-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Chair Signals Faster Than Taper Pace

EXECUTIVE SUMMARY

- MNI BRIEF: Powell Says Fed Will Discuss Faster Taper in December

- MNI BRIEF: Clarida-Prices Must Slow To Keep Expectations Stable

- US DATA: MNI Chicago Business Barometer Falls To 61.8 In November

- CDC CONSIDERING REQUIRING QUARANTINE FOR SOME ARRIVALS, Bbg

US

FED: The Federal Reserve will consider speeding up the taper of its QE program at its December meeting given strong inflation, growth and employment data.

He told the Senate Banking Committee it is "appropriate to consider wrapping up the taper of our asset purchases, which we actually announced at the November meeting, perhaps a few months sooner."

- At the November FOMC Powell said they "took a step back from 'transitory'" in the Statement, which explained that supply-side factors driving high inflation largely reflect factors "that are expected to be transitory", a change from language that said elevated inflation "largely" reflected "transitory factors".

- Powell explained this change at the time: "It's become a word that's attracted a lot of attention that maybe is distracting from our message, which we want to be as clear as possible".

- "I'm comfortable now where inflation expectations are," Clarida said Tuesday in a talk with Cleveland Fed President Loretta Mester. "Price stability, this is about well-anchored inflation expectations, and so getting actual inflation, you know, down close to 2 is going to be an important part of keeping those expectations anchored."

- The inflation goal for raising near-zero interest rates has been met and the FOMC's last dot plot showing a split on hiking next year is consistent with monitoring the other goal on full employment, he said. "There have been enormous improvements in the labor market," Clarida said, and "wage gains are healthy, but they're not out of line with the productivity we're seeing in the economy."

US TSYS: Fed Chair Powell Roils Policy Waters Ahead Friday Blackout

So much for not roiling the waters ahead late Friday's media blackout on monetary policy. Likely under pressure to allay higher and/or entrenched inflation concerns, Fed Chair Powell surprised mkts at Tue's Cares Act testimony when he suggested it was "TIME TO RETIRE THE WORD TRANSITORY REGARDING INFLATION" while the "THREAT OF PERSISTENTLY HIGHER INFLATION HAS GROWN."- Yld curves flattened as Tsys reversed course/sold off, short end hammered, bonds bounced back to session highs within an hour (30YY 1.7745L).

- Fed Chair comments on wrapping up tapering a "few months sooner" took a toll on short end, Sep'22 Eurodollar futures fell appr 12bps to 99.30 low, VIX vol index spiked to 28.56 (+5.7), put volumes surged and equities sold off (ESZ1 -80.0 at 4571.0). Significant Block 5s/ultra 10s flattener: -14,021 FVH2 vs. +5,650 UXYH2.

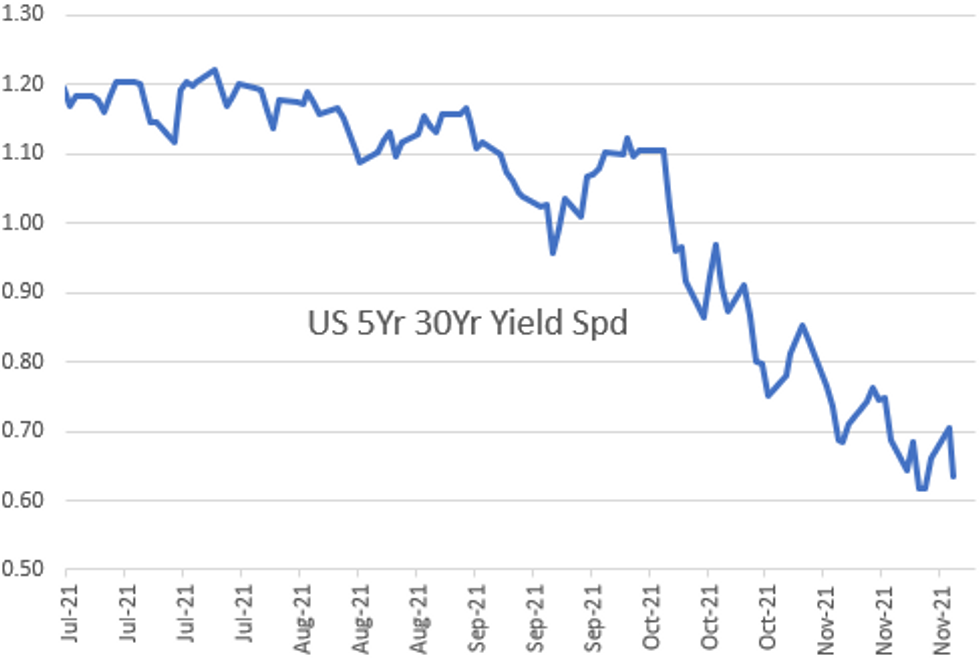

- Long end outperformed amid flurry of steepener stop-outs, general view of economy, uncertainty over Covid variants etc. 5s30s almost dipped below 59.0 -- lowest since March 2020, drew spec and fast$ buying with spd back to 63.5 late.

- Data on tap Wed includes ADP private jobs (+525k est vs. +571k prior) may give some indication on employ conditions ahead Fri' NFP (+535k est vs. +531k prior).

- The 2-Yr yield is up 3.9bps at 0.5236%, 5-Yr is down 0.3bps at 1.1468%, 10-Yr is down 6.1bps at 1.4375%, and 30-Yr is down 7.3bps at 1.7818%.

OVERNIGHT DATA

- MNI CHICAGO BUSINESS BAROMETER 61.8 NOV V 68.4 OCT

- MNI CHICAGO: PRICES PAID AT 93.8; DOWN MODESTLY ON OCT

- MNI CHICAGO: OCT EMPLOYMENT AT 51.6 VERSUS 56.6 OCT

- MNI CHICAGO: PRODUCTION 61.5 NOV V 58.5 OCT

The Chicago Business Barometer fell 6.6 points to 61.8 in November, the lowest reading since February, driven by a slow-down in new orders. Inventories hit a three-year high as firms stock up in an attempt to beat shortages and long lead times.

- Among the five main indicators, Inventories saw the largest increase, followed by Production. All other indicators dropped compared to October, with Order Backlogs seeing the largest decline.

- Production recovered slightly in November, up 3 points following three straight falls from August to October. New Orders fell back to their February level, down 9.3 points to 58.2.

- US Q3 FHFA HPI Q/Q SA +4.2% V +18.5% Q3 2020

- US SEP FHFA HPI SA +0.9% V +1.0% AUG; +17.7% Y/Y

- US REDBOOK: NOV STORE SALES +16.9% V YR AGO MO

- US REDBOOK: STORE SALES +21.9% WK ENDED NOV 27 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

- CANADA Q3 GDP DATA SHOW WAGES +2.9%, 2ND MOST SINCE 2000

- CANADA FLASH OCTOBER GDP +0.8% MOM

- CANADA SEP GROSS DOMESTIC PRODUCT +0.1% MOM

- CANADA SEP GOODS INDUSTRY GDP -0.6%, SERVICES +0.4%

- CANADA REVISED AUG GROSS DOMESTIC PRODUCT +0.6% MOM

- CANADIAN Q3 GROSS DOMESTIC PRODUCT +5.4% ANNUALIZED

- CANADIAN Q2 REVISED GDP -3.2% ANNUALIZED

- CANADIAN Q3 GDP +1.3% ON QOQ BASIS

MARKET SNAPSHOT

Key late session market levels:

- DJIA down 494.31 points (-1.41%) at 34643.03

- S&P E-Mini Future down 61 points (-1.31%) at 4590.25

- Nasdaq down 194.8 points (-1.2%) at 15588.21

- US 10-Yr yield is down 6 bps at 1.4392%

- US Mar 10Y are up 17.5/32 at 130-26.5

- EURUSD up 0.0029 (0.26%) at 1.132

- USDJPY down 0.39 (-0.34%) at 113.14

- WTI Crude Oil (front-month) down $3.76 (-5.38%) at $66.21

- Gold is down $9.36 (-0.52%) at $1775.27

- EuroStoxx 50 down 46.45 points (-1.13%) at 4063.06

- FTSE 100 down 50.5 points (-0.71%) at 7059.45

- German DAX down 180.73 points (-1.18%) at 15100.13

- French CAC 40 down 55.09 points (-0.81%) at 6721.16

US TSY FUTURES CLOSE

- 3M10Y -6.627, 138.427 (L: 135.296 / H: 145.576)

- 2Y10Y -9.266, 91.783 (L: 90.015 / H: 101.21)

- 2Y30Y -10.021, 126.61 (L: 122.877 / H: 136.854)

- 5Y30Y -6.225, 63.902 (L: 59.042 / H: 74.489)

- Current futures levels:

- Mar 2Y down 0.75/32 at 109-12.25 (L: 109-08.62 / H: 109-18)

- Mar 5Y up 4.75/32 at 121-13.25 (L: 121-01 / H: 121-27.5)

- Mar 10Y up 17.5/32 at 130-26.5 (L: 130-08.5 / H: 131-10)

- Mar 30Y up 1-22/32 at 162-4 (L: 160-14 / H: 162-12)

- Mar Ultra 30Y up 3-13/32 at 200-17 (L: 197-08 / H: 201-04)

US EURODOLLAR FUTURES CLOSE

- Dec 21 +0.003 at 99.795

- Mar 22 -0.020 at 99.720

- Jun 22 -0.025 at 99.555

- Sep 22 -0.035 at 99.345

- Red Pack (Dec 22-Sep 23) -0.035 to steady

- Green Pack (Dec 23-Sep 24) +0.010 to +0.060

- Blue Pack (Dec 24-Sep 25) +0.070 to +0.085

- Gold Pack (Dec 25-Sep 26) +0.090 to +0.105

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00012 at 0.07650% (+0.00238/wk)

- 1 Month -0.00525 to 0.09400% (+0.00362/wk)

- 3 Month +0.00238 to 0.17325% (-0.00212/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00275 to 0.24325% (-0.00275/wk)

- 1 Year -0.03750 to 0.38238% (-0.02800/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $85B

- Daily Overnight Bank Funding Rate: 0.07% volume: $279B

- Secured Overnight Financing Rate (SOFR): 0.05%, $953B

- Broad General Collateral Rate (BGCR): 0.05%, $350B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $328B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $1.574B accepted vs. $2.555B submission

- Tsy 7Y-10Y, $2.801B accepted vs. $7.360B submission earlier

- Next scheduled purchases

- Wed 12/01 1100-1120ET: Tsy 4.5Y-7Y, appr $5.275B

- Thu 12/02 1010-1030ET: TIPS 7.5Y-30Y, appr $1.075B

- Fri 12/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

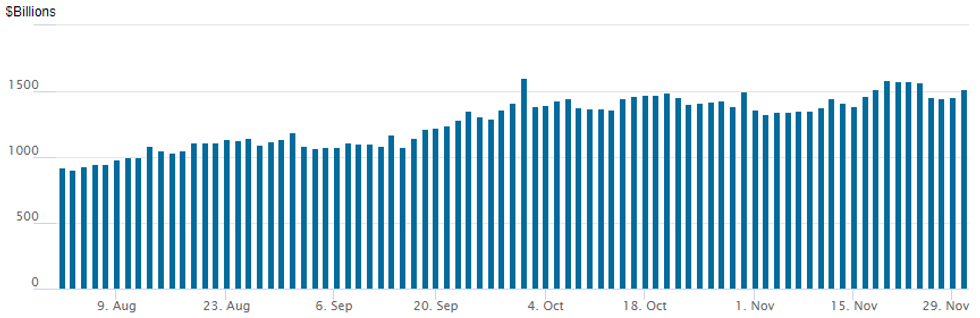

FED Reverse Repo Operation

NY Federal Reserve/MNI

Still a little off mid-November highs, NY Fed reverse repo usage climbs to $1,517.956B from 84 counterparties vs. $1,459.339B on Monday. Record high remains at 1,604.881B from Thursday, September 30.

PIPELINE: $5.775B Priced Monday, Farm Credit Banks Sys 2Y on Tap

- Date $MM Issuer (Priced *, Launch #)

- 11/30 $Benchmark Farm Credit Banks Sys 2Y

- $5.775B Priced Monday

- 11/29 $1.35B *Consolidated Edison $750M 2.4% '31 tap +87, $600M 30Y +132

- 11/29 $1.2B *Dollar Tree $800M 10Y +115, $400M 30Y +150

- 11/29 $1.15B *Duke Energy FL $650M 10Y +90, $500M 30Y +115

- 11/29 $625M *Burlington Northern WNG 30Y +102

- 11/29 $600M *American Transmission WNG 10Y +115

- 11/29 $500M *AON Corp 10Y +108

- 11/29 $350M *Swedish Export Credit 2023 tap FRN/SOFR+16

- 11/29 $Benchmark Olympus 5Y investor calls

EGBs-GILTS CASH CLOSE: Significant Flattening

Bunds and Gilts outperformed Treasuries Tuesday, with the long ends of the curves enjoying a strong rally despite a near-30Y high eurozone inflation reading.

- Though the overall tone was bullish, with equities tumbling amid fears over the Omicron Covid variant/lockdowns, short-end US Tsys sold off on Fed Chair Powell's signalling a quicker taper pace may be imminent; 2Y UK and German yields rose sharply in tandem.

- Overall, curves ended much flatter - UK 5s30s and 10s30s flattest since 2008.

- Periphery EGB spreads widened after enjoying some compression Monday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.4bps at -0.737%, 5-Yr is up 0.7bps at -0.618%, 10-Yr is down 3.2bps at -0.349%, and 30-Yr is down 7.7bps at -0.058%.

- UK: The 2-Yr yield is down 2.1bps at 0.484%, 5-Yr is down 3.2bps at 0.62%, 10-Yr is down 5.2bps at 0.809%, and 30-Yr is down 9.3bps at 0.853%.

- Italian BTP spread up 2.4bps at 131.8bps / Spanish up 0.9bps at 74.8bps

FOREX: Dollar Whipsaws On Omicron/Fed’s Powell Headlines

- The greenback spent the early part of Tuesday in a steady downtrend as Moderna's CEO poured some water on hopes that the current suite of vaccines would retain effectiveness in the face of new variants.

- Just as wires reported the U.S. dollar was posting its biggest drop since early May, Fed Chair Powell shocked the markets by stating the FOMC can consider wrapping up the taper “a few months early” as well as commenting that it may be time to retire the word transitory regarding inflation.

- The headlines culminated in an immediate spike in the dollar and an entire reversal of the day’s losses. The dollar index rallied a little over 1% amid the pressure in equities and front-end US yields shifting higher. EURUSD sold off from 1.1375 to 1.1236 and USDJPY rose back above the 1.13 mark to print highs at 1.1370.

- Despite the powerful move higher for broad dollar indices, follow through was short-lived and momentum quickly subsided. The dollar index spent the next few hours grinding lower, back into negative territory. As of writing, the DXY resides down 0.25%.

- Overall, there are mixed performances in G10 FX. With EURUSD and USDJPY broadly tracking the dollar index performance, risk/commodity tied currencies such as AUD and CAD have actually weakened around 0.5% against the greenback – continuing their November downtrends.

- On the technical front it is worth pointing out that initial firm resistance in EURUSD at 1.1374, Nov 18 high and the 20-day EMA at 1.1383. have held at the first time of asking amid the volatile price action.

- In emerging markets, USDTRY made another all-time-high at 13.6820 as reports emanated that a central bank executive director had left his post and Lira losses extended amid the late hit to global risk sentiment.

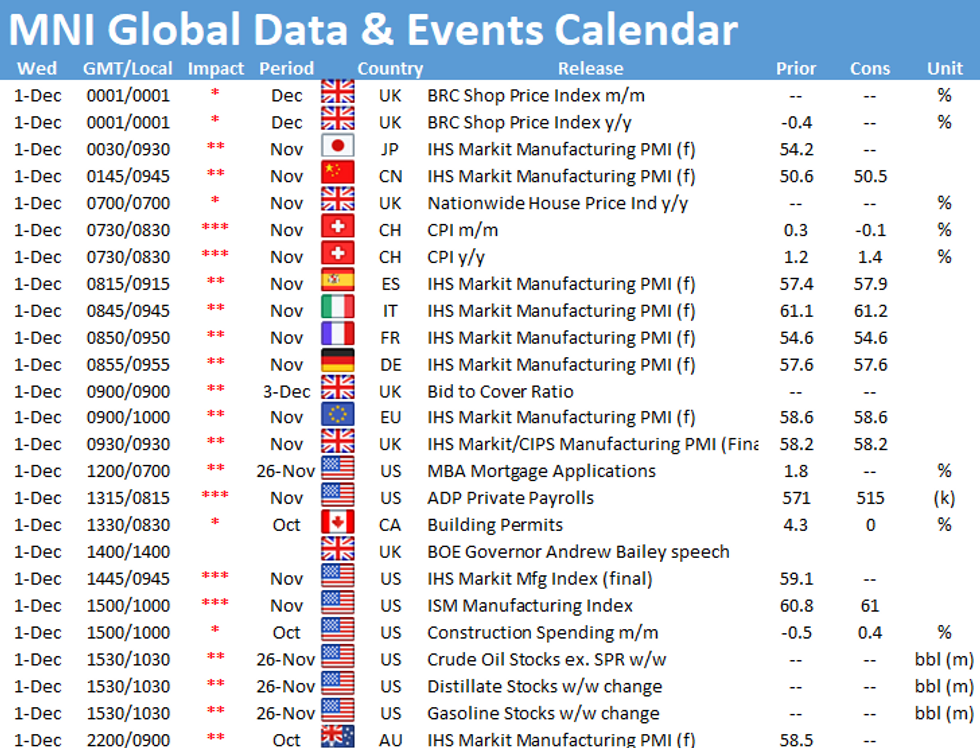

- December kicks off with Australian Q3 GDP overnight before final European PMI prints. US ADP and Ism Manufacturing PMI headline the US docket ahead of Fridays NFP report.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.