-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: U.S./Allies Bar Select Russia Banks From SWIFT

EXECUTIVE SUMMARY

- MNI: Select Russian Banks Barred From SWIFT By U.S. And Allies

- MNI FED: Bullard Sticks To His Guns, Fed Fund Futures Firm 1bp

- MNI BRIEF: Fed: Current Inflation Less Widespread Vs 1970s

- MNI BRIEF: Fed's Trimmed Mean PCE Inflation Fastest Since 1991

- EU TO CLOSE AIRSPACE TO RUSSIAN AIRCRAFT, GERMANY'S ARD SAYS

- LUFTHANSA SUSPENDS FLIGHTS TO RUSSIA FOR SEVEN DAYS: DPA

US

US/ALLIES: Select Russian banks will be removed from the SWIFT banking transaction system, the White House said on on 26 February in a joint statement with allies, to "harm their ability to operate globally” because of Moscow’s ongoing military invasion of Ukraine as part of a new series of tough measures that include curbs on Russia's central bank.- Earlier sanctions by the U.S. and allies placed on Russia included freezing the assets of certain individuals and some transactions. but avoided curbs on oil and gas exports and stricter financial measures.

- “Second, we commit to imposing restrictive measures that will prevent the Russian Central Bank from deploying its international reserves in ways that undermine the impact of our sanctions,” the statement, issued jointly with the European Commission, France, Germany, Italy, the United Kingdom and Canada, said.

- For the Russian central bank, which could mean an inability to use is roughly $630 billion in currency reserves to defend the ruble.

FED: Monetary Policy Report. Excerpt from latest report: "With inflation well above the FOMC’s longer-run objective and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate."

- While measures of near-term inflation expectations moved substantially higher over the course of last year, measures of longer-term inflation expectations have moved up only modestly; they remain in the range observed over the decade before the pandemic and thus appear broadly consistent with the FOMC’s longer-run inflation objective of 2 percent.

- Link to latest Statement on Longer-Run Goals and Monetary Policy Strategy:

- https://www.federalreserve.gov/monetarypolicy/file...

- Bullard repeats he wants to see rates 100bp higher by Jul 1 (i.e. in three meetings), with the timing of the implied 50bp down to the Fed chair, and also for the balance sheet to start shrinking by then.

- There doesn't appear to be outright support for 50bp liftoff next month across the FOMC. George and Bowman prior to the invasion and Waller yesterday indicated they remain open to 50bp liftoff conditional on upcoming data but another hawk in Mester repeated she sees 25bp as her base case yesterday.

- Fed Funds futures pricing firm 1bp on Bullard comments, sitting at 32bp for Mar, 87bp for Jun and 160bp for Dec meetings.

US TSYS: Late Friday Roundup: Geopol Risks Reassessed

Distinction between calm or exhausted markets was hard to tell Friday, the second day after Russia invasion of Ukraine. Treasuries traded modestly weaker on an inside range as equities enjoyed strong gains in late trade - both a continuation from late Thursday trade as markets reassessed geopol-risk of the Ukraine invasion as well as the costs of punitive sanctions on Russia.

- Amid myriad sanctions against Russian banks, wealthy individuals (including Pres Putin and foreign minister Lavrov) is the ongoing debate over whether Russian would be banned from the SWIFT banking system.

- Select Russian banks will be removed from the SWIFT banking transaction system, the White House said on on 26 February in a joint statement with allies, to "harm their ability to operate globally” because of Moscow’s ongoing military invasion of Ukraine as part of a new series of tough measures that include curbs on Russia's central bank.

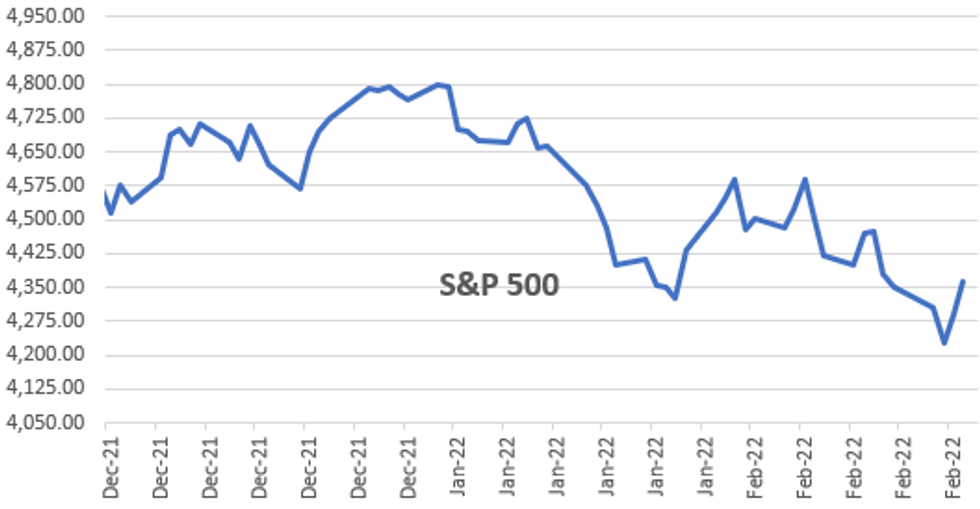

- Despite the bounce back to early Monday level (ESH2 at 4378.75, +94.75 late Fri) E-Mini S&P technical conditions are bearish however price remains above Thursday’s 4101.75 low and a corrective bounce extended Friday.

- Heavy session volumes in Tsy futures largely tied to final rolling from March to June futures that take lead on Monday. TYM2 traded 126-11 after the bell, -2.

- Lead Eurodollar quarterly EDH2 traded weaker even before latest 3M LIBOR set' gain of +0.01514 to 0.52300% -- new high last seen around early May 2020 after benchmark climbs +0.4343 total for the week. Chances of 50bp liftoff n March back around 50% with EDH2 at 99.325, -0.0575 after the bell.

- Later next week: Fed Chair Powell will be giving the semi-annual monetary policy report testimony to the House Financial Services Committee on Weds March 2 and the Senate Banking Committee on Thu March 3 - 1000ET/1500GMT in each case.

OVERNIGHT DATA

- US JAN PERSONAL INCOME +0.0%; NOM PCE +2.1%

- US JAN PCE PRICE INDEX +0.6%; +6.1% Y/Y

- US JAN CORE PCE PRICE INDEX +0.5%; +5.2% Y/Y

- US JAN UNROUNDED PCE PRICE INDEX +0.569%; CORE +0.517%

- US JAN DURABLE NEW ORDERS +1.6%; EX-TRANSPORTATION +0.7%

- US DEC DURABLE GDS NEW ORDERS REV TO +1.2%

- US JAN NONDEF CAP GDS ORDERS EX-AIR +0.9% V DEC +0.4%

- Solid rise in core durable goods orders in Jan with +0.9% M/M but perhaps more interesting from a supply side issue perspective was the rise in core shipments, up +1.9% M/M for the largest monthly increase since Jan 2021.

- Personal incomes were flat vs consensus for a -0.3% M/M decline despite the dropping off in child tax credits, although in real terms this will be sizeable decline, at a time of a large bounce in spending.

- Core PCE inflation was broadly as expected with the pace almost exactly unchanged in Jan at +0.52% M/M after a small upward revision to 0.53% in Dec (from 0.50%, not 0.47% said earlier).

- With both demand and supply side faring better than expected, it has only limited new implications for mon pol. Tsys trimmed ~0.5bps on release and BBDXY sitting close to where it was prior to the data but equally influenced by geopol headlines.

FED: The Federal Reserve Bank of Dallas's trimmed mean PCE inflation rose 3.53% in the 12 months ending January, the biggest jump since 1991. The one-month annualized trimmed mean rate was 6.66%, the highest since 1982. Fed officials have cited the trimmed mean measure as one of the best indicators of the underlying inflation trend. It had stayed near 2% throughout the pandemic, then started accelerating rapidly in September. The Cleveland Fed's median PCE inflation rate released Friday also showed its monthly figure at the highest since 1982.

- Official BEA data earlier Friday showed headline PCE inflation rising 6.1% over the year and core PCE rising 5.2%.

- MICHIGAN FINAL FEB. CONSUMER SENTIMENT AT 62.8; EST. 61.7, Bbg

- MICHIGAN FEB. 1-YR EXPECTED INFLATION UNCHANGED AT 4.9% Bbg

- MICHIGAN FEB. 5-YR EXPECTED INFLATION AT 3% FROM 3.1%, Bbg

- US NAR JAN PENDING HOME SALES INDEX 109.5 V 116.1 IN DEC

- US NAR JAN PENDING HOME SALES -5.7% MOM; -9.5% YOY

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 693.61 points (2.09%) at 33905.57

- S&P E-Mini Future up 75.25 points (1.76%) at 4358

- Nasdaq up 130.9 points (1%) at 13600.38

- US 10-Yr yield is up 1.9 bps at 1.9826%

- US Mar 10Y are down 6.5/32 at 126-8.5

- EURUSD up 0.0069 (0.62%) at 1.1261

- USDJPY up 0.05 (0.04%) at 115.57

- Gold is down $11.63 (-0.61%) at $1892.30

- EuroStoxx 50 up 141.4 points (3.69%) at 3970.69

- FTSE 100 up 282.08 points (3.91%) at 7489.46

- German DAX up 515.13 points (3.67%) at 14567.23

- French CAC 40 up 231.38 points (3.55%) at 6752.43

US TSY FUTURES CLOSE

- 3M10Y +0.181, 164.046 (L: 160.06 / H: 166.679)

- 2Y10Y +1.575, 39.345 (L: 35.534 / H: 40.292)

- 2Y30Y +1.25, 70.5 (L: 66.173 / H: 72.025)

- 5Y30Y -0.31, 40.992 (L: 38.367 / H: 43.158)

- Current futures levels:

- Mar 2Y down 0.875/32 at 107-22 (L: 107-17.625 / H: 107-22.375)

- Mar 5Y down 2.5/32 at 117-28.25 (L: 117-19.5 / H: 118-00.5)

- Mar 10Y down 2/32 at 126-13 (L: 126-00 / H: 126-21.5)

- Mar 30Y up 5/32 at 152-19 (L: 151-21 / H: 153-07)

- Mar Ultra 30Y up 16/32 at 181-4 (L: 179-23 / H: 182-13)

US 10Y FUTURES TECHS: (H2) Remains In A Corrective Cycle

- RES 4: 128-22+ High Jan 24

- RES 3: 128-11+ High Feb 1

- RES 2: 127-29 50-day EMA

- RES 1: 127-12+ High Feb 24

- PRICE: 126-06+ @ 19:47 GMT Feb 25

- SUP 1: 126-00/125-17+ Low Feb 25 / Low Feb 10 and bear trigger

- SUP 2: 125-06+ Low May 30 2019 (cont)

- SUP 3: 125-04+ 2.00 proj of the Jan 13 - 19 - 24 price swing

- SUP 4: 123-21+ 2.0% 10-dma envelope

Treasuries rallied Thursday to a high of 127-12+ before retracing to give back its gains. The climb however does signal scope for an extension of the current corrective cycle and attention remains on the 50-day EMA at 127-29. Note that MA studies still highlight a broader bearish trend condition and the 50-day EMA is seen as an important resistance. On the downside watch key support at 125-17+, the Feb 10 low and bear trigger.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.053 at 99.330

- Jun 22 -0.030 at 98.830

- Sep 22 -0.025 at 98.430

- Dec 22 -0.035 at 98.080

- Red Pack (Mar 23-Dec 23) -0.04 to -0.02

- Green Pack (Mar 24-Dec 24) -0.015 to -0.005

- Blue Pack (Mar 25-Dec 25) -0.005 to +0.005

- Gold Pack (Mar 26-Dec 26) +0.015 to +0.020

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00029 at 0.07714% (+0.00157/wk)

- 1 Month +0.02200 to 0.23057% (+0.05986/wk)

- 3 Month +0.01514 to 0.52300% (+0.04343/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02428 to 0.82871% (+0.04742/wk)

- 1 Year +0.04442 to 1.33071% (+0.04485/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $64B

- Daily Overnight Bank Funding Rate: 0.07% volume: $243B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $924B

- Broad General Collateral Rate (BGCR): 0.05%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $332B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Tsy 0Y-22.5Y, $6.201B accepted vs. $32.145B submission

- Next scheduled purchases

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

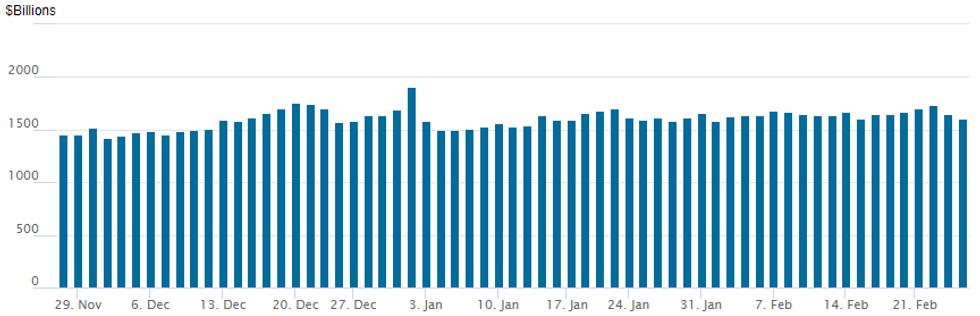

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,603.349B w/ 77 counterparties vs. $1,650.399B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

FOREX: Equity Markets Stabilisation Weighs On Greenback, Boosts Other Major FX

- Following the extension of Thursday’s late rebound on Wall Street, the greenback was on the backfoot approaching the close. Despite the dollar index making a fresh 19-month high this week amid the geopolitical circumstances, the DXY has slowly been edging away from these lofty levels as risk sentiment stabilises. The index remains around 0.7% higher for the week.

- Indeed, currency market sentiment is more favourable for Friday, helping the likes of AUD (+0.77%), NZD (+0.66) and CAD (+0.62%) towards the top of the G10 leaderboard.

- EURUSD also traded on a much more surer footing, edging further away from yesterday’s low print of 1.1106, rising back above 1.1250. Bearish technical developments this week defines a firm short-term resistance at 1.1280, the Feb 14 low.

- In similar vein, emerging market currencies bounced back with USDRUB seen 2.65% lower and in turn TRY, ZAR and MXN all posting near 1% gains on Friday.

- Outside of geopolitical risk, month-end flows had little impact on Friday, with most models pointing toward a USD-buying bias headed into Monday’s fix.

- Monday’s docket is kickstarted with Japanese and Aussie retail sales data before the US session is highlights by the MNI Chicago Business Barometer.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/02/2022 | 0030/1130 |  | AU | Business Indicators | |

| 28/02/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 28/02/2022 | 0700/0800 | *** |  | SE | GDP |

| 28/02/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 28/02/2022 | 0700/0800 | ** |  | SE | Trade Data |

| 28/02/2022 | 0730/0830 | *** |  | CH | CPI |

| 28/02/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 28/02/2022 | 0800/0900 | *** |  | CH | GDP |

| 28/02/2022 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 28/02/2022 | 1130/1230 |  | EU | ECB Panetta speech at EUI monetary policy debate | |

| 28/02/2022 | 1330/0830 | ** |  | US | advance trade, advance business inventories |

| 28/02/2022 | 1330/0830 | * |  | CA | Current account |

| 28/02/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 28/02/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/02/2022 | 1530/1030 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/02/2022 | 1550/1650 |  | EU | ECB Lagarde speech on Women in Econ & Finance | |

| 28/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.