-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Yields Gain Ahead Key Employ Data

EXECUTIVE SUMMARY

- MNI INTERVIEW: US, UK Recessions May Be Deeper Than GFC Slump

- MNI INTERVIEW: No Recession In Sight As ISM Poised For Gains

- MNI: Bullard Wants Expeditious Fed Rate Hikes To Neutral

- MNI BRIEF: Consumers Push Against High Prices -Fed Beige Book

US

US: ISM's gauge of U.S. manufacturing activity will likely take another step up in June and July as China reopens, Institute for Supply Management chair Timothy Fiore told MNI Wednesday, noting continued strong consumer demand and rebuffing fears of a possible recession.

- U.S. manufacturing activity picked up in May as demand for goods remains strong, and the reopening in China and surge in goods transport later this month may only push the ISM PMI higher, Fiore said.

- The ISM manufacturing index increased in May 0.7ppts to 56.1, against consensus expectations for a slight decrease, led by new orders, export orders, and inventories that were up 4.3ppts to 55.9. "We're still running on inventory," he said. For more see MNI Policy main wire at 1348ET.

- Policymakers are too focused on inflation pressures that will likely subside within a few months and not enough on leading indicators like plunging lumber prices and shipping activity that show an economy already flirting with a significant slowdown, he said.

- “My suspicion is this recession will be longer-lasting and deeper” than that seen in 2007-2009, said Blanchflower, now a professor at Dartmouth College, in an interview. For more see MNI Policy main wire at 1235ET.

- "We will move more quickly than we have in past tightening cycles. We'd want to be at neutral even if inflation came down to 2%, even if inflation magically dissipated," he said, adding that he thinks policy will need to go beyond neutral to become restrictive.

- About half of the Fed districts said many contacts maintained pricing power, often with fuel surcharges. Most Fed districts reported that employment rose modestly or moderately while one explicitly reported that the pace of job growth had slowed. The Beige Book said some firms in most of the coastal Fed regions noted hiring freezes or other signs that market tightness had begun to ease.

US TSYS: No Recession Here, Move Along

Tsy futures still weaker across the board, but stable after the bell, yield curves flatter but off lows (2s10s -1.728 at 26.625 currently vs. 23.778 low).

- Random volatility/thin liquidity contributing to the whippy trade. "People are trading terminal fed funds rates like they know what is going to happen....they don't," one desk offered. Carry over month end rebalancing played a part in this morning's bounce.

- While hawkish BOC annc may have been a factor, data more likely trigger for sell-off: Much stronger than expected May ISM Manufacturing Index of 56.1 vs. 54.5 exp while the Prices Paid component is 82.2 vs. 80.5; April reading of Construction Spending is +0.2 vs. +0.5% exp.

- FED'S BARKIN ('24 voter) SAYS HE DOESN'T SEE A RECESSION IN THE DATA - DATA SIGNALS THAT CONSUMER SPENDING IS HOLDING UP - bbg

- DALY ('24 voter): DON'T SEE A RECESSION, IT'S NOT MY MODAL OUTLOOK - bbg

- Focus on Thu: ADP Private Employ (+300k est vs. +247k prior), Wkly Claims (210k) -- NFP on Friday.

OVERNIGHT DATA

- US REDBOOK: MAY STORE SALES +12.4% V YR AGO MO

- US REDBOOK: STORE SALES +12.6% WK ENDED MAY 28 V YR AGO WK

- US ISM MAY MANUF PURCHASING MANAGERS INDEX 56.1

- US ISM MAY MANUF PRICES PAID INDEX 82.2

- US ISM MAY MANUF NEW ORDERS INDEX 55.1

- US ISM MAY MANUF EMPLOYMENT INDEX 49.6

- US ISM MAY MANUF PRODUCTION INDEX 54.2

- US ISM MAY MANUF SUPPLIER DELIVERY INDEX 65.7

- US APR CONSTRUCT SPENDING +0.2%

- US APR PRIVATE CONSTRUCT SPENDING +0.5%

- US APR PUBLIC CONSTRUCT SPENDING -0.7%

- US MBA: MARKET COMPOSITE -2.3% SA THRU MAY 27 WK

- US MBA: REFIS -5% SA; PURCH INDEX -1% SA THRU MAY 27 WK

- US MBA: UNADJ PURCHASE INDEX -14% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 5.33% VS 5.46% PREV

- US BLS: JOLTS OPENINGS RATE 11.400M IN APR

- US BLS: JOLTS QUITS RATE 2.9% IN APR

- BOC RAISES KEY RATE TO 1.5% FROM 1%, SAYS MORE IS NEEDED

- BOC IS 'PREPARED TO ACT MORE FORCEFULLY IF NEEDED'

- BOC: INFLATION HASN'T PEAKED YET, CONTINUES TO BROADEN

- BOC SAYS THE RISK OF ENTRENCHED HIGH INFLATION HAS RISEN

- BOC SAYS ECONOMY CLEARLY OPERATING IN EXCESS DEMAND

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 72.66 points (-0.22%) at 32917.48

- S&P E-Mini Future down 10.75 points (-0.26%) at 4121.5

- Nasdaq down 5.4 points (0%) at 12076.19

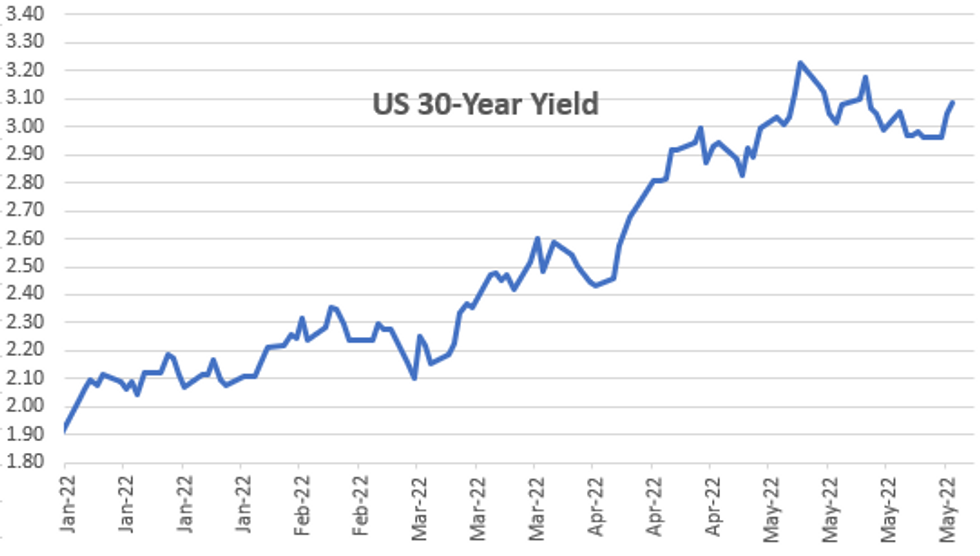

- US 10-Yr yield is up 9.1 bps at 2.935%

- US Sep 10Y are down 27.5/32 at 118-19

- EURUSD down 0.0077 (-0.72%) at 1.0657

- USDJPY up 1.49 (1.16%) at 130.16

- WTI Crude Oil (front-month) up $1.16 (1.01%) at $115.84

- Gold is up $10.87 (0.59%) at $1848.22

- EuroStoxx 50 down 16.67 points (-0.44%) at 3759.54

- FTSE 100 down 45.18 points (-0.59%) at 7532.95

- German DAX down 9.59 points (-0.07%) at 14340.47

- French CAC 40 down 20.74 points (-0.32%) at 6418.89

US TSY FUTURES CLOSE

- 3M10Y +2.887, 179.552 (L: 169.006 / H: 181.558)

- 2Y10Y -1.463, 26.89 (L: 23.778 / H: 29.951)

- 2Y30Y -6.389, 41.988 (L: 39.973 / H: 49.958)

- 5Y30Y -7.654, 14.619 (L: 12.547 / H: 22.907)

- Current futures levels:

- Sep 2Y down 7.875/32 at 105-9.75 (L: 105-09.25 / H: 105-17)

- Sep 5Y down 21.25/32 at 112-9.25 (L: 112-07.75 / H: 112-30)

- Sep 10Y down 27/32 at 118-19.5 (L: 118-20 / H: 119-16.5)

- Sep 30Y down 31/32 at 138-15 (L: 138-06 / H: 140-00)

- Sep Ultra 30Y down 26/32 at 154-30 (L: 154-19 / H: 156-19)

US 10Y FUTURES TECH: (U2) Remains Below The 50-Day EMA

- RES 4: 122-00 Round number resistance

- RES 3: 121-27+ High Apr 5

- RES 2: 121-27+ High Apr 7

- RES 1: 120-13+/19+ 50-day EMA / High May 26

- PRICE: 119-08+ @ 11:22 BST Jun 1

- SUP 1: 119-03 Low May 23

- SUP 2: 118-01+ Low May 18 and a key short-term support

- SUP 3: 117-18 Low May 11

- SUP 4: 116-21 Low May 9 and a bear trigger

Treasuries have faded off recent highs and have traded lower again today. The 50-day EMA, at 120-13+ today, remains intact. A clear breach of this average is required to pave the way for a stronger bull cycle and this would open the 122-00 handle. Recent gains are considered corrective and the primary trend direction remains down. Key support and the bear trigger is 116-21, May 9 low. Initial firm support to watch is 118-01+, May 18 low.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.003 at 98.233

- Sep 22 -0.050 at 97.365

- Dec 22 -0.090 at 96.815

- Mar 23 -0.145 at 96.620

- Red Pack (Jun 23-Mar 24) -0.18 to -0.165

- Green Pack (Jun 24-Mar 25) -0.155 to -0.135

- Blue Pack (Jun 25-Mar 26) -0.135 to -0.11

- Gold Pack (Jun 26-Mar 27) -0.10 to -0.075

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00286 to 0.81914% (-0.00643/wk)

- 1M -0.00015 to 1.11971% (+0.05800/wk)

- 3M +0.01529 to 1.62600% (+0.02814/wk) * / **

- 6M +0.00329 to 2.10929% (+0.02315/wk)

- 12M +0.03543 to 2.77543% (+0.07972/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.62600% on 6/1/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $76B

- Daily Overnight Bank Funding Rate: 0.82% volume: $235B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.79%, $1.040T

- Broad General Collateral Rate (BGCR): 0.80%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $351B

- (rate, volume levels reflect prior session)

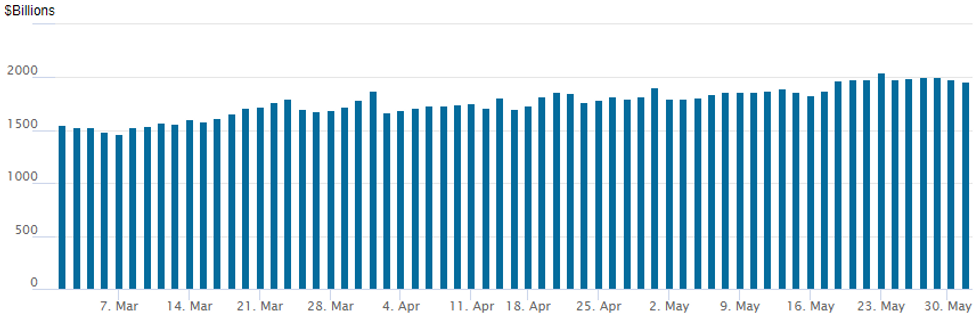

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to 1,965.015B w/ 93 counterparties vs. 1,978.538B prior session, compares to Monday's record high $2,044.658B.

PIPELINE: $5.5B TD Bank 4Pt Leads Day's Issuance

$5.5B TD Bank 4pt the lions share of over $18.5B already launched today.

- Date $MM Issuer (Priced *, Launch #)

- 06/01 $5.5B #TD Bank $1.65B 3Y +95, $350M 3Y SOFR+102, $1.5B 5Y +120, $2B 10Y +155

- 06/01 $2B #Handelsbanken $850M 3Y +85, $350M 3Y SOFR+91, $800M 5Y +105

- 06/01 $1.6B *Royal Bank pf Canada 3Y SOFR+65

- 06/01 $1.5B #John Deere $1B 3Y +55, $500M 10Y +100

- 06/01 $1.1B #SEB $700M 3Y +90, $400M 3Y SOFR+96

- 06/01 $1B #NY Life $650M 2Y +53, $350M 2Y SOFR+43

- 06/01 $1B *Province of Saskatchewan 5Y SOFR+55

- 06/01 $1B #Liberty Mutual 30Y +240

- 06/01 $850M #Truist Financial 6NC5 +118

- 06/01 $850M #PNC Financial 11NC10 +170

- 06/01 $500M *Baltimore Gas&Electric WNG 30Y +180a

- 06/01 $1.8B Tenet Healthcare 8NC3

FOREX: US Dollar Back In Favour As DXY Rises 0.8%, JPY Weakness Extends

- The US Dollar came storming back on Wednesday as core yields trended higher once again amid renewed weakness in global equity benchmarks.

- The USD Index advanced 0.8%, its best performance in 3 weeks. The greenback was aided by some stronger ISM Manufacturing data, along with the deteriorating risk sentiment across equity markets on Wednesday.

- The main victim to the dollar’s advance has been the Japanese Yen, retreating 1.15%. USDJPY has moved back above the 130.00 mark. The move higher signals the end of the recent corrective pullback and also highlights the point that corrections in USDJPY are shallow. This reinforces bullish conditions and signals scope for a climb towards the bull trigger at 131.35, May 9 high.

- In similar vein, both the Euro and GBP weakened, with the former falling back below $1.07 to print a low of 1.0627. EURUSD continues to reverse a challenge on the top of the bear channel drawn from the Feb 10 high, currently intersecting at 1.0795. This level marks a key short-term resistance. The primary trend is down though and a reversal lower would reinforce a bearish theme and open 1.0533 initially.

- Relative outperformance was seen in AUD and CAD, both rising 0.1% against the greenback. The Canadian dollar was buffeted by a surprisingly hawkish statement from the BoC, with the key change the Bank now being prepared to act ‘more’ forcefully if needed to meet its 2% inflation target. USDCAD price action was whippy following the release with the pair battling between more hawkish BOC rhetoric and a strengthening dollar throughout the session.

- Thursday marks the beginning of a two-day holiday in the UK. Tomorrow will bring euro area producer price data for April as well as Spanish unemployment. US ADP employment data headlines the US docket before NFP on Friday.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/06/2022 | 0130/1130 | ** |  | AU | Trade Balance |

| 02/06/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 02/06/2022 | 0630/0830 | *** |  | CH | CPI |

| 02/06/2022 | 0900/1100 | ** |  | EU | PPI |

| 02/06/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 02/06/2022 | 1230/0830 | * |  | CA | Building Permits |

| 02/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 02/06/2022 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 02/06/2022 | 1400/1000 | ** |  | US | factory new orders |

| 02/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 02/06/2022 | 1445/1045 |  | CA | BOC Deputy Beaudry Economic Progress Report Speech | |

| 02/06/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 02/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/06/2022 | 1600/1200 |  | US | New York Fed's Lorie Logan | |

| 02/06/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.