-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Talk of New Covid Curbs Rattles Markets

EXECUTIVE SUMMARY

- US Pres Biden to address Covid spread, newest measures Tuesday (no set time)

- MNI INTERVIEW:BOC May Tighten As Spring Budget Keeps Taps Open

- NYC MAYOR SAYS HE'S AGAINST MORE SHUTDOWNS, RESTRICTIONS, Bbg

US TSYS: Covid Surge Underpins Short End, Stocks Under Pressure

Tsys trading mostly weaker on moderate volumes after Monday's close, well off Asia/London crossover highs. Tsy 2s-5s outperformed while 10s-30s see-sawed to weaker levels/session lows by the close. Main drivers on day: concerns over measures to contain covid surge, and knock-on effect of Sen Manchin torpedoing Pres Biden's $2T BBB spending plan.

- Trading desks reported better real$ selling of long end Tsys during Asia hours, two-way with misc sellers in the belly on surprisingly robust volumes ahead the holiday. Volume surged around the Asia/London crossover included steepener Block package: 5s and 10s vs 30s at 0212:42ET.

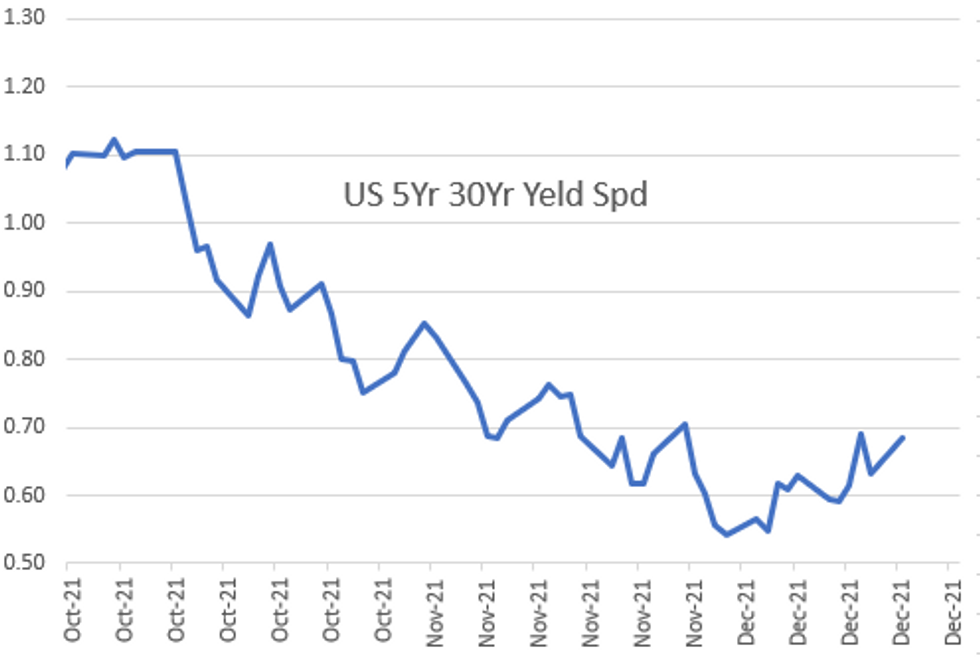

- Bonds extended session lows (30YY 1.8545% high), equities holding weaker (ESH2 -65.0 at 4545.0 late vs. 4520.75 low), decoupling again after brief period negative correlation late last week. 5s30s back to Nov 30 levels, tapped 70.24.

- Trading desks reporting two-way flow in short end with leveraged fund buying vs. foreign real$ selling 2s, leveraged$ selling 5s, real$ selling 20s ($20B 20Y Bond sale Tuesday, 912810TC2). Sporadic flattener unwinds 2s10s, 5s and 10s vs. 30s.

- The 2-Yr yield is down 1.2bps at 0.6256%, 5-Yr is down 1.6bps at 1.1586%, 10-Yr is up 1.2bps at 1.414%, and 30-Yr is up 3.7bps at 1.8436%.

CANADA

BOC: The Bank of Canada may be pulling back on stimulus to curb inflation next spring just as the government introduces a budget aimed at cashing in CAD78 billion of election campaign promises, former finance department official Rebekah Young told MNI.

- "It is going to be the Bank of Canada that is going to be leading the exits from this pandemic," likely starting in April, said Young. "They can more or less expect that CAD78 billion to be put into the system and more or less baked into their forecasts" at the next rate meeting in January, she said.

- "It's not enough to say that it would pull rates rate forecasts much earlier, more aggressive, just kind of underpin the direction that they're already leaning," Young said. Some investors are betting on a hike to the 0.25% policy rate in January or March, ahead of the BOC's guidance for the middle quarters of next year.

OVERNIGHT DATA

November reading of Leading Economic Indicators +1.1% MoM vs. +0.9% est.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 525.75 points (-1.49%) at 34835.38

- S&P E-Mini Future down 61 points (-1.32%) at 4548.25

- Nasdaq down 206.1 points (-1.4%) at 14959.34

- US 10-Yr yield is up 1.2 bps at 1.414%

- US Mar 10Y are steady at at 131-5.5 at 131-5.5

- EURUSD up 0.0042 (0.37%) at 1.1282

- USDJPY up 0.04 (0.04%) at 113.67

- WTI Crude Oil (front-month) down $2.63 (-3.71%) at $68.23

- Gold is down $6.87 (-0.38%) at $1791.00

- EuroStoxx 50 down 54.22 points (-1.3%) at 4107.13

- FTSE 100 down 71.89 points (-0.99%) at 7198.03

- German DAX down 292.02 points (-1.88%) at 15239.67

- French CAC 40 down 56.53 points (-0.82%) at 6870.1

US TSY FUTURES CLOSE

- 3M10Y +1.617, 137.009 (L: 129.551 / H: 137.179)

- 2Y10Y +3.068, 79.11 (L: 74.392 / H: 79.281)

- 2Y30Y +5.798, 122.275 (L: 115.032 / H: 122.811)

- 5Y30Y +5.907, 68.893 (L: 62.898 / H: 70.244)

- Current futures levels:

- Mar 2Y up 1.25/32 at 109-6.375 (L: 109-05 / H: 109-08.875)

- Mar 5Y up 3.25/32 at 121-10.75 (L: 121-08.25 / H: 121-18.25)

- Mar 10Y down 1/32 at 131-4.5 (L: 131-04 / H: 131-19)

- Mar 30Y down 22/32 at 161-28 (L: 161-27 / H: 163-19)

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.005 at 99.645

- Jun 22 +0.010 at 99.415

- Sep 22 +0.020 at 99.230

- Dec 22 +0.030 at 99.010

- Red Pack (Mar 23-Dec 23) +0.015 to +0.025

- Green Pack (Mar 24-Dec 24) steady to +0.010

- Blue Pack (Mar 25-Dec 25) -0.025 to -0.01

- Gold Pack (Mar 26-Dec 26) -0.045 to -0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00175 at 0.07250% (+0.00200 total last wk)

- 1 Month +0.00100 to 0.10350% (-0.00612 total last wk)

- 3 Month +0.00162 to 0.21425% (+0.01438 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00388 to 0.31663% (+0.02450 total last wk)

- 1 Year +0.00225 to 0.53188% (+0.02025 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $257B

- Secured Overnight Financing Rate (SOFR): 0.05%, $910B

- Broad General Collateral Rate (BGCR): 0.05%, $338B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $326B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, appr $4.501B accepted vs. $11.752B submission

- Next scheduled purchases

- Tue 12/21 1010-1030ET: TIPS 7.5Y-30Y, appr $0.925B vs. $1.075B prior

- Wed 12/22 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B

- NY Fed buy-operations pause for holidays, resume Jan 3

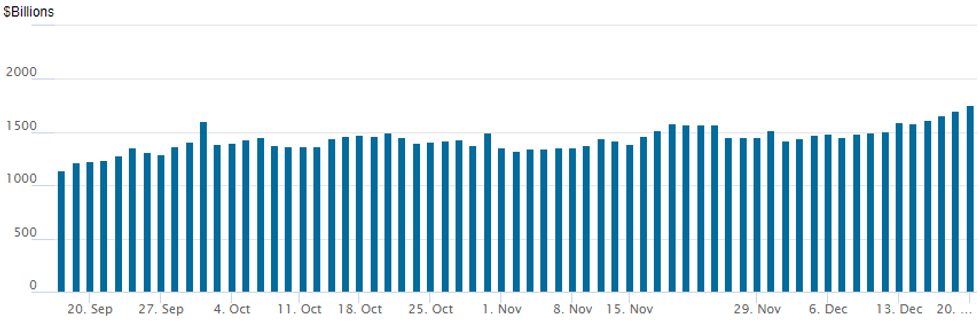

FED Reverse Repo Operation, Fourth Consecutive New High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to fourth consecutive all-time high of $1,758.041B from 81 counterparties vs. Friday's $1,704.586B.

EGBs-GILTS CASH CLOSE: Drop In Yields Reverses Course

After dropping Monday morning on risk-off headlines and a sharp move lower in equities, Bund and Gilt yields bounced back in the afternoon.

- The risk-off tone was set overnight with sharp weakness in Asian stocks on resurgent Omicron concerns and news that US Pres Biden's expansive fiscal plans had been derailed.

- The flattening curve moves on the open later reversed as European equities came off lows, though Germany's moved decisively steeper by the cash close and the UK's remained flatter. Volumes were notably weak.

- Several headlines of note though none moved the market: Germany's Nagel nominated to head Bundesbank; UK not (yet) introducing tougher measures to combat Omicron; Italy released 2022 funding plans.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1bps at -0.73%, 5-Yr is down 0.6bps at -0.613%, 10-Yr is up 1.1bps at -0.367%, and 30-Yr is up 2.9bps at -0.008%.

- UK: The 2-Yr yield is up 3.3bps at 0.542%, 5-Yr is up 2.6bps at 0.64%, 10-Yr is up 1.3bps at 0.772%, and 30-Yr is up 2bps at 0.952%.

- Italian BTP spread up 2.3bps at 129.6bps / Portugal down 0.1bps at 63.3bps

FOREX: EUR Crosses Benefit From Risk-Off Tone, TRY Spikes

- Senator Manchin's one-handed tanking of Biden's Build Back Better bill combined with fresh Omicron-related restriction fears guided risk lower to start the week.

- The pressure on both equity and commodity markets weighed on the likes of NZD and CAD, both around 0.45% lower against the greenback.

- A mixed performance for the US dollar and a broadly unchanged dollar index was largely down to a higher Euro with EURUSD slowly eroding Friday’s retreat and briefly retaining the 1.13 handle. Naturally there was very supportive price in Euro crosses, with EURNZD and EURCAD rising close to 1%.

- In emerging markets, USDTRY is currently just above the 13.00 mark after a stunning 34% intra-day reversal from highs of 18.36 to lows around 12.27. Comments from President Erdogan sparked some renewed optimism for the Lira, with understandably poor liquidity exacerbating the price action.

- The government announced measures including the introduction of a new program that will protect savings from fluctuations in the local currency. The government will make up for losses incurred by holders of lira deposits should the lira’s declines against hard currencies exceed interest rates promised by banks. The pair reversed the entirety of the December rally.

- Despite the lack of event risk in the immediate pipeline with the holidays approaching, overnight markets will see the latest RBA minutes and Canadian retail sales will be the highlight of the North American data docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.