-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Aggressive Rate Hike Pricing is Back

EXECUTIVE SUMMARY

- MNI: Fed’s Evans Prepared To Hike More Aggressively If Needed

- MNI INTERVIEW: US Mfg On Growth Path Despite Many Risks - ISM

- KREMLIN SPOKESMAN SAYS RUSSIA WILL STRENGTHEN ITS WESTERN BORDERS SO THAT IT WOULD NEVER OCCUR TO ANYONE TO ATTACK - RIA NEWS

US

FED: Chicago Federal Reserve President Charles Evans said Friday he's prepared to hike interest rates more aggressively if the Ukraine invasion and more Covid waves push inflation higher.

- "Both of these present upside risks to inflation and downside risks to growth, and we will be monitoring their impact on the economy very closely. As we move through the year, we will certainly learn more and will be prepared to adjust policy as needed," he said in the text of a speech.

- "I am well aware that developments may transpire in a way that would cause me to alter my assessment," that's in line with the FOMC median estimate for the equivalent of seven quarter-point rate hikes this year and three next year, Evans said.

- "I'm still of the belief that the manufacturing economy will continue to expand all the way through the end of next year," he said.

- Fiore interpreted the Biden administration's announcement to release millions of barrels of oil from the Strategic Petroleum Reserve as a "good thing" that gives consumers and producers a bridge. "That says to me Biden's given the U.S. industry six months to get up to 13-14 million barrels per day, because they can't do it overnight," he said.

- "That's probably the issue that I'm most concerned about at USD100 a barrel oil. That's just not good for expanding manufacturing," he added. For more see MNI Policy main wire at 1328ET

US TSYS: Positive Start to New Quarter

New quarter underway with FI markets extending jobs-data lows, June 30Y bond futures through early Wed lows to 147-29 (-2-05), 30YY taps 2.5416 high before grinding higher around midmorning.

- Short end back to pricing in more aggressive/multiple 50bp rate hikes for year (216bp by year end vs. 220bp on Monday). Broad-based inversions vs. 10s: yield curves bear flattened -- 2s10s slipped to -8.135 low, 5s10s slips to -18.522 low.

- TYM2 currently at 122-07 (-21), above key resistance of 120-30+ Low Mar 28 and the bear trigger where a break would confirm a continuation of the downtrend and would open the 120-00 handle.

- Decent jobs data (431k vs. 490k est but Fed up-revision of 95k and unemployment rate drop to 3.6%) initially underpinned stocks with SPX eminis to 4502.0 second half low.

- Stock indexes traded mixed after the FI close, off midday lows to near middle of the session range. S&P eminis trading +4.75 at 4535.5, ESM2 well above key support of 4440.90 50-day EMA.

- Cross asset update, crude see-sawed in weaker territory (WTI -$0.88 (-0.88%) at $99.37; Gold -$14.34 (-0.74%) at $1923.42.

- Limited data next week, FOMC minutes release on Wednesday.

- The 2-Yr yield is up 12.2bps at 2.4564%, 5-Yr is up 10.7bps at 2.5671%, 10-Yr is up 5.5bps at 2.3932%, and 30-Yr is down 0.6bps at 2.4416%.

OVERNIGHT DATA

- US MAR NONFARM PAYROLLS +431K; PRIVATE +426K, GOVT +5K

- US PRIOR MONTHS PAYROLLS REVISED: FEB +750K; JAN +504K

- BLS PAYROLLS NET REVISIONS FOR FEB, JAN +95K

- US MAR AVERAGE HOURLY EARNINGS +0.4% Vs FEB +0.1%; +5.6% YOY

- US MAR AVERAGE WEEKLY HOURS 34.6 HRS

- US MAR UNEMPLOYMENT RATE 3.6%

- US ISM PURCHASING MANAGERS MANUF INDEX 57.1 MAR VS 58.6 FEB

- US ISM PRICES PAID INDEX 87.1 MAR VS 75.6 FEB (NSA)

- US ISM NEW ORDERS INDEX 53.8 MAR VS 61.7 FEB

- US ISM EMPLOYMENT INDEX 56.3 MAR VS 52.9 FEB

- US ISM PRODUCTION INDEX 54.5 MAR VS 58.5 FEB

- US ISM SUPPLIER DELIVERY INDEX 65.4 MAR VS 66.1 FEB

- US ISM ORDER BACKLOG INDEX 60.0 MAR VS 65.0 FEB (NSA)

- US ISM INVENTORIES INDEX 55.5 MAR VS 53.6 FEB

- US ISM CUSTOMER INV INDEX 34.1 MAR VS 31.8 FEB (NSA)

- US ISM EXPORTS INDEX 53.2 MAR VS 57.1 FEB (NSA)

- US ISM IMPORTS INDEX 51.8 MAR VS 55.4 FEB (NSA)

- US FEB CONSTRUCT SPENDING +0.5%

- US FEB PRIVATE CONSTRUCT SPENDING +0.8%

- US FEB PUBLIC CONSTRUCT SPENDING -0.4%

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 155.94 points (0.45%) at 34835.52

- S&P E-Mini Future up 9 points (0.2%) at 4540.25

- Nasdaq up 37.5 points (0.3%) at 14259.08

- US 10-Yr yield is up 5.3 bps at 2.3913%

- US Jun 10Y are down 25/32 at 122-3

- EURUSD down 0.0021 (-0.19%) at 1.1046

- USDJPY up 0.85 (0.7%) at 122.54

- WTI Crude Oil (front-month) down $0.88 (-0.88%) at $99.37

- Gold is down $14.34 (-0.74%) at $1923.42

- EuroStoxx 50 up 16.16 points (0.41%) at 3918.68

- FTSE 100 up 22.22 points (0.3%) at 7537.9

- German DAX up 31.73 points (0.22%) at 14446.48

- French CAC 40 up 24.44 points (0.37%) at 6684.31

US TSY FUTURES CLOSE

- 3M10Y +3.746, 186.529 (L: 182.099 / H: 192.554)

- 2Y10Y -6.851, -6.912 (L: -7.853 / H: 2.902)

- 2Y30Y -12.591, -1.685 (L: -2.408 / H: 13.624)

- 5Y30Y -11.159, -12.72 (L: -13.294 / H: 0.35)

- Current futures levels:

- Jun 2Y down 10.875/32 at 105-19.875 (L: 105-19.125 / H: 105-27.875)

- Jun 5Y down 24.5/32 at 113-29.5 (L: 113-27 / H: 114-16.25)

- Jun 10Y down 25.5/32 at 122-2.5 (L: 121-24 / H: 122-21.5)

- Jun 30Y down 18/32 at 149-16 (L: 147-29 / H: 150-02)

- Jun Ultra 30Y up 6/32 at 177-10 (L: 173-31 / H: 178-07)

US 10Y FUTURES TECH: (M2) Downtrend Intact

- RES 4: 125-21 50-day EMA

- RES 3: 124-28+ High Mar 17

- RES 2: 123-30 20-day EMA

- RES 1: 123-12 High Mar 23

- PRICE: 122-06+ @ 1430ET Apr 1

- SUP 1: 120-30+ Low Mar 28 and the bear trigger

- SUP 2: 120.28 Low Dec 26 2018 (cont)

- SUP 3: 120-04+ Low Dec 12/13 2018 (cont)

- SUP 4: 120.00 Low Dec 6 2018 (cont) and psychological support

A bearish outlook remains intact in Treasuries and recent gains are considered corrective. Initial resistance at 123-12, the Mar 23 high, remains in place and this lies ahead of the 20-day EMA, at 123-30. A resumption of weakness would refocus attention on the recent low of 120-30+ where a break would confirm a continuation of the downtrend and would open the 120-00 handle.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.050 at 98.420

- Sep 22 -0.130 at 97.690

- Dec 22 -0.180 at 97.160

- Mar 23 -0.195 at 96.845

- Red Pack (Jun 23-Mar 24) -0.225 to -0.20

- Green Pack (Jun 24-Mar 25) -0.195 to -0.165

- Blue Pack (Jun 25-Mar 26) -0.15 to -0.08

- Gold Pack (Jun 26-Mar 27) -0.065 to -0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00442 at 0.32729% (+0.00072/wk)

- 1 Month -0.01443 to 0.43757% (-0.00757/wk)

- 3 Month +0.00043 to 0.96200% (-0.02086/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01928 to 1.48914% (+0.03800/wk)

- 1 Year +0.07014 to 2.17157% (+0.08286/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $57B

- Daily Overnight Bank Funding Rate: 0.32% volume: $145B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.29%, $979B

- Broad General Collateral Rate (BGCR): 0.30%, $303B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $288B

- (rate, volume levels reflect prior session)

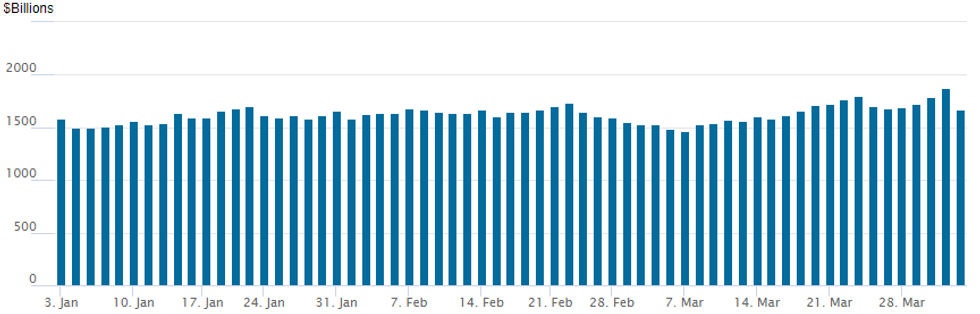

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to 1,666.063B w/ 77 counterparties from Thu's new year-to-date high of $1,871.970B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: Over $258B Total March Corporate Issuance Highest Since May 2020

Total $38B high-grade corporate issuance for the week, puts March total at $258.425B -- highest issuance since May 2020. See MNI Markets fixed page: US$ Corporate Supply Pipeline for detailed breakdown.- Date $MM Issuer (Priced *, Launch #)

- No new issuance Friday

- $14.45B Priced Thursday

- 03/31 $6.5B *Corebridge Financial $1B 3Y +105, $1.25B 5Y +125, $1B 7Y +145, $1.5B 10Y +160, $500M 20Y +175, $1.25B 30Y +195

- 03/31 $2.1B *United Overseas Bank (UOB) $750M 3Y +60, $350M 3Y SOFR+70, $1B 10.5NC5.5 +145

- 03/31 $1.95B *Broadcom $750M 7Y +160, $1.2B 10Y +185

- 03/31 $1.8B *Daimler Trucks $500M 2Y SOFR+100, $650M 3Y +108, $650M 5Y +128

- 03/31 $1.2B *Equinix 10Y Green +165

- 03/31 $900M *American Homes $600M 10Y +160, $300M 30Y +200

EGBs-GILTS CASH CLOSE: Yields Fade Late

German and UK yields faded lower toward the end of Friday's session, reversing most of the morning's initial rise. European curves flattened in sympathy with their US counterparts.

- The US employment report was the most anticipated event of the session but came in almost exactly in line with survey.

- Spanish and Italian PMIs came in weaker than expected; Eurozone inflation beat stale expectations, little discernable market reaction.

- Periphery spreads widened; BTPs underperformed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at -0.068%, 5-Yr is up 0.3bps at 0.378%, 10-Yr is up 0.7bps at 0.555%, and 30-Yr is up 0.6bps at 0.672%.

- UK: The 2-Yr yield is up 2.2bps at 1.374%, 5-Yr is up 1.2bps at 1.417%, 10-Yr is down 0.2bps at 1.608%, and 30-Yr is down 2.6bps at 1.737%.

- Italian BTP spread up 4.7bps at 153.8bps / Spanish up 2.9bps at 91.7bps

FOREX: USDJPY Set To Post Fourth Consecutive Week Of Gains

- The week’s price action was centred around volatility in the Japanese Yen. Following USDJPY’s multi-year high print above the 125 handle, a sharp retracement ensued, resulting in a near 400 pip weekly range.

- With gains of 0.75% on Friday, the pair looks set to post its fourth consecutive week of gains and close around 122.60 with initial support now established at 121.28. On the upside, initial resistance is seen at 123.20, the Mar 30 high with the bull trigger unchanged at 125.09.

- US NFP data did little to move the dial in the currency space, with the greenback extending its recovery off the Wednesday lows. The dollar index gained 0.3% on Friday and looks set to post very minor losses for the week.

- AUD displayed clear outperformance, rising a quarter of a percent against the dollar. Breaching back above $0.7500, the pair has narrowed the gap with the cycle high at 0.7540 printed on Mar28. Progress through here opens 0.7556, the Oct 28 High and a key resistance.

- A quiet data day on Monday, however there may be comments from BoE’s Bailey on Monday, before the RBA meeting/decision on Tuesday. China observes holidays on Monday and Tuesday.

- In the US, ISM Services data is scheduled for Tuesday before the FOMC minutes will be released on Wednesday. Currency markets remain on watch for any further steps toward a ceasefire made at new negotiations between Russian and Ukrainian representatives.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/04/2022 | 0600/0200 | * |  | TR | Turkey CPI |

| 04/04/2022 | 0600/0800 | ** |  | DE | trade balance |

| 04/04/2022 | 0830/0930 |  | UK | BOE Mann Speech at Resolution Foundation on Economic Outlooks | |

| 04/04/2022 | 0905/1005 |  | UK | BOE Bailey Speech at Stop Scams Conference | |

| 04/04/2022 | 1400/1000 | ** |  | US | factory new orders |

| 04/04/2022 | 1400/1500 |  | UK | BOE Cunliffe at European Economics & Financial Centre Seminar | |

| 04/04/2022 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 04/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 04/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.