-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA OPEN: Shrugging Off Dec Jobs Miss, Yields Up

EXECUTIVE SUMMARY

- MNI: Services Inflation Seen As The Fed's Next Big Problem

- MNI BRIEF: Canada Pre-Omicron Job Market Outpaces Expectations

- US: CDC Director: We Have Not Seen Peak Of Omicron, COVID To Be Endemic

- SF Fed DALY WANTS GRADUAL RISE IN FED RATE AFTER BALANCE SHEET FADES

- CITI TO FIRE VACCINE HOLDOUTS THIS MONTH IN STRICT U.S. MANDATE, Bbg

- NATO Rules Out Any Halt to Expansion, Rejects Russian Demand

US

US DATA: Inflation in the vast U.S. service sector may soon replace the surge in goods prices as the Federal Reserve's primary headache as wage increases gain traction, Mickey Levy, and an advisor to the Treasury's Office of Financial Research, told MNI.

- "Even when we get through these bottlenecks in production and goods prices come down - that will be more than offset by the services and you're going to be stuck with high inflation, said Levy, who also advises several Fed banks, together with the Bank of Japan and the European Commission, and is chief economist for Asia and the U.S. at Berenberg Capital.

- "The probability that inflation stays high, say over 4% in 2022, is a higher probability than that it comes back toward where the Fed thinks it will," he said.

- Even after sizeable prior revisions, weaker-than-expected payrolls growth was once again at odds with a strong household survey, with total payrolls +199k (cons 447k) vs household employment up +651k.

- There was another large drop in the unemployment rate from 4.2% to 3.9% (cons 4.1%) on household employment strength.

- The participation rate was unchanged after it was revised up a tenth to 61.9% as it slowly crawls back towards pre-covid levels. There was a similar story in prime age (25-54yr) participation too, also unchanged at an upward revised 81.9% and the highest post-Covid but still ~1ppt from the levels immediately prior.

- In a sign of getting towards maximum employment, lower unemployment was met with even stronger wage growth. Average hourly earnings were up 0.61% M/M after 0.35% M/M (revised up a tenth on rounding).

- There was reasonable dispersion across categories, with particularly large gains in utilities and information-based jobs after a weak Nov but it's nevertheless a strong print.

- There was a similar strength in the non-supervisory measure (the bottom 80% of employment), which continues to outstrip total wage growth with 0.68% M/M after 0.46% M/M.

- Walensky's warning comes as the 7-day average of new cases comes in at above 600k/day for the first time during the pandemic.

- WaPo reports that that US gov't and US Postal Service are finalising plans to begin postal deliveries of lateral flow tests to people's homes, although neither the White House nor USPS have commented. Last month, WH Press Sec Jen Psaki sarcastically denied plans to embark on federal test procurement and distribution.

CANADA

DATA: Canada's jobless rate declined for a seventh straight month in December, beating market expectations, in a survey taken early in the month before the omicron variant forced a new wave of social distancing restrictions across the country.

- Employment rose by 54,700 and the jobless rate fell 0.1pp to 5.9%, the lowest since the pandemic and within sight of the modern record low of 5.4%, Statistics Canada reported Friday. Markets expected 15,000 jobs and no change in unemployment.

- Wages climbed 2.7% from a year earlier, similar to the recent trend and above the central bank's 2% inflation target. The figures follow a trade report Thursday that also showed surprising economic resilience at the end of last year. Employment rebounded 4.8% in 2021 with 886,000 jobs following the plunge in 2020 as Covid-19 emerged.

OVERNIGHT DATA

- US DEC NONFARM PAYROLLS +199K; PRIVATE +211K, GOVT -12K

- US PRIOR MONTHS PAYROLLS REVISED: NOV +249K; OCT +648K

- US DEC AVERAGE HOURLY EARNINGS +0.6% Vs NOV +0.4%; +4.7% YOY

- US DEC AVERAGE WEEKLY HOURS 34.7 HRS

- CANADA DEC EMPLOYMENT +54.7K; JOBLESS RATE 5.9%

- CANADA DEC FULL-TIME JOBS +122.5K; PART-TIME -67.7K

MARKETS SNAPSHOT

Key late session market levels- DJIA up 127.34 points (0.35%) at 36363.91

- S&P E-Mini Future down 1.75 points (-0.04%) at 4685.5

- Nasdaq down 74.7 points (-0.5%) at 15006.08

- US 10-Yr yield is up 4.4 bps at 1.7655%

- US Mar 10Y are down 7/32 at 128-10

- EURUSD up 0.0066 (0.58%) at 1.1363

- USDJPY down 0.27 (-0.23%) at 115.56

- WTI Crude Oil (front-month) down $0.59 (-0.74%) at $78.89

- Gold is up $6.08 (0.34%) at $1797.24

- EuroStoxx 50 down 18.98 points (-0.44%) at 4305.83

- FTSE 100 up 34.91 points (0.47%) at 7485.28

- German DAX down 104.29 points (-0.65%) at 15947.74

- French CAC 40 down 30.18 points (-0.42%) at 7219.48

US TSYS: Yields Higher Despite Headline Jobs Miss

Headline Dec jobs figure way off the mark (+199k vs. +445k est), the reaction not what you would expect as Tsys traded weaker until late morning.- Tsy futures traded weaker after Dec jobs gain of +199k missed a +447k estimate -- weak yes, but focus quickly turned to solid underlying data: household survey gain +650k, hourly earnings +4.7% YoY, unemployment drop to 3.9%, not to mention the Nov (modest) up-revision to +249k from +210k.

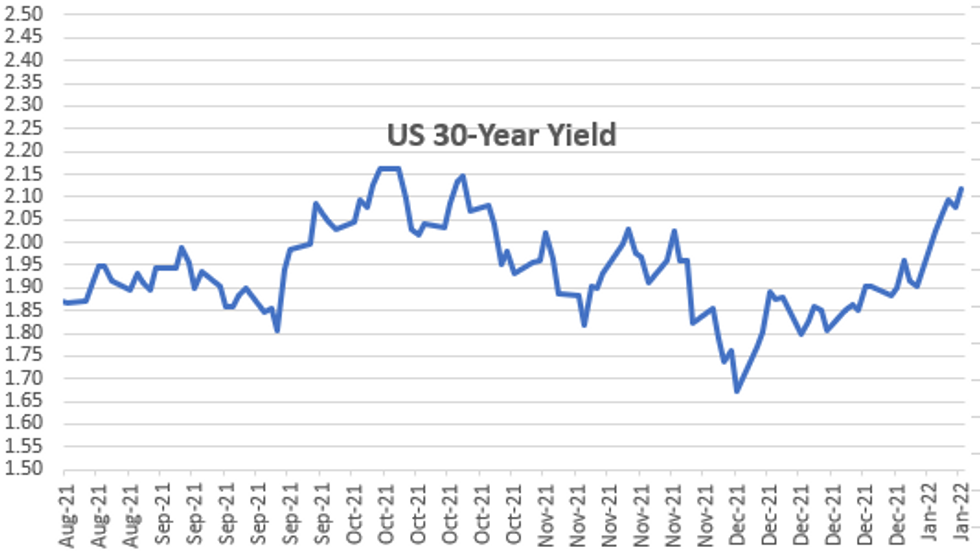

- Tsys bottomed out by late morning, 30YY hit 2.1432%H, 10YY 1.7992%, recovering near half the move/near midrange by the bell.

- Decent session volumes (TYH2>1.65M) amid otherwise quite late trade. Rates mostly weaker, curves steeper with short end outperforming (heavy TUH volume >445k), long end near middle session range.

- Two-way flow w/better buyers in short end long end since midday as accts look to next week's data: CPI (0.4% vs. 0.8% prior), PPI (final demand MoM 0.4% vs. 0.8% prior) and Retail Sales (+0.0% est vs. 0.3% prior).

- The 2-Yr yield is down 0.2bps at 0.8641%, 5-Yr is up 2.8bps at 1.497%, 10-Yr is up 4.4bps at 1.7655%, and 30-Yr is up 3.7bps at 2.1123%.

US TSY FUTURES CLOSE

- 3M10Y +4.266, 166.233 (L: 159.897 / H: 170.033)

- 2Y10Y +4.417, 89.566 (L: 83.846 / H: 91.601)

- 2Y30Y +3.577, 124.201 (L: 118.948 / H: 126.41)

- 5Y30Y +0.428, 60.975 (L: 58.066 / H: 62.863)

- Current futures levels:

- Mar 2Y up 1.125/32 at 108-25.875 (L: 108-23.125 / H: 108-26.5)

- Mar 5Y down 3.5/32 at 119-24.25 (L: 119-20.25 / H: 119-31.25)

- Mar 10Y down 6/32 at 128-11 (L: 128-01 / H: 128-24)

- Mar 30Y down 24/32 at 155-6 (L: 154-20 / H: 156-12)

- Mar Ultra 30Y down 26/32 at 188-27 (L: 187-26 / H: 190-16)

US 10Y FUTURES Tech (H2) Stabilises at Support

- RES 4: 131-19 High Dec 20 and key resistance

- RES 3: 130-18+/28+ High Dec 31 / High Dec 22

- RES 2: 129-31 Low Dec 8 and a recent breakout level

- RES 1: 129-00/19 High Jan 6 / High Jan 4

- PRICE: 128-06+ @ 15:54 GMT Jan 7

- SUP 1: 128-05 1.618 proj of the Dec 20 - 29 - 31 price swing / Low Jan 7

- SUP 2: 128-00 Psychological round number

- SUP 3: 127-30 1.764 proj of the Dec 20 - 29 - 31 price swing

- SUP 4: 127-18+ 2.00 proj of the Dec 20 - 29 - 31 price swing

Treasuries remain soft, reversing a very brief spell of strength following the NFP release. This emboldens the short-setting seen since the break of key support at 128-22+, the Nov 22 low. The break strengthens bearish conditions and the focus is on the 128-00 psychological handle next. Moving average conditions remain bearish and this reinforces the current broader downtrend. Initial resistance is seen at 129-19, the Jan 4 high. Short-term gains would likely be corrective in nature.

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.010 at 99.605

- Jun 22 +0.020 at 99.325

- Sep 22 +0.010 at 99.085

- Dec 22 steady00 at 98.820

- Red Pack (Mar 23-Dec 23) -0.045 to -0.01

- Green Pack (Mar 24-Dec 24) -0.06 to -0.055

- Blue Pack (Mar 25-Dec 25) -0.055 to -0.045

- Gold Pack (Mar 26-Dec 26) -0.04 to -0.035

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N -0.00143 at 0.07271% (+0.00833/wk)

- 1 Month +0.00115 to 0.10529% (+0.00190/wk)

- 3 Month +0.00485 to 0.23614% (+0.02701/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00986 to 0.37643% (+0.03768/wk)

- 1 Year +0.01400 to 0.66171% (+0.07858/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $262B

- Secured Overnight Financing Rate (SOFR): 0.05%, $942B

- Broad General Collateral Rate (BGCR): 0.05%, $350B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $9.301B accepted vs. $38.962B submission

- Next scheduled purchases:

- Mon 01/10 1010-1030ET: Tsy 7Y-10Y, appr $2.425B

- Tue 01/11 1010-1030ET: Tsy 4.5Y-7Y, appr $4.525B

- Tue 01/11 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B

- Wed 01/12 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B

- Thu 01/13 1500ET: Updated NY Fed Operational Purchase Schedule

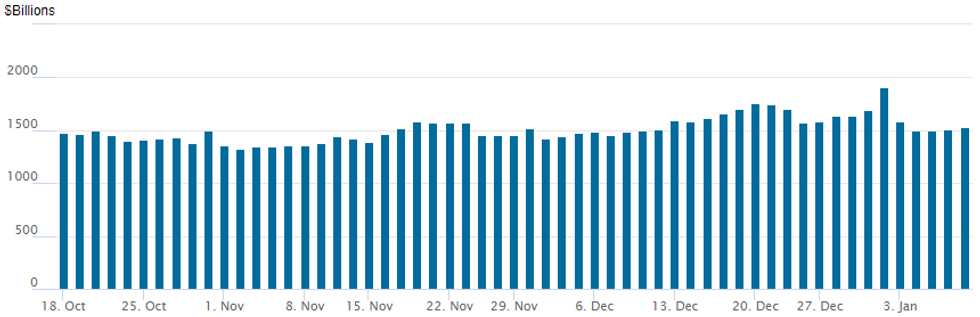

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,530.096B (75 counterparties) vs. $1,510.553B on Thursday.

All-time high of $1,904.582B on Friday, December 31.

PIPELINE: High-Grade Debt Issuance: $80.6B Total on Wk

$10.95B Priced Thursday, $80.6B total on week. Nothing on Friday's docket as yet, may see some pop up after today's employment data.- Date $MM Issuer (Priced *, Launch #)

- 01/06 $3.5B *IADB 5Y SOFR+22

- 01/06 $2.5B *GM Fncl $1B 5Y +90, $300M 5Y SOFR+104, $1.2B 10Y +138

- 01/06 $1.5B *UBS Group perp NC5 4.875%

- 01/06 $1B *Genuine Parts $500M 3NC1 +70, $500M 10Y +115

- 01/06 $1B *Federal Farm Credit System Banks 3Y+6

- 01/06 $500M *Banco de Brasil 7Y 4.95%

- 01/06 $500M *Ares Capital +5Y +150

- 01/06 $450M *Protective Life 3Y +50a

FOREX: Mixed Payrolls Data Results In Greenback Weakness

- Markets were characterised by some two-way action following the mixed US payrolls report. The initial reaction was to sell dollars on a weaker than expected headline figure of 199k vs. an estimate of 450k. Given some moderately positive revisions and a lower unemployment rate, the greenback quickly pared losses, trading within close proximity of pre-data levels.

- As the dust settled, the underwhelming headline figures and potential short-term positioning dynamics prompted the USD to grind lower throughout the course of Friday’s trading session. The dollar index has weakened by 0.6% and sits at the low of the day approaching the close.

- The largest beneficiaries from the dollar’s decline were the Euro and the Canadian dollar, the latter aided by some much stronger employment data with particular advances in the full-time component.

- USDCAD has had the biggest move on Friday (-0.75%) and the pair is re-approaching last week’s low of 1.2621 - a key short-term support. A move below these levels would cancel any possible reversal pattern and initially open 1.2608 and 1.2585, low Nov 19.

- EURUSD, once again, struggled below the 1.1300 mark and the greenback retreat eventually led to a break of Wednesday’s highs through 1.1346. The current consolidation means resistance at 1.1383/86, Nov 30 and Dec 31 high, is intact and that the pair remains inside December’s range. For technical bulls, clearance of these levels would suggest scope for a stronger short-term recovery.

- AUD, NZD and GBP all rallied between 0.3-0.4%, while the Japanese Yen edged higher but remained in a tighter 30 pip range following the data.

- Monday’s data docket is extremely light before the Wednesday’s main event – the release of US December CPI.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/01/2022 | 1500/1500 |  | UK | BOE Mann on panel at AEA | |

| 08/01/2022 | 1500/1600 |  | EU | ECB Schnabel at AEA meeting | |

| 08/01/2022 | 1715/1715 |  | UK | BOE Mann on panel at AEA | |

| 08/01/2022 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 10/01/2022 | 0130/1230 | * |  | AU | Building Approvals |

| 10/01/2022 | 0830/0930 | ** |  | SE | Private Sector Production |

| 10/01/2022 | 1000/1100 | ** |  | EU | unemployment |

| 10/01/2022 | 1500/1000 | ** |  | US | wholesale trade |

| 10/01/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 10/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.