-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk-On, FOMC Charts 2022 Liftoff

EXECUTIVE SUMMARY

- MNI: FED KEEPS KEY RATE 0-0.25%, GUIDANCE UNCHANGED

- FED TAPER ACCELERATES TO USD30 BN FROM JAN

- FEDERAL RESERVE DECISION HAS NO DISSENTS

- FED SAYS RISKS TO ECONOMIC OUTLOOK REMAIN AMID COVID

- MNI: Fed Quickens Taper, Sees Three 2022 Hikes

- BOC SAYS INFLATION EXPECTATIONS REMAIN WELL ANCHORED

- U.S. Set to Ban American Investment in Some Chinese Companies Over Surveillance, DJ

US

FED: The Federal Reserve will reduce its bond buying more quickly, ending the program in March, and officials signaled three interest rate hikes next year, a hawkish decision that acknowledged simmering inflation pressures can no longer be described as transitory.

- “Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation” the Fed said in its statement, as MNI reported was likely.

- The Fed now sees inflation ending next year at 2.6%, a jump from its 2.2% September forecasts. The Fed accelerated the reduction in its monthly bond purchases to USD60 billion per month starting in January, as MNI reported the central bank was set to do. Purchases are now set to end in March.

- The Fed’s Summary of Economic Projections saw policymakers moving up the timing of interest rates rises forward into 2022, with the median estimate now pointing to three rate increases next year and three more in 2023.

US: "'Schumer is likely to push a vote on the Build Back Better plan until next year...He doesn't have the votes as Manchin remains noncommittal" Benzinga Newswire tweet

CANADA

MNI BRIEF: BOC Says To Keep Price Gains From Becoming Embedded -- Elevated inflation means now isn't the time to use flexibility to pursue full employment

- Bank of Canada Governor Tiff Macklem in a speech Wednesday said he will keep elevated global price pressures from becoming "embedded" into inflation running at the fastest pace in decades.

- Price expectations remain well anchored in a well-advanced economic rebound and inflation should slow in the second half of next year, he said. The inflation-targeting agreement with the government refreshed Monday allows for some flexibility to overshoot the 2% CPI goal and recognizes that lower global neutral rates will mean more use of forward guidance and asset purchases, Macklem said.

- "Having ended QE, we are now focused on our forward guidance-on assessing the diminishing degree of slack in the economy and on bringing inflation sustainably back to target," he said.

- Last week the Bank said conditions for a rate increase could be in place by April. Today Macklem said that in general, full employment and keeping inflation on target "go hand in hand."

OVERNIGHT DATA

- US NOV RETAIL SALES +0.3%; EX-MOTOR VEH +0.3%

- US OCT RETAIL SALES REVISED +1.8%; EX-MV +1.8%

- US NOV RET SALES EX GAS & MTR VEH & PARTS DEALERS +0.2% V OCT +1.6%

- US NOV RET SALES EX MTR VEH & PARTS DEALERS +0.3% V US NOV +1.8%

- US NOV RET SALES EX AUTO, BLDG MATL & GAS +0.1% V OCT +1.5%

- US NY FED EMPIRE STATE MFG INDEX 31.9 DEC

- US NY FED EMPIRE MFG NEW ORDERS 27.1 DEC

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 21.4 DEC

- US NY FED EMPIRE MFG PRICES PAID INDEX 80.2 DEC

- US NOV IMPORT PRICES +0.7%

- US NOV EXPORT PRICES +1.0%; NON-AG +1.0%; AGRICULTURE +0.8%

- US MBA: MARKET COMPOSITE -4.0% SA THRU DEC 10 WK

- US MBA: REFIS -6% SA; PURCH INDEX +1% SA THRU DEC 10 WK

- US MBA: UNADJ PURCHASE INDEX -9% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE UNCHANGED AT 3.30%

- US NAHB HOUSING MARKET INDEX 84 IN DEC

- US NAHB DEC SINGLE FAMILY SALES INDEX 90; NEXT 6-MO 84

- US OCT BUSINESS INVENTORIES +1.2%; SALES +2.1%

- US OCT RETAIL INVENTORIES +0.1%

- CANADA NOV CPI 4.7% YOY

US TSYS: Hawkish FOMC In-Line, Liftoff After Mar'22 Taper End

Final FOMC of 2021, Fed increased pace of taper (bond purchases end by March '22) and charting liftoff in 2022 with dot-plot shift implying three .25 bps hikes in 2022 and 2023. Fed now sees inflation ending next year at 2.6%, a jump from its 2.2% September forecasts.- Widely anticipated (not as hawkish as some analysts expected) Tsys finished near late session lows following some initial whip-saw action on the release, yield curves steeper (5s30s at 60.67 late), equities reversed losses/session highs late: (ESH2 +65.0 at 4693.0) while VIX fell to 19.16 low from pre-annc high of 23.47.

- Chairman Powell sounded upbeat as he discussed solid job gains that have averaged "378,000 per month over the last 3 months. The unemployment rate has declined substantially falling .6 percentage point since our last meeting and reaching 4.2% in November."

- Sometime after Mar'22 (end of asset buys), Chair Powell said the Fed will "be in a position to raise interest rates as and when we think it's appropriate and we will, to the extent that's appropriate" and benefitting by "a few more months of data."

- Early action: Tsys gapped lower just ahead stocks open, weighed by large -30k FVH2 note sale at 120-28.25 that pushed 5s to 120-24 low in the aftermath. Not headline driven, sources reported prop, fast$ and option-tied buying in shorts to intermediates as futures bounce.

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 383.25 points (1.08%) at 35537.35

- S&P E-Mini Future up 75 points (1.62%) at 4614

- Nasdaq up 327.9 points (2.2%) at 15095.62

- US 10-Yr yield is up 1.7 bps at 1.4582%

- US Mar 10Y are down 1.5/32 at 130-19

- EURUSD up 0.0034 (0.3%) at 1.1263

- USDJPY up 0.36 (0.32%) at 113.88

- WTI Crude Oil (front-month) up $0.85 (1.2%) at $70.48

- Gold is up $7.85 (0.44%) at $1766.61

- EuroStoxx 50 up 15.17 points (0.37%) at 4159.68

- FTSE 100 down 47.89 points (-0.66%) at 7170.75

- German DAX up 22.79 points (0.15%) at 15476.35

- French CAC 40 up 32.32 points (0.47%) at 6927.63

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00850 at 0.06863% (-0.00363/wk)

- 1 Month -0.00225 to 0.10750% (-0.00113/wk)

- 3 Month +0.00475 to 0.21563% (+0.01738/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01037 to 0.30150% (+0.01325/wk)

- 1 Year +0.01900 to 0.51688% (+0.00750/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.05%, $919B

- Broad General Collateral Rate (BGCR): 0.05%, $356B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $336B

- (rate, volume levels reflect prior session)

- Thu 12/16 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B vs. $1.425B prior

- Thu 12/16 1100-1120ET: TIPS 1Y-7.5Y, appr $1.525B vs. $1.775B prior

- Fri 12/17 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B vs. $1.600B prior

- Note, while the size of buy-operations in 10-30Y actually increased slightly to account for the drop in number of operations from 4 to 3, combined purchases still reduced.

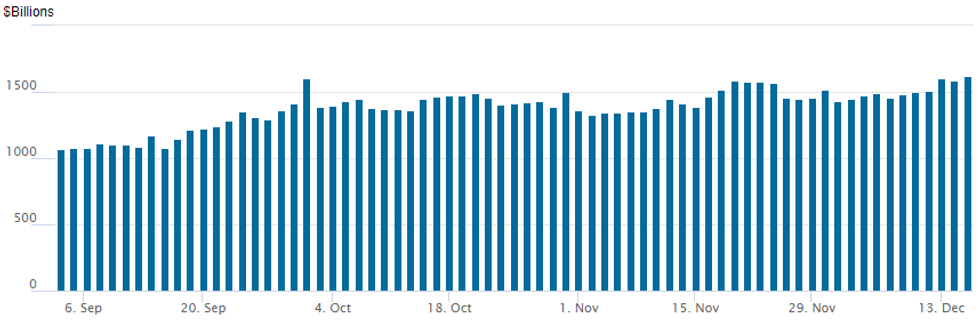

FED Reverse Repo Operation -- New All-Time High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new all-time high of $1,621.097B from 85 counterparties vs. $1,584.488B on Tuesday. Prior record high: 1,604.881B from Thursday, September 30.

FOREX: Greenback Loses Shine As Equities Bounce Post-FOMC

- The US Dollar initially reacted favourably to the announcement of an accelerated taper by the Federal Reserve on Wednesday.

- The dollar index rose roughly 30 pips on the release with EURUSD fading to a fresh low of 1.1222 and USDJPY rising back above 114 for the first time since November 28.

- The initial gains were short-lived and the underlying supportive tone for equity indices worked against the greenback throughout Chair Powell’s press conference.

- The dollar index (-0.22%) plumbed fresh lows for the session and EURUSD squeezed all the way back to 1.1299.

- Revived risk sentiment lent support to both AUD (+0.85%) and NZD (+0.45%) with AUDJPY a standout, rising well over 1% on the session.

- NOK was also at the top of the G10 leaderboard with bolstered risk sentiment and worth noting there is a Norges Bank decision tomorrow morning where consensus is for them to hike 25bps.

- Additionally, we have the two main events, in the form of the BoE and the ECB as well as a policy decision from the SNB.

- Preceding this, Aussie employment data is scheduled overnight with Eurozone Flash PMIs also on the docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.