-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline: $8.8B to Price Wednesday

Key Inter-Meeting Fed Speak – Jan 2025

US TREASURY AUCTION CALENDAR: 20Y Reopen Trades Through

MNI Commodity Weekly: January Oil Market Shake-Up

MNI ASIA OPEN: Fed Speak Same As It Ever Was

EXECUTIVE SUMMARY

- MNI BRIEF: Fed's Waller Backs 75BP Hike This Month, 50 in Sept

- MNI BRIEF: Fed Must Follow Through On Guidance, Bullard Says

- MNI BRIEF: St. Louis Fed Model Sees 'Very Strong' June Jobs

- MNI: New UK PM To Be Chosen By Early September, FT

US

FED: Federal Reserve Governor Christopher Waller on Thursday backed another 75 basis point rate increase this month followed by 50bps in September, saying it's essential to front-load tightening to prevent the economy from being overwhelmed by persistent inflation.

- After those moves the Fed can “debate whether we go back to 25," he said on a NABE webinar. “We need to move to a much more restrictive setting, and we need to do so as quickly as possible.” His comments mesh with what ex-officials told MNI about future moves. (See: Fed Sees 75bp Hike As New Baseline- Ex-Officials)

- “Everybody understands that we’ve got to get inflation under control” rather than worry about the stop-and-start tightening cycle seen in the 1970s, he said. The Fed can't allow expectations to become un-anchored as opposed to worry about over tightening, he said. “If we don’t get inflation under control, inflation on its own can put us in a really bad” spot, Waller said.

- The Fed has raised the policy rate, promised to raise the policy rate further in the future, and begun passive balance sheet reduction, and forward guidance on these dimensions is helping the Fed move policy more quickly to the degree necessary to keep inflation under control, he said.

- "The fact that market interest rates have moved above their pre-pandemic benchmarks while the policy rate has not can be read as an illustration of the effect of credible forward guidance," he said at a Little Rock Regional Chamber event.

FED: U.S. employment likely rose by a solid 500,000 in June, according to a real-time labor market index from the Federal Reserve Bank of St. Louis, economist Max Dvorkin told MNI.

- The Coincident Employment Index, using weekly data from time-tracker software provider Homebase, "continues its upward path and this suggests a very strong jobs report for June," Dvorkin said. The forecast for household survey employment is an increase of around 500,000 seasonally adjusted and a bit over 1 million employed people in unadjusted terms. For more see MNI Policy main wire at 1211ET.

UK

- The FT reports that the new UK Prime Minster to replace Boris Johnson after today's resignation is set to be chosen by early September.

- The current betting favourite for the next leader of the Conservative Party according to smarkets is Ben Wallace at circa 25%.

- GBPUSD isn't sure what to make of what, if accurate, would likely be a longer process than many expected, only dipping a handful of pips to 1.2013 to keep it +0.7% on the day.

US TSYS: Risk-On Ahead June Employment Data

Early skittishness gave way to steadily higher bond yields by Thu's close, 30YY topping 3.2032%. Early session swings unlikely related to session data: Trade Deficit slightly wider than expected (-$85.5B vs. -$84.7B exp), weekly claims slightly higher than expected at 235k vs. 230k, continuing claims +1.375M vs. 1.328M.- Early moves more likely associated to positioning ahead Friday's June employment report (268k est vs. 390k prior) while late session comments from StL Fed Bullard and Fed Gov Waller underscored recent pricing of another 75bp hike at the end of the month (Bullard), Waller sees recession fears as overblown.

- Further curve inversion after the minutes keeps recession talk in the foreground while the FOMC admits inflation is job 1 and tightening will weaken the economy. Markets price in 75bp hike at the end of the month, but struggle with forward guidance: looking at rate cuts one year hence.

- Strong stocks (SPX eminis currently trading +61.5 (1.6%) at 3909.75; DJIA +358.03 (1.15%) at 31394.56; Nasdaq +266.7 (2.3%) at 11628.23), underscored the late risk-on tone.

- Decent pick-up in swappable corporate debt issuance ($10.6B total) generated two-way hedging/unwind flow across the curve

OVERNIGHT DATA

- US PREV JOBLESS CLAIMS REVISED TO 231K IN JUN 25 WK

- US CONTINUING CLAIMS +0.051M to 1.375M IN JUN 25 WK

- US MAY TRADE GAP -$85.5B VS APR -$86.7B

- US Challenger Job-Cut Announcements Rose 58.8% Y/y in June

- Atlanta Fed GDPNow model estimate for real GDP growth in the second quarter of 2022 is -1.9 percent, up from -2.1 percent on July 1.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 358.03 points (1.15%) at 31394.56

- S&P E-Mini Future up 61.5 points (1.6%) at 3909.75

- Nasdaq up 266.7 points (2.3%) at 11628.23

- US 10-Yr yield is up 7.6 bps at 3.0038%

- US Sep 10Y are down 24/32 at 118-9.5

- EURUSD down 0.0023 (-0.23%) at 1.0158

- USDJPY up 0.08 (0.06%) at 136.03

- WTI Crude Oil (front-month) up $4.17 (4.23%) at $102.70

- Gold is up $1.65 (0.09%) at $1740.39

- EuroStoxx 50 up 66.66 points (1.95%) at 3488.5

- FTSE 100 up 81.31 points (1.14%) at 7189.08

- German DAX up 248.7 points (1.97%) at 12843.22

- French CAC 40 up 94.32 points (1.6%) at 6006.7

US TSY FUTURES CLOSE

- 3M10Y +8.358, 107.846 (L: 97.35 / H: 108.031)

- 2Y10Y +4.303, -3.284 (L: -7.955 / H: -3.265)

- 2Y30Y +4.134, 15.638 (L: 10.963 / H: 16.11)

- 5Y30Y +1.081, 14.582 (L: 11.447 / H: 16.806)

- Current futures levels:

- Sep 2Y down 4.75/32 at 104-27.25 (L: 104-25.75 / H: 105-00.125)

- Sep 5Y down 14.25/32 at 112-3.5 (L: 112-00.25 / H: 112-19.75)

- Sep 10Y down 24.5/32 at 118-9 (L: 118-06 / H: 119-05)

- Sep 30Y down 1-12/32 at 138-13 (L: 138-06 / H: 140-00)

- Sep Ultra 30Y down 1-30/32 at 151-31 (L: 151-20 / H: 154-11)

US 10YR FUTURES TECHS: (U2) Corrective Pullback

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 120-16+ High Jul 6

- PRICE: 118-09 @ 1455ET Jul 7

- SUP 1: 118-06 Intraday low

- SUP 2: 117-27+ 20-day EMA

- SUP 3: 116-11 Low Jun 28 and a key near-term support

- SUP 4: 115-20 Low Jun 17

Treasuries have retreated from Wednesday’s 120-16+ high. The trend condition remains bullish and short-term weakness is considered corrective. Current trend conditions remain bullish following recent gains and the breach of the 50-day EMA. This signals scope for a continuation higher towards 120-19+, the May 26 high. Key short-term support has been defined at 116-11, Jun 28 low. A break is required to signal a possible reversal.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.015 at 96.745

- Dec 22 -0.060 at 96.255

- Mar 23 -0.110 at 96.305

- Jun 23 -0.120 at 96.475

- Red Pack (Sep 23-Jun 24) -0.11 to -0.075

- Green Pack (Sep 24-Jun 25) -0.09 to -0.08

- Blue Pack (Sep 25-Jun 26) -0.115 to -0.10

- Gold Pack (Sep 26-Jun 27) -0.12 to -0.115

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00528 to 1.56771% (+0.00042/wk)

- 1M +0.06528 to 1.87214% (+0.07457/wk)

- 3M +0.03700 to 2.42757% (+0.13471/wk) * / **

- 6M +0.05728 to 3.05614% (+.15685/wk)

- 12M +0.10343 to 3.65743% (+0.09314/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.39057% on 7/6/22

- Daily Effective Fed Funds Rate: 1.58% volume: $95B

- Daily Overnight Bank Funding Rate: 1.57% volume: $270B

- Secured Overnight Financing Rate (SOFR): 1.54%, $966B

- Broad General Collateral Rate (BGCR): 1.51%, $359B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $349B

- (rate, volume levels reflect prior session)

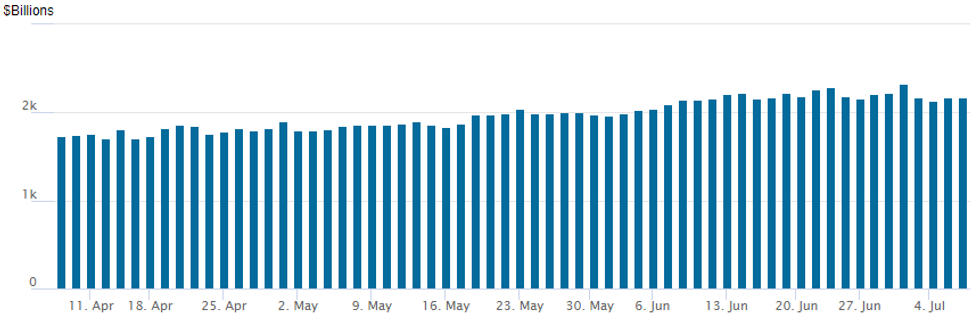

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,172.457B w/ 102 counterparties vs. $2,168.026B prior session. Record high stands at $2,329.743B from Thursday June 30.

PIPELINE: $7.5B Celanese 5Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/07 $7.5B #Celanese $2B 2Y +287, $1.75B 3Y +300, $2B 5Y +312, $750M 7Y +325, $1B 10Y +337

- 07/07 $1.5B *FHLBanks 2Y +9.5

- 07/07 $1B #MetLife 30Y +180

- 07/07 $600M #Tampa Electric $300M 2Y +85, $300M 30Y +180

EGBs-GILTS CASH CLOSE: Gilts Outperform As Johnson Set To Depart

The German curve sold off sharply at the short end/in the curve belly Thursday, while Gilts easily outperformed despite a knee-jerk move weaker following UK PM Johnson's resignation as party leader.

- Both the UK and German curves bear flattened as ECB/BoE hike pricing rebounded, with equities gaining strongly but the Euro falling to fresh 2-decade lows versus the USD.

- Periphery spreads widened (though mostly recovered) following a Bloomberg sources piece that suggested the ECB's anti-fragmentation tool might not be fully agreed by the July 21 meeting.

- Attention swiftly turns to Friday's US Employment report data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 17bps at 0.558%, 5-Yr is up 15.6bps at 0.977%, 10-Yr is up 11.2bps at 1.318%, and 30-Yr is up 2.9bps at 1.552%.

- UK: The 2-Yr yield is up 7.4bps at 1.827%, 5-Yr is up 6.5bps at 1.811%, 10-Yr is up 3.6bps at 2.128%, and 30-Yr is up 1bps at 2.548%.

- Italian BTP spread up 4.3bps at 199.1bps / Greek up 13.1bps at 222.3bps

FOREX: EUR/USD Retains Primary Downtrend

- EUR/USD printed a lower low for the 8th time in the past nine session, putting the pair at new multi-decade lows of 1.0151. This retains the primary downtrend inside the bear channel drawn off the February 10 high. Reports from Bloomberg cited sources in saying that the ECB's anti-fragmentation tool may not be ready and prepared for the July 21st governing council meeting, tilting the currency lower still. The single currency following Italian bond futures lower, with the 10y yield rising by 15bps Thursday.

- Political tumult continued in the UK, with the PM Johnson formally announcing his resignation and his intention to carry on as a caretaker PMI until a new leader is elected by the Conservative Party. GBP took the news in its stride, showcasing how well priced the currency was for political uncertainty. GBP traded better against most others into the London close, putting EUR/GBP on track to test key 50-day EMA support at 0.8536. Weakness through here opens the Jul 6 low at below.

- Lastly, AUD and NZD were among the session's best performers, rallying against most others in G10 as the risk-off backdrop faded. Equity futures globally improved, helping high beta and commodity currencies outperform.

- Focus Friday turns to the June nonfarm payrolls report, with markets on watch for any slowdown in hiring and the resulting implications for the Fed's policy path. See the full MNI preview here: https://marketnews.com/markets/pdfs/mni-us-payrolls-preview-growth-concerns-thrown-into-the-mix ).

- Outside of payrolls, the Canadian jobs report is also due, while ECB's Lagarde, Visco, Muller and Villeroy are due to speak as well as Fed's Williams.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/07/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/07/2022 | 0645/0845 | * |  | FR | Current Account |

| 08/07/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 08/07/2022 | 1155/1355 |  | EU | ECB Lagarde at Les Rencontres Economiques | |

| 08/07/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/07/2022 | 1230/0830 | *** |  | US | Employment Report |

| 08/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/07/2022 | 1230/0830 |  | US | New York Fed's John Williams | |

| 08/07/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/07/2022 | 1500/1100 |  | US | New York Fed's John Williams | |

| 08/07/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.