year 0.2447%, 5-year 0.8702%, 10-year 1.4376%, 30-year 2.0566%.

- TYU1 has traded up to 132-17, just off the 132-18 high for the day.

- The MNI Chicago PMI dropped to 66.1 in June, below the 70.0 consensus poll and marking the weakest print since February.

- The Fed's reverse repo facility saw record usage of USD992bn tying in with quarter-end.

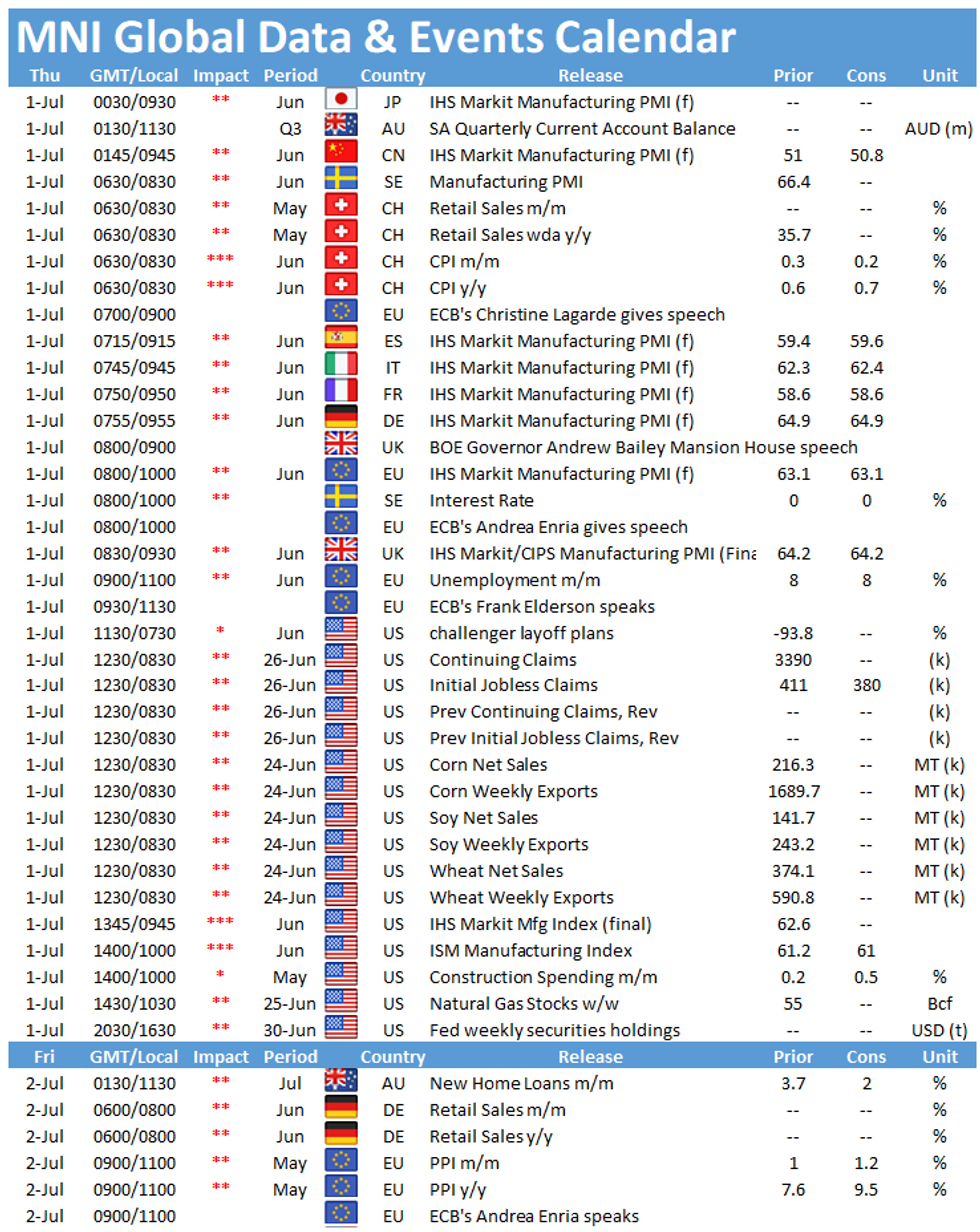

- Looking ahead, tomorrow sees the release of jobless claims data and the latest ISM manufacturing update for June.

FOREX: Dollar Index Firms To 12-Week Highs

- The US dollar was consistently supported On Wednesday with the dollar index printing fresh 12-week highs, back above 92.30, up 0.42% on the day.

- A solid ADP Employment headline of 692k and above expectation pending home sales continued to bolster the greenback as markets dealt with month-, quarter, half-end flows approaching the London WMR fix. Despite most month-end models signalling USD sales into June month-end, the price action suggested otherwise with some strong dollar buying.

- USDJPY extended gains in the lead up to the WMR, briefly showing above the Monday high of 110.98. The move coincided with best volumes of the day for JPY futures, with just shy of 5,000 contracts changing hands inside the five minutes preceding the fix.

- USDJPY went on to match 111.12 highs from last week. A breach would see the pair at its highest level since March 2020. Around $1.8b of 111.00 strikes are set to roll off July 2; volumes on DTCC show interest in July 2 111.40 strikes incorporating non-farm payrolls.

- Elsewhere, EURUSD slipped to the worst levels of the week below 1.19 and was unable to recover amid the strong bid for the dollar, hitting fresh lows at 1.1845. Attention is on 1.1837, a Fibonacci retracement where a break would open 1.1704, Mar 31 low and a key support.

- Bank of England Governor Bailey speaks tomorrow at 9am London. The US docket is headlined by weekly jobless claims and ISM Manufacturing PMI, however markets may patiently await the June Employment report due Friday.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.