-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Yields Surge Higher Ahead Key Employ Data

EXECUTIVE SUMMARY

- MNI: Fed To Keep Any Emergency US Default Response To Minimum

- MNI REALITY CHECK: US Hiring Seen Higher, But Capped by Supply

- MNI BRIEF: BOC Remains Confident of 2H Growth, Mkts See Taper

- U.S. Sends Special-Operations Forces, Marines to Taiwan to Train Troops, U.S. Officials Say .. Small U.S. Contingent Has Been Secretly in Taiwan for at Least a Year, Officials Say, DJ

- IRELAND READY TO SIGN UP TO 15% MINIMUM CORPORATE TAX DEAL, Bbg

US

FED: The Federal Reserve stands ready to provide liquidity and calm any financial turbulence that could follow a technical default by the U.S. Treasury, but Chair Jay Powell would be loathe to take actions that may politicize the Fed, former senior officials and analysts told MNI.

- Senate Democrats and GOP leaders reached a deal Thursday to raise the debt ceiling until early December, pushing back the so-called "drop-dead date" for a U.S. default by a couple of months, but the parties could find themselves at another impasse by year-end.

- Treasury could prioritize payments to protect the Treasuries market if the debt ceiling is not raised. If it doesn't, the U.S. central bank would be prepared to accept defaulted Treasuries as collateral at its discount window and repo facilities to keep markets working well.

- "We continue to see elevated demand for labor from employers," Indeed economist AnnElizabeth Konkel told MNI, and job postings on Indeed were up 45% through September from February 2020.

- Openings in loading and stocking were up 88% compared to their pre-pandemic baseline, and postings for jobs in human resources were up 87%, she said.

CANADA

BOC: Bank of Canada Governor Tiff Macklem said Thursday that markets appear to have a good handle on any future moves to taper bond purchases, and said he remains confident about solid economic growth through the rest of the year.

- The economy shows good underlying momentum even after GDP shrank in the second quarter, though growth prospects have faded with some companies taking longer than expected to hire back workers, he said. "We continue to see a strong second half of the year," he said at a press conference following a speech about global capital controls.

- Investors predict Macklem will hold a record low 0.25% policy rate at its Oct. 27 decision and many economists see a taper to CAD1 billion a week that would stabilize the size of the balance sheet. "We've tried to be pretty deliberate in our communications," he said when asked about tapering, and "the market hopefully can get a pretty good idea of where we're headed."

OVERNIGHT DATA

- US JOBLESS CLAIMS -38K TO 326K IN OCT 02 WK

- US PREV JOBLESS CLAIMS REVISED TO 364K IN SEP 25 WK

- US CONTINUING CLAIMS -0.097M to 2.714M IN SEP 25 WK

- US AUG CONSUMER CREDIT +$14.4B

- US AUG REVOLVING CREDIT +$3.0B

- US AUG NONREVOLVING CREDIT +$11.4BB

MARKET SNAPSHOT

- DJIA up 367.53 points (1.07%) at 34779.78

- S&P E-Mini Future up 43.5 points (1%) at 4397

- Nasdaq up 180.9 points (1.2%) at 14682.16

- US 10-Yr yield is up 4.5 bps at 1.566%

- US Dec 10Y are down 9.5/32 at 131-13.5

- EURUSD down 0.0002 (-0.02%) at 1.1553

- USDJPY up 0.19 (0.17%) at 111.6

- WTI Crude Oil (front-month) up $1.07 (1.38%) at $78.51

- Gold is down $6.56 (-0.37%) at $1756.16

- European bourses closing levels:

- EuroStoxx 50 up 85.69 points (2.14%) at 4098.34

- FTSE 100 up 82.17 points (1.17%) at 7078.04

- German DAX up 277.53 points (1.85%) at 15250.86

- French CAC 40 up 107.07 points (1.65%) at 6600.19

US TSYS: NFP Optimism

Tsy futures trade on late session lows after the bell underscored by the better than expected wkly jobless claims (-38K to 326K) in the lead up to Friday's Sep employment data. The gradual/consistent risk-on tone since the opening bell saw equities holding near midday session highs (ESZ1 +50.0).- Current mean estimate for the Sep employ report holds at +500k jobs (Bbg whisper number around +475k) -- a number that would most certainly keep the Fed on track to announce asset purchase tapering at the November FOMC -- a precursor to rate normalization later next year (as long as the economy continues to improve).

- Futures volumes were not exceptional -- closer to below average as larger accts plied the sidelines to await the Fri data.

- On the other hand, option trading was robust with better buying of low delta puts (TYX 131 puts, short Dec Eurodollar midcurves hedging on Dec'22 downside risk) and vol plays: 1-day vol buyer wk2 TY 131.5 straddle that expire late Friday, later rolled to wk 3 straddles.

- Flow included two-way positioning w/better selling on net, option-tied hedging and rate lock hedging on appr $6.5B swappable corporate issuance.

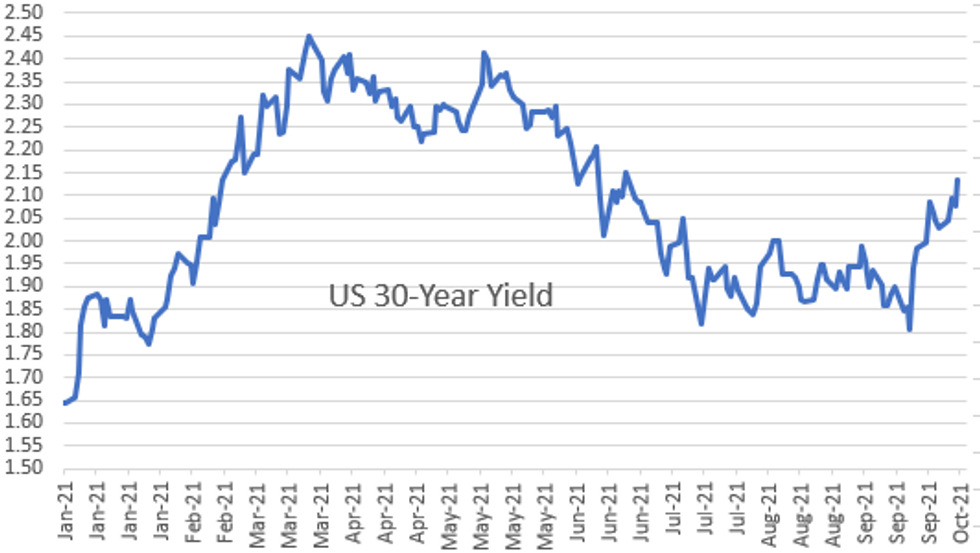

- By the bell, 2-Yr yield is up 1.2bps at 0.3055%, 5-Yr is up 3.4bps at 1.0154%, 10-Yr is up 4.5bps at 1.566%, and 30-Yr is up 5.1bps at 2.1299%.

US TSY FUTURES CLOSE

- 3M10Y +4.201, 151.7 (L: 143.702 / H: 152.477)

- 2Y10Y +3.512, 126.021 (L: 121.072 / H: 126.545)

- 2Y30Y +3.322, 181.662 (L: 176.302 / H: 182.89)

- 5Y30Y +0.862, 110.299 (L: 107.958 / H: 111.869)

- Current futures levels:

- Dec 2Y down 0.875/32 at 109-31.625 (L: 109-31.5 / H: 110-00.62)

- Dec 5Y down 6/32 at 122-19.5 (L: 122-19 / H: 122-26.25)

- Dec 10Y down 10.5/32 at 131-12.5 (L: 131-11 / H: 131-25)

- Dec 30Y down 30/32 at 158-17 (L: 158-12 / H: 159-24)

- Dec Ultra 30Y down 1-25/32 at 189-29 (L: 189-16 / H: 192-06)

US EURODOLLAR FUTURES CLOSE

- Dec 21 +0.010 at 99.840

- Mar 22 +0.005 at 99.855

- Jun 22 steady at 99.790

- Sep 22 -0.010 at 99.665

- Red Pack (Dec 22-Sep 23) -0.04 to -0.02

- Green Pack (Dec 23-Sep 24) -0.045 to -0.04

- Blue Pack (Dec 24-Sep 25) -0.05 to -0.045

- Gold Pack (Dec 25-Sep 26) -0.055 to -0.05

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00037 at 0.07238% (-0.00200/wk)

- 1 Month -0.00113 to 0.08600% (+0.01075/wk)

- 3 Month -0.00037 to 0.12363% (-0.00950/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00025 to 0.15588% (-0.00112/wk)

- 1 Year +0.00200 to 0.24313% (+0.00825/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $75B

- Daily Overnight Bank Funding Rate: 0.07% volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.05%, $902B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $348B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.974B submission

- Next scheduled purchase

- Fri 10/08 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

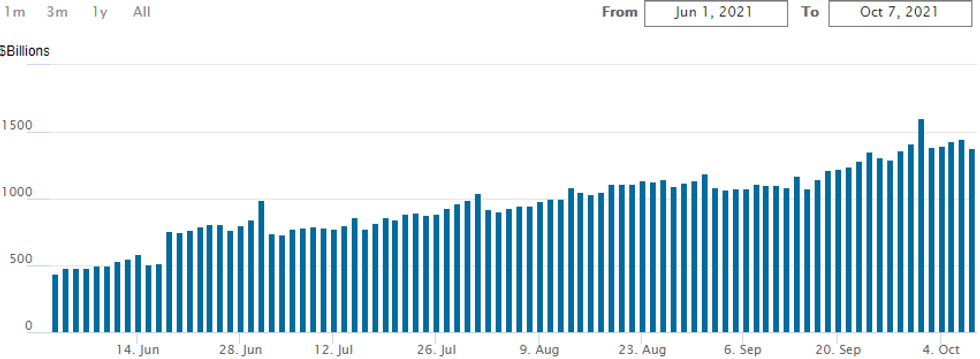

FED Reverse Repo Operation, Lower

NY Fed reverse repo usage recedes to $1,375.863B from 76 counterparties vs. $1.451.175B on Wednesday. Compares to record high of $1,604.881B on Thursday, September 30.

PIPELINE: $2.25B TransCanada Pipelines 2Pt Launched

- Date $MM Issuer (Priced *, Launch #

- 10/07 $2.4B #Kyndryl $700M 5Y +105, $500M 7Y +135, $650M 10Y +160, $550M 20Y +205

- 10/07 $2.25B #TransCanada Pipelines $1.25B 3Y +45, $1B 10Y +100

- 10/07 $1B #John Deere $600M 3Y FRN SOFR+20, $400M 5Y +32

- 10/07 $800M #Ontario Teachers Cadillac Property Trust 10Y +105

EGBs-GILTS CASH CLOSE: Peripheries Gain As Core Consolidates

A further moderation in energy prices helped support core European FI in a fairly rangebound session for core instruments Thursday, with Friday's U.S. payrolls figure still dominating attention.

- Gilts underperformed, with comments by BoE's new chief econ Huw Pill appearing to put him in a majority at the bank who see guidance conditions already "met".

- It was a generally risk-on session with strong equities, and periphery EGB spreads tightened, with ECB's Stournaras pushing against market rate hike pricing, and a BBG sources story on the ECB considering anew post-crisis bond-buying program.

- ECB minutes showed officials stressing PEPP flexbility.

- Supply this morning came from France (E10bn) and Spain (E4.9bn).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1bps at -0.704%, 5-Yr is down 1bps at -0.559%, 10-Yr is down 0.3bps at -0.185%, and 30-Yr is up 0.1bps at 0.302%.

- UK: The 2-Yr yield is up 0.4bps at 0.474%, 5-Yr is up 0.7bps at 0.698%, 10-Yr is up 0.6bps at 1.077%, and 30-Yr is up 0.1bps at 1.429%.

- Italian BTP spread down 3.3bps at 104.1bps / Greek down 2.9bps at 107.3bps

FOREX: JPY Sinks as US Lawmakers Strike Debt Ceiling Deal

- Haven currencies edged lower alongside the greenback Thursday, with solid progress on the US debt ceiling helping buoy risk sentiment. A vote among lawmakers is now possible ahead of Friday, with a bipartisan deal struck that would avoid the near-term crunch of a mid-October credit event. The $480bln package knocks back the debt ceiling deadline to early December, at which more political tussles are highly likely.

- As a result, equities rallied sharply, helping pressure the JPY to the bottom of the G10 pile and putting USD/JPY on track for a test of the mid-week highs at 111.79.

- Growth proxy currencies outperformed, with AUD leading markets higher to prompt a new October high at 0.7324. Further progress for the pair from here opens the 100-dma resistance at 0.7435.

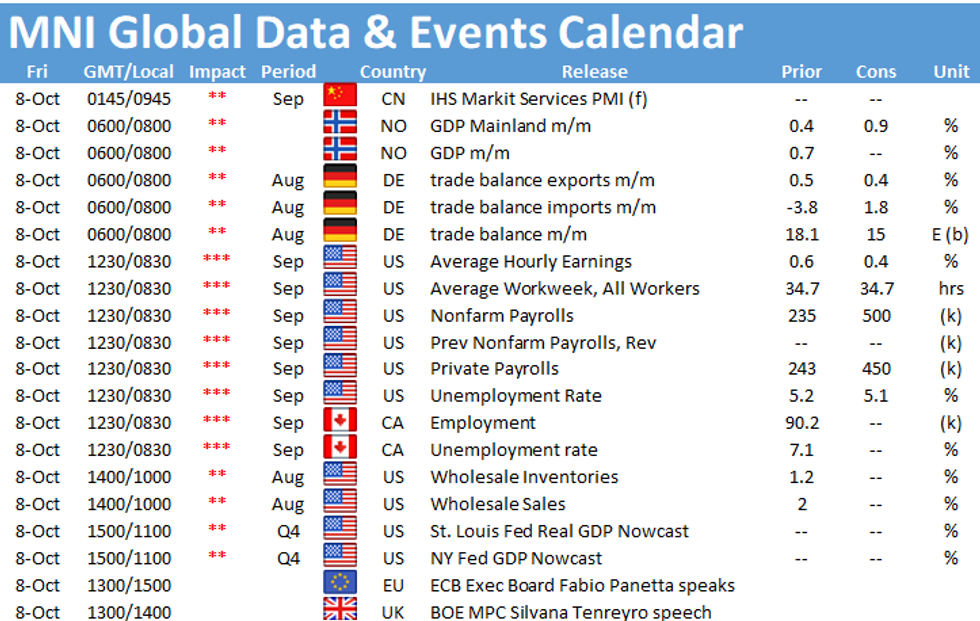

- Friday's nonfarm payrolls release is in focus, with markets expecting job gains of 500k over the month of September, equating to a drop of 0.1ppts in the unemployment rate. Caixin composite and services PMI data is also due from China, as well as Canada's latest labour market report. ECB's Lagarde also makes an appearance, speaking alongside US Treasury Secretary Yellen.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.