-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Mkts Skittish on Russia/Ukraine Headlines

EXECUTIVE SUMMARY

- MNI: US Consumer Price Expectations Drop - New York Fed Survey

- FED: Bullard: Asset Sales "Plan B"; Ukraine Crisis Not Leading Macro Issue

- UKRAINE SEES NO FULL-SCALE RUSSIAN ATTACK IN COMING DAYS, IFX

- TRUDEAU TO INVOKE EMERGENCY POWERS IN RESPONSE TO PROTEST, CBC

US

FED: Bullard continues on CNBC - arguably not as hawkish on balance sheet policy as some of his colleagues (incl KC George this morning) who have advocated for active Fed asset sales.

- Says hikes/runoff are "relatively cheap from my perspective as a policymaker" - at this point they're not tightening policy, but removing accommodation.

- Bullard says would like runoff to steepen the yield curve.

- Fed hasn't decided on tactics; it's all "in the works". Would like to get passive runoff started in Q2 and some Plan B where can use asset sales if necessary to speed up runoff. "Exactly how that could work is an open question" but that could put more pressure on long-end of the curve. For now, he's "happy" to see passive runoff.

- Says US has one of the strongest labor markets it's ever seen; projecting unemp rate could go below 3% this year. Bullard says companies are "scrambling" for workers; expect to see that reflected in wages; says will show up in CPI as well.

- Says expects positive reopening impact on Q2/Q3 GDP. Says companies he's talked to unsure whether supply-chain constraints will ease this year, could last into next year.

- Re Ukraine-Russia: more of a concern for Europe than the US; have seen fighting in that area of the world. An important policy issue, but not necessarily a leading macroeconomic issue, at least at this point.

- The median inflation outlook for the next year dropped by 0.2 percentage point to 5.8%, the first decline in short-term inflation expectations since October 2020. The median three-year outlook for inflation showed a broad-based drop, decreasing 0.5 percentage points to 3.5%, the largest monthly decline in the measure since the inception of the survey in 2013.

- In a separate blog released alongside the updated figures, authors, including New York Fed President John Williams, wrote that long-run inflation expectations remain stable. In figures not usually released monthly, they show that 5-year ahead price expectations fell to 3.0% in January from 3.2% in November 2021.

US TSYS: Fall in Love W/ FI on Valentine's Day, Give the Gift of Risk Mitigation

Rates finished weaker Monday, lower half of the range after making an attempt to reverse losses on late chatter concerning Russia/Ukraine tensions.- While markets reacted positively to early Russia official Lavrov comments over keeping negotiations open re: Russia/Ukraine tensions, late headlines purporting satellite images of Russia troop movements closer to Ukraine border and headline that Ukraine Pres Zelensky told Russia invasion would proceed Wed (apparently tied to mistranslated comments made in a speech hours prior) spurred risk-off moves.

- Markets remain skittish over Russia/Ukraine headlines -- more apt to spur a tail-event move than Fed speak after StL Fed Pres Bullard reprised his hawkish stance on CNBC Monday morning after green-lighting 50bps March lift-off and suggesting potential for off-meeting move.

- Tsy futures extending session lows as StL Fed Bullard reiterates stance on higher/faster rate hikes to address growing inflation, would like to see 100bp in hikes by July, Fed not moving fast enough. Bullard Wants balance sheet run-off in second quarter. On supply chain drag, Bullard said a feed-back loop may last into 2023.

- Active early trade, bearish option hedging as underlying rates react to StL Fed Bullard reiterating hardline stance on rising inflation and cooling geopol headlines re: Russia/Ukraine. Call skew firmed briefly on second half bounce in underlying.

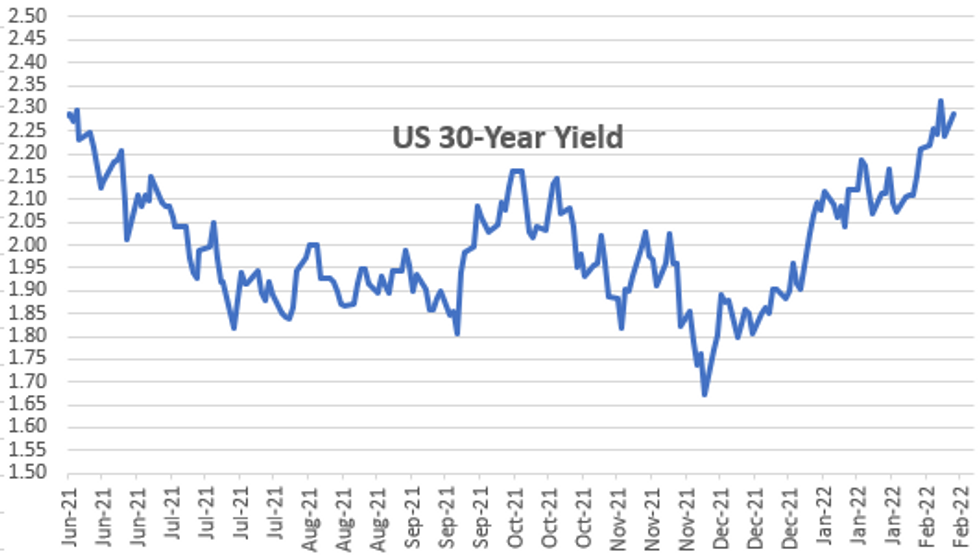

- Late: 2-Yr yield is up 7.9bps at 1.5785%, 5-Yr is up 5.2bps at 1.9063%, 10-Yr is up 4.9bps at 1.9858%, and 30-Yr is up 5.2bps at 2.2905%.

OVERNIGHT DATA

NY Fed: Inflation Expectations Decline at the Short- and Medium-Term Horizons

The Federal Reserve Bank of New York’s Center for Microeconomic Data today released the January 2022 Survey of Consumer Expectations, which shows a decrease in short- and medium-term inflation expectations. Median home price expectations, however, increased above its 2021 average. Labor, income, and spending expectations were all largely stable in January.

Tuesday Data Roundup: On PPI, Morgan Stanley economists forecast headline data to "increase 0.38%M vs. +0.17%M prior, lowering the y/y from 9.8% to 8.9% ... supported by a pickup in food prices and little change in energy prices. We expect core PPI to rise a lesser 0.29%M vs. +0.37% prior, lowering the y/y from 6.9% to 6.2%."

- US Data/Speaker Calendar (prior, estimate)

- Feb-15 0830 PPI Final Demand MoM (0.3% rev, 0.5%); YoY (9.7%, 9.1%)

- Feb-15 0830 PPI Ex Food and Energy MoM (0.5%, 0.04%); YoY (8.3%, 7.8%)

- Feb-15 0830 PPI Ex Food, Energy, Trade MoM (0.3% rev, 0.4%); YoY (6.9%, 6.3%)

- Feb-15 0830 Empire Manufacturing (-0.7, 12.0)

- Feb-15 1030 NY Fed buy-op: Tsy 4.5Y-7Y, appr $3.225B vs. $6.025B prior

- Feb-15 1415 Senate Banking Comm nomination hearing of Fed members

- Feb-15 1600 Net Long-term TIC Flows ($137.4B, --)

- Feb-15 1600 Total Net TIC Flows ($223.9B, --)

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 203.68 points (-0.59%) at 34543.4

- S&P E-Mini Future down 17.75 points (-0.4%) at 4394

- Nasdaq up 8.5 points (0.1%) at 13802.9

- US 10-Yr yield is up 5 bps at 1.9875%

- US Mar 10Y are down 10.5/32 at 126-2

- EURUSD down 0.005 (-0.44%) at 1.13

- USDJPY up 0.17 (0.15%) at 115.6

- WTI Crude Oil (front-month) up $1.69 (1.82%) at $94.78

- Gold is up $12.72 (0.68%) at $1871.49

- EuroStoxx 50 down 90.78 points (-2.18%) at 4064.45

- FTSE 100 down 129.43 points (-1.69%) at 7531.59

- German DAX down 311.15 points (-2.02%) at 15113.97

- French CAC 40 down 159.4 points (-2.27%) at 6852.2

US TSY FUTURES CLOSE

- 3M10Y +3.351, 159.091 (L: 150.435 / H: 161.721)

- 2Y10Y -1.879, 40.668 (L: 37.952 / H: 44.472)

- 2Y30Y -1.7, 71.157 (L: 67.472 / H: 76.015)

- 5Y30Y +0.207, 38.445 (L: 36.196 / H: 41.714)Z

- Current futures levels:

- Mar 2Y down 4.625/32 at 107-17.375 (L: 107-15.125 / H: 107-23.875)

- Mar 5Y down 8.75/32 at 117-19.25 (L: 117-12.75 / H: 118-03)

- Mar 10Y down 11/32 at 126-1.5 (L: 125-25 / H: 126-25.5)

- Mar 30Y down 26/32 at 151-27 (L: 151-04 / H: 153-15)

- Mar Ultra 30Y down 1-12/32 at 181-17 (L: 180-12 / H: 184-17)

US 10Y FUTURES TECH: (H2) Gains Considered Corrective

- RES 4: 128-17+ 50-day EMA

- RES 3: 127-24 High Feb 4

- RES 2: 127-15 20-day EMA

- RES 1: 127-01 High Feb 7

- PRICE: 125-28 @ 16:32 GMT Feb 14

- SUP 1: 125-17+ Low Feb 10

- SUP 2: 125-06+ Low May 30 2019 (cont)

- SUP 3: 125-04+ 2.00 proj of the Jan 13 - 19 - 24 price swing

- SUP 4: 124-17 2.0% 10-dma envelope

Treasuries recovered Friday and the contract is trading above recent lows. Short-term gains are considered corrective and the primary downtrend remains intact. The contract recently cleared a layer of support between 126-01 and 125-10+ to a fresh cycle low and marked a continuation of the bearish price sequence of lower lows and lower highs. The focus is on 125-06+, 30 May 2019 (cont). Firm short-term resistance is seen at 127-01.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.030 at 99.280

- Jun 22 -0.020 at 98.710

- Sep 22 -0.050 at 98.310

- Dec 22 -0.060 at 98.020

- Red Pack (Mar 23-Dec 23) -0.07 to -0.065

- Green Pack (Mar 24-Dec 24) -0.07 to -0.06

- Blue Pack (Mar 25-Dec 25) -0.05 to -0.035

- Gold Pack (Mar 26-Dec 26) -0.04 to -0.035

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00172 at 0.07671% (+0.00143 total last wk)

- 1 Month -0.06543 to 0.12571% (+0.07585 total last wk)

- 3 Month -0.04786 to 0.45857% (+0.16743 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.04657 to 0.79386% (+0.28500 total last wk)

- 1 Year -0.07015 to 1.32214% (+0.39329 total last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $67B

- Daily Overnight Bank Funding Rate: 0.07% volume: $251B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $903B

- Broad General Collateral Rate (BGCR): 0.05%, $338B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

NY Fed updated purchase schedule: The Desk plans to purchase approximately $20 billion over the monthly period from 2/14/22 to 3/11/22 -- in effect ending intermeeting move. Note: Eurodollar lead quarterly EDH2 +0.030 at 99.31 as 50bp hike odds fall below 50%.

- Tue 02/15 1010-1030ET: Tsy 4.5Y-7Y, appr $3.225B vs. $6.025B prior

- Thu 02/17 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/22 1010-1030ET: TIPS 1Y-7.5Y, appr $1.025B vs. $2.025B prior

- Thu 02/24 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B steady

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

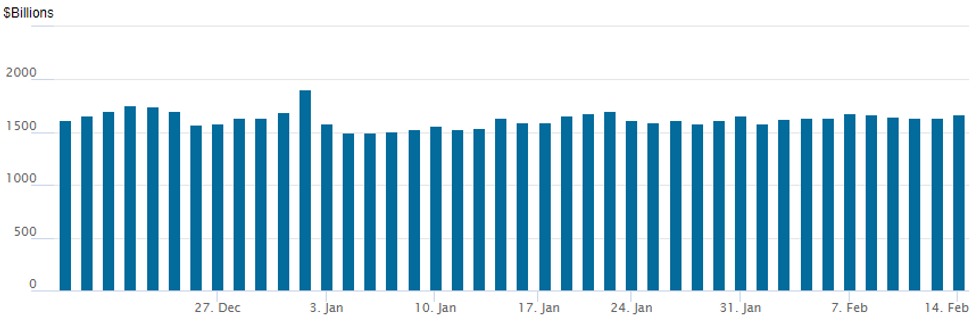

FED: Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,666.232B w/ 80 counterparties vs. $1,635.826B Friday -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE

No new issuance since last Thursday, $19.85B total high-grade debt issued last week.

EGBs-GILTS CASH CLOSE: Geopolitical Reversals

Bunds outperformed Gilts Monday in a session dominated by geopolitical headlines.

- The open was met with risk-selling and core FI buying on Russia-Ukraine conflict fears, but this reversed almost completely in the afternoon as Russia indicated it saw a "way forward" on talks. Later, Interfax reported that Ukraine saw no full-scale Russian attack in the coming days, and yields finished near their highs.

- The standout move was at the UK short end, with 2Y yields at the highest since Feb 2011 - close attention on UK jobs data tomorrow, inflation Weds.

- Periphery spreads widened sharply on the open, and didn't come fully back despite the recovery in broader risk sentiment.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.7bps at -0.361%, 5-Yr is down 4bps at 0.044%, 10-Yr is down 1.4bps at 0.283%, and 30-Yr is down 0.2bps at 0.494%.

- UK: The 2-Yr yield is up 9.6bps at 1.51%, 5-Yr is up 6.7bps at 1.504%, 10-Yr is up 4.4bps at 1.589%, and 30-Yr is up 2.9bps at 1.646%.

- Italian BTP spread up 3.4bps at 169bps / Greek up 3bps at 237.5bps

FOREX: Greenback Firms Amid Shaky Sentiment, EURUSD Back Below 1.1300

- The US dollar remained well supported throughout Monday as risk sentiment deteriorated over mounting tensions regarding Ukraine. The dollar index edged slowly higher from the open, registering a 0.3% advance on Monday. Currencies, however, remained the sideshow to volatile trading in both equity and bond markets.

- Both EUR (-0.45%) and NZD (-0.45%) exhibited the most notable weakness, suffering from the dollar strength.

- EURUSD in particular continues to grind lower, spending the latter half of the session back below 1.13 and in close proximity to the ECB-day lows at 1.1268. A key short-term resistance has now been defined at Thursday’s high of 1.1495 and broader moving average signals still suggest the medium-term trend is down. Key short-term support has been breached through 1.1320, the top of the former channel.

- Despite the shaky risk backdrop, emerging market currencies seem to be trading resiliently with roughly half percent advances in RUB, ZAR and MXN.

- A busier data calendar on Tuesday with RBA minutes overnight and then UK unemployment data followed by German ZEW sentiment figures. US PPI and Empire State Manufacturing headlines the US schedule.

- Additionally, German Cahancellor Scholz is scheduled to visit Moscow on Tuesday, where he plans to hold talks with Russian President Vladimir Putin.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2022 | 2350/0850 | *** |  | JP | GDP (p) |

| 15/02/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 15/02/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/02/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/02/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/02/2022 | 1000/1100 | * |  | EU | employment |

| 15/02/2022 | 1000/1100 | *** |  | EU | GDP (p) |

| 15/02/2022 | 1000/1100 | * |  | EU | trade balance |

| 15/02/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/02/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2022 | 1330/0830 | *** |  | US | PPI |

| 15/02/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/02/2022 | 1400/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 15/02/2022 | 1915/1415 |  | US | Senate Banking Committee votes on Federal Reserve nominees | |

| 15/02/2022 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.