-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Hedging For Higher May CPI

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Set For Three 50BP Rate Hikes - Kroszner

- MNI STATE OF PLAY: ECB Paves Way For July, Sept Rate Hikes

- MNI: BOC Says Rate Hikes And Housing Are Adding To Market Risk

- MNI: BOC Says Canada Needs Higher Rates, CPI Well Above Target

- Ukraine To Receive Initial EU Support For Path To Membership, Bbg

US

FED: The Federal Reserve will probably raise interest rates by half a percentage point in the next three meetings in order to tame a surge in inflation and ensure longer-run price expectations don’t take off, former Fed board governor Randall Kroszner told MNI.

- “They’re on a path to raise rates most likely for the next three meetings in 50-basis-point chunks and then it’s maybe time to reassess," he said in an interview. "They want to make sure that inflation expectations don’t become unanchored. They have the opportunity now relatively quickly to make sure they don’t.”

- Recent comments pushing back against the prospect of a pause in rate hikes from Lael Brainard, the Fed’s new vice chair, clearly cemented that prospect, Kroszner said. “This is a clear pivot from Lael who had been more dovish. That was not an accident. It’s really about expectations management.” For more see MNI Policy main wire at 1224ET.

EUROPE

ECB: The European Central Bank agreed Thursday that it would aim to raise its key interest rate for the first time since 2011 by 25 basis points in July, and said it could increase rates by a greater increment in September unless the inflation outlook moderates.

- While the announcement was largely in line with expectations, the possibility of a 50-point increase in September was an acknowledgement both of inflationary pressures -- staff projections now see headline inflation at 2.1% in 2024 -- and the concerns of more hawkish policymakers.

- "The Governing Council expects to raise the key ECB interest rates again in September," the decision stated. "The calibration of this rate increase will depend on the updated medium-term inflation outlook. If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting."For more see MNI Policy main wire at 1136ET

ECB: As expected, the ECB has announced that the APP will end in early July (July 1) and has signaled that rate liftoff will occur at the July 21 meeting (""the Governing Council intends to raise the key ECB interest rates by 25 basis points at its July monetary policy meeting.").

- We had warned in our ECB Preview that the bank could signal the possibility of hiking rates in 50bp increments by referring to the 'magnitude' of policy hikes being data dependent. The ECB today stated "The calibration of this rate increase will depend on the updated medium-term inflation outlook. If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting."

- While revising down the growth forecasts, the ECB forecasts inflation resting above target in 2024 at 2.1%.

- Of course, all EU member states would need to unanimously support the opening of membership talks with Ukraine in order for the process to progress.

- While this will be viewed as positive news in Kyiv, there remain significant political and economic hurdles to Ukraine's membership application. Notably Germany has proved hesitant to offer a fast-track to Ukraine when other countries in the Western Balkans have gone through a lengthy process of reform and economic management in order to progress.

- Ukraine still short of the 'Maastricht criteria' of entry regarding the nation's fiscal position, and unclear whether Ukraine would meet EU standards on respect for the rule of law and fighting institutional corruption.

CANADA

BOC: The Bank of Canada said Thursday that financial market risk has climbed over the last year as central banks raise interest rates and domestic consumers pile on even more mortgage debt.

- Global rate hikes will add to pressures on markets grappling with high inflation and Russia's invasion of Ukraine, according to the Bank's Financial System Review. Markets are vulnerable to another dash for cash, a sudden repricing of energy assets amid emerging climate change rules and cyber attacks increasingly organized by state-sponsored hackers, the report said. For more see MNI Policy main wire at 1028ET.

- "The Bank's number one priority is to get inflation back to target, and we are raising interest rates to make that happen," Macklem said in opening remarks for a press conference. "The economy can handle-- indeed needs-- higher interest rates." His remarks didn't mention potential for `forceful' action that have triggered some bets on a 75bp hike at the next meeting on July 13, following two straight 50bp increases.

US TSYS: Anticipating Higher Inflation, How Much Priced in Ahead Fri CPI?

Broader markets caught up to ECB hawkish hold early Thursday, rates extending lows on ECB guidance of additional rate hikes in Sep and on w/potential for 50bp move anticipated.

- After some early volatility, yield curves extended flatter, 2s10s -2.338 at 22.212 vs. 25.237 early high. Large front end sales/crosses contributed to curve bear flattening after -12,434 TUU2 104-30.62 (-4.88), sell through 104-31.12 post-time bid at 1102:04ET.

- Tys pared losses, bonds back steady immediately after $19B 30Y auction re-open (912810TG3) stops through: 3.185% high yield vs. 3.200% WI; 2.35x bid-to-cover vs. 2.38x last month.

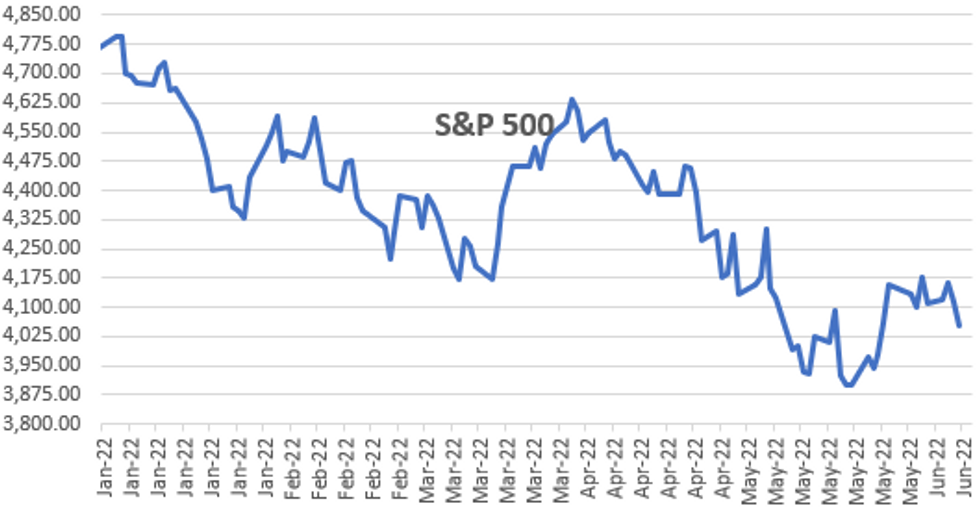

- stocks extending lows in late NY trade (ESM2 -40.0 at 4076.0) as markets contemplated already high CPI estimated read for May CPI (+0.7% vs. 0.3% prior) in the aftermath of the ECB's hawkish hold policy annc this morning.

- Support for stocks evaporated after the ECB said it would aim to raise its key interest rate for the first time since 2011 by 25 basis points in July, and said it could increase rates by a greater increment in September unless the inflation outlook moderates.

OVERNIGHT DATA

- US JOBLESS CLAIMS +27K TO 229K IN JUN 04 WK

- US PREV JOBLESS CLAIMS REVISED TO 202K IN MAY 28 WK

- US CONTINUING CLAIMS +0.000M to 1.306M IN MAY 28 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 379.08 points (-1.15%) at 32533.74

- S&P E-Mini Future down 59.5 points (-1.45%) at 4053.75

- Nasdaq down 225.7 points (-1.9%) at 11860.55

- US 10-Yr yield is up 1.7 bps at 3.0381%

- US Sep 10Y are down 5/32 at 117-29.5

- EURUSD down 0.0096 (-0.9%) at 1.0619

- USDJPY up 0.04 (0.03%) at 134.29

- WTI Crude Oil (front-month) down $0.73 (-0.6%) at $121.38

- Gold is down $5.12 (-0.28%) at $1848.23

- EuroStoxx 50 down 64.48 points (-1.7%) at 3724.45

- FTSE 100 down 116.79 points (-1.54%) at 7476.21

- German DAX down 247.19 points (-1.71%) at 14198.8

- French CAC 40 down 90.17 points (-1.4%) at 6358.46

US TSY FUTURES CLOSE

- 3M10Y +0.835, 176.355 (L: 171.897 / H: 179.574)

- 2Y10Y -2.503, 22.047 (L: 21.079 / H: 25.237)

- 2Y30Y -4.774, 34.768 (L: 34.315 / H: 39.619)

- 5Y30Y -3.716, 10.048 (L: 9.747 / H: 14.108)

- Current futures levels:

- Sep 2Y down 3.625/32 at 104-31.875 (L: 104-30.5 / H: 105-03.75)

- Sep 5Y down 5.5/32 at 111-23.75 (L: 111-20.25 / H: 112-00)

- Sep 10Y down 5/32 at 117-29.5 (L: 117-22 / H: 118-07)

- Sep 30Y up 3/32 at 137-1 (L: 136-07 / H: 137-10)

- Sep Ultra 30Y up 7/32 at 153-1 (L: 151-25 / H: 153-16)

US 10Y FUTURES TECH: (U2) Outlook Remains Bearish

- RES 4: 121-27+ High Apr 5

- RES 3: 120-27+ High Apr 7

- RES 2: 120-00/19+ 50-day EMA / High May 26 and bull trigger

- RES 1: 119-16+ High Jun 1

- PRICE: 117-29 @ 15:04 BST Jun 9

- SUP 1: 117-22 Low Jun 9

- SUP 2: 117-18 Low May 11 07

- SUP 3: 116-21 Low May 9 and a bear trigger

- SUP 4: 116-00 Round number support

Short-term conditions in Treasuries remain bearish following recent weakness. Price is trading below the 50-day EMA - at 120-00. This EMA represents a key resistance and a clear break would allow for a stronger recovery towards 122-00. The recent move away from the average continues to suggest the correction between May 9 - 26 is over. A continuation lower would open key support at 116-21, May 9 low.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.005 at 98.228

- Sep 22 -0.030 at 97.295

- Dec 22 -0.050 at 96.670

- Mar 23 -0.080 at 96.420

- Red Pack (Jun 23-Mar 24) -0.09 to -0.06

- Green Pack (Jun 24-Mar 25) -0.05 to -0.03

- Blue Pack (Jun 25-Mar 26) -0.025 to -0.01

- Gold Pack (Jun 26-Mar 27) -0.005 to steady

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00043 to 0.82000% (+0.00086/wk)

- 1M +0.05500 to 1.25471% (+0.13500/wk)

- 3M +0.03358 to 1.72129% (+0.09529/wk) * / **

- 6M +0.02786 to 2.29429% (+0.18500/wk)

- 12M +0.04643 to 2.95857% (+0.18314/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.72129% on 6/9/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $79B

- Daily Overnight Bank Funding Rate: 0.82% volume: $247B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.76%, $959B

- Broad General Collateral Rate (BGCR): 0.78%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.78%, $354B

- (rate, volume levels reflect prior session)

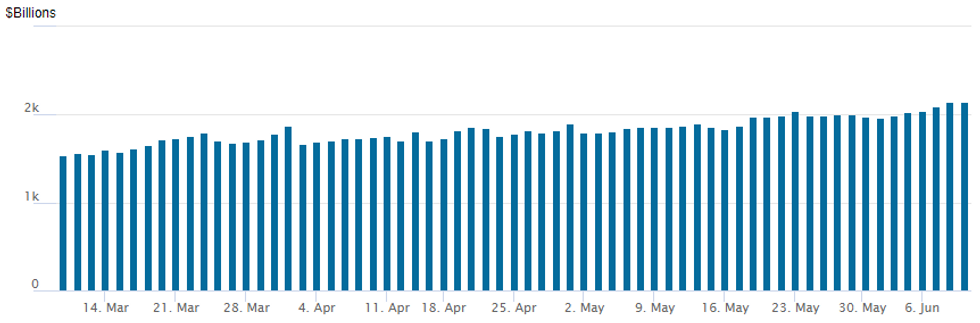

FED Reverse Repo Operation, Third Consecutive Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of 2,142.318B w/ 101 counterparties vs. Wednesday's prior record of 2,140.277B.

PIPELINE: Hi-Grade Issuance Over $38B/Wk

Limited corporate issuance on tap today after just over $38B priced Mon-Wed

- Date $MM Issuer (Priced *, Launch #)

- 06/09 $600M Callon Petroleum 8NC3 investor call

- $16.35B Priced Wednesday, $38.1B/wk

- 06/08 $3.5B *Enel Finance $750M 3Y +145, $750M 5Y +165, $1B 10Y +215, $1B 30Y +240

- 06/08 $3B *Hungary $1.75B 7Y +240, $1.25B 12Y +280 (E750M 9Y +250 as well)

- 06/08 $2.65B *Societe Generale $600M 3Y +140, $800M 5Y +165, $1.25B 11NC10 +320

- 06/08 $1.95B *Bank of NY Mellon $700M 3NC2 +65, $500M 6NC5 +95, $750M 11NC10 +125

- 06/08 $1.5B *CPPIB Capital 5Y SOFR+52

- 06/08 $1B *Council of Europe Development Bank (CoE) 3Y SOFR+21

- 06/08 $750M *Synchrony Financial 3Y +195 (upsized from $500M)

- 06/08 $750M *Bangkok Bank 5Y +130

- 06/08 $650M *Jordan +5Y 7.95%

- 06/08 $600M *ASB Bank 10NC5 +225

- 06/08 $Benchmark Asian Infrastructure Inv Bank (AAIB) 3Y investor calls

EGBs-GILTS CASH CLOSE: Bear Flattening On Hawkish ECB Signals

European bonds sold off Thursday on what was perceived as a hawkish signal from the ECB meeting, with periphery EGBs underperforming.

- The ECB's signaling hikes in July (25bp) and September (probably >25bp), with an open path to further hikes in order to quell inflation, helped short-end rate expectations sell off.

- July pricing was pared as a 50bp move was faded, but Sep thru Dec implied rates hit cycle highs.

- The German curve flattened accordingly, with the UK following suit.

- Italian 10Y reached the widest since May 2018 (+ bp) on the combination of incoming rate hikes and an apparent lack of progress on an anti-fragmentation tool (reinforced later in the session by a Reuters sources piece).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 13.4bps at 0.835%, 5-Yr is up 11.8bps at 1.195%, 10-Yr is up 7.6bps at 1.43%, and 30-Yr is up 3.4bps at 1.626%.

- UK: The 2-Yr yield is up 7.5bps at 1.855%, 5-Yr is up 8.2bps at 1.963%, 10-Yr is up 7.7bps at 2.323%, and 30-Yr is up 3.3bps at 2.491%.

- Italian BTP spread up 15.2bps at 217.3bps / Spanish up 6.5bps at 119.3bps

FOREX: Volatile Euro Ends At Week’s Lows Following ECB

- EURUSD initially traded well on the back of the ECB rate decision, showing above the bear channel top and printing 1.0774 - albeit briefly. The pair was unable to maintain its bid and sharply reversed course into the European close, taking out the week's lows in the process. Having failed above the bear channel top, key short-term support at 1.0627, the Jun 01 low, was then breached with the next notable support residing at 1.0533, the May 20 low.

- Broad dollar indices are extending gains late Thursday, having risen over 0.6% to the best levels of the week. Downward pressure on equities and higher US yields supporting the price action and weighing on the likes of AUD, CAD and NZD.

- AUDUSD the notable underperformer across G10, retreating 1.29%. The pair has traded back below the 20-day EMA, at 0.7153 today and a sustained break of this average would threaten the recent recovery. A stronger reversal would refocus attention on the bear trigger at 0.6829, May 12 low.

- In emerging markets, it is worth noting a particularly volatile session for the Turkish Lira. After an aggressive, albeit brief, spike to fresh recent highs of 17.3717, price had consolidated somewhat before the finance ministry stated that Turkey would announce new economy steps later today. As of writing, no announcement has been made, however, TRY has been significantly bolstered by the news.

- A sharp reversal lower for USDTRY saw the pair briefly print below 16.80 and remains just above 16.90, down 1.25% for the session. Firm support lies at 16.1964, the 20-day EMA.

- US CPI headlines the data docket on Friday. Core CPI inflation is expected to dip slightly from +0.57% M/M in April to +0.5% M/M, with a faster rise in headline CPI at +0.7% M/M amid energy price rises. Canadian employment data also round off the week’s calendar.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/06/2022 | 0001/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 10/06/2022 | 0130/0930 | *** |  | CN | CPI |

| 10/06/2022 | 0130/0930 | *** |  | CN | Producer Price Index |

| 10/06/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/06/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 10/06/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 10/06/2022 | 0830/0930 | ** |  | UK | Bank of England/TNS Inflation Attitudes Survey |

| 10/06/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 10/06/2022 | 1230/0830 | *** |  | US | CPI |

| 10/06/2022 | 1345/1545 |  | EU | ECB Lagarde Message for Goethe Uni Law & Finance Institute | |

| 10/06/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/06/2022 | 1400/1000 | * |  | US | Services Revenues |

| 10/06/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 10/06/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.