-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Delivers 50Bp Hike, Start QT in June

EXECUTIVE SUMMARY

- US FED RAISES FED FUNDS TARGET BY 50BPS TO 0.75-1.0%

- FED TO BEGIN REDUCING BALANCE SHEET IN JUNE

- FED: CAPS TO START AT $30B TSYS, $17.5B MBS; RISES AFTER 3 MOS

- FED: Powell Opens Door For 50bps Hikes at Next Couple of Meetings

- MNI: US Treasury To Cut Auction Sizes in May-July Quarter

- US TSYS/SUPPLY: Treasury Eyes Boosting Share Of Bills And TIPS In Debt Mix

- TSY SEC YELLEN: BELIEVES IN MARKET-BASED VALUE FOR DOLLAR; U.S. PREPARED TO RESPOND STRONGLY TO PURPOSEFUL DEVALUATIONS OF CURRENCIES; SOME OF DOLLAR INCREASE DUE TO HIGHER U.S. INTEREST RATES, WSJ/Bbg

- EU VON DER LEYEN PROPOSES 'ORDERLY' EU BAN ON RUSSIAN OIL, EU BAN WOULD HALT CRUDE BUYING WITHIN 6 MONTHS, Bbg

US

FED: The Federal Reserve on Wednesday raised the interest on reserve balances rate to 0.9% and the overnight reverse repo rate to 0.8% after hiking the target fed funds rate range by a half-point, keeping the administered rates at the same 10bp spread.

- The Fed's reverse repo facility (ON RRP) was previously set at 30 bps and the rate paid on reserves (IORB) was set at 40 bps. The Fed's discount window was also increased to 1%, and remains at the top of the fed funds range.

The decision is basically in line with expectations (though only 2 distinct levels of caps in the ramp-up period, as opposed to 3); bills to make up remainder of room left under Tsy caps.

- Statement doesn't really get more hawkish from last time: does NOT alter language on "anticipates that ongoing increases in the target range will be appropriate" (some had seen this being altered to specify a more "expedient" or "front-loaded" pace).

- The opening paragraph of the statement acknowledges the weak Q1 GDP growth figure, but notes that household spending and business investment remained strong; notes job gains have been "robust" (rather than "strong" in previous statement).

- Adds discussion of COVID lockdown in China, hawkish on this front, notes "likely to exacerbate supply chain disruptions" and that the FOMC "is highly attentive to inflation risks".

- "We are strongly committed to resorting price stability. Broad sense on the Committee" that 50bp hikes "should be on the table at the next couple of meetings". "We will make our decisions meeting by meeting."

- Goes on to explain the details of QT, says prepared to adjust in light of econ and financial decisions.

- "Inflation has obviously surprised to the upside over the past year, and further surprises could be in store. We therefore will need to be nimble in responding to incoming data and the evolving outlook. We will strive to avoid adding uncertainty to what is already a extraordinarily challenging and uncertain time."

US TSYS: Relief Rally After Fed 50Bp Hike, June QT

Fed hiked rates 50bp Wednesday, the most in 22 years, while leaving the door open for additional 50bp moves over the next few meetings to address surging inflation.

The Fed also penciled in June for start of balance sheet drawdown or quantitative tightening. Risk-on after less hawkish forward guidance

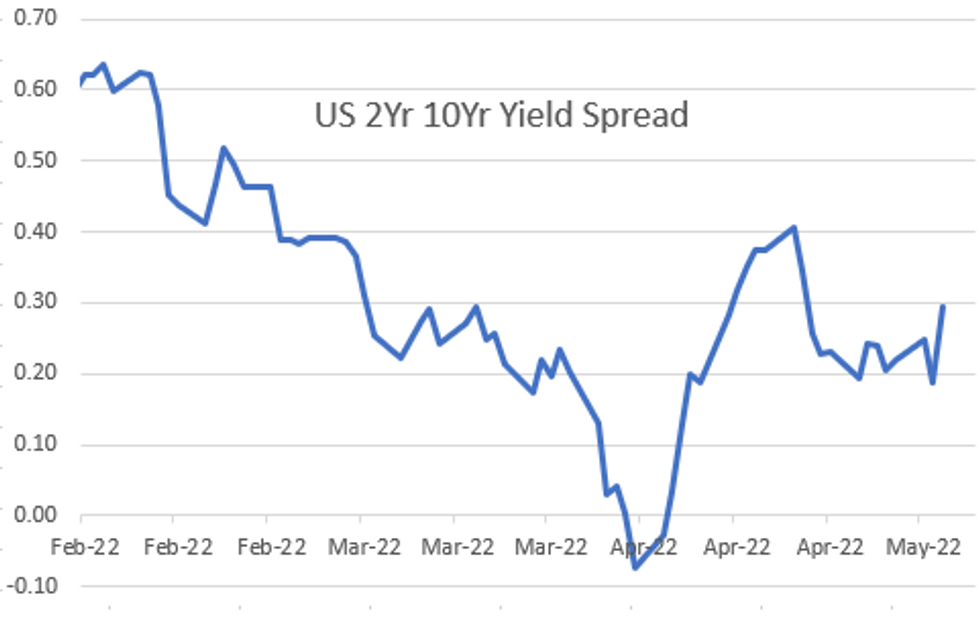

- Stocks staged a strong rally after Fed Chairman Powell poured cold water on chances of 75bp hike in the near term, while yield curves re-steepened off lows (2s10s finished at 28.653 after topping 30.0 briefly, compared to early session low of 13.987) as short end rates adjusted higher.

- Earlier session action: Brief two-way trade after April ADP private employ data +247k vs. +385k est, FI trading weaker into the NY open -- bounces after quarterly US Tsy refunding annc.

- Tsy plans to continue reducing auction sizes of coupons during the May-July quarter, but by smaller increments than in previous quarters, and left open the door for additional cuts in future quarters if needed.

- The U.S. Treasury Wednesday said it plans to continue reducing auction sizes of coupons during the May-July quarter, but by smaller increments than in previous quarters, and left open the door for additional cuts in future quarters if needed.

- The department will issue USD103 billion of securities at next week's quarterly refunding, raising USD55.2 billion in new cash. Officials say they plan to sell USD45 billion in 3-year notes on May 10, USD36 billion in 10-year notes on May 11, and USD22 billion in 30-year bonds on May 12.

US TSYS/SUPPLY: Treasury Eyes Boosting Share Of Bills And TIPS In Debt Mix

The Treasury's announced coupon auction size figures are probably at the low-ish end of expectations, but hardly a shock especially given the latest financing requirement numbers out earlier this week.

- The Treasury Borrowing Advisory Committee recommended these reductions "given the notable reduction in borrowing needs this quarter and with the share of bills in outstanding debt already near the lower end of TBAC's recommended range" - and notes that while auction sizes are expected to "level out" next quarter (in line w current expectations, as discussed in our preview), the Treasury "may need to consider further reductions based on evolving fiscal needs"

- Over the longer run: "this issuance path is expected to gradually lengthen the average maturity of Treasury debt and the average duration of debt to levels modestly above their historical ranges; leave the T-bill share of outstanding debt within the recommended 15% to 20% range; and gradually increase the share of TIPS in outstanding debt."

OVERNIGHT DATA

- US MAR TRADE GAP -$109.8B VS FEB -$89.8B

- ADP RESEARCH INSTITUTE SAYS U.S. ADDED 247,000 JOBS IN APRIL

- ADP employment rises 247k in April, a 136k miss to consensus. Revisions should make up for it (24k to Mar at 479k, 115k to Feb at 601k), but the larger one in Feb likely receives less attention.

- Those revisions plus the limited reliability of month-to-month correlation with NFPs should limit impact.

- There was however an unusually large hit from small businesses, where jobs fell by 120k, the largest decline since May'19 and before that Feb'09 (barring the 5.2M drop in Apr'20).

- Fed Funds futures pricing of hikes firmed modestly shortly after the release, with cumulative hikes for June sitting off earlier highs but still at 111bps.\

- US FINAL APR SERVICES PMI 55.6 (FLASH 54.7); MAR 58.0

- US FINAL APRIL SERVICES PMI REVISED UP 0.9 POINTS

- US ISM APR SERVICES COMPOSITE INDEX 57.1

- US ISM APR SERVICES BUSINESS INDEX 59.1

- US ISM APR SERVICES PRICES 84.6

- US ISM APR SERVICES EMPLOYMENT INDEX 49.5

- US ISM APR SERVICES NEW ORDERS 54.6

- Service sectors saw surging price pressures as the rate of input price inflation accelerated for the third successive month to the fastest in over 11yrs of data, whilst increased passthrough of higher cost burdens onto clients through hiking selling prices saw a notable acceleration in the pace of charge inflation, for the fourth month running and to the fastest on record.

- Combined with the previously released manufacturing data, the composite PMI showed mounting price pressures with both input prices and output charges increasing at the sharpest rates on record, led by material and labor shortages alongside greater transportation costs.

- Fed hike expectations for the year have continued to build (264bps to year-end including an expected 50bps later today) but the next test will be the ISM Services report shortly.

- CANADA MARCH TRADE BALANCE +CAD2.5 BLN VS FORECAST +CAD4 BLN

- CANADA REVISES FEB TRADE BALANCE TO +CAD3.1B FROM +CAD2.7B

- CANADA EXPORTS AND IMPORTS BOTH CLIMBED TO RECORDS IN MARCH

- CANADA MAR EXPORTS 63.6 BLN CAD, IMPORTS 61.1 BLN CAD

- CANADA REVISED FEB MERCHANDISE TRADE BALANCE +3.1 BLN CAD

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 932.27 points (2.81%) at 34061.06

- S&P E-Mini Future up 123 points (2.95%) at 4292.75

- Nasdaq up 401.1 points (3.2%) at 12964.86

- US 10-Yr yield is down 5.8 bps at 2.913%

- US Jun 10Y are up 20/32 at 119-4.5

- EURUSD up 0.0098 (0.93%) at 1.0619

- USDJPY down 1 (-0.77%) at 129.14

- WTI Crude Oil (front-month) up $5.54 (5.41%) at $107.95

- Gold is up $18.6 (1%) at $1886.66

- EuroStoxx 50 down 36.2 points (-0.96%) at 3724.99

- FTSE 100 down 67.88 points (-0.9%) at 7493.45

- German DAX down 68.65 points (-0.49%) at 13970.82

US TSY FUTURES CLOSE

- 3M10Y -1.552, 202.579 (L: 197.472 / H: 207.182)

- 2Y10Y +11.047, 29.519 (L: 13.987 / H: 30.554)

- 2Y30Y +16.415, 38.647 (L: 17.232 / H: 39.189)

- 5Y30Y +12.865, 11.227 (L: -3.384 / H: 11.39)

- Current futures levels:

- Jun 2Y up 9.375/32 at 105-18.625 (L: 105-03.75 / H: 105-19.75)

- Jun 5Y up 19/32 at 112-28 (L: 111-31.5 / H: 112-28.5)

- Jun 10Y up 20/32 at 119-4.5 (L: 118-04.5 / H: 119-06.5)

- Jun 30Y up 3/32 at 140-3 (L: 138-29 / H: 140-17)

- Jun Ultra 30Y down 15/32 at 158-6 (L: 157-02 / H: 159-06)

US 10Y FUTURES TECH: (M2) Trend Needle Still Points South

- RES 4: 122-06 50-day EMA

- RES 3: 122-12+ High Apr 4

- RES 2: 121-09 High Apr 14 and a reversal point

- RES 1: 119-30+/120-18+ 20-day EMA / High Apr 27

- PRICE: 118-17 @ 11:22 BST May 4

- SUP 1: 118-04+ Low May 3

- SUP 2: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 117-22+ Low Nov 8 2018 (cont)

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

Treasuries remain bearish. The contract initially traded lower Tuesday to probe support at 118-08, Apr 22 low and a bear trigger. This signals a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. MA studies remain in a bear mode. Potential is seen for weakness towards 118-02+ next, a Fibonacci projection and 117-22+, the Nov 8 2018 low (cont). Key short-term resistance is at 120-18+.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.070 at 98.165

- Sep 22 +0.135 at 97.335

- Dec 22 +0.150 at 96.860

- Mar 23 +0.165 at 96.625

- Red Pack (Jun 23-Mar 24) +0.130 to +0.165

- Green Pack (Jun 24-Mar 25) +0.10 to +0.120

- Blue Pack (Jun 25-Mar 26) +0.050 to +0.090

- Gold Pack (Jun 26-Mar 27) +0.005 to +0.040

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00000 to 0.33029% (+0.00029/wk)

- 1M +0.01343 to 0.84514% (+0.04185/wk)

- 3M +0.04285 to 1.40614% (+0.07128/wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.03871 to 2.01957% (+0.10886/wk)

- 12M +0.05357 to 2.74843% (+0.11986/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $79B

- Daily Overnight Bank Funding Rate: 0.32% volume: $260B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $923B

- Broad General Collateral Rate (BGCR): 0.30%, $354B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $343B

- (rate, volume levels reflect prior session)

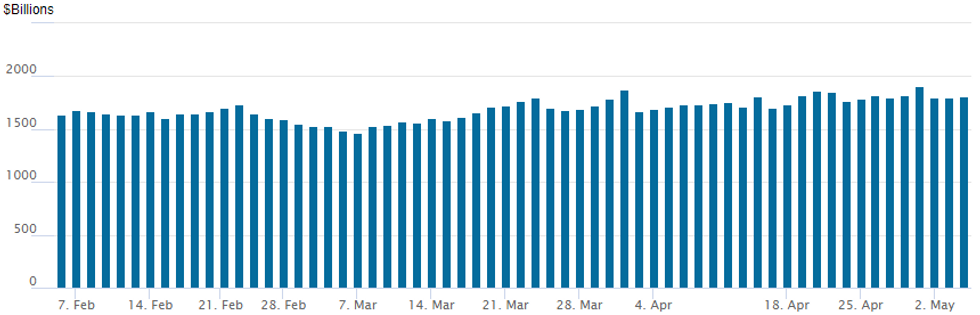

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage at 1,815.656B w/ 87 counterparties vs. prior session's 1,796.252B (all-time high of $1,906.802B on Friday, March 29, 2022).

PIPELINE

- Date $MM Issuer (Priced *, Launch #)

- 05/04 No new issuance Wednesday, sidelined ahead FOMC

- $3.7B Priced Tuesday, $7.55B/wk

- 05/03 $3B *UBS Group $1.2B 4NC3 +155, $600M 4NC3 SOFR+158, $1.2B 6NC5 +175

- 05/03 $700M *Excel Energy 10Y +167

- $3.85B Priced Monday

- 05/02 $1.85B *Constellation Brands $550M 2Y +90, $600M 5Y +135, $700< 10Y +180

- 05/02 $1.5B *Georgia Power $700M 10Y +175, $800M 30Y +210

- 05/02 $500M *Northern States Power 30Y +148

FOREX: Powell Rules Out 75BP Hike Consideration, Greenback Falters

- After some initial two-way price action for the greenback following the FOMC decision and early comments from Chair Powell, the US Dollar came under significant pressure with Dollar Indices retreating close to 1.0%.

- The comment that 50bp hikes "should be on the table at the next couple of meetings" and then dismissing any consideration of a 75bp increase particularly weighed on USD with price action extending throughout the press conference.

- The likes of EURUSD and USDJPY moved in line with this greenback weakness with the former rising back above the 1.06 handle to reach 1.0626 and the latter crashing back below 129.00.

- However, the key outperformers on Wednesday following the decision were Antipodean currencies and in particular the Australian dollar. AUDUSD has rallied close to 2%, benefitting from rallying equities as well as yesterday’s hawkish domestic monetary policy developments.

- Despite the sharp pullback, bearish conditions still dominate the technical outlook which puts particular significance of the nearest resistance points of at 0.7261, Apr 5 high and then firmer resistance at 0.7301, the 50-day EMA.

- USD weakness remained fairly broad based with CHF and CNH relative underperformers, only rising between 0.35-0.4%.

- With a fairly light global economic data calendar on Thursday, focus will be on the Bank of England meeting/decision where markets are expecting a 25bp rate increase by the MPC to 1.00%. The MNI Preview can be found here: https://marketnews.com/markets/central-bank-reports/central-bank-preview/bank-of-england-preview/mni-boe-preview-may-2022-25bp-now-what-next

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/05/2022 | 0130/1130 | * |  | AU | Building Approvals |

| 05/05/2022 | 0130/1130 | ** |  | AU | Trade Balance |

| 05/05/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/05/2022 | 0600/0800 | ** |  | DE | manufacturing orders |

| 05/05/2022 | 0630/0830 | *** |  | CH | CPI |

| 05/05/2022 | 0645/0845 | * |  | FR | industrial production |

| 05/05/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 05/05/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/05/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 05/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/05/2022 | 1000/1200 |  | EU | ECB Lane Speech on Euro Area Outlook | |

| 05/05/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 05/05/2022 | 1130/1230 |  | UK | BOE post-MPC press conference | |

| 05/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 05/05/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 05/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 05/05/2022 | 1300/1400 |  | UK | Bank of England DMP Survey | |

| 05/05/2022 | 1340/0940 |  | CA | BOC Deputy Schembri speech to Indigenous group. | |

| 05/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 05/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 05/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.