-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak Data Cools Forward Guidance

EXECUTIVE SUMMARY

- MNI INTERVIEW: Housing Could Lead U.S. Into Recession - NAHB

- MNI STATE OF PLAY: ECB Hikes 50-BPS, Approves Anti-Crisis Tool

- MNI BRIEF: ECB's New Crisis Tool To Ensure Policy Transmission

- MNI ITALY: Italian General Election September 25

- MNI US PRESIDENT BIDEN TESTS POSITIVE FOR COVID-19: WHITE HOUSE

US

US: The U.S. housing market appears set to fall into a downturn and could lead the broader economy into a recession, but so far doesn't show signs of triggering wider financial instability, National Association of Home Builders chief economist Robert Dietz told MNI.

- "A housing recession is clearly underway, which could be a leading indicator of a broader economic downturn," he said. "A few more months' data and we can probably judge whether or not we're in a broader recession but it could come in late 2022, early 2023."

- Still, the housing market's fundamental drivers in the long run, from a housing deficit and demographics, all suggest the sector has sturdy medium term growth prospects once this period of turbulence ebbs and inflation comes back under control, he said. For more see MNI Policy main wire at 1013ET.

- Statement: "This morning, President Biden tested positive for COVID-19. He is fully vaccinated and twice boosted and experiencing very mild symptoms. He has begun taking Paxlovid. Consistent with CDC guidelines, he will isolate at the White House and will continue to carry out all of his duties fully during that time. He has been in contact with members of the White House staff by phone this morning, and will participate in his planned meetings at the White House this morning via phone and Zoom from the residence.

- Consistent with White House protocol for positive COVID cases, which goes above and beyond CDC guidance, he will continue to work in isolation until he tests negative. Once he tests negative, he will return to in-person work.

- Out of an abundance of transparency, the White House will provide a daily update on the President’s status as he continues to carry out the full duties of the office while in isolation.

- Per standard protocol for any positive case at the White House, the White House Medical Unit will inform all close contacts of the President during the day today, including any Members of Congress and any members of the press who interacted with the President during yesterday’s travel. The President’s last previous test for COVID was Tuesday, when he had a negative test result."

EUROPE

ECB: The European Central Bank raised rates by a higher-than-expected 50 basis points on Thursday and said it had approved a tool to prevent any blowout in eurozone bond spreads, though much of the detail of the new facility remains to be revealed.

- Rising inflation prompted the ECB to double the size of its first hike in 11 years from the 25 basis points it had indicated was likely in June, despite significant downside risks to growth from the war in Ukraine, President Christine Lagarde told a news conference.

- Further hikes can be expected at upcoming meetings, Lagarde said, as the ECB transitions to “a meeting-by-meeting approach to our interest rate decisions.” Unlike in June, Lagarde did not give forward guidance as to the size of future hikes, and indicated that the pick-up in the pace of rate-rises did not imply a change in this cycle’s interest rate end point.

- “All members of the Governing Council rallied to the consensus of 50 basis points,” she said, adding that this was made possible by unanimous support for the new Transmission Protection Instrument, whose purchases will have no pre-defined limit.

US TSYS: Weak Data Over 50Bp ECB Hike

Initially selling off after the ECB hiked 50bp this morning, Tsys reversed course after weaker than expected data - drifting near highs after the bell. Decent volumes (TYU2 1.5M) on wide ranges, yield curves mixed.- Tsys bounced on weak US data soon after: weekly jobless claims higher than expected at 251k vs. 240k, continuing claims 1.384M vs. 1.340M est, sharp miss on Philly Fed Mfg index at -12.3 vs. 0.8 est. Positive spin for stocks: data miss deemed positive in relation to watering down hawkish forward Fed expectations.

- Second leg higher: Tsys continued to extend session highs with the rally in European core sovereign with the front-loading aspects and not moving an assumed terminal rate.

- Underscoring rally: Huge 5Y Block buy: +40,000 FVU2 111-24, buy through 111-20.75 post-time offer at 0915:30, 111-27 last +11.75. Additional Blocks in second half: 5Y/10Y ultra-bond steepeners, weighted neutral.

- Long end seeing selling by bank and real$ accts ahead midday. While a 75bp hike next week remains priced in, probability of a third consecutive 75bp move at the September meeting has started to ebb.

- Friday data focus:

- Jul-22 0830 S&P Global US Mfg PMI (52.7, 52.0)

- Jul-22 0830 S&P Global US Services PMI (52.7, 52.7)

- Jul-22 0830 S&P Global US Composite PMI (52.3, 52.4)

OVERNIGHT DATA

- US JOBLESS CLAIMS +7K TO 251K IN JUL 16 WK

- US PREV JOBLESS CLAIMS REVISED TO 244K IN JUL 09 WK

- US CONTINUING CLAIMS +0.051M to 1.384M IN JUL 09 WK

- US JUL PHILADELPHIA FED MFG INDEX -12.3

- US JUNE INDEX OF LEADING ECONOMIC INDICATORS FALLS 0.8% (-0.6% est)

MARKETS SNAPSHOT

Key late session market levels:

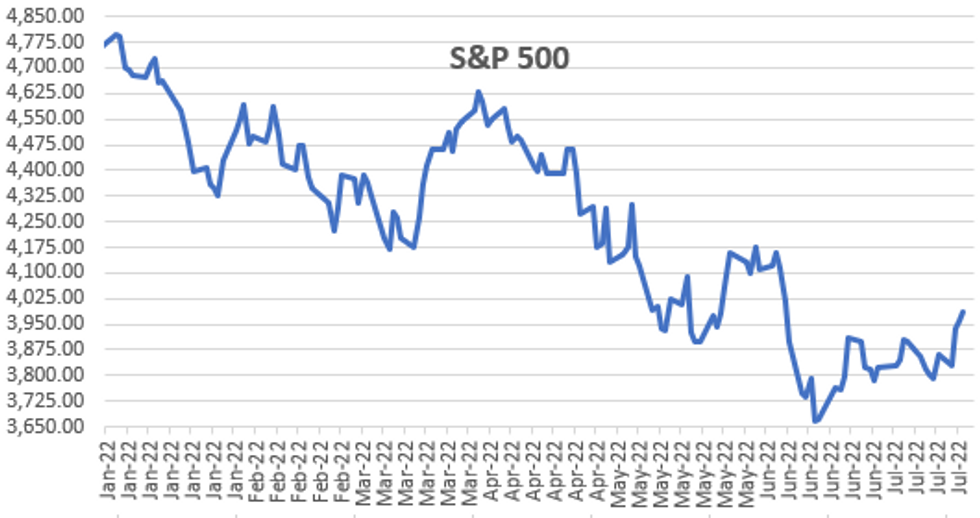

- DJIA up 31.01 points (0.1%) at 31901.29

- S&P E-Mini Future up 24.75 points (0.62%) at 3986.5

- Nasdaq up 122 points (1%) at 12017.52

- US 10-Yr yield is down 11.9 bps at 2.9079%

- US Sep 10Y are up 36/32 at 118-29

- EURUSD up 0.0015 (0.15%) at 1.0194

- USDJPY down 0.55 (-0.4%) at 137.67

- Gold is up $18.02 (1.06%) at $1714.58

- EuroStoxx 50 up 11.27 points (0.31%) at 3596.51

- FTSE 100 up 6.2 points (0.09%) at 7270.51

- German DAX down 35.34 points (-0.27%) at 13246.64

- French CAC 40 up 16.45 points (0.27%) at 6201.11

US TSY FUTURES CLOSE

- 3M10Y -8.587, 44.885 (L: 41.703 / H: 58.029)

- 2Y10Y +1.305, -19.181 (L: -23.308 / H: -18.156)

- 2Y30Y +4.668, -2.619 (L: -8.945 / H: -2.118)

- 5Y30Y +7.231, 6.368 (L: -2.26 / H: 6.709)

- Current futures levels:

- Sep 2Y up 10/32 at 104-26.375 (L: 104-15.5 / H: 104-26.625)

- Sep 5Y up 26.25/32 at 112-9.5 (L: 111-11 / H: 112-10)

- Sep 10Y up 1-3.5/32 at 118-28.5 (L: 117-14.5 / H: 118-29.5)

- Sep 30Y up 1-27/32 at 140-11 (L: 137-23 / H: 140-15)

- Sep Ultra 30Y up 2-21/32 at 155-16 (L: 151-29 / H: 155-29)

US 10YR FUTURES TECHS: (U2) Buy The Dip Mentality Intact

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 119-06/120-16+ High Jul 13 / High Jul 6 and the bull trigger

- PRICE: 118-18+ @ 15:49 BST Jul 20

- SUP 1: 117-18/12 Low Jul 8 / 50.0% of the Jun 14 - Jul 6 rally

- SUP 2: 116-11 Low Jun 28 and a key near-term support

- SUP 3: 115-20 Low Jun 17

- SUP 4: 114-05+ Low Jun 14 and the bear trigger

Treasuries slipped through early Thursday trade, but rebounded sharply into the close following the ECB rate decision. This put prices back above the 118-00 handle to mount a test on first key resistance at 119-06, the Jul 13 high. This keeps the short-term outlook bullish and supports the view that pullbacks are deemed corrective for now. Key short-term support is at 116-11, Jun 28 low where a break would strengthen a bearish threat and signal scope for a deeper retracement.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.050 at 96.565

- Dec 22 +0.135 at 96.205

- Mar 23 +0.190 at 96.390

- Jun 23 +0.195 at 96.550

- Red Pack (Sep 23-Jun 24) +0.205 to +0.210

- Green Pack (Sep 24-Jun 25) +0.185 to +0.210

- Blue Pack (Sep 25-Jun 26) +0.145 to +0.175

- Gold Pack (Sep 26-Jun 27) +0.120 to +0.140

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00343 to 1.56571% (+0.00057/wk)

- 1M +0.04543 to 2.25900% (+0.13871/wk)

- 3M +0.02400 to 2.78300% (+0.04543/wk) * / **

- 6M +0.04357 to 3.37743% (+0.06614/wk)

- 12M +0.02571 to 3.91871% (+0.02228/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.78300% on 7/21/22

- Daily Effective Fed Funds Rate: 1.58% volume: $95B

- Daily Overnight Bank Funding Rate: 1.57% volume: $274B

- Secured Overnight Financing Rate (SOFR): 1.53%, $916B

- Broad General Collateral Rate (BGCR): 1.51%, $369B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $361B

- (rate, volume levels reflect prior session)

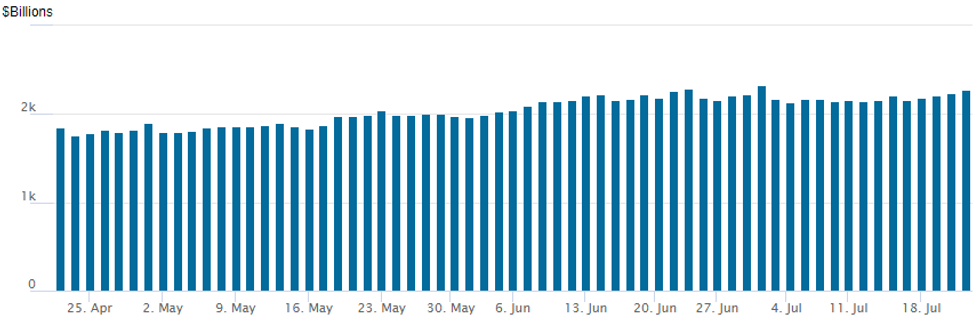

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,271.756B w/ 101 counterparties vs. $2,240.204B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: CSX 3Pt Issuance Extends to 46Y

- Date $MM Issuer (Priced *, Launch #)

- 07/21 $Benchmark, CSX 10Y +120, 30Y +145, 46Y +180

- $9.05B Priced Wednesday; $48.35B/wk

- 07/20 $3.25B *IBM $1B 3Y +75, $750M 5Y +100, $750M 10Y +145, $750M 30Y +180 (adds to $1.8B issued in early Feb w/ $650M 5Y +60, $500M 10Y +95, $650M 30Y +132)

- 07/20 $1.5B *NTT Finance $500M Each: 2Y +90, 3Y +100, 5Y +120

- 07/20 $1.25B *Lenovo $625M each: 5.5Y +265, 10Y +350

- 07/20 $1B *Imperial Brands 5Y +320

- 07/20 $850M *Nationwide BS 5Y +170

- 07/20 $700M *Korea Hydro 5Y +123

- 07/20 $500M *Bank Leumi 5Y +210

EGBs-GILTS CASH CLOSE: ECB Delivers Big Hike, But Reaction Mixed

The German curve twist flattened Thursday, with BTP spreads widening sharply and Gilts bull flattening, as the ECB delivered a bigger-than-expected 50bp hike.

- Schatz yields spiked 15bp on the ECB decision but that move almost completely faded as forward guidance was dropped and Lagarde was noncommittal on a September hike.

- BTP spreads widened sharply in a dramatic day including the resignation of PM Draghi in the morning and the ECB's announcement of the Transmission Protection Instrument (TPI).

- Ambiguous details on TPI contributed to BTP weakness. Compounding issues for BTPs, as cash markets closed, media outlets reported the next Italian election would be held on September 25 - our Politics Team has published a briefing on what to expect next.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 6.9bps at 0.676%, 5-Yr is up 1.3bps at 1.024%, 10-Yr is down 3.4bps at 1.223%, and 30-Yr is down 5.1bps at 1.403%.

- UK: The 2-Yr yield is down 6.8bps at 2.001%, 5-Yr is down 6.8bps at 1.848%, 10-Yr is down 9.2bps at 2.047%, and 30-Yr is down 12.9bps at 2.531%.

- Italian BTP spread up 18.8bps at 232.2bps / Greek up 13bps at 233.7bps

FOREX: Hawkish ECB Surprise Fails To Sustain Initial Euro Bullishness

- The larger-than-expected 50bp rate hike from the ECB sparked solid short-term demand for the single currency, however, this price action was short-lived and EURUSD then reversed aggressively to the lows of the day before consolidating throughout the US session.

- In the lead up to the press conference, the hawkish surprise took EURUSD to the best levels of the week, printing 1.0278. This was 5 pips above Wednesday’s high and coincided with a weaker US Philly Fed datapoint.

- Instead of the breach sparking some momentum buyers, Euro optimism quickly faded as markets attempted to grapple with the details surrounding the new Transmission Protection Instrument (TPI), announced by the central bank.

- With Euro bulls rapidly losing faith, the path of least resistance was lower and EURUSD quickly found itself trading below pre-rate announcement levels with one eye on the daily lows. Sure enough, the pair fell close to another half a percent, with 1.0154 marking the day’s low. Interestingly, E1.8bln worth of expiries between $1.0200-10 was a strong enough magnet to drag the pair back up approaching the NY cut where the pair seemed comfortable consolidating as the dust settled.

- Overall, currency markets remain close to Wednesday’s closing levels with whipsaws in the Euro largely being mirrored by the USD index. Slight outperformance has been seen in the JPY and CHF, both rising 0.35% amid an underwhelming day for commodities/risk.

- European Flash PMI’s will be in focus on Friday, as market participants look for further signals of weaker economic to start the third quarter. The UK and Canada both report retail sales data.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/07/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 22/07/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 22/07/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 22/07/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 22/07/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 22/07/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0800/1000 |  | EU | ECB Survey of Professional Forecasters | |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 22/07/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/07/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/07/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.