-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: PCE, Fed's Preferred Inf Measure Misses the Mark

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed to Push Off Taper, Look Through Inflation

- MNI Interview: St Louis Fed Model Sees Payrolls Slowdown in July

- US DATA: MNI Chicago Business Barometer Up Sharply in July

- MNI BRIEF: Fed's Bullard Sees Stronger H2 Growth

- BULLARD: 4Q 2022 INTEREST-RATE INCREASE IS HIS BASE CASE, Bbg

- BULLARD: MARKETS `VERY MUCH READY FOR A TAPER' TO START IN FALL, Bbg

- U.S. PAUSES IPO REGISTRATIONS FOR CHINESE COMPANIES: RTRS

US

FED: Federal Reserve officials are so keenly focused on seeing actual job market gains before tightening monetary policy that they could wait until well into 2022 before tapering bond buys, Yuriy Gorodnichenko, a visiting scholar at the San Francisco Fed, told MNI.

- "The Fed will continue to push on the gas pedal if strong employment gains don't materialize," he said in an interview. "My guess is that they will keep stimulating the economy with all means for another year and then gradually taper the support."

- That would be a lot longer than Wall Street's timeline, which now centers around some kind of fall announcement for a year-end start to the taper. For more see MNI Policy main wire at 0746ET.

- That will leave the economy with an annualized growth rate of 7% for 2021 as a whole, Bullard said, calling it a "stellar" pace and expecting strong momentum to persist into 2022.

- "The index continued its upward trend, albeit at a slower rate," St. Louis Fed economist Max Dvorkin told MNI, and "it's not clear whether the effects of the Delta variant are noticeable in the data." For more see MNI Policy main wire at 1434ET.

- Supplier Deliveries were unchanged in Jul at 86.5, still showing the highest level since Mar 1974.

- Anecdotal evidence showed that firms planned to hire new employees, but staff availability remains subdued.

- Factory gate prices eased slightly in Jul to 91.6, although firms noted higher prices for materials and freight.

- Inventories rose to 42.6 in July, but remained in contraction since April.

- The majority (48.8%) of respondents expect business activity growth to be between 5% and 10% in the second half of the year.

OVERNIGHT DATA

- US JUN PERSONAL INCOME +0.1%; NOM PCE +1.0%

- US JUN PCE PRICE INDEX +0.5%; +4.0% Y/Y

- US JUN CORE PCE PRICE INDEX +0.4%; +3.5% Y/Y

- US JUN UNROUNDED PCE PRICE INDEX +0.513%; CORE +0.450%

- US Q2 EMPL COST INDEX 0.7% V Q1 0.7%

- US Q2 EMPL COST INDEX Y/Y 2.9% V Q1 2.6%

- US Q2 BENEFIT PAYMENTS 0.4% V Q1 0.6%;Q2 Y/Y 2.2%(Q1 2.5%)

- MNI CHICAGO BUSINESS BAROMETER 73.4 JUL VS 66.1 JUN

- MNI CHICAGO BUSINESS BAROMETER AT TWO-MONTH HIGH

- MNI CHICAGO: PRODUCTION SHOWED LARGEST M/M INCREASE IN JUL

- MNI CHICAGO: SUPPLIER DELIVERIES AT HIGHEST SINCE MAR 1974

- CANADA MAY GROSS DOMESTIC PRODUCT -0.3% MOM

- CANADA MAY GOODS INDUSTRY GDP -0.4%, SERVICES -0.2%

- CANADA REVISED APR GROSS DOMESTIC PRODUCT -0.5% MOM

- CANADA JUN INDUSTRIAL PRICES +0.0% MOM; EX-ENERGY -0.1%

- CANADA JUN RAW MATERIALS PRICES +3.9% MOM; EX-ENERGY +1.0%

- CANADA FLASH JUNE GDP +0.7% MOM

- CANADA FLASH Q2 GDP +2.5% ANNUALIZED

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 175.12 points (-0.5%) at 34906.97

- S&P E-Mini Future down 24 points (-0.54%) at 4387.5

- Nasdaq down 107.4 points (-0.7%) at 14670.21

- US 10-Yr yield is down 4.2 bps at 1.2273%

- US Sep 10Y are up 10/32 at 134-17

- EURUSD down 0.003 (-0.25%) at 1.1857

- USDJPY up 0.28 (0.26%) at 109.76

- WTI Crude Oil (front-month) up $0.14 (0.19%) at $73.78

- Gold is down $17.09 (-0.93%) at $1811.04

- EuroStoxx 50 down 27.47 points (-0.67%) at 4089.3

- FTSE 100 down 46.12 points (-0.65%) at 7032.3

- German DAX down 96.08 points (-0.61%) at 15544.39

- French CAC 40 down 21.01 points (-0.32%) at 6612.76

US TSY SUMMARY: PCE, Fed's Preferred Inflation Measure Misses the Mark

Rates see-sawed higher Friday, modest two-way action after early data, while chunky two-way flow going into the close saw better month-end selling as futures pared gains slightly.- Not exactly unexpected US/China headlines lent a small bid to Tsys pre-open: U.S. PAUSES IPO REGISTRATIONS FOR CHINESE COMPANIES: RTRS.

- Rates saw some fast two-way flow after PCE came out softer than anticipated (+0.5% vs. 0.6% est; core +0.4% vs. 0.6% est), levels moving off early session highs on moderate volume.

- StL Fed Bullard first to exit blackout said "MARKETS `VERY MUCH READY FOR A TAPER' TO START IN FALL".

- Tsys came under late sell pressure in the lead-up to the close, apparently month-end related amid chunky two-way flow as volume jumps appr 200k in TYU to 1.23M after the bell. Bonds off initial lows.

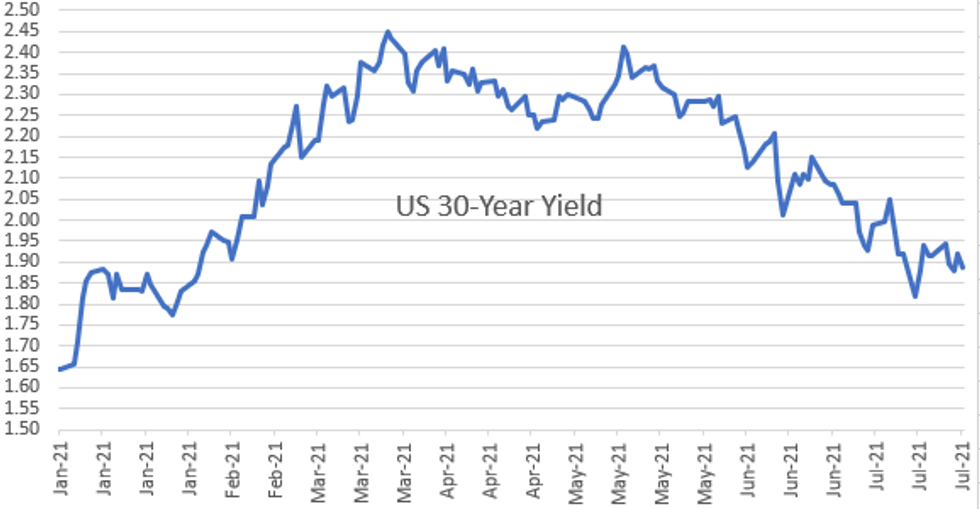

- Yield curves held mostly flatter all day. The 10YY still inside 1.29 to 1.22% range all week. The 2-Yr yield is down 1.8bps at 0.1859%, 5-Yr is down 3.8bps at 0.6967%, 10-Yr is down 4.2bps at 1.2273%, and 30-Yr is down 3.5bps at 1.8845%.

MONTH-END EXTENSIONS: Updated Barclays/Bbg Extension Estimates for US

Updated forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.14Y; US Gov inflation-linked 0.23Y. Note, MBS extension nearly doubled from 0.08Y preliminary to 0.15.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.09 | 0.04 | 0.05 |

| Credit | 0.06 | 0.12 | 0.08 |

| Govt/Credit | 0.07 | 0.1 | 0.08 |

| MBS | 0.15 | 0.07 | 0.06 |

| Aggregate | 0.09 | 0.09 | 0.08 |

| Long Gov/Cr | 0.07 | 0.09 | 0.07 |

| Iterm Credit | 0.07 | 0.1 | 0.08 |

| Interm Gov | 0.08 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.08 | 0.09 | 0.08 |

| High Yield | 0.09 | 0.11 | 0.1 |

US TSY FUTURES CLOSE

- 3M10Y -3.368, 118.743 (L: 117.576 / H: 121.022)

- 2Y10Y -1.6, 104.581 (L: 103.385 / H: 105.738)

- 2Y30Y -1.029, 170.177 (L: 168.875 / H: 171.079)

- 5Y30Y +0.562, 118.842 (L: 117.419 / H: 119.752)

- Current futures levels:

- Sep 2Y up 0.75/32 at 110-10.375 (L: 110-09.375 / H: 110-10.625)

- Sep 5Y up 4.25/32 at 124-14.5 (L: 124-09 / H: 124-16)

- Sep 10Y up 8.5/32 at 134-15.5 (L: 134-06 / H: 134-19)

- Sep 30Y up 21/32 at 164-26 (L: 164-03 / H: 165-00)

- Sep Ultra 30Y up 30/32 at 199-21 (L: 198-16 / H: 199-30)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.875

- Dec 21 +0.005 at 99.830

- Mar 22 +0.005 at 99.845

- Jun 22 +0.010 at 99.805

- Red Pack (Sep 22-Jun 23) +0.015 to +0.030

- Green Pack (Sep 23-Jun 24) +0.030 to +0.040

- Blue Pack (Sep 24-Jun 25) +0.035 to +0.040

- Gold Pack (Sep 25-Jun 26) +0.030

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00250 at 0.07688% (-0.00325/wk)

- 1 Month -0.00525 to 0.09050% (+0.00438/wk)

- 3 Month -0.00800 to 0.11775% (-0.01113/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00075 to 0.15313% (-0.00538/wk)

- 1 Year -0.00187 to 0.23513% (-0.00625/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $70B

- Daily Overnight Bank Funding Rate: 0.08% volume: $253B

- Secured Overnight Financing Rate (SOFR): 0.05%, $877B

- Broad General Collateral Rate (BGCR): 0.05%, $377B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $341B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.401B accepted vs. $21.043B submission

- Next scheduled purchases

- Mon 8/02 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B

- Tue 8/03 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 8/04 1100-1120ET: Tsy 7Y-10Y, appr $3.225B

- Thu 8/05 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 8/06 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

FED: Reverse Repo Operations -- Record High, Over $1T

NY Fed reverse repo usage climbs to new record high, first time over $1T: $1,039.394B from 86 counterparties vs. $987.283B on Thursday. Compares to prior record high of $991.939B on June 30.

PIPELINE: Apple's $6.5B 4Pt Helped Push Issuance for Wk Over $28B

- Date $MM Issuer (Priced *, Launch #)

- 07/30 $750M United Rentals 10.5NC5

- $15.1B to price Thursday; $28.9B/wk

- 07/29 $6.5B *Apple 4pt jumbo: $2.3B 7Y +40, $1B 10Y +47, $1.8B 30Y +77, $1.4B 40Y +92 (adds to $8.5B issued back on May 4, 2020: $2B 3Y +60, $2.25B 5Y +80, $1.75B 10Y +110, $2.5B 30Y +145)

- 07/29 $3B *Humana $1.5B 2NC.5 +50, $750M 5Y +65, $750M 10Y +90

- 07/29 $2.5B *Synnex $700M 3NC1 +90, $700M 5Y +110, $600M 7Y +135, $500M 10Y +145

- 07/29 $2B *Blackstone $650M 7Y +65, $850M 10.5Y +85a, 30Y +95a

- 07/29 $500M *New York Life 10Y +58

- 07/29 $600M *DR Horton Inc 5Y +60

EGB-GILTS CASH CLOSE: Lowest close for Bund yields since 2 February

Bunds and gilts have outperformed Treasuries today despite some decent data this morning.

- German GDP disappointed but there were some positive surprises elsewhere, both in the pan-Eurozone data and in Italian, Spanish and (to a lesser extent) French data.

- Eurozone inflation data also came in higher than expected with the headline rate rising to 2.2%Y/Y (2.0% expected) although core was in line with expectations at 0.7% Y/Y.

- Despite this better than expected data, peripheral spreads are generally a little wider on the day, with 10-year BTP-Bund spreads widening 0.7bp to 108.0bp.

- The moves higher for Bunds have seen yields close at their lowest level since February 2.

- Gilt yields in contrast have managed to close above the 200-dma which has now been breached many times over the past 2 weeks on an intraday basis.

- Bund futures are up 0.13 today at 176.57 with 10y Bund yields down -1.1bp at -0.462% and Schatz yields down -0.5bp at -0.767%.

- Gilt futures are up 0.04 today at 129.79 with 10y yields down -0.8bp at 0.564% and 2y yields down -1.4bp at 0.054%.

- BTP futures are down -0.07 today at 154.28 with 10y yields down -0.4bp at 0.620% and 2y yields unch at -0.453%.

FOREX: Greenback Stages Partial Recovery Ahead Of Month-End

- After retreating for four consecutive trading days the US dollar bucked the short-term trend and regained some poise on Friday.

- The dollar index firmed 0.3% ahead of the month-end WMR fix, with reported signals from sell-side institutions mixed ahead of the event. Despite the minor recovery, the index is set to post a 1% weekly drop.

- With stocks rolling off their highs, AUDUSD and NZDUSD came under pressure, the former losing roughly 0.65%.

- EURUSD breached the 1.19 handle but stopped just shy of touted short-term key resistance at the 50-day EMA at 1.1916. Broad dollar strength brought he single currency back to lows of 1.1852, traded just before 4pm London.

- The most notable turnaround in G10 was the Norwegian Krona where EURNOK reversed the majority of the last two days losses to post a positive week. USDNOK rose 1.15%.

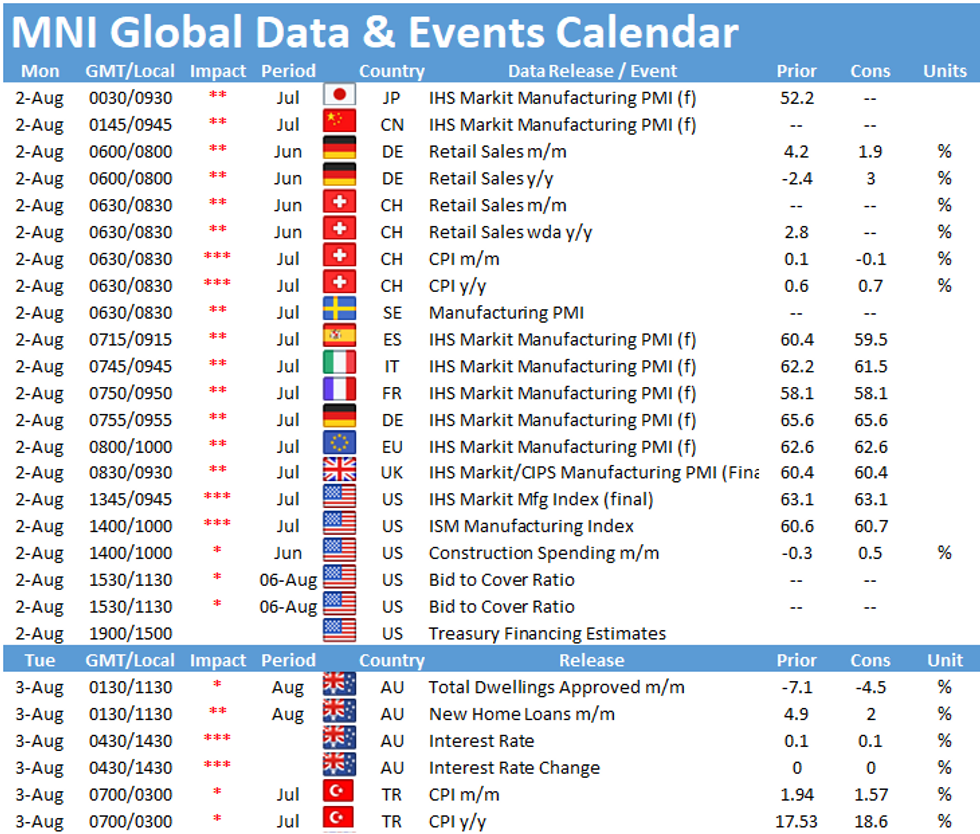

- Final European Manufacturing PMI readings on Monday before US ISM Manufacturing PMI headlines the docket. Canada will be out for Civic Holiday.

- The main focus for markets next week will be Friday's release of US Non-Farm Payrolls. Other notable events include the RBA and BOE meetings as well as NZ and CAD unemployment.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.