-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Recession Fears Dominate

Highlights:

- Dollar surges as risk-off backdrop intensifies

- WTI, Brent stall, drop as much as 11% on recession fears

- US Tsy 2s5s invert for first time since Feb'20 as inflation expectations slide

US TSYS: 2s5s Inverts For the First Time Since Feb’20

- Risk-off sentiment has dominated FI markets today, with the US coming back from holiday and driving a substantial rally before a partial reversal of the move later on as Treasuries belatedly followed a bounce in equities (S&P 500 close to Friday’s high, Nasdaq touches high since Jun 28).

- Headlines indicate that China tariff discussions could disappoint, removing only $10B worth of the duties imposed by Trump on approximately $370B worth of imports from China.

- With the front end lagging the rally further along the curve (2Y -2bps vs 5Y, 10Y and 30Y -6-7bps), the curve has flipped back into inversion in the case of 2s10s (last mid June) and for the first time for 2s5s since Feb-2020.

- Having initially been driven by a sizeable decline in real yields, falling commodity prices including WTI below $100/bbl have since seen a greater pivot towards breakevens leading yields lower, with the 5Y breakeven sliding 9bps to 2.55% which aside from Friday’s fleeting low of 2.52% is the lowest since Oct 1 and more firmly at pre-taper levels.

- TYU2 has pulled back from session highs of 120-07 having briefly cleared resistance at Friday's high of 120-04, potentially opening key resistance at 120-19+ (May 26 high) as the bull cycle remains in play.

- With a heavy docket tomorrow, the FOMC minutes and ISM services in particular come into focus with the heightened sensitivity to slowing growth.

US EURODOLLARS: Significant Inversion Maintained

- Eurodollars have unwound some of today’s rally, especially further out the curve, but it doesn’t materially change the takeaway from the session: implied yields have been trimmed across the curve (6.5-8bps in most cases) and the recent aggressive inversion through 2023 remains intact.

- Having initially reversed the rally seen after growth fears were exacerbated by Friday’s ISM manufacturing miss (including the first contraction in new orders since May’20), yields are now between 5-15bps lower than pre-ISM levels again, with the largest difference in the green pack.

- Yields are seen peaking in EDZ2 at 3.60% before 75bps of cuts in EDZ2/EDZ3 and then a further 25bp in EDZ3/EDZ4, although interestingly before renewed hikes are priced further out.

FOREX: Dollar Surges on Risk-Off Backdrop

- The greenback made light work of resistance on the way higher Tuesday, rallying against all others to top the G10 pile. The risk-off backdrop pushing the USD Index well clear of the 106.00 handle for the first time since 2002, mirroring the sizeable drop in European and US equities.

- Recession fears and diverging policy outlooks remain responsible, with the continued creep higher in energy prices (not helped by outages in Norwegian gas fields) across Europe prompting serious concerns over the feasibility of the ECB's tightening plans for H2. Markets expressed this view by sending EUR/USD below 1.03 - a move that's prompted a number of sell-side outfits to consider the prospect of parity in the pair in the coming months.

- EUR/USD remains inside the bear channel drawn off the February highs, with initial support crossing at 1.0233, the 1.382 projection of Feb 10 - Mar 7 - 31 price swing.

- Commodity-tied currencies suffered markedly, with CAD and NOK among the session's worst performers (USD/NOK rose as much as 2.5% ahead of the close) as WTI and Brent stalled, dropping as much as 9% on the day as abject growth fears rippled through the market.

- The ISM services index is the calendar highlight Wednesday, with markets remaining on watch for any signals ahead of the Friday nonfarm payrolls release. The data follows the final reading of June services PMI, which is expected unrevised. German factory orders, Eurozone retail sales and the Fed minutes are also on the docket.

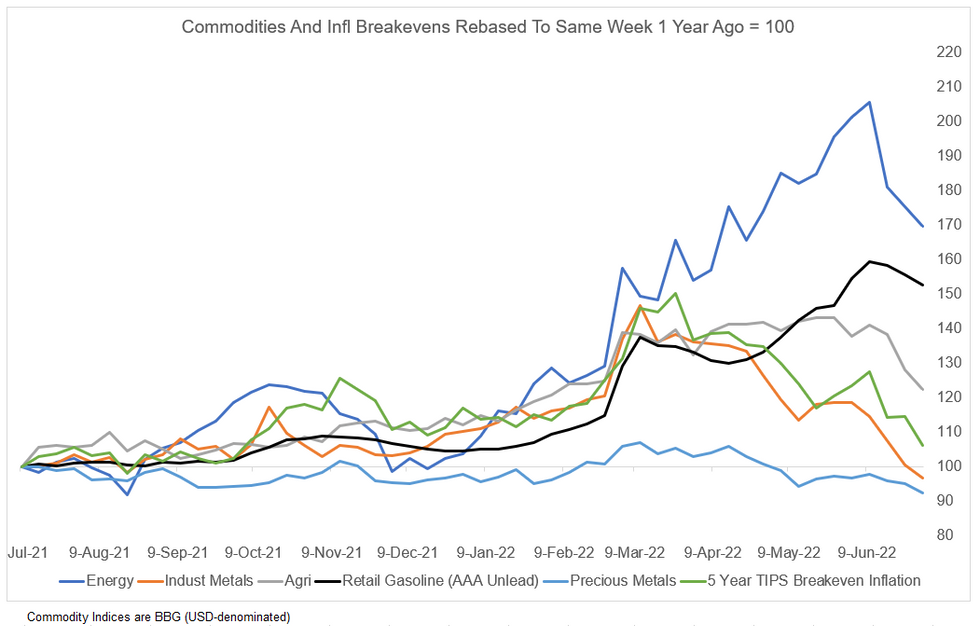

Commodity Prices Increasingly Showing Signs Of Y/Y U.S. Inflation Peak

With the accelerated sell-off today, commodity prices are increasingly showing signs of U.S. inflation having "peaked". While energy prices remain 70% above their level a year ago, that's well off the doubled price level seen earlier this month.

- Agricultural commodity and retail gasoline prices, which never hit the heights of the commodities complex as a whole, appear to be rolling over.

- And on a year-on-year basis, industrial metals prices have fallen into negative territory over the past week.

- This is clearly translating into softening inflation expectations: 5Y TIPS-implied breakevens are now barely above where they were a year ago, and at 2.56%, are nearly 120bp below the March high.

- While there are plenty of other elements factoring into inflation concerns (services / rents), the sharp drop in commodity prices and the pullback in inflation expectations provides further evidence that we've seen a peak in inflation pressures.

Source: BBG, MNI Calculations

Source: BBG, MNI Calculations

EUR: Parity Calls Accelerate as EUR/USD Tumbles

EUR/USD's extended move lower and new multi-decade lows has got a lot of outfits discussing parity in the pair. Over the last 24 hours or so, we've had:

- Citi see an 80% chance of falling to parity in near-term

- Nomura say parity could be breached in August, forecasting a fall to 0.9500

- CIBC say parity is within reach, and a close below 1.03 today would confirm

- CBA write that, technically, EUR/USD's path to parity faces little resistance because there are no important support levels until 1.0000

Options markets have taken note, with options now implying a 54% chance of EUR/USD touching parity at some point in Q3. That's risen from just 16% at the beginning of last week.

FX OPTIONS: Expiries for Jul06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2030(E530mln)

- USD/JPY: Y135.00($615mln)

- NZD/USD: $0.6410(N$1.2bln)

- USD/CAD: C1.2610-25($2.0bln), C$1.3200-10($595mln)

Price Signal Summary - EURUSD Cracks Support

- In the equity space, S&P E-Minis remain vulnerable following last week’s move lower and reversal from 3950.00, the Jun 28 high. A resumption of weakness would open 3735.00, the Jun 23 low. A breach of this level would expose key support at 3639.00, the Jun 17 low and bear trigger. Clearance of 3950.00 is required to strengthen a bullish case. EUROSTOXX 50 futures are trading lower and approaching the 3400.00 handle. Conditions remain bearish following last week’s reversal from 3584.00, the Jun 27 high. This has exposed the key support and bear trigger at 3384.00, Jun 16 low. A break would resume the primary downtrend. On the upside, clearance of 3584.00 is required to reverse the short-term outlook.

- In FX, the EURUSD has breached support at 1.0359, Jun 15 low, and 1.0350, the May 13 low. The break confirms a resumption of the primary downtrend and an extension lower within the bear channel drawn from the Feb 10 high. This has opened 1.0233, the 1.382 projection of Feb 10 - Mar 7 - 31 price swing. GBPUSD remains vulnerable. The focus is on the bear trigger at 1.1934, Jun 14 low. Resistance to watch remains 1.2406, the Jun 16 high. Initial resistance is at 1.2256, the 20-day EMA. The USDJPY path of least resistance remains up. Last week’s gains delivered a fresh cycle high and confirmed a resumption of the primary uptrend. Short-term retracements are considered corrective and initial support is at 134.27, the Jun 23 low. A resumption of gains would open 137.30 next, 1.50 projection of the Feb 24 - Mar 28 - 31 price swing.

- On the commodity front, Gold remains vulnerable. The yellow metal weakened last week and this reinforces bearish conditions. Attention is on the key support and bear trigger at $1787.00, May 16 low. This level was breached, briefly, on Friday. A clear break would confirm a resumption of the downtrend and open $1780.4 Jan 28 low. Key trendline resistance intersects at $1859.2. The trendline is drawn from the Mar 8 high. In the Oil space, WTI futures found resistance last week at $114.05, the Jun 29 high. A break of this hurdle is required to confirm a resumption of the recent recovery and open $116.58, the Jun 17 high. For bears, an extension lower would open key support at $101.53, the Jun 22 low. The first key support to watch is $104.56, the Jul 1 low.

- In the FI space, Bund futures resumed their short-term uptrend last week and a bull cycle remains intact. The focus is on 152.28, 76.4% retracement of the May 12 - Jun 16 bear leg. Gilts cleared resistance on Friday at 114.55, Jun 24 high The break highlights potential for a stronger short-term recovery and this has opened 117.48, 1.236 projection of the Jun 16 - 24 - 29 price swing.

FED Reverse Repo Usage Lowest In A Month

- NY Fed reverse repo usage stepped a little further back to $2,138B from Friday’s $2,167B, hitting the lowest since Jun 7 having pulled back from Thursday’s month and quarter-end driven new record of $2,330B.

- The number of counterparties also dipped to a more typical 96 from 99 on Friday and 108 on that Thursday high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/07/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/07/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 06/07/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/07/2022 | 0800/1000 | ** |  | ES | Industrial Production |

| 06/07/2022 | 0810/0910 |  | UK | BOE Pill Speaks at Qatar Centre Conference | |

| 06/07/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/07/2022 | 0900/1100 | ** |  | EU | retail sales |

| 06/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/07/2022 | 1230/1330 |  | UK | BOE Cunliffe Panels Qatar Centre Conference | |

| 06/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/07/2022 | 1300/0900 |  | US | New York Fed President John Williams | |

| 06/07/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 06/07/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/07/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 06/07/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 06/07/2022 | 1800/1400 |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.