-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Inflation Focus

EXECUTIVE SUMMARY

- MNI INTERVIEW: Consumers Fear Policy Inaction on US Inflation

- MNI INTERVIEW: US Job Mkt Has Hard Road Back To Broad Strength

- MNI BRIEF: Williams Says Fed's FAIT Framework Still Needed

- CHICAGO FED EVANS: NERVOUS PRICE PRESSURES LASTING LONGER THAN HE EXPECTED

- MNI: EVANS SAYS EXPECTATIONS REMAIN RELATIVELY WELL BEHAVED

- MNI: EVANS SAYS TAPERING SHOULD BE DONE BY MID-2022

US

FED: Americans are increasingly worried inflation will stick around longer than Washington policymakers have maintained, and the strains could intensify as workers push to catch up with bigger wage increases, the head of the University of Michigan's Survey of Consumers told MNI.

- Many households view the recurring message that inflation is transitory as a sign that authorities are unlikely to act, Richard Curtin said in a phone interview Thursday.

- "Consumers don't think the government has policies that will restrain inflation so they're very pessimistic about getting any help in the future," Curtin said. "They interpret the government message as they will not do anything."

FED: America's job market faces big challenges restoring broad-based gains such as matching laid-off workers back into positions lost in the pandemic and restoring participation rates held back by older workers and women, the head of a Minneapolis Federal Reserve institute told MNI.

- "What we didn't know before some of this newer work is that the participation rate does seem to be responding to these cyclical ups and downs, but just potentially with a very great lag," said Abigail Wozniak, Director of the Opportunity and Inclusive Growth Institute. "It really points to the importance of trying to retain workers' connections to the labor market to grow out of downturns like this one."

- "This matching process, and I think that is something that hasn't made it into the conversation as much about kind of a significant barrier to workers returning," she said. "There could be some role for asking employers to take a broader look at their applicant pools, potentially some kinds of encouragements for workers to try searching, or workplaces to try offering some more flexibility." For more see MNI Policy main wire at 1042ET.

- "Those factors are unlikely to change anytime soon," he said. "The fundamental realities of the global economy are still there and so the reasons to set up the new framework, which again was about anchoring inflation expectations at the target, not below the target, and obviously the issues around explaining maximum employment and how that how that fits into our policy strategy. Those are completely relevant for the future as well." For more see MNI Policy main wire at 1031ET.

Philly Fed Sees Further Inflationary Pressures

Today's Philly Fed report looks very similar to Empire from earlier this week so has less shock for markets (hence very little reaction in Tsys), but inflationary pressures continued to intensify within the details.

- The prices paid diffusion increased back to just shy of June's 42-year high whilst prices received was the highest since 1974 (47-year), with a net 63% of firms increasing prices on the month.

- In the special questions, firms saw their own prices rising a median 5.3% over the next four quarters, up from 5% when last asked in Aug.

- Employee compensation costs are expected to rise 4.8% over the next four quarters, up from 4.0% in Aug.

Inside Range, Little React Weekly Claims, Dec/Mar Roll Gets Underway

Rates trading firmer after the bell, inside range day for Tsys, short end curves mildly flatter on average overall volumes: TYZ1 just over 1.2M. Pick-up in Dec/Mar quarterly futures rolling contributing to volumes (TYZ/TYH near 100k in late trade.- Not much of a react to data: weekly claims slipped -1K to 268K, continuing claims -0.129M to 2.080M; though Philly Fed mfg index climbed 39.0 vs. 24.0 est the report looked very similar to Empire from earlier this week so has less shock for markets (hence very little reaction in Tsys), but inflationary pressures continued to intensify within the details.

- Not as much of a positive correlation between rates and equities today with the former rallying as equities pared gains after the open (only to recover by noon). Mixed flow two-way positioning/squaring ahead next week's shortened Thanksgiving holiday.

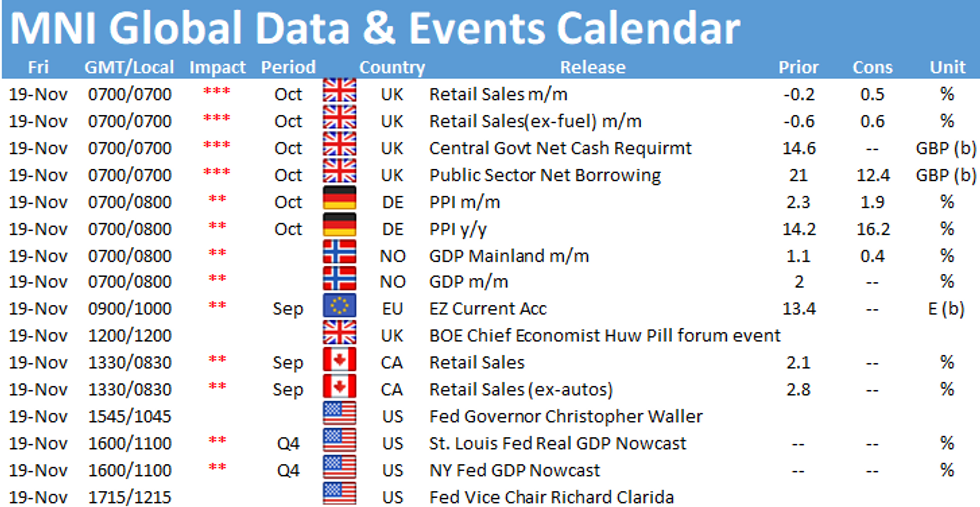

- No data on tap Friday, but Fed Gov Waller will discuss eco-outlook and take moderated Q&A (1045ET) followed by Fed VC Clarida, discussing global mon-pol coordination, w/ text and moderated Q&A at 1215ET.

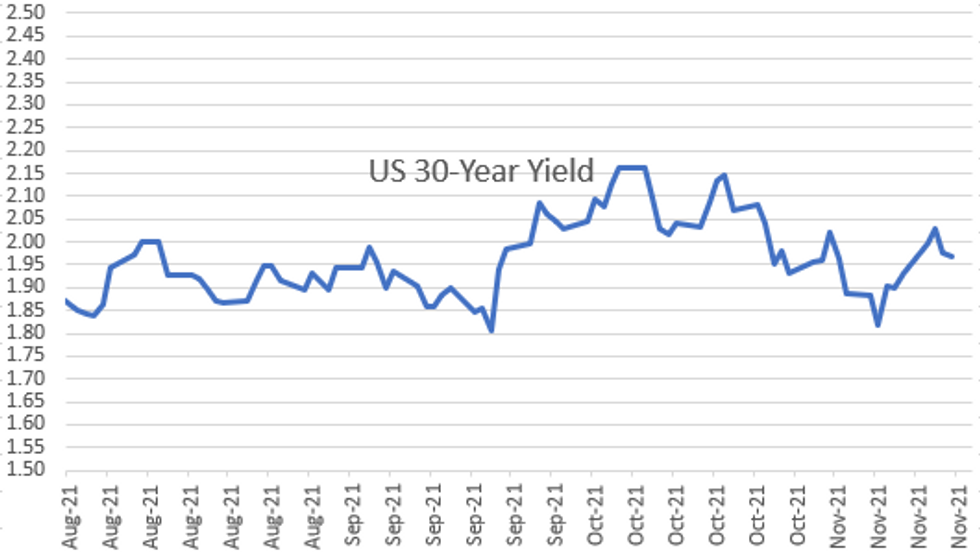

- The 2-Yr yield is up 0bps at 0.4981%, 5-Yr is down 1.1bps at 1.2196%, 10-Yr is down 0.5bps at 1.5838%, and 30-Yr is down 0.8bps at 1.9678%.

OVERNIGHT DATA

- US JOBLESS CLAIMS -1K TO 268K IN NOV 13 WK

- US PREV JOBLESS CLAIMS REVISED TO 269K IN NOV 06 WK

- US CONTINUING CLAIMS -0.129M to 2.080M IN NOV 06 WK

- US NOV PHILADELPHIA FED MFG INDEX 39

- October reading of the Leading Economic Indicators is +0.9%

- FOREIGN HOLDINGS OF CANADA SECURITIES +20.0B CAD IN SEP

- CANADIAN HOLDINGS OF FOREIGN SECURITIES +17.2B CAD IN SEP

MARKET SNAPSHOT

Key late session market levels:

- DJIA down 48.64 points (-0.14%) at 35880.07

- S&P E-Mini Future up 12.25 points (0.26%) at 4698.5

- Nasdaq up 40 points (0.3%) at 15961

- US 10-Yr yield is down 0.5 bps at 1.5838%

- US Dec 10Y are up 4.5/32 at 130-19

- EURUSD up 0.0052 (0.46%) at 1.1371

- USDJPY up 0.16 (0.14%) at 114.24

- WTI Crude Oil (front-month) up $0.56 (0.71%) at $78.93

- Gold is down $8.82 (-0.47%) at $1858.63

- EuroStoxx 50 down 17.11 points (-0.39%) at 4383.7

- FTSE 100 down 35.24 points (-0.48%) at 7255.96

- German DAX down 29.4 points (-0.18%) at 16221.73

- French CAC 40 down 14.87 points (-0.21%) at 7141.98

US TSY FUTURES CLOSE

- 3M10Y +0.34, 153.65 (L: 151.6 / H: 156.056)

- 2Y10Y +0.22, 108.71 (L: 107.246 / H: 110.225)

- 2Y30Y +0.176, 147.397 (L: 146.159 / H: 149.157)

- 5Y30Y +1.093, 75.445 (L: 73.435 / H: 75.632)

- Current futures levels:

- Dec 2Y up 0.875/32 at 109-21.125 (L: 109-20 / H: 109-21.375)

- Dec 5Y up 2.75/32 at 121-18 (L: 121-12.5 / H: 121-19.25)

- Dec 10Y up 4.5/32 at 130-19 (L: 130-11.5 / H: 130-21.5)

- Dec 30Y up 14/32 at 160-28 (L: 160-13 / H: 161-05)

- Dec Ultra 30Y up 24/32 at 194-23 (L: 193-28 / H: 195-08)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.793

- Mar 22 +0.005 at 99.755

- Jun 22 +0.010 at 99.585

- Sep 22 +0.005 at 99.355

- Red Pack (Dec 22-Sep 23) +0.005 to +0.030

- Green Pack (Dec 23-Sep 24) +0.030 to +0.040

- Blue Pack (Dec 24-Sep 25) +0.040

- Gold Pack (Dec 25-Sep 26) +0.035 to +0.040

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00100 at 0.07425% (-0.00050/wk)

- 1 Month +0.00238 to 0.09113% (+0.00200/wk)

- 3 Month +0.00213 to 0.15963% (+0.00688/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00513 to 0.22350% (-0.00263/wk)

- 1 Year -0.00888 to 0.38975% (-0.00875/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $271B

- Secured Overnight Financing Rate (SOFR): 0.05%, $893B

- Broad General Collateral Rate (BGCR): 0.05%, $347B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $1.576B accepted vs. $3.762B submission

- Next scheduled purchase

- Fri 11/19 1010-1030ET: TIPS 1Y-7.5Y, appr $1.775B

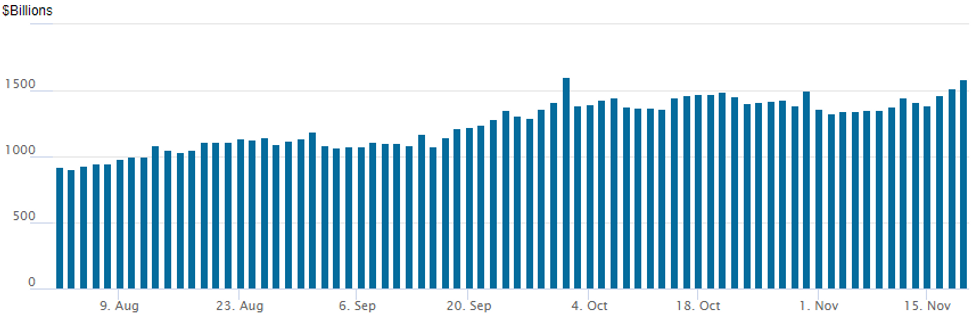

FED Reverse Repo Operation, Closing In On All-Time High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new month high of $1,584.097B from 74 counterparties vs. Wednesday's $1,520.000B. Closing in on record high of 1,604.881B from Thursday, September 30.

PIPELINE: $5.625B Corporate Debt Issuance Thursday

- Date $MM Issuer (Priced *, Launch #)

- 11/18 $1.35B #Renesas $500M 3Y Green +70, $850M 5Y +95

- 11/18 $1.05B #CubeSmart $550M 7Y +85, $500M 10Y +100

- 11/18 $1B *Kommuninvest 2Y 0.539%

- 11/18 $1B #IHS Towers $500M 5NC2 5.625%, $500M 7NC3 6.25%

- 11/18 $675M #Massachusetts Mutual Life 40Y +125

- 11/18 $550M #HUB Int 8NC3 5.625% (dropped $650M 7NC3)

- 11/18 $Benchmark Valero Energy 10Y +130a, 30Y +170a

- 11/19 $Benchmark CDW Corp investor calls Fri

FOREX: Euro Extends Bounce Off Lows As Dollar Momentum Halted

- EURUSD rose the best part of half a percent on Thursday as broad dollar indices consolidated at lower levels. The single currency strengthened to around 1.1370, edging toward initial resistance at 1.1386, Tuesday's high.

- NZDUSD matched the Euro's ascent and remains atop the G10 leaderboard. The currency took the lead from 2yr inflation expectation data released overnight, which surged to 2.96% from 2.27% previously - the highest rate since 2011. NZD/USD rallied to narrow the gap with the 50-dma of 0.7056. A break above here would see the short-term outlook improve toward 0.71 and the 200-dma.

- Elsewhere EURNOK had a notable move higher of around 1.2%. EURNOK finds itself back above 10.00 for the first time since early October. The move came amid news from the central bank that they are halting their krone purchases carried out on behalf of the government for the rest of the month, effective from Nov. 19.

- In emerging markets, there was continued focus on an extremely volatile Turkish Lira. Liquidity evaporated in USDTRY above 11.00, sparking a rapid acceleration to print fresh all-time highs at 11.3118. This extended the daily range to a massive 8.25%, before the pair consolidated somewhat back towards the 11 handle, currently up 3.3% for Thursday. The days advance strings together 8 consecutive positive sessions, strengthening roughly 17% at its Thursday peak.

- UK October retail sales kicks off tomorrow's data calendar before ECB's LaGarde is due to deliver opening remarks at the Frankfurt European Banking Congress. Canadian retail sales is the highlight of the US session before Fed's Clarida speaks at 1715GMT/1215ET on global monetary policy coordination.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.