-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - New EUR Highs on German Concessions

MNI ASIA OPEN: Tsy Yields Off Highs Into Month-End

EXECUTIVE SUMMARY

- MNI BRIEF: Fed's Trimmed Mean PCE Inflation Fastest Since 1991

- PUTIN: BUYERS OF GAS SHOULD OPEN ACCOUNTS IN RUSSIAN BANKS, Bbg

- PUTIN: ACTIVE CONTRACTS WILL BE HALTED IF DEMANDS NOT MET, Bbg

US

FED: The Dallas Fed's trimmed mean PCE inflation rate quickened to 3.63% over the 12 months to February, the biggest gain since 1991.

- Officials have cited the measure as one of the best indicators of underlying inflation and it had stayed near 2% throughout the pandemic before surging late last year. Not all the data showed upside risk-- the one-month annualized trimmed mean rate slowed in February to 4.01% from 6.45%.

- The Cleveland Fed's median PCE inflation rate released Thursday also showed its month-over-month measure dropping, to 0.44% from 0.54%, while the year-over-year figure increased to 4.18%, the highest since 1991. Official Bureau of Economic Analysis data from the Commerce Department earlier Thursday showed headline PCE inflation rising 6.4% over the year and core PCE rising 5.4%.

Month-End Rebalancing Roils Mkt Ahead March NFP

Rates see-sawed higher Thursday, near middle of the session range following late month-end rebalancing trade, volumes spiked on late buying in SPX eminis, ESM2 climbing off lows to 4582.5, before scaling back to 4557.0, while TYM2 trades from 123-00.5 to 122-27 into the FI close, 122-27 (+7) last.- Little react to earlier data, PCE in-line +0.6%; +6.4% Y/Y; MNI PMI recovered to 62.9 in March, after last month's dip to 56.3. Focus on Fri's March employment data.

- March nonfarm payrolls are expected to have risen by 490k (Bbg primary dealer median sits at 520k). We see two-sided risks to May pricing for Fed hikes and somewhat asymmetric risk to the downside for the broader rate path, but acknowledge that there's a long way to go between this report and the next FOMC decision on May 4, especially in the current geopolitical climate.

- FI rallied briefly after headlines aired Russia's Putin expects gas delivery contracts to be paid in Roubles, buyers must have Rouble funds deposited in Russian banks or risk being shut off. Timing over payments in question: initial report was by today; more recent reporting suggests second half of April to early May.

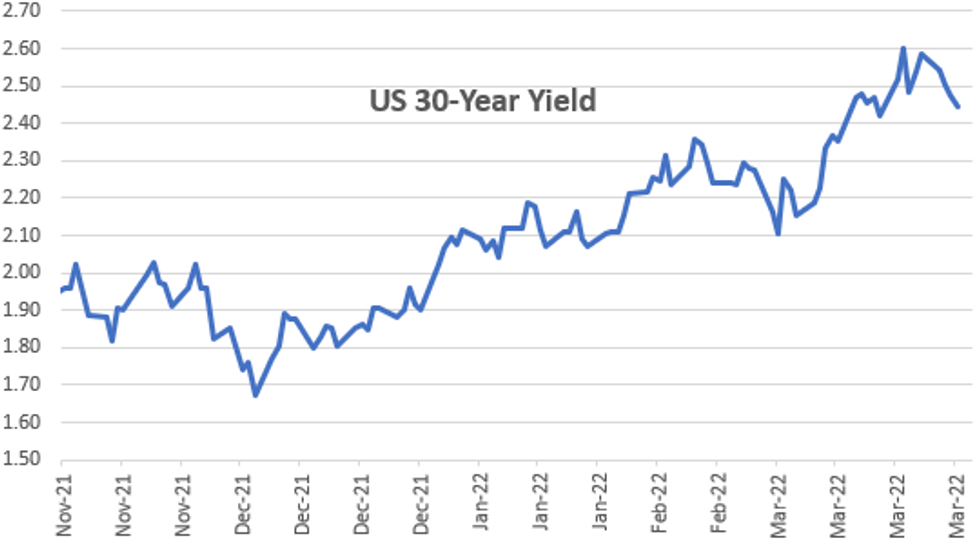

- The 2-Yr yield is down 1.8bps at 2.2882%, 5-Yr is down 1.3bps at 2.4249%, 10-Yr is down 2.2bps at 2.327%, and 30-Yr is down 2.9bps at 2.4453%.

OVERNIGHT DATA

- US PREV JOBLESS CLAIMS REVISED TO 188K IN MAR 19 WK

- US CONTINUING CLAIMS -0.035M to 1.307M IN MAR 19 WK

- US FEB PCE PRICE INDEX +0.6%; +6.4% Y/Y

- US FEB CORE PCE PRICE INDEX +0.4%; +5.4% Y/Y

- US FEB UNROUNDED PCE PRICE INDEX +0.579%; CORE +0.354%

- MNI Chicago Business Barometer Sees March Recovery:

- The Chicago Business BarometerTM, produced with MNI, recovered to 62.9 in March, after last month's dip to 56.3. Inventories reached levels not seen since 1973. All main indicators increased, with Inventories and New Orders seeing the largest boost. Only prices paid declined in March.

- CANADA JAN GROSS DOMESTIC PRODUCT +0.2% MOM

- CANADA JAN GOODS INDUSTRY GDP +0.8%, SERVICES +0.0%

- CANADA REVISED DEC GROSS DOMESTIC PRODUCT +0.1% MOM

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 195.49 points (-0.55%) at 35031.16

- S&P E-Mini Future down 19.75 points (-0.43%) at 4576

- Nasdaq down 51.1 points (-0.4%) at 14390.58

- US 10-Yr yield is down 2.2 bps at 2.327%

- US Jun 10Y are up 6.5/32 at 122-26.5

- EURUSD down 0.0088 (-0.79%) at 1.1072

- USDJPY down 0.21 (-0.17%) at 121.62

- WTI Crude Oil (front-month) down $6.91 (-6.41%) at $100.88

- Gold is up $9.11 (0.47%) at $1942.06

- EuroStoxx 50 down 56.62 points (-1.43%) at 3902.52

- FTSE 100 down 63.07 points (-0.83%) at 7515.68

- German DAX down 191.3 points (-1.31%) at 14414.75

- French CAC 40 down 81.72 points (-1.21%) at 6659.87

US TSY FUTURES CLOSE

- 3M10Y +0.329, 180.128 (L: 174.788 / H: 182.099)

- 2Y10Y -0.513, 3.134 (L: 0.938 / H: 5.223)

- 2Y30Y -1.6, 14.677 (L: 12.947 / H: 19.436)

- 5Y30Y -1.97, 1.213 (L: 1.05 / H: 7.564)

- Current futures levels:

- Jun 2Y up 2.25/32 at 105-30.375 (L: 105-28.25 / H: 106-00.25)

- Jun 5Y up 4/32 at 114-21.5 (L: 114-16.75 / H: 114-27.75)

- Jun 10Y up 8/32 at 122-28 (L: 122-19 / H: 123-04)

- Jun 30Y up 22/32 at 150-4 (L: 149-10 / H: 150-09)

- Jun Ultra 30Y up 1-11/32 at 177-13 (L: 175-19 / H: 177-16)

US 10Y FUTURES TECH: (M2) Corrective Cycle Extends

- RES 4: 126-04 High Mar 14

- RES 3: 124-01+ 20-day EMA

- RES 2: 123-25+ Low Mar 16 and a recent breakout level

- RES 1: 123-12 High Mar 23

- PRICE: 122-28 @ 1515ET Mar 31

- SUP 1: 120-30+ Low Mar 28 and the bear trigger

- SUP 2: 120.28 Low Dec 26 2018 (cont)

- SUP 3: 120-04+ Low Dec 12/13 2018 (cont)

- SUP 4: 120.00 Low Dec 6 2018 (cont) and psychological support

The trend direction in Treasuries is bearish, however, with price trading higher the contract remains in a corrective phase. Initial resistance is at 123-12, the Mar 23 high ahead of the 20-day EMA at 124-01+. A resumption of weakness would refocus attention on the recent low of 120-30+ where a break would confirm a resumption of the downtrend and this would open the 120-00 handle.

US EURODOLLAR FUTURES CLOSE

- Jun 22 steady at 98.465

- Sep 22 +0.020 at 97.810

- Dec 22 +0.030 at 97.330

- Mar 23 +0.045 at 97.035

- Red Pack (Jun 23-Mar 24) +0.030 to +0.040

- Green Pack (Jun 24-Mar 25) +0.035 to +0.045

- Blue Pack (Jun 25-Mar 26) +0.045 to +0.055

- Gold Pack (Jun 26-Mar 27) +0.060 to +0.065

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00357 at 0.33171% (+0.00514/wk)

- 1 Month -0.00314 to 0.45200% (+0.00686/wk)

- 3 Month -0.00529 to 0.96157% (-0.02129/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00214 to 1.46986% (+0.01872/wk)

- 1 Year -0.02443 to 2.10143% (+0.01272/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $80B

- Daily Overnight Bank Funding Rate: 0.32% volume: $249B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $900B

- Broad General Collateral Rate (BGCR): 0.30%, $324B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $310B

- (rate, volume levels reflect prior session)

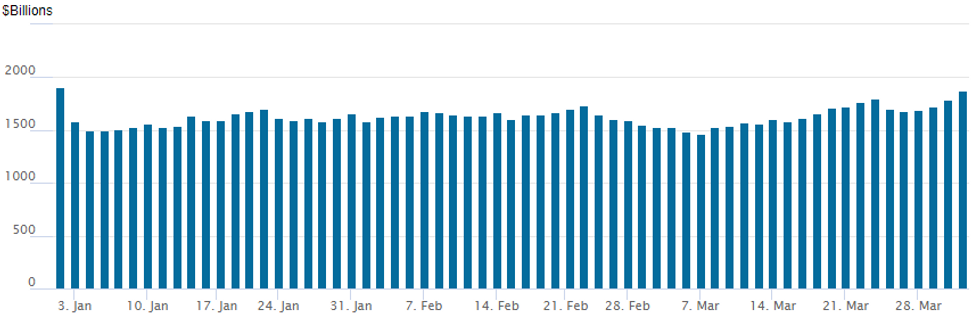

FED Reverse Repo Operation: New Year-to-Date High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new year-to-date high of $1,871.970B w/ 100 counterparties vs. prior session's $1,785.939B. Nearing all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $6.5B Corebridge Financial 6Pt Jumbo Launched

$14.45B total to price Thursday- Date $MM Issuer (Priced *, Launch #)

- 03/31 $6.5B #Corebridge Financial $1B 3Y +105, $1.25B 5Y +125, $1B 7Y +145, $1.5B 10Y +160, $500M 20Y +175, $1.25B 30Y +195

- 03/31 $2.1B #United Overseas Bank (UOB) $750M 3Y +60, $350M 3Y SOFR+70, $1B 10.5NC5.5 +145

- 03/31 $1.95B #Broadcom $750M 7Y +160, $1.2B 10Y +185

- 03/31 $1.8B #Daimler Trucks $500M 2Y SOFR+100, $650M 3Y +108, $650M 5Y +128

- 03/31 $1.2B #Equinix 10Y Green +165

- 03/31 $900M #American Homes $600M 10Y +160, $300M 30Y +200

EGBs-GILTS CASH CLOSE: German Yields Close Quarter With Sharp Drop

German yields outperformed Thursday, with Bobl and Bund rallying sharply.

- Yields tracked both mixed inflation data (France's beat wasn't as big as feared) and a fall in oil prices, with crude dropping overnight on anticipation the US would release strategic reserves.

- Later in the session, the Bund rally extended as equities slipped. Gilts lagged slightly.

- Periphery EGBs kept pace with BTPs rallying the most in a month. 10Y spreads ended a little wider though; Spain 10s a little tighter.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.6bps at -0.074%, 5-Yr is down 10.9bps at 0.375%, 10-Yr is down 9.8bps at 0.548%, and 30-Yr is down 6.6bps at 0.666%.

- UK: The 2-Yr yield is down 3bps at 1.352%, 5-Yr is down 3.8bps at 1.405%, 10-Yr is down 5.6bps at 1.61%, and 30-Yr is down 5bps at 1.763%.

- Italian BTP spread up 0.9bps at 149.1bps / Spanish down 0.8bps at 88.8bps

FOREX: Greenback Firms As Putin Roils Markets, Oil Hurts NOK

- The USD index has risen around 0.4% on Thursday and looks set to snap a two-day losing streak for the greenback.

- Headlines from Russia’s Putin surrounding the issue of a decree demanding payment for natural gas in rubles. Despite appearing to temper the order by allowing dollar and euro payments through a designated bank, the headlines weighed on risk with major equity benchmarks grinding lower throughout the session and lending support to the USD.

- The Euro was the main victim of the price action with EURUSD retracing back below 1.11 and settling towards the day’s low around 1.1070. Euro weakness was broad based as EURJPY and EURCHF both reside around 1% weaker.

- The Japanese Yen has continued its unwind from oversold conditions with USDJPY briefly making a fresh low for the week below 1.2130 and nearly 400 pips from the high posted on Monday.

- Substantially lower oil prices weighed heavily on the Norwegian Krona. USDNOK is seen over 2.5% higher approaching the APAC crossover, rejecting the breach of 8.60 and rising towards the best levels of last week around 8.80.

- Eurozone CPI Flash Estimate for March highlights the European session on Friday.

- However, focus remains on the US employment report. March nonfarm payrolls are expected to have risen by 490k according to the Bloomberg survey median. A few much softer analyst forecasts result in a lower average of 466k although the dispersion of views is relatively tightly packed between 450-550k and the primary dealer median sits at 520k.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/04/2022 | 2350/0850 | *** |  | JP | Tankan |

| 01/04/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/04/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/04/2022 | 0630/0830 | ** |  | SE | Manufacturing PMI |

| 01/04/2022 | 0630/0830 | *** |  | CH | CPI |

| 01/04/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 01/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/04/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/04/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/04/2022 | 1230/0830 | *** |  | US | Employment Report |

| 01/04/2022 | 1305/0905 |  | US | Chicago Fed's Charles Evans | |

| 01/04/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/04/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/04/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.