-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Will Fed Be More Aggressive Than Expected?

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: Fed To Pick Up Tightening Pace

- MNI BRIEF: BOC Says Rate Must Keep Rising As Economy Overheats

US

FED: The Federal Reserve on Wednesday is expected to raise benchmark interest rates by 50 basis points in its most aggressive move in two decades to curb inflation. It's also set to announce plans to shrink its USD9 trillion balance sheet at a rapid pace starting next month.

- The U.S. central bank, criticized for waiting too long to respond to soaring inflation, appears to be aiming to frontload multiple 50-bp increases to get the fed funds rate to around 2% before reassessing the pace of further rate hikes.

- Investors will be looking for Fed Chair Jerome Powell to confirm those plans, or even to signal the FOMC is open to a still larger 75 bp move in June, as well as insight into the committee's latest thinking on how restrictive policy needs to get to combat inflation.

- The Fed's blueprint for asset runoffs is likely to show a short ramp-up period leading to a combined USD95 billion monthly cap on the reinvestment of proceeds from maturing Treasuries and agency mortgage-backed securities. For more see MNI Policy main wire at 0813ET.

CANADA

BOC: The Bank of Canada must keep raising the low policy interest rate to hold down demand in a hot economy, Senior Deputy Governor Carolyn Rogers said Tuesday, without giving a view on whether another 50bp move or something bigger is needed.

- "With the Canadian economy starting to overheat, we can't let demand get too far ahead of supply or we risk adding further to inflation," Rogers said in her debut speech as the No. 2 official, and the Bank's first such in-person remarks since the pandemic. The Bank last month raised rates 50bp to 1% and said neutral was 2.5%; the next meeting is June 1.

US TSYS: Yld Curves Bull Flatten Ahead FOMC, Early ADP Employ Data

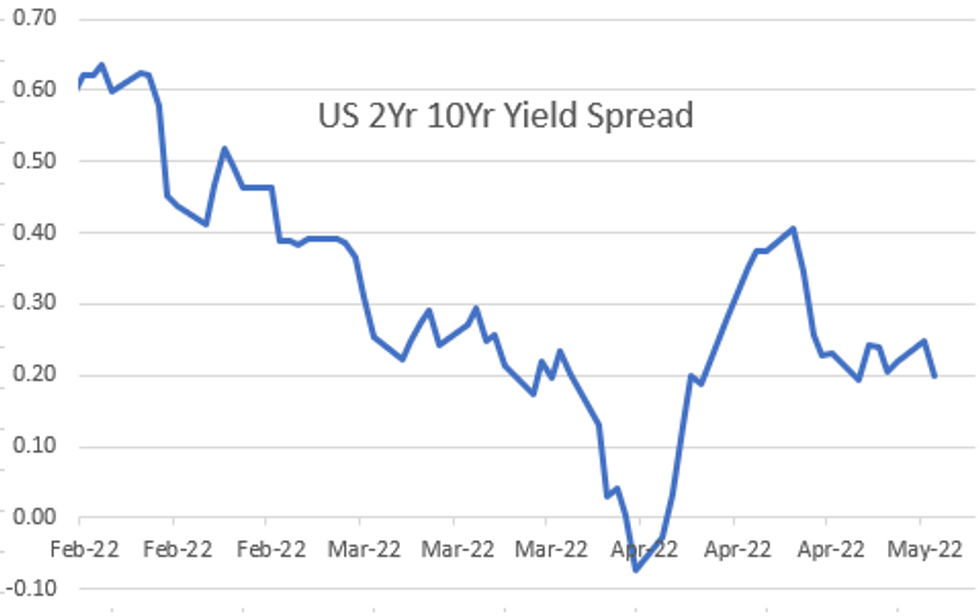

US Rates traded mixed Tuesday, futures rebounded from the week opener's broad based sell-off, curves bull flattening (2s10s -4.060 at 20.487) as long end rates outperformed in the lead-up to Wednesday's FOMC policy annc at 1400ET (Chairman Powell presser at 1430ET).

- Front end support in Eurodollar futures reversed in late trade, however, White pack (EDM2-EDH3) trading -0.005 in the lead quarterly to -0.050 across the balance of the strip. While market expectations of multiple 50bp hikes has expanded to 250bp by year end, the late reversal in the short end has some desks pondering a more aggressive forward guidance from the Fed may be revealed soon.

- Goldman Sachs agrees with consensus on a 50bp hike and QT announced at the May meeting, and they say the key question is what comes next. Despite Bullard raising the possibility of 75bp hikes in future, this is unlikely (but not implausible under certain circumstances).

- Aside from the FOMC, Wednesday data focus on ADP Employment Change (455k, 385k) at 0815ET that may provide some incite to Friday's Nonfarm Payrolls for April (+390k est vs. +431k prior).

- The 2-Yr yield is up 3.9bps at 2.7702%, 5-Yr is up 0.4bps at 3.0081%, 10-Yr is down 1.2bps at 2.9692%, and 30-Yr is down 1.6bps at 3.0167%.

OVERNIGHT DATA

- US BLS: JOLTS OPENINGS RATE 11.549M IN MAR

- US MAR FACTORY ORDERS +2.2%; EX-TRANSPORT NEW ORDERS +2.5%

- US MAR DURABLE ORDERS +1.1%

- US MAR NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +1.3%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 70.22 points (0.21%) at 33136.89

- S&P E-Mini Future up 19.75 points (0.48%) at 4171

- Nasdaq up 26 points (0.2%) at 12562.79

- US 10-Yr yield is down 1.3 bps at 2.9673%

- US Jun 10Y are up 3.5/32 at 118-14.5

- EURUSD up 0.0012 (0.11%) at 1.0519

- USDJPY up 0.02 (0.02%) at 130.18

- WTI Crude Oil (front-month) down $2.31 (-2.2%) at $102.86

- Gold is up $3.73 (0.2%) at $1866.80

- EuroStoxx 50 up 28.75 points (0.77%) at 3761.19

- FTSE 100 up 16.78 points (0.22%) at 7561.33

- German DAX up 100.4 points (0.72%) at 14039.47

- French CAC 40 up 50.57 points (0.79%) at 6476.18

US TSY FUTURES CLOSE

- 3M10Y -12.867, 204.699 (L: 198.79 / H: 208.47)

- 2Y10Y -4.843, 19.704 (L: 17.92 / H: 24.522)

- 2Y30Y -5.29, 24.455 (L: 22.43 / H: 29.516)

- 5Y30Y -1.946, 0.527 (L: -0.587 / H: 3.515)

- Current futures levels:

- Jun 2Y down 2.625/32 at 105-9 (L: 105-08.625 / H: 105-13.75)

- Jun 5Y down 0.25/32 at 112-8 (L: 112-02.5 / H: 112-18.25)

- Jun 10Y up 3.5/32 at 118-14.5 (L: 118-04.5 / H: 118-30)

- Jun 30Y up 23/32 at 139-26 (L: 139-01 / H: 140-24)

- Jun Ultra 30Y up 1-09/32 at 158-12 (L: 157-10 / H: 159-26)

US 10Y FUTURES TECH: (M2) Fresh Cycle Low

- RES 4: 122-10+ 50-day EMA

- RES 3: 122-12+ High Apr 4

- RES 2: 121-09 High Apr 14 and a reversal point

- RES 1: 120-18+ High Apr 27 and key resistance

- PRICE: 118-28+@ 1130ET May 3

- SUP 1: 118-04+ Intraday low

- SUP 2: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 117-22+ Low Nov 8 2018 (cont)

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

Treasuries have traded lower today and probed support at 118-08, the Apr 22 low and a bear trigger. This signals a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. Moving average studies remain in a bear mode. Potential is seen for weakness towards 118-02+ next, a Fibonacci projection and 117-22+, the Nov 8 2018 low (cont). Key short-term resistance has been defined at 120-18+.

US EURODOLLAR FUTURES CLOSE

- Jun 22 steady at 98.10

- Sep 22 -0.050 at 97.20

- Dec 22 -0.050 at 96.710

- Mar 23 -0.055 at 96.455

- Red Pack (Jun 23-Mar 24) -0.04 to +0.005

- Green Pack (Jun 24-Mar 25) +0.010 to +0.030

- Blue Pack (Jun 25-Mar 26) +0.035 to +0.050

- Gold Pack (Jun 26-Mar 27) +0.045 to +0.050

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00029 to 0.33029% (+0.00357 total last wk)

- 1M +0.02842 to 0.83171% (+0.09986 total last wk)

- 3M +0.02843 to 1.36329% (+0.12125 total last wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.07015 to 1.98086% (+0.08700 total last wk)

- 12M +0.06629 to 2.69486% (+0.02186 total last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $77B

- Daily Overnight Bank Funding Rate: 0.32% volume: $253B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $984B

- Broad General Collateral Rate (BGCR): 0.30%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $345B

- (rate, volume levels reflect prior session)

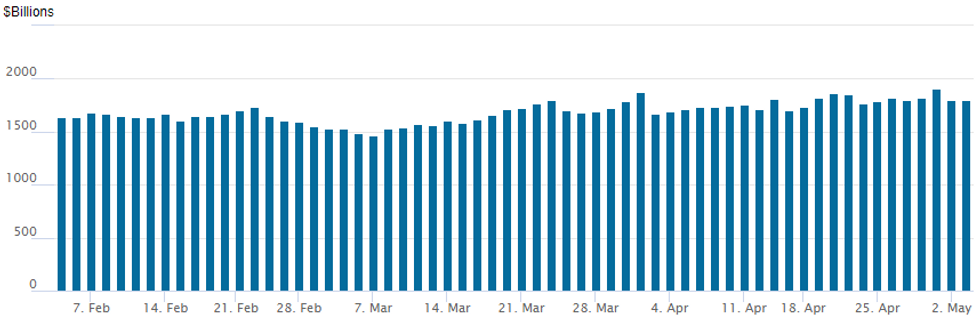

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage at 1,796.252B w/ 83 counterparties vs. prior session's 1,796.302B (all-time high of $1,906.802B on Friday, March 29, 2022).

PIPELINE: $3B UBS Group 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 05/03 $3B #UBS Group $1.2B 4NC3 +155, $600M 4NC3 SOFR+158, $1.2B 6NC5 +175

- 05/03 $700M #Excel Energy 10Y +167

EGBs-GILTS CASH CLOSE: Yields Back Off Multi-Year Highs

UK yields underperformed their German counterparts Tuesday, particularly at the long end as Bund and Buxl yields dipped. Overall, yields drifted lower after hitting multi-year highs (notably Bund >1%) this morning.

- The Gilt move of course reflected a catch-up following the UK markets reopening from a long weekend, but was also seen in context of Thursday's BoE decision (MNI's preview went out today).

- Periphery spreads widened modestly, with BTP/Bund spreads hitting a fresh post-May 2020 high.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.3bps at 0.275%, 5-Yr is up 2.6bps at 0.708%, 10-Yr is down 0.3bps at 0.965%, and 30-Yr is down 5.2bps at 1.087%.

- UK: The 2-Yr yield is up 5.5bps at 1.646%, 5-Yr is up 5.6bps at 1.727%, 10-Yr is up 5.3bps at 1.958%, and 30-Yr is up 4.2bps at 2.079%.

- Italian BTP spread up 2.5bps at 191.7bps / Spanish up 1.3bps at 105.9bps

FOREX: USD Pares Some Gains Ahead Of May FOMC, AUD Outperforms

- EURUSD had a sharp squeeze as the US session commenced. The pair rallied from 1.05 to 1.0578 on the back of little news headlines, echoing the price action throughout Monday’s European session. However, strength was short-lived and the pair continues to be well offered on rallies with supportive conditions for the greenback continuing to preside over currency markets.

- With that said the USD index trades 0.3% lower on Tuesday amid firmer equity indices and ahead of the long-awaited May FOMC decision.

- Technically, the USD is in a clear uptrend and this was reinforced in April. The bull theme is clearly highlighted in the USD Index (DXY) chart. A number of important technical factors are evident on the monthly frequency: see latest MNI analysis for details: https://marketnews.com/dxy-candle-pattern-reinforces-bullish-conditions-2657257678

- AUD held on to gains on Tuesday, following the RBA surprising markets overnight with a 25bps rate hike to 0.35% vs. expectations of a 15bps tweak. In the subsequent press conference, Governor Lowe flagged that the bank could raise rates as high as 1.5% by the end of 2022, and to 2.5% at a cyclical peak.

- In response, AUD/USD settled around the 0.71 mark after rallying to just shy of 0.7150 in the aftermath of the decision.

- The RBNZ Financial Stability Report will kick off the APAC session with Governor Orr due to hold a press conference about the report shortly afterwards. Additionally, New Zealand employment data shortly afterwards. Additionally, New Zealand Q1 Employment data will be released.

- China and Japan remain out for local holidays before a fairly light European calendar headlined by Spanish unemployment.

- US ADP employment data will be released on Wednesday which is unlikely to influence the market before the May FOMC decision and subsequent press conference with Governor Powell.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/05/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 04/05/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 04/05/2022 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 04/05/2022 | 0600/0800 | ** |  | DE | trade balance |

| 04/05/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/05/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/05/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/05/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/05/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 04/05/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/05/2022 | 0900/1100 | ** |  | EU | retail sales |

| 04/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/05/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 04/05/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 04/05/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 04/05/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 04/05/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 04/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 04/05/2022 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.