-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN

NOTE: Due to the U.S. Independence Day holiday, the next MNI Asia Open will be published on Tuesday July 6.

- U.S. Unemployment Rate Rises Despite Above-Consensus Payrolls Gains

- Massive Ransomware Attack May Impact Thousands of Victims

- BOC Seen Holding Rate to 2023, Mirroring Fed (MNI)

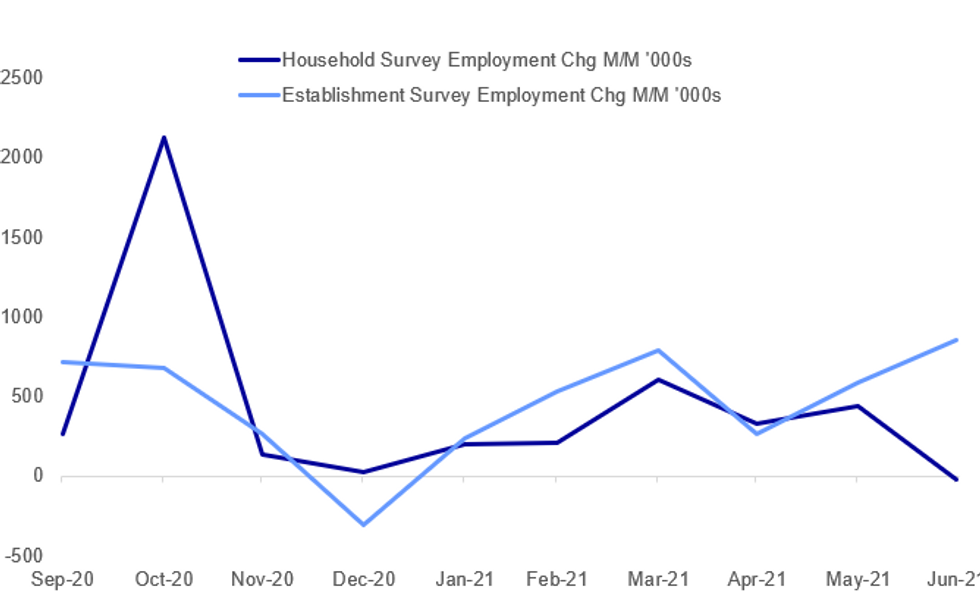

Fig. 1: Divergence Between Household And Establishment Surveys in June U.S. Nonfarm Payrolls Report

NORTH AMERICA

CANADA (MNI): BOC Seen Holding Rate to 2023, Mirroring Fed

The Bank of Canada may hold its key lending rate at 0.25% beyond its guidance for a hike in the second half of next year, mirroring the Fed's challenge in restoring growth led by the private sector, the Ontario finance department's former forecasting manager Tony Stillo told MNI.

CYBERATTACK (BBG): Just weeks after President Joe Biden implored Vladimir Putin to curb cyber crime, a notorious, Russia-linked ransomware gang has been accused of pulling off an audacious attack on the global software supply chain. REvil, the group blamed for the May 30 ransomware attack of meatpacking giant JBS SA, is believed to be behind hacks on at least 20 managed-service providers, which provide IT services to small- and medium-sized businesses. More than 1,000 businesses have already been impacted, a figure that's expected to grow, according to the cybersecurity firm Huntress Labs Inc.

EUROPE

EUROZONE (MNI): EU Can Ease Debt Rules

European Union rules on public borrowing could be loosened without revising EU treaties, a top European Commission official told MNI, though he cautioned that a bold reshaping of the Stability and Growth Pact will only be possible if member states meet reform commitments under the EUR800 billion NextGenerationEU plan to rebuild the economy after Covid.

OIL

OPEC (@Amena__Bakr Twitter): All countries at the JMMC except for the UAE supported a recommendation to ease the cuts by 400k aug-Dec and extend the DOC pact beyond April 2022.

DATA

US (MNI): US Payrolls Up Despite Rising Unemployment Rate

The pace of job growth accelerated in June, the Bureau of Labor Statistics said Friday, an encouraging sign that labor market conditions are improving, though unemployment was on the rise and the participation rate and employment-population ratio, favored by the Federal Reserve, were unchanged.

U.S. employers in June added 850,000 jobs, the Bureau of Labor Statistics said Friday, far more than the 700,000 gain forecast by Bloomberg, although the unemployment rate still ticked up by a tenth to 5.9%.

Notable job gains came from leisure and hospitality (+343,000), as highlighted in MNI's Reality Check, professional and business services (+72,000), and retail trade (+67,100). Government payrolls were up 188,000 through the month. Meanwhile, hourly earnings rose 0.3% in June and 3.6% from one year ago. The participation rate was unchanged at 61.6%, as was the employment-population ratio at 58.

**MNI: US MAY FACTORY ORDERS +1.7%; EX-TRANSPORT NEW ORDERS +0.7%

MAY DURABLE ORDERS +2.3%

MAY NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.1%

FIXED INCOME: Nonfarm Fireworks Only Brief Ahead Of Long Weekend

The much-anticipated June employment report provided an upside surprise on headline job gains Friday, but mixed underlying data dampened the fireworks ahead of the long holiday weekend.

- An above-consensus nonfarm payrolls gain of 850k (130k more than expected, plus higher revisions to prior) was offset by a slightly higher unemployment rate (+0.1pp to 5.9% vs 5.6% expected), as the Establishment and Household surveys appeared to tell slightly different stories.

- Either way it didn't change the macro narrative conclusively. The curve steepened slightly (5Y yields headed lower, potentially fading earlier Fed liftoff risks). Once the immediate volatility played out, TYs continued their short-trend higher, narrowing the gap with the Jun 21 high of 132-30.

- Sep 10-Yr futures (TY) up 14.5/32 at 132-23 (L: 132-07.5 / H: 132-23.5) The 2-Yr yield is down 1.7bps at 0.2356%, 5-Yr is down 3.5bps at 0.8573%, 10-Yr is down 3.1bps at 1.4272%, and 30-Yr is down 1.9bps at 2.0417%.

- This came alongside continued gains in equities (S&P hit an ATH for the 6th straight day).

- Globex futures trade until 1700ET Friday, but CME floor closed at 1300ET and Sifma recommended cash close at 1400ET. The latter two resume Tuesday.

FOREX: Dollar Fades Post Payrolls

- Greenback strength was the order of the day ahead of June non-farm payrolls, with the dollar index trading close to 3-month highs, potentially anticipating a strong set of data.

- The USD initially traded firmer on the higher than expected headline, however, dollar optimism faded almost immediately. A strong reversal ensued, with the potential trigger being an unexpected 0.1ppts rise in the unemployment rate, taking the shine off the report.

- Additional positioning implications heading into the US holiday weekend prompted a sharp move to fresh lows for Friday's session. The DXY is extending losses into the close (-0.37%) ending a five-day win streak for the index.

- Stronger US equities boosted risk-tied pairs with AUD, NZD and CAD all benefitting between 0.8-0.9%. Similarly, emerging market currencies performed very well with EMFX indices seen around 0.5% higher with notable reversals in MXN and ZAR both around 1.25% better off.

- EURUSD (0.17%) ends just marginally higher on the session with a large amount of option expiries around 1.1850 capping the price action. USDJPY has fallen back below the important breakout point at 111.12 after posting highs at 111.66 during European hours.

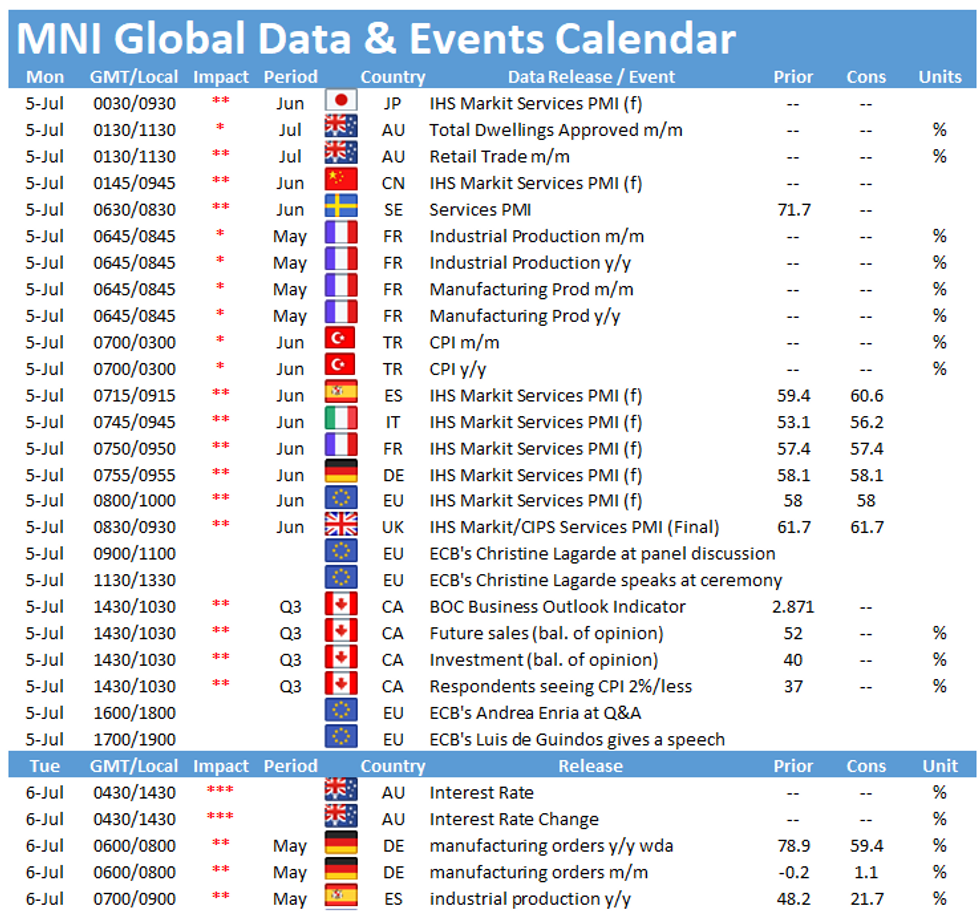

- Next week, markets will focus on the release of the FOMC minutes. Elsewhere Tuesday's RBA meeting will be of importance as well as Canadian Employment data to round of the week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.