-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Speak Vs. Recession Cares

EXECUTIVE SUMMARY

- MNI: Narrow Soft Landing Path Amid Need For Fast Hikes - BIS

- MNI BRIEF: Fed’s Bullard Downplays Risk Of U.S. Recession

- FED'S BULLARD: WE ADDED TO BALANCE SHEET FOR A YEAR TOO LONG, Bbg

- BULLARD: SO FAR, QUANTITATIVE TIGHTENING WORKING, JUST STARTED, Bbg

- Supreme Court Overturns Roe v. Wade Abortion-Rights Ruling

US

US:Global central banks that missed the inflation surge must err on the side of breaking that cycle and only a "narrow path" remains to a soft landing as opposed to a worst-case scenario of global recession and stubborn high prices, the Bank for International Settlements said Sunday.

- "The most pressing challenge for central banks is to restore low and stable inflation without, if possible, inflicting serious damage to the economy," according to the BIS annual report. "Real policy rates will need to increase significantly in order to moderate demand. Delaying the necessary adjustment heightens the likelihood that even larger and more costly future policy rate increases will be required."

- The world economy faces the most significant stagflation risk since World War II following the invasion of Ukraine and the risk of a wage-price spiral should not be under-estimated, the BIS reported. Fragile financial markets, food shortages and destabilizing movement of capital from emerging markets add to the danger. For more see MNI Policy main wire at 1100ET Sunday.

FED: The Federal Reserve's monetary tightening will slow the economy but is unlikely to push it into recession because household wealth is high and business activity is strong, St. Louis Fed President James Bullard said Friday.

- "I think it's a little early to have this debate about recession probabilities in the U.S.," Bullard told an event sponsored by UBS. "We'll slow down to a trend pace of growth as opposed to below trend."

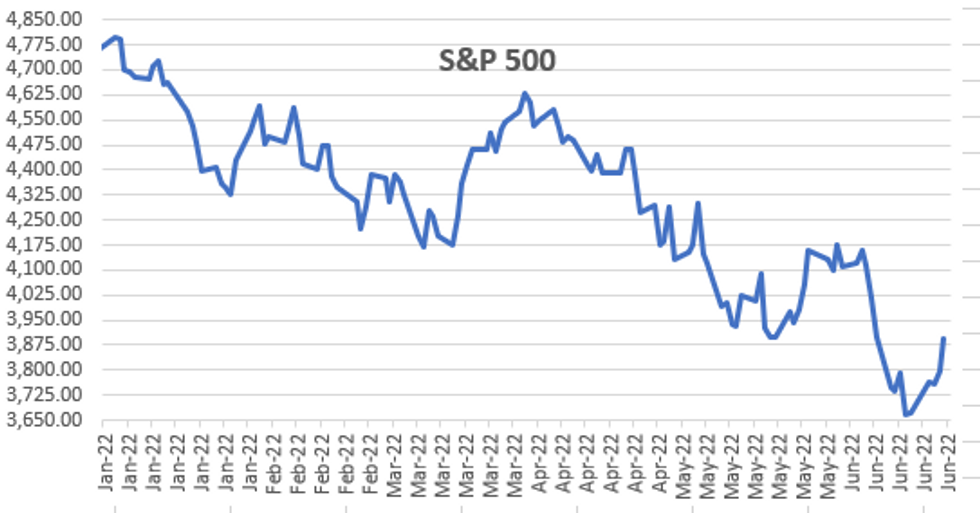

US TSYS: Cautious Risk Appetite Gains Momentum

US rates trade sideways through the second half, finishing near session lows, yield curves steeper with short end outperforming. Early risk-on tone gained momentum in late morning trade as stocks climbed to two-week highs: SPX eminis back to June 13 levels, ESU2 currently at 3899.0 (+99.25) vs. post FOMC low of 3649.00. DJIA +718 (2.34%) at 31397.09; Nasdaq +303 (2.7%) at 11536.68.

- Tsys opened with a modest risk-on tone on firmer stocks, pared losses/traded steady to mildly higher after U-Mich 5-10Y inflation exp revised lower to 3.1%, home sales strong +10.7% to 696k - much better than estimated 590k.

- Short end Eurodollar futures spiked just prior to U-Mich data: EDU2 gapped +0.095 to 96.785 a minute before the data release before tapping 96.79 briefly after some two-way flow. Currently +0.060 at 96.75, dragging EDZ2 0.060 higher as more aggressive rate hike pricing into year end cools slightly.

- Meanwhile, Fed monetary tightening will slow the economy but is unlikely to push it into recession because household wealth is high and business activity is strong, St. Louis Fed President James Bullard said Friday.

- "I think it's a little early to have this debate about recession probabilities in the U.S.," Bullard told an event sponsored by UBS. "We'll slow down to a trend pace of growth as opposed to below trend."

- Reminder, shortened work week next week (early Fri close, Mon holiday for 4th of July), Tsys will have two bill and 2 note auctions Monday:

- US Tsy $46B 2Y note and $42B 26W bill auctions at 1130ET

- US Tsy $47B 5Y Note and $45B 13W bill auctions at 1300ET

OVERNIGHT DATA

- US MAY NEW HOME SALES +10.7% TO 0.696M SAAR

- US APR NEW HOME SALES REVISED TO 0.629M SAAR

- University of Michigan End-Jun Sentiment 50.0

- MICHIGAN 5-10 YR INFLATION EXPECTATIONS REVISED LOWER TO 3.1%

US: Consumer Express Highest Uncertainty Over Long-Run Inflation Since 1991. The final UMich report on inflation makes for interesting reading - much of expectations decline down to college-educated consumers reacting to the Fed rate hike:

- In contrast, long run expectations receded from the mid-month reading of 3.3% and settled at 3.1%, back within the 2.9-3.1% range seen in the past 10 months. Initial evidence suggests that college-educated consumers, who were more likely to be aware of Fed policy, exhibited larger declines in expectations after the preliminary reading than other consumers.

- Overall, the late-June reversion in long run inflation expectations was generated by growth in the share of consumers expecting extremely low inflation in the years ahead. About half of these consumers expressed bleak views about the risks of recession or unemployment during the interviews.

These pessimistic views contributed to general uncertainty over inflation, - These pessimistic views contributed to general uncertainty over inflation, which continued to escalate after the mid-month reading. In fact, consumers expressed the highest level of uncertainty over long-run inflation since 1991.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 685.24 points (2.23%) at 31363.47

- S&P E-Mini Future up 96.25 points (2.53%) at 3896

- Nasdaq up 299.9 points (2.7%) at 11531.95

- US 10-Yr yield is up 3.8 bps at 3.1245%

- US Sep 10Y are down 11/32 at 117-10

- EURUSD up 0.0026 (0.25%) at 1.0549

- USDJPY up 0.26 (0.19%) at 135.21

- WTI Crude Oil (front-month) up $3.19 (3.06%) at $107.46

- Gold is up $7.17 (0.39%) at $1829.92

- EuroStoxx 50 up 96.88 points (2.82%) at 3533.17

- FTSE 100 up 188.36 points (2.68%) at 7208.81

- German DAX up 205.54 points (1.59%) at 13118.13

- French CAC 40 up 190.02 points (3.23%) at 6073.35

US TSY FUTURES CLOSE

- 3M10Y -2.869, 143.721 (L: 137.072 / H: 149.461)

- 2Y10Y -0.269, 6.131 (L: 1.596 / H: 8.858)

- 2Y30Y +1.468, 19.13 (L: 13.478 / H: 22.448)

- 5Y30Y +2.521, 7.577 (L: 2.759 / H: 10.111)

- Current futures levels:

- Sep 2Y down 1.125/32 at 104-23 (L: 104-20.875 / H: 104-29.375)

- Sep 5Y down 4.25/32 at 111-13.25 (L: 111-09.75 / H: 111-27.5)

- Sep 10Y down 11/32 at 117-10 (L: 117-07 / H: 118-00)

- Sep 30Y down 1-02/32 at 136-01 (L: 135-25 / H: 137-16)

- Sep Ultra 30Y down 2-05/32 at 150-21 (L: 150-10 / H: 153-10)

US 10Y FUTURES TECH: (U2) Corrective Cycle Still In Play

- RES 4: 120-00 Round number resistance

- RES 3: 119-16+ High Jun 1

- RES 2: 119-03+ 76.4% retracement of the May 26 - Jun 14 bear leg

- RES 1: 118-08/24 High Jun 24 / 50-day EMA

- PRICE: 117-12 @ 1037ET Jun 24

- SUP 1: 116-25+ Low Jun 23

- SUP 2: 115-20/114-07+ Low Jun 17 / Low Jun 14 and bear trigger

- SUP 3: 114-00 Round number support

- SUP 4: 113-19 Low Jun 19, 2009 (cont)

Treasuries maintain a firmer short-term tone. Thursday’s gains resulted in a break of the 20-day EMA, suggesting potential for a continuation higher with the focus on 118-24 next, the 50-day EMA. The primary trend direction remains down however and this week’s climb is still likely a correction. Initial firm support to watch is 115-20, the Jun 17 low. A break would signal the end of the corrective cycle and open the bear trigger at 114-07+.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.055 at 96.745

- Dec 22 +0.040 at 96.260

- Mar 23 +0.005 at 96.270

- Jun 23 -0.025 at 96.360

- Red Pack (Sep 23-Jun 24) -0.065 to -0.035

- Green Pack (Sep 24-Jun 25) -0.07 to -0.07

- Blue Pack (Sep 25-Jun 26) -0.085 to -0.075

- Gold Pack (Sep 26-Jun 27) -0.09 to -0.085

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00514 to 1.57614% (+0.00881/wk)

- 1M +0.00914 to 1.63271% (+0.02042/wk)

- 3M +0.03714 to 2.23443% (+0.13857/wk) * / **

- 6M +0.03128 to 2.86657% (+0.08714/wk)

- 12M +0.01142 to 3.54471% (-0.04115/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2+Y high: 2.19729% on 6/23/22

- Daily Effective Fed Funds Rate: 1.58% volume: $84B

- Daily Overnight Bank Funding Rate: 1.57% volume: $257B

- Secured Overnight Financing Rate (SOFR): 1.44%, $944B

- Broad General Collateral Rate (BGCR): 1.46%, $368B

- Tri-Party General Collateral Rate (TGCR): 1.45%, $358B

- (rate, volume levels reflect prior session)

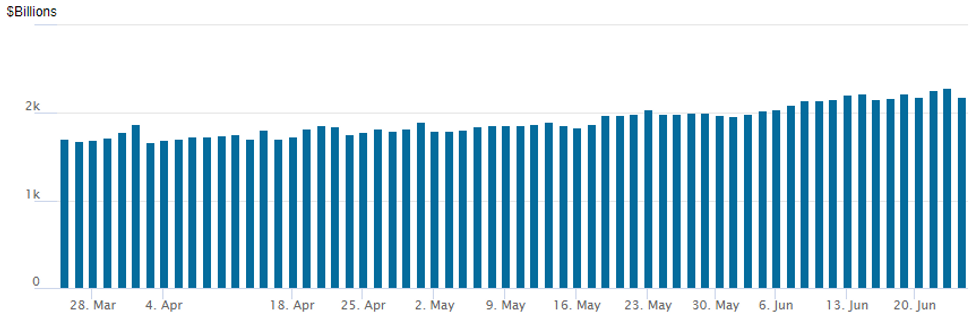

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,180.984B w/ 97 counterparties vs. record high in prior session of $2,285.428B.

FOREX: Firmer Risk Sentiment Dents Greenback, Boosts AUD, CAD & NZD

- While USDJPY reversed the entirety of its overnight losses to print fresh highs at 135.40, the move appeared to be Yen led, with the USD index retreating 0.2%. The index held a relatively narrow range all week, respecting the 1.04-1.05 parameters.

- With an uptick in risk sentiment leading to much firmer major equity indices, the likes of Aussie, Kiwi and the Canadian Dollar were outperformers, rising between 0.55-0.75%.

- Meanwhile, Scandi currencies inched higher, with the NOK among the best performers following yesterday's sizeable Norges Bank rate hike. Despite the NOK strength, EUR/NOK remains in a decent uptrend, with recent highs at 10.54 still well within range. Trend signals also hold bullish, with the 50-dma forming a golden cross formation at the beginning of last week.

- In emerging markets, there was some late volatility for the Turkish Lira following Turkey’s banking regulator banning commercial lira loans to some corporate borrowers if their FX cash position exceeds a certain level relative to their assets or annual sales. USDTRY fell aggressively from around 17.35 all the way to 16.50 before paring some of the move approaching the close. The pair remains around 3.5% lower on Friday.

- Monday sees a fairly light data calendar throughout Asia and European timezones. US durable goods and pending home sales data headlines the US docket.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/06/2022 | 0700/0900 | ** |  | ES | PPI |

| 27/06/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/06/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/06/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 27/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/06/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/06/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/06/2022 | 1830/2030 |  | EU | ECB Lagarde Opens ECB Forum | |

| 27/06/2022 | 1900/2100 |  | EU | ECB Schnabel on Financial Stability at ECB Forum |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.