-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Darkest Before the Dawn, Fed In Media Blackout

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: BOC May Keep Rate Guidance, Reinvest QE

- MNI BRIEF: No Big Shift In Amount Tightening Needed- Tenreyro

- Sen Manchin Open to $1.75T Spending Plan After Biden Meeting, Bbg

CANADA

BOC: The Bank of Canada on Wednesday will likely stand firm on guidance that conditions for raising the record low policy interest rate will remain out of reach until the second half of next year, while offering inflation hawks another taper of quantitative easing to end new net purchases.

- The target overnight lending rate will remain 0.25% in the 10am EST decision according to all 19 forecasts in an MNI survey. Most investors say Governor Tiff Macklem will scale back the CAD2 billion a week of federal bond purchases to either CAD1 billion a week or CAD4 billion-CAD5 billion a month to roughly match maturing assets and keep the balance sheet stable around CAD500 billion. About a third of the market predicts a formal announcement that the "reinvestment phase" has begun. For more see MNI Policy main wire at 1214ET.

EUROPE

BOE: Bank of England Monetary Policy Committee Silvana Tenreyro rejected the idea that recent news flow has driven up sharply the magnitude of the rate hikes that are likely to be required in coming years. Her comments, at a CEPR event Monday, suggested that she believes recent market re-pricing, which showed Bank Rate, currently at 0.1%, rising to 1.25% by the end of 2022 was overdone.

- The balance of the latest "set of news is unlikely to have a large effect on the amount of tightening required over the next few years," she said, noting that in its August forecast round the MPC had only envisaged only gentle tightening over the three year forecast horizon. BOE Chief Economist Huw Pill last week made headlines saying that the November MPC meeting was "live" but he too downplayed the amount of tightening that would be required.

US TSYS: Focus on Midweek BoC, ECB Policy Announcements

Rather muted open to the week after the Fed entered policy blackout late Friday (through Nov 3, day after FOMC annc). No data, inside range trade. Mkts do have Bank of Canada (Wed) and ECB policy (Thu) announcements to look forward to.- Tsys hold modest gains across the board after the close -- near session highs since the initial move off session lows on the open. EGBs reacted similarly with no substantive headline or event to trigger. Yield curves held steeper profiles all session (5s30s +4.17 at 91.27 late).

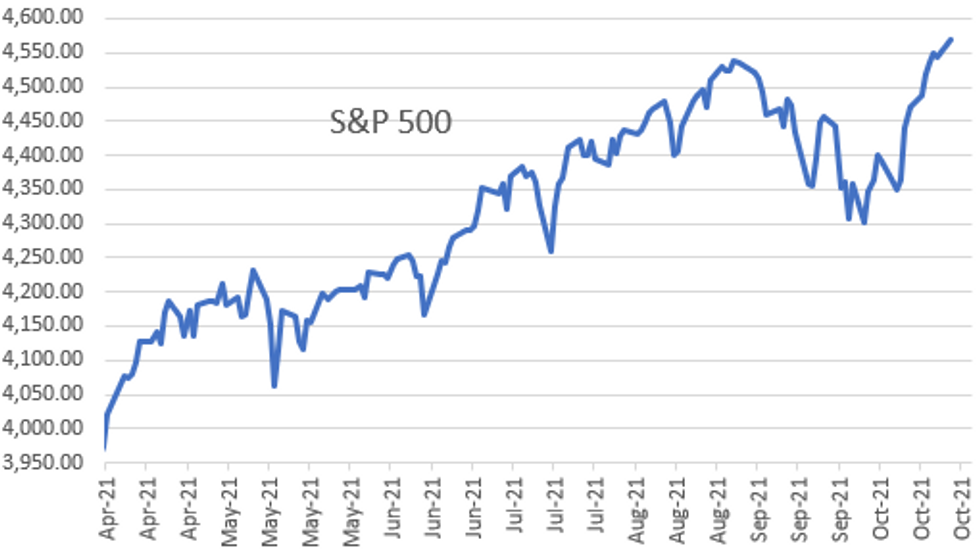

- Equities did continue to make new all-time highs (ESZ1 4564.0H) as latest earnings cycle expected to pick up this week. Meanwhile, WTI crude above $85/bbl (first time since late 2014) "after Saudi Arabia urged caution in boosting supply" Bbg.

- Large Eurodollar futures Block/cross: +10,000 White packs (EDZ1-EDU2) at +0.025 early in the second half, while Reds (EDZ2-EDU3) outperformed +0.045 after the bell. Option flow more paired with pick-up in low delta calls and call spds in the first half.

- The 2-Yr yield is down 2bps at 0.4332%, 5-Yr is down 2.3bps at 1.1727%, 10-Yr is up 0bps at 1.6325%, and 30-Yr is up 1.6bps at 2.0847%.

OVERNIGHT DATA

U.S. OCT. DALLAS FED MANUFACTURING INDEX AT 14.6 (vs. 6.2 est)

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 69.54 points (0.19%) at 35747.4

- S&P E-Mini Future up 23.25 points (0.51%) at 4560

- Nasdaq up 148.2 points (1%) at 15235.5

- US 10-Yr yield is up 0 bps at 1.6325%

- US Dec 10Y are up 7/32 at 130-18

- EURUSD down 0.0031 (-0.27%) at 1.1612

- USDJPY up 0.18 (0.16%) at 113.67

- WTI Crude Oil (front-month) down $0.26 (-0.31%) at $83.50

- Gold is up $15.16 (0.85%) at $1807.80

- EuroStoxx 50 down 0.5 points (-0.01%) at 4188.31

- FTSE 100 up 18.27 points (0.25%) at 7222.82

- German DAX up 56.25 points (0.36%) at 15599.23

- French CAC 40 down 20.82 points (-0.31%) at 6712.87

US TSY FUTURES CLOSE

- 3M10Y +0.87, 158.027 (L: 156.263 / H: 161.563)

- 2Y10Y +2.171, 119.667 (L: 117.7 / H: 121.571)

- 2Y30Y +3.877, 164.965 (L: 161.292 / H: 166.494)

- 5Y30Y +4.032, 91.134 (L: 87.225 / H: 92.195)

- Current futures levels:

- Dec 2Y up 2/32 at 109-22 (L: 109-20.125 / H: 109-22.875)

- Dec 5Y up 6/32 at 121-25.5 (L: 121-18.75 / H: 121-27.5)

- Dec 10Y up 7/32 at 130-18 (L: 130-08 / H: 130-22)

- Dec 30Y up 5/32 at 158-14 (L: 157-24 / H: 158-25)

- Dec Ultra 30Y up 2/32 at 191-4 (L: 189-29 / H: 191-27)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.810

- Mar 22 +0.025 at 99.780

- Jun 22 +0.020 at 99.620

- Sep 22 +0.025 at 99.450

- Red Pack (Dec 22-Sep 23) +0.030 to +0.045

- Green Pack (Dec 23-Sep 24) +0.015 to +0.035

- Blue Pack (Dec 24-Sep 25) +0.005 to +0.015

- Gold Pack (Dec 25-Sep 26) steady to +0.010

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00200 at 0.07150% (+0.00038 total last wk)

- 1 Month -0.00013 to 0.08775% (+0.00750 total laast wk)

- 3 Month +0.00962 to 0.13450% (+0.00125 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00588 to 0.17788% (+0.01150 total last wk)

- 1 Year +0.01250 to 0.32938% (+0.03725 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $274B

- Secured Overnight Financing Rate (SOFR): 0.05%, $863B

- Broad General Collateral Rate (BGCR): 0.05%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $331B

- (rate, volume levels reflect prior session)

- Tsys 22.5Y-30Y, $1.999B accepted vs. $4.227B submission

- Next scheduled purchases

- Tue 10/26 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 10/27 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 10/28 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Fri 10/29 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

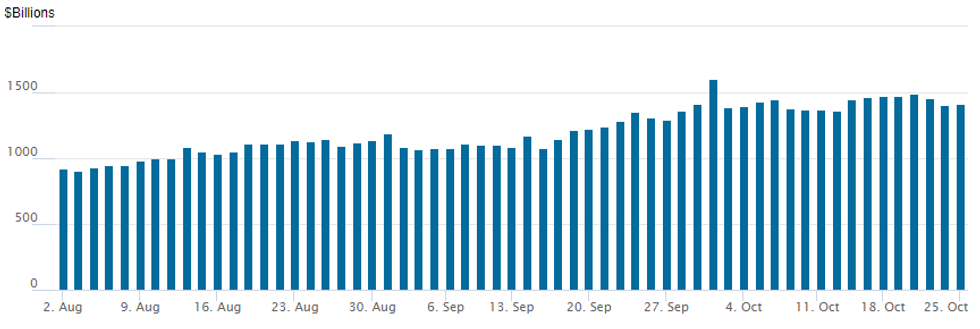

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,413.188B from 77 counterparties from $1,403.020B on Friday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: Synchrony Launched, Goldman Sachs Expected Shortly

- Date $MM Issuer (Priced *, Launch #)

- 10/25 $750M #Synchrony 10Y +125

- 10/25 $600M Goldman Sachs PerpNC5 4.375%a

- 10/25 $Benchmark SVB Financial 5Y +80a

- No New Issuance Friday; total for week at $63.25B, $120.7B/month

EGBs-GILTS CASH CLOSE: Peripheries Outperform As ECB Week Begins

German bonds strengthened across the curve Monday, while the UK saw bull steepening, following the lead of US Treasuries which saw an early afternoon rally.

- Little in the way of macro catalysts in the session, with some of last week's moves faded ahead of the ECB meeting this week and BoE next.

- Italy outperformed the space following S&P's ratings outlook revision to positive from stable after the close Friday. Portuguese 10s spread to Bunds dipped below 50bp, again nearing a 12-year tight level of 49bp (last set in January).

- BOE Tenreyro's commentary was predictably dovish-leaning, little market reaction.

- Supply included an auction tap of 7-Yr NGEU for E2.5bln.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.7bps at -0.664%, 5-Yr is down 2.9bps at -0.452%, 10-Yr is down 0.9bps at -0.114%, and 30-Yr is up 3bps at 0.269%.

- UK: The 2-Yr yield is down 1.4bps at 0.647%, 5-Yr is down 0.9bps at 0.82%, 10-Yr is down 0.5bps at 1.14%, and 30-Yr is down 0.3bps at 1.358%.

- Italian BTP spread down 2.5bps at 107.9bps/ Portuguese down 1.1bps at 50.4bps

FOREX: EUR Crosses Come Under Pressure As ECB Beckons

- G10 currencies exhibited mixed performances to start the week with a lack of economic data and a slew of central bank decisions scheduled over the coming days.

- The Euro was a notable underperformer ahead of Thursday's ECB rate decision and press conference. EURUSD held once again between 1.1665-70 before selling pressure saw the pair dip back below the 1.16 mark to lows of 1.1591. Broader trend conditions have remained bearish with recent gains for the pair considered corrective. Key support and the bear trigger is 1.1524.

- With the single currency under some renewed pressure, the most significant moves since the open were in EURAUD and EURNZD, rising 0.65% and 0.45% respectively. This marked a resumption of a broad downtrend in place for both these pairs throughout October and may be monitored more closely as Thursday's meeting looms.

- USDCAD continues to consolidate ahead of Wednesday's BoC decision. The pair however remains in downtrend with moving average conditions remaining in bear mode, reinforcing current trend conditions. Initial firm resistance is seen at 1.2494, Sep 3 low. A break would ease bearish pressure.

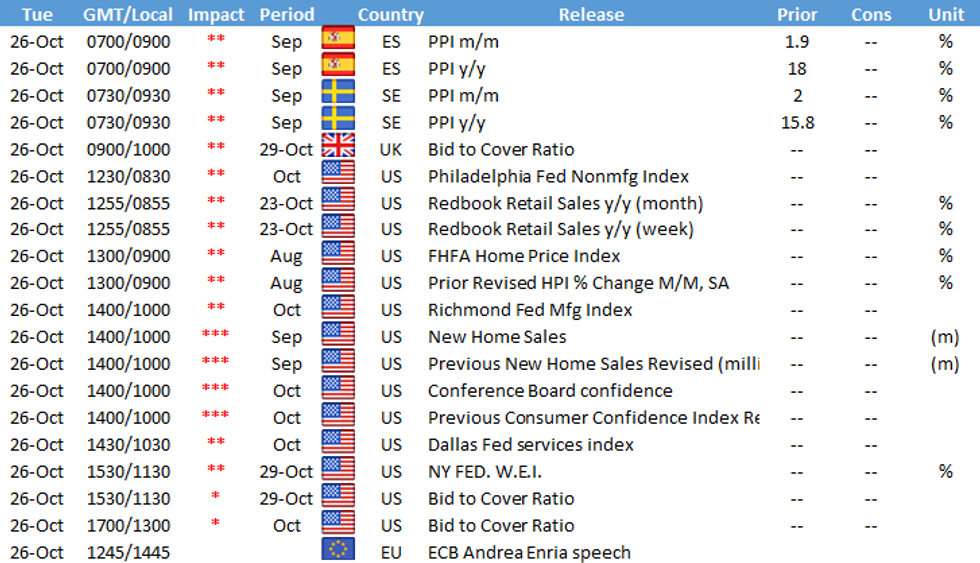

- Another light data calendar on Tuesday with US consumer confidence the headline. Markets will focus their attention on Wednesday's release of Australian CPI and the Bank of Canada October meeting.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.