-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Yld Curves Bear Steepen Ahead FOMC

EXECUTIVE SUMMARY

- MNI INTERVIEW: ISM Miss Doesn't Signal Recession - Mfg Chief

- MNI BRIEF: Eurogroup Head Reveals New ESM Head Shortlist

- GERMANY'S CLIMATE MINISTER: GERMANY IS READY TO SUPPORT BAN ON RUSSIAN OIL, Bbg

US

US: U.S. manufacturers are experiencing weaker business growth in the face of global disruptions but the sector will likely sustain moderate growth levels through 2023, and renewed supply troubles may actually lengthen the expansion as demand persists, Institute for Supply Management chair Timothy Fiore told MNI Monday.

- "If you look at the headline number you could say that there's indication that it would" lead to recession fears, Fiore said. "But, no, absolutely not. There's no end to demand here. We're still seeing 3-to-1 positive comments on demand" from manufacturers.

- While maintaining his view the U.S. manufacturing sector will see continuous growth through the end of next year, Fiore attributed April's surprising 1.7ppt drop in the PMI to 55.4 to seasonal factors. For more see MNI Policy main wire at 1341ET.

EUROPE

EU: Eurogroup Chair Paschal Donohoe has revealed the shortlist of candidates to succeed Klaus Regling as head of the European Stability Mechanism. The list includes: Italy's Marco Buti, a senior EU Commission official and currently Commissioner Paolo Gentiloni's chief of staff, Luxembourg's Pierre Gramegna, a former finance minister of Luxembourg. The Netherlands proposed Menno Snel, a former state secretary for finance, and Portugal put forward Joao Leao, another former finance minister.

- EU finance ministers will make a decision on which of the four will take over the role at their meeting on May 23.

US TSYS: 10YY Breached 3% Briefly

London and Asia extended spring holiday weekend, exacerbated already thin markets Monday with accts sidelined ahead Wed's FOMC policy annc. TYM2 neared key resistance of 118-02.5 in the second half.

- Notably, 10YY breached of 3.0% to 3.0003% briefly - the highest level since Dec 2018), rebounded after the bell (TYM2 at 118-12.5) as did equities: SPX emini Jun'22 futures at 4145.0 +17.5 vs. 4056.25 second half low.

- May’s FOMC decision will be the most hawkish in recent memory, with a 50bp hike and the launch of balance sheet reduction. However, already aggressive market hike pricing limits the potential hawkish impact. Focus will be on the FOMC’s openness to 75bp hikes and/or moving above “neutral”, and any hint of asset sales.

- That said, lead quarterly Eurodollar futures finished near session highs (ESM2 at 98.105 +0.030, EDU2 +0.010 at 97.25).

- Tuesday data kicks off at 1000ET: Factory Orders (-0.5%, 1.2%); ex-trans (0.4%, --); Durable Goods Orders (0.8%, 0.8%); ex-trans (1.1%, 1.1%); Cap Goods Orders Nondef Ex Air (1.0%, 1.0%); ship (0.2%, --) and JOLTS Job Openings (11.266M, 11.200M).

OVERNIGHT DATA

- U.S. S&P GLOBAL APRIL MANUFACTURING PMI AT 59.2 VS 58.8 PRIOR

- US ISM APR MANUF PRICES PAID INDEX 84.6

- US ISM APR MANUF NEW ORDERS INDEX 53.5

- US ISM APR MANUF EMPLOYMENT INDEX 50.9

- US ISM APR MANUF PRODUCTION INDEX 53.6

- US ISM APR MANUF SUPPLIER DELIVERY INDEX 67.2

- US MAR CONSTRUCT SPENDING +0.1%

- US MAR PRIVATE CONSTRUCT SPENDING +0.2%

- US MAR PUBLIC CONSTRUCT SPENDING -0.2%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 16.45 points (0.05%) at 32992.29

- S&P E-Mini Future up 5.25 points (0.13%) at 4134

- Nasdaq up 126.3 points (1%) at 12459.33

- US 10-Yr yield is up 5.3 bps at 2.9866%

- US Jun 10Y are down 24/32 at 118-13

- EURUSD down 0.0038 (-0.36%) at 1.0508

- USDJPY up 0.45 (0.35%) at 130.14

- WTI Crude Oil (front-month) up $0.6 (0.57%) at $105.29

- Gold is down $35.12 (-1.85%) at $1861.78

- EuroStoxx 50 down 70.42 points (-1.85%) at 3732.44

- German DAX down 158.81 points (-1.13%) at 13939.07

- French CAC 40 down 108.16 points (-1.66%) at 6425.61

US TSY FUTURES CLOSE

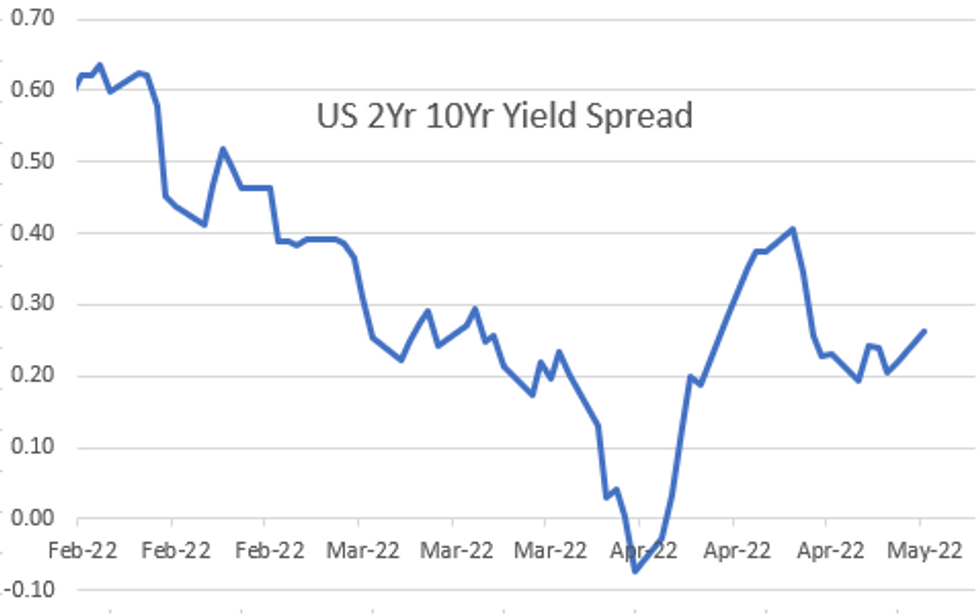

- 3M10Y +9.373, 218.153 (L: 203.54 / H: 220.564)

- 2Y10Y +5.07, 26.354 (L: 17.891 / H: 27.153)

- 2Y30Y +5.66, 33.284 (L: 24.312 / H: 33.739)

- 5Y30Y +1.071, 5.134 (L: 2.26 / H: 6.379)

- Current futures levels:

- Jun 2Y down 1/32 at 105-12 (L: 105-09.875 / H: 105-14)

- Jun 5Y down 12/32 at 112-9.5 (L: 112-05.75 / H: 112-20)

- Jun 10Y down 23.5/32 at 118-13.5 (L: 118-07 / H: 119-02)

- Jun 30Y down 1-14/32 at 139-8 (L: 138-29 / H: 140-15)

- Jun Ultra 30Y down 3-08/32 at 157-06 (L: 156-26 / H: 159-17)

(M2) Trend Outlook Remains Bearish

- RES 4: 122-16 50-day EMA

- RES 3: 122-12+ High Apr 4

- RES 2: 121-09 High Apr 14 and a reversal point

- RES 1: 120-18+ High Apr 27 and key resistance

- PRICE: 118-14+ @ 1420ET May 2

- SUP 1: 118-08 Low Apr 22 and the bear trigger

- SUP 2: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 117-22+ Low Nov 8 2018 (cont)

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

Treasuries last week pulled back from Wednesday’s high of 120-18+. The trend outlook is unchanged and remains bearish. MA studies are in a bear mode and fresh cycle lows on Apr 22 confirmed a resumption of the primary downtrend and an extension of the bearish price sequence of lower lows and lower highs. The focus is on 118-02+ next, a Fibonacci projection. Key short-term resistance has been defined at 120-18+, the Apr 27 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.030 at 98.105

- Sep 22 +0.020 at 97.260

- Dec 22 steady at 96.770

- Mar 23 -0.025 at 96.520

- Red Pack (Jun 23-Mar 24) -0.09 to -0.035

- Green Pack (Jun 24-Mar 25) -0.11 to -0.10

- Blue Pack (Jun 25-Mar 26) -0.12 to -0.115

- Gold Pack (Jun 26-Mar 27) -0.13 to -0.125

SHORT TERM RATES

US DOLLAR LIBOR: No settlements Monday with London out for May Day holiday

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $76B

- Daily Overnight Bank Funding Rate: 0.32% volume: $244B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.28%, $915B

- Broad General Collateral Rate (BGCR): 0.30%, $354B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $333B

- (rate, volume levels reflect prior session)

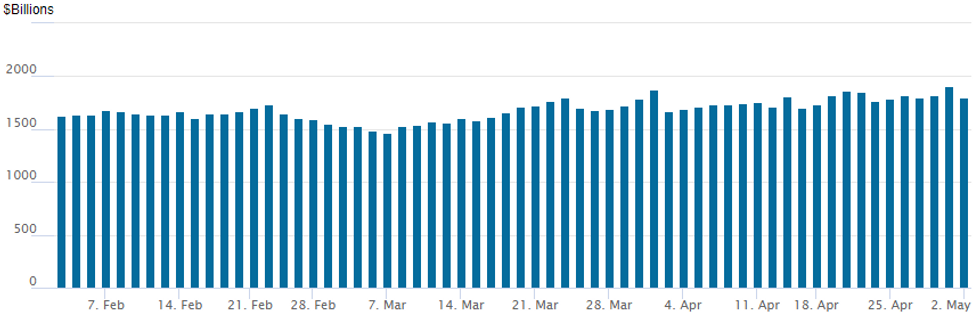

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs recedes to 1,796.302B w/ 84 counterparties from prior session's new all-time high of 1,906.802B (prior all-time high of $1,904.582B on Friday, December 31).

PIPELINE: $1.85B Constellation Brands 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 05/02 $1.85B #Constellation Brands $550M 2Y +90, $600M 5Y +135, $700< 10Y +180

- 05/02 $1.5B #Georgia Power $700M 10Y +175, $800M 30Y +210

- 05/02 $500M *Northern States Power 30Y +148

FOREX: Greenback Maintains Upward Trajectory, Erases Friday’s Pullback

- The US dollar trades firmly in the green on Monday, with the USD Index (+0.76%) recouping the entirety of Friday’s pullback and narrowing the gap with most recent cycle highs, situated at 103.928.

- Price action during the second half of Monday trade has generally been a slow grind, with a UK market holiday keeping many traders on the sidelines ahead of key risk events later this week - most notably Wednesday’s FOMC meeting as well as Friday's Nonfarm Payrolls release.

- Strength in the greenback has been broad based, however, Scandinavian FX are the notable underperformers, ranking at the bottom of the G10 pile, closely followed by weakness in CHF, CNH and GBP.

- GBPUSD (-0.72%) has slipped back below the 1.2500 mark with last Friday’s gains considered technically corrective following last week’s overall acceleration of the downtrend. 1.2412, the Apr 28 low remains the bear trigger before 1.2375, a Fibonacci projection of the Mar 23 - Apr 13 - 14 price swing.

- AUDUSD relatively outperforms, retreating just 0.3%, however the pair remains in close proximity to the recent lows amid the downward momentum for global equity benchmarks. Last week’s price action resulted in a breach of 0.7095, the Feb 24 low, and reinforces bearish conditions. Nearest support is seen at 0.6968, the Jan 28 low ahead of the RBA announcement due overnight. The much firmer than expected Q122 CPI print in Australia may have tilted the scales towards a cash rate hike at tomorrow’s May meeting.

- Aside from the RBA, both Japan and China are out for local holidays which may impact local liquidity during the APAC session. Eurozone unemployment figures along with US JOLTS data headline the Tuesday calendar.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/05/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 03/05/2022 | 0755/0955 | ** |  | DE | unemployment |

| 03/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/05/2022 | 0900/1100 | ** |  | EU | PPI |

| 03/05/2022 | 0900/1100 | ** |  | EU | unemployment |

| 03/05/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/05/2022 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 03/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 03/05/2022 | 1300/1500 |  | EU | ECB Lagarde High School Q&A | |

| 03/05/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/05/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 03/05/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 03/05/2022 | 1515/1615 |  | UK | BOE Mutton Panellist at Bankers Association | |

| 03/05/2022 | 1630/1230 |  | CA | BOC Sr Deputy Rogers speaks on operational independence |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.