-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI ASIA OPEN: Year-End Policy Panoply

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: Record Inflation Spurs Faster Fed Tightening

- MNI: Draghi Tells Staff To Gauge Market Impact Of President Bid

- MNI STATE OF PLAY: BOC- Hot CPI Still Focus Amid New Job Goal

- MNI: CANADA EXTENDS 2% CPI TARGET, ADDS MAX EMPLOYMENT GOAL

US

FED: The Federal Reserve is expected to scale back its pandemic-era asset purchase program more quickly on Wednesday and pencil in two to three rate hikes next year after inflation hit a 39-year high last month.

- U.S. inflation topped 6.8% in November and core CPI hit 4.9% as strong demand for cars and furniture were again met with supply shortages. Price pressures have also broadened in recent months, with shelter costs climbing steadily and restaurant industry wage hikes filtering through to higher dining out prices.

- Ex-officials interviewed by MNI expect a likely doubling of the pace of QE tapering to USD30 billion in January and February, giving policymakers the option to lift interest rates from near zero as soon as the March FOMC meeting.

CANADA

BOC: Bank of Canada Governor Tiff Macklem on Monday said his focus remains bringing inflation back to the 2% target and now isn't the time to use an expanded mandate giving him flexibility to seek maximum employment.

- “This is an agreement for five years, and with respect to this idea of actively seeking or probing for maximum sustainable employment, I want to underline that’s something that you do when inflation is close to target and interest rates are at more normal levels," Macklem said at a press conference in response to a question from MNI. "That’s not the situation that we’re in right now. Right now inflation is well above our target and we’re very focused on assessing the diminishing degree of excess supply in our economy and bringing inflation sustainably back to target.”

- Macklem and Finance Minister Chrystia Freeland on Monday added a new mandate to seek maximum employment when possible within its primary goal of targeting 2% inflation, a move few expected and the biggest overhaul of an agreement with the government since CPI targeting was introduced three decades ago. For more see MNI Policy main wire at 1344ET.

EUROPE

ITALY: Italian Prime Minister Mario Draghi has told close advisors to gauge the possible impact of his departure on financial markets as he considers moving to the country’s presidency in February, two sources familiar with the matter told MNI.

- Draghi has also asked his team to avoid any serious confrontation within his coalition in the weeks leading up to January’s secret ballots by both houses of the Parliament and regional representatives to elect the successor to President Sergio Mattarella, the sources said.

- Italy’s political parties want a new president able to use the largely ceremonial role in the interests of stability, but while Draghi meets the job description, he would first want to lay the foundations for his government to be able to survive without him. A recent article in the Financial Times warning of trouble if Draghi leaves the premiership caused dismay in his inner circle, one of the sources said, noting that a negative market reaction to a change in his role would be more likely if the coalition collapses, triggering snap elections. For more see MNI Policy main wire at 0846ET.

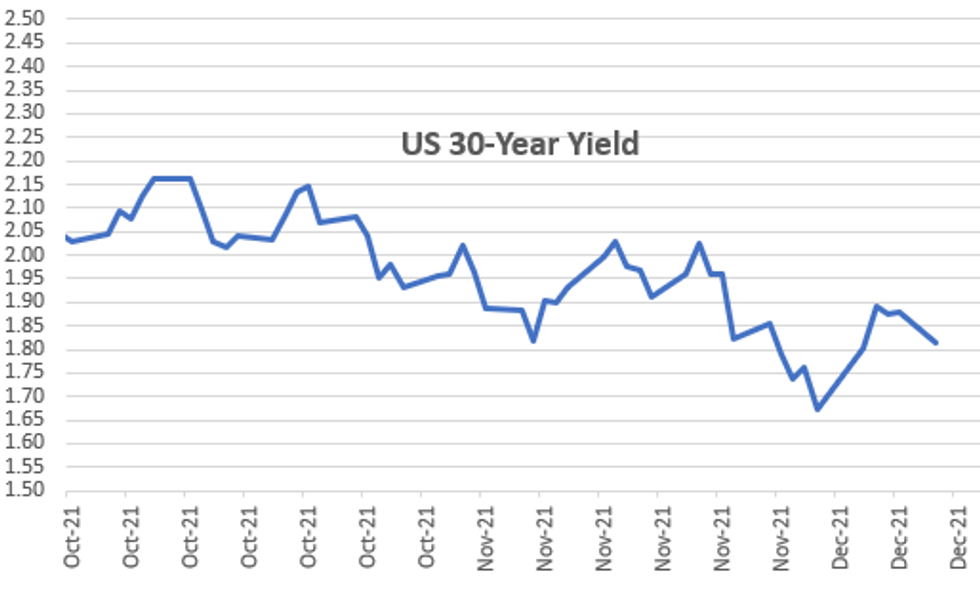

US TSYS: Tsy Yields Recede, Inflation Exp Rise

Busy week for central bank policy annc, FOMC on Wed, BoE and ECB on Thursday. Modest volumes with no data Monday (TYH2 just over 790k late), though NY Fed released 1Y inflation expectation of 6% underpinning rates.

- Rates marched steadily higher from narrow pre-open levels. Yield curves bear steepening (5s30s back below 60.0 at 59.605 late), 30YY 1.7991% low, 10YY 1.4105% low.

- Trading desks reported selling into the grinding bid swap-tied selling in intermediates, domestic real$ selling 30s. No corporate or Tsy coupon supply tied hedging. Either risk-off with two-three waves of program selling in equities (ESH2 -30.0 late) -- or simply position squaring ahead the FOMC.

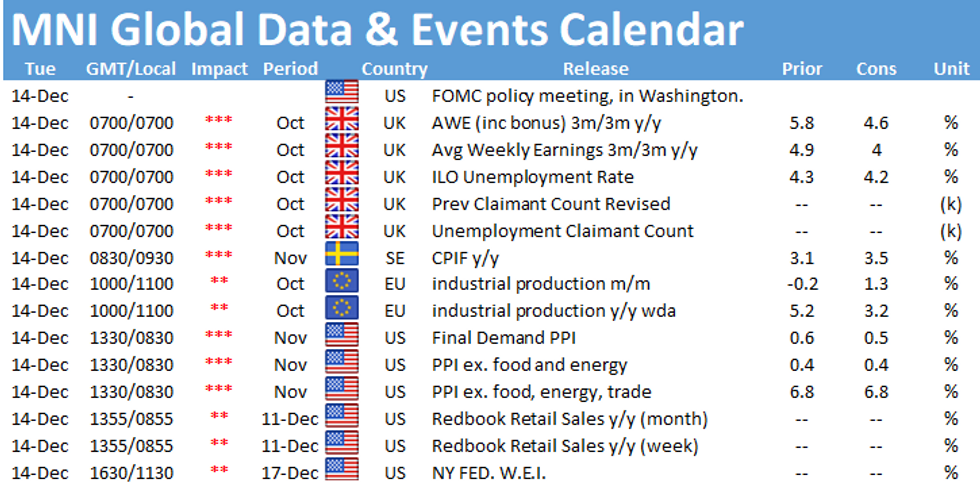

- Tuesday data focus PPI Final Demand MoM (0.6%, 0.5%); YoY (8.6%, 9.2%).

- The 2-Yr yield is down 1.2bps at 0.6425%, 5-Yr is down 3.8bps at 1.2125%, 10-Yr is down 6bps at 1.4241%, and 30-Yr is down 6.6bps at 1.8118%.

OVERNIGHT DATA

- CANADA EXTENDS 2% CPI TARGET, ADDS MAX EMPLOYMENT GOAL

- BOC TO ACTIVELY SEEK MAX EMPLOYMENT WHEN CONDITIONS ALLOW

- BOC MANDATE ADDS LINES ON CLIMATE CHANGE, INEQUALITY

- FREELAND, MACKLEM CALL STRONG INFLATION A GLOBAL PRESSURE

- BOC SAYS LOW RATE ERA MEANS OTHER TOOLS NEEDED MORE OFTEN

- BOC MAY USE MORE PATIENCE AND PROBING ON RATE HIKES

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 234.13 points (-0.65%) at 35737.21

- S&P E-Mini Future down 26.75 points (-0.57%) at 4676.5

- Nasdaq down 123.8 points (-0.8%) at 15506.14

- US 10-Yr yield is down 6 bps at 1.4241%

- US Mar 10Y are up 13/32 at 130-26

- EURUSD down 0.0024 (-0.21%) at 1.1289

- USDJPY up 0.09 (0.08%) at 113.53

- WTI Crude Oil (front-month) down $0.46 (-0.64%) at $71.21

- Gold is up $4.84 (0.27%) at $1787.68

- EuroStoxx 50 down 16.12 points (-0.38%) at 4183.04

- FTSE 100 down 60.34 points (-0.83%) at 7231.44

- German DAX down 1.59 points (-0.01%) at 15621.72

- French CAC 40 down 48.77 points (-0.7%) at 6942.91

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00488 at 0.07713% (-0.00425 total last wk)

- 1 Month +0.00112 to 0.10975% (+0.00450 total last wk)

- 3 Month +0.00450 to 0.20275% (+0.01062 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00688 to 0.29513% (+0.01712 total last wk)

- 1 Year -0.00438 to 0.50500% (+0.04788 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $261B

- Secured Overnight Financing Rate (SOFR): 0.05%, $919B

- Broad General Collateral Rate (BGCR): 0.05%, $352B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $334B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $1.574B accepted vs. $2.447B submission

- Updated NY Fed Operational Purchase Schedule:

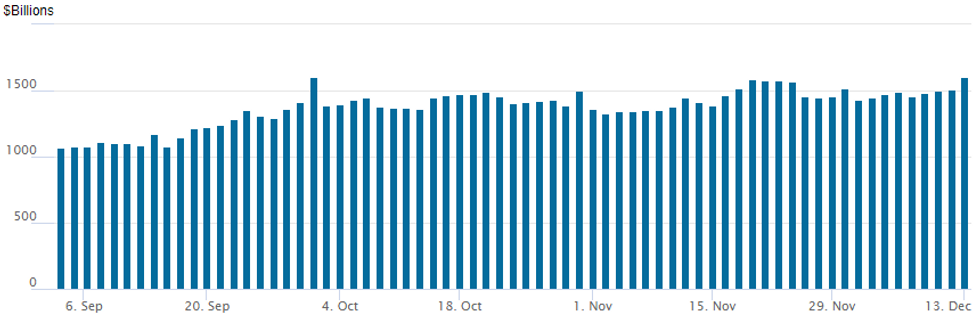

FED Reverse Repo Operation -- Usage Surge Near All-Time High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,599.768B from 80 counterparties vs. $1,507.147B on Friday. Today's operation just off record high of 1,604.881B from Thursday, September 30.

PIPELINE

No new high-grade issuance, Dec running total stands at $62.2B

FOREX: Greenback Edges Higher As Equities Fade, NOK Fades

- The dollar held onto early gains on Monday as equities turned from green to red throughout the US trading hours. The dollar index strengthened 0.2% to 96.30, slightly off the 96.44 highs reached during European trade.

- Dampened risk sentiment weighed on AUD, NZD and CAD, all retreating around a half a percent to start the week.

- USDCAD rose for a fourth consecutive day, briefly breaching 1.28 once again. Having broken initial resistance at 1.2768, the Dec 7 high, bearish technical pressure has eased and attention now turns to the key resistance and bull trigger at 1.2854, Dec 3 high.

- EURUSD and USDJPY both less directional, with the early dollar strength for both pairs waning and 1.1300 and 113.50 appearing the short-term inflection points for now.

- The clear underperformer on Monday was the Norwegian Krona. Both EURNOK and USDNOK rose close to one percent as fresh restrictions were announced in Norway. Interestingly, the restrictions appear less strict than perhaps expected, however, the sell-side remain mixed on whether the Norges Bank will proceed with a planned rate hike this Thursday.

- UK unemployment data will kick off the European session on Tuesday, before US PPI and potential comments from RBNZ Governor Orr - due to testify before the finance and expenditure select committee.

- The focus remains on G10/EM central bank decisions this week, with the Fed, ECB and BoE in focus from Wednesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.